ParaSwap Community Votes to Compensate Hack Victims

ParaSwap's community has agreed to use treasury funds to compensate victims of the Augustus V6 contract vulnerability, highlighting the project's commitment to its users' security.

Weiliang

Weiliang

With Circle's successful listing on Nasdaq, the stablecoin market is also undergoing a structural reshaping. While the market is paying attention to Circle's $5 billion market value and its stablecoin business model, a deeper transformation is taking place: the value creation center of stablecoins is migrating from the simple "issuance" link to "creation, empowerment and in-depth application scenarios." This is not a simple adjustment of business strategy, but a fundamental reconstruction of the value logic of the entire industry. By deeply analyzing the driving factors, market structure and development path of this transformation, we will seethat the core of the future competition of stablecoins is not "who can issue more coins", but "who can create and control more valuable application scenarios."

When we analyze the development trajectory of the stablecoin industry, a clear pattern emerges: this field is shifting from "issuance-centered" to "scenario-centered". This shift is not accidental, but the result of the joint promotion of five structural forces.

The squeeze effect of the issuance link. Circle's prospectus reveals a key reality: even as the second largest issuer in the market, it must pay 50% of its net interest income (NII) to Coinbase as a distribution subsidy. This costly distribution model exposes the substantial compression of the profit space in the issuance link. As excess profits diminish, market participants are forced to explore other links in the value chain, especially at the application scenario level.

The network effect of the issuance link has solidified. As a medium of value, the utility of stablecoins depends largely on acceptance - the more people use a certain stablecoin, the more valuable it is. This typical network effect has enabled USDT to firmly occupy 76% of the market share, USDC to maintain its position of 16%, and all other competitors to share the remaining 8%. This market structure has been highly solidified, and it is difficult for new entrants to shake the existing pattern by simply issuing new stablecoins.

A fundamental shift in regulatory orientation. The global regulatory framework for stablecoins is shifting from "risk prevention" to "innovation promotion and application emphasis". The US GENIUS Act clearly distinguishes "payment stablecoins" from other types of stablecoins, and designs a specific compliance path for the former; the Stablecoin Issuer Regulations, which were officially passed and implemented in Hong Kong on May 21, 2024, not only regulate issuance activities, but also provide a clear legal framework for innovative applications based on stablecoins; the Monetary Authority of Singapore (MAS) further divides stablecoins into "single currency stablecoins" (SCS) and other types, and designs differentiated regulatory measures for different scenarios. These regulatory trends point to one direction: the value of stablecoins will increasingly depend on their performance in actual application scenarios, rather than simply the scale of issuance. Qualitative changes in user needs. The sign of the market's increasing maturity is that user demand has shifted from simply holding stablecoins to solving specific problems through stablecoins. Early users may be satisfied with simply holding a "digital version of the US dollar", but users in mature markets expect to see actual application value beyond speculation. This shift in demand forces market participants to shift their focus from "minting more tokens" to "creating more uses".

Sustainability considerations for business models. As competition in the stablecoin market intensifies, business models that rely solely on seigniorage and issuance scale face long-term sustainability challenges. Competition in the issuance link will lead to an increase in the bidding for reserve fund yields, squeezing profit margins. In contrast, the development of application scenarios can bring a more diversified income structure, including transaction fees, value-added service fees, and financial product revenue sharing, providing a more sustainable business model for stablecoin ecosystem participants.

These five forces jointly drive the transformation of the stablecoin industry from "issuance war" to "scenario competition". Looking at the development history of the industry, we can clearly identify three stages of development:

Proof of concept period (2014-2018)

: Stablecoins are accepted by the market as a concept, mainly to meet the liquidity needs of the crypto trading market

Transaction medium period (2018-2023)

: The position of stablecoins in trading scenarios is consolidated, and the minting volume surges

: The position of stablecoins in trading scenarios is consolidated, and the minting volume surges leaf="">Practical Value Period (2024-)

: Market focus shifts from issuance scale to development of actual application scenarios and value creation

We are at the beginning of the third stage, and the core competition in this stage will revolve around "who can create more valuable application scenarios". It is crucial for market participants to understand this shift because it will redefine the criteria for success and the model of value distribution.

To truly understand the deep logic of "scene is king", we need to penetrate the surface technical discussion and deeply analyze the specific mechanism of stablecoin creating value in different application scenarios. This analysis cannot stop at the simple statement of "improving efficiency" and "reducing costs", but needs to analyze the inherent complexity, existing pain points and transformative potential of stablecoin technology in each scenario.

1. B2B cross-border payment and trade finance: beyond simple "fund transmission"

The problem of B2B cross-border payment is far more complicated than it seems on the surface. The traditional narrative often focuses on the speed and cost of payments, but the real pain point lies in the fragmentation and uncertainty of the entire cross-border payments and trade finance ecosystem.

When an Asian company pays a European supplier, the challenges it faces include:

Exchange rate risk management

Exchange rate fluctuations can erode 1-3% of value during the lag period between payment decision and funds arrival

Liquidity fragmentation

The company's funding pools in different markets are isolated from each other and cannot be effectively integrated

Uncertainty of settlement time

: The arrival time of traditional cross-border payments is highly variable, which brings difficulties to supply chain management and cash flow planning

Complexity of payment compliance

: Cross-border payments involve multiple regulatory frameworks, with high compliance costs and significant risks

Disconnection between finance and payment

: There is a lack of seamless connection between payment and trade finance (such as letters of credit, factoring, and supply chain financing)

stablecoinsin this scenario are not only about accelerating the transfer of funds, but also about creating a comprehensive value system through smart contracts and blockchain technology:

Programmable payment conditions

: Payments can be automatically associated with trade events (such as cargo shipment confirmation, quality inspection passed) to achieve programmatic control of the trade process

Real-time foreign exchange processing

: Minimize exchange rate fluctuation risks through intelligent routing and real-time pricing of multi-currency stablecoin pools

Liquidity integration

: Cross-market and cross-currency liquidity can be managed uniformly on the same infrastructure, significantly improving the efficiency of capital use

Programming of trade finance

Traditional trade finance instruments such as letters of credit and accounts receivable financing can be converted into smart contracts on the blockchain to achieve automatic execution and risk management. This comprehensive value enhancement goes far beyond simple efficiency improvements. It actually reconstructs the entire B2B cross-border payment and trade finance operation model. It is worth noting that realizing this vision requires solving many practical challenges, including legal framework adaptation (the legal effect of smart contracts in different jurisdictions), legacy system integration (interconnection with enterprise ERP and bank core systems) and cross-chain interoperability (value transfer between different blockchain networks).

2. Physical Asset Tokenization (RWA): Creating a New Internet of Value

Physical asset tokenization is another application scenario with transformative potential for stablecoins, but its complexity and challenges are often underestimated.

In the traditional financial system, physical assets (such as real estate, commodities, and private equity) have a significant liquidity discount, which stems from multiple factors such as high transaction costs, limited market participants, and inefficient value discovery mechanisms. Physical asset tokenization promises to reduce this discount through blockchain technology, but to truly realize this promise, a complete ecosystem is needed, and stablecoins are the key infrastructure of this ecosystem.

Stablecoins play three key roles in the RWA ecosystem:

Value bridge

: Connecting tokenized assets on the chain with legal tender in the traditional financial system

Transaction medium

: Providing liquidity and counterparties for tokenized assets

Income distribution channel

: Provide an automated distribution mechanism for the income generated by assets (such as real estate rent, bond coupons)

Taking real estate tokenization as an example, the deep integration of stablecoins can create a new value model: Investors can purchase tokenized real estate shares through stablecoins, rental income can be distributed to token holders in real time in the form of stablecoins, and tokens can be used as collateral to obtain liquidity on stablecoin lending platforms. All of these operations can be automatically executed through smart contracts without the need for traditional intermediaries.

However, the realization of this scenario faces complex challenges:

Legal connection between on-chain and off-chain assets

How to ensure the legal relevance and enforcement mechanism between on-chain tokens and off-chain assets

Trustworthy value input

How to reliably input off-chain asset information into the on-chain system (oracle problem)

Complexity of regulatory compliance

: Tokenized assets may be subject to multiple regulatory frameworks such as securities law, commodity law, and payment law

In this scenario, if stablecoin issuers only focus on maintaining currency stability without participating in building a broader RWA ecosystem, it will be difficult to capture scenario value. On the contrary, participants who can provide comprehensive solutions that integrate stablecoin payments, asset tokenization, transaction matching, and compliance management will dominate this field.

3. Cross-ecological connector: the bridge between DeFi and traditional finance

There are two parallel ecosystems in the current financial system: decentralized finance (DeFi) and traditional finance (TradFi). Each of these two ecosystems has unique advantages: DeFi provides permissionless access, programmability, and extremely high capital efficiency; TradFi has regulatory certainty, deep liquidity, and a broad user base. In the long run, the value of these two systems will be maximized through connection rather than substitution.

Stablecoins are becoming a key link between these two ecosystems because they have the attributes of both worlds: they are tokens on the blockchain that can interact seamlessly with smart contracts; they also represent the value of legal tender and are compatible with the traditional financial system. This makes it a natural medium for the flow of value between the two systems.

In this connector role, the specific application scenarios supported by stablecoins include:

Dual-ecological strategy for corporate treasury management

: Enterprises can handle daily operating funds in the traditional banking system, while deploying part of the liquidity to DeFi protocols through stablecoins to obtain returns

Cross-ecological optimization path for funds

: Build an intelligent system to automatically optimize the allocation of funds between TradFi and DeFi according to the market conditions of different ecosystems

Compliance-packaged DeFi services

: Access DeFi services in a compliant manner through stablecoin service providers with regulatory licenses to meet the access needs of institutional investors

Aiying Aiying found in her exchanges with the treasury departments of many companies in the Asia-Pacific region that this "day and night fund management" model is being adopted by more and more companies - even traditional companies are beginning to realize that deploying part of their liquidity funds to the DeFi field through stablecoins can create additional returns while maintaining necessary risk control.

However, the construction of such scenarios needs to overcome several key challenges: the complexity of regulatory compliance (especially for regulated financial institutions), risk isolation mechanisms (ensuring that DeFi risks do not spread to core businesses) and the simplification of user experience (making it easy for non-crypto professionals to use). Successful solutions need to provide innovation in three dimensions: technology, regulation and user experience.

Through an in-depth analysis of these three core scenarios, we can clearly see that:The value creation of stablecoins has far exceeded the simple concept of "digital dollars" and is moving towards the construction of a complex and multi-dimensional application ecosystem. In this direction, the simple issuance capability is no longer a winning factor, but requires a deep understanding of specific scenario requirements, the construction of an application ecosystem that integrates all parties, and the comprehensive ability to provide a frictionless user experience.

The regulatory environment both shapes and reflects the direction of market evolution. By deeply analyzing the stablecoin regulatory strategies of Hong Kong and Singapore, two major financial centers in the Asia-Pacific region, we can more clearly grasp the trend of the value center of stablecoins shifting to scenario applications.

Hong Kong: Evolution from sandbox to mature framework

On May 21, 2024, the Legislative Council of Hong Kong formally passed the Stablecoin Issuers Bill, which marked that Hong Kong's stablecoin regulation has entered the mature framework stage from the exploratory stage. The core features of this regulation include:

Layered regulatory framework

: Design differentiated regulatory requirements for different types of stablecoins, and give regulatory priority to payment-oriented single legal currency-anchored stablecoins

Full-chain risk control

: Not only focusing on the issuance link, but also covering the entire ecological chain including custody, trading, payment processing, etc.

Scenario-oriented regulatory incentives: Providing compliance convenience and policy support for application scenarios that serve the real economy From the policy documents of the Hong Kong Monetary Authority and industry exchanges, we have noticed that Hong Kong's strategic focus has clearly shifted from "attracting stablecoin issuers" to "cultivating an innovative application ecosystem based on stablecoins." This shift is reflected in specific policies, such as providing regulatory clarity for corporate clients to use stablecoins for cross-border trade settlement, providing guidance for financial institutions to carry out stablecoin depository and exchange businesses, and supporting the interconnection of stablecoin payments with traditional payment systems.

There are unique strategic considerations behind Hong Kong's strategic positioning: as a gateway connecting mainland China and the international market, Hong Kong hopes to strengthen its strategic position in global offshore RMB business, cross-border financial services in the Greater Bay Area, and Asia's international asset management center through the construction of a stablecoin application ecosystem.

Singapore: A refined risk-appropriate framework

Compared with Hong Kong, the Monetary Authority of Singapore (MAS) has adopted a more refined "risk-appropriate" regulatory strategy. In its framework, stablecoins are subdivided into multiple categories, each subject to different regulatory standards:

Single Currency Stablecoin (SCS)

: Stablecoins anchored to a single fiat currency and mainly used for payment purposes, subject to the most stringent reserve requirements and risk control standards

Non-single currency stablecoins

: Including stablecoins anchored to a basket of currencies or other assets, subject to differentiated regulatory requirements

Scenario-adaptive regulation

:Adjust the intensity of regulation according to the usage scenarios of stablecoins (such as retail payments, wholesale payments, transaction media, etc.)

It is worth noting that Singapore's regulatory strategy places special emphasis on the application value of stablecoins in cross-border payments, trade finance and capital markets. MAS has launched pilot projects for multiple stablecoin application scenarios, including Ubin+ (exploring cross-border stablecoin settlement), Guardian (tokenization and trading of sustainable financial assets) and Project Orchid (retail stablecoin payments). These projects all point to a common direction: the value of stablecoins lies not in the issuance itself, but in the application scenarios it supports.

Singapore's direction is consistent with its positioning as an international trade hub and financial center. By promoting the application of stablecoins in actual business scenarios, it will strengthen its strategic role in connecting global trade and financial flows.

Commonalities and inspirations of regulatory trends

Comparing the regulatory strategies of Hong Kong and Singapore, we can identify several key common trends:

Regulatory shift from "risk prevention" to "innovation promotion"

: The regulatory authorities of both places have shifted from an initial cautious attitude to a more active direction of guiding innovation

Attaching importance to the value of application scenarios

:All regard stablecoins as financial infrastructure rather than simple financial products, and pay attention to their value creation in actual application scenarios

Tilt allocation of regulatory resources

:Tilt regulatory resources towards stablecoin applications that serve the real economy and solve practical problems

These regulatory trends further verify my core point: the value of the stablecoin ecosystem is migrating from the issuance link to the application scenario. Regulators have realized this evolutionary direction and guided the market in this direction through policy design.

For market participants, this regulatory landscape means that competitive strategies that only focus on the issuance link will face increasing limitations, while those participants who can innovate application scenarios and solve practical problems within the regulatory framework will gain more policy support and market opportunities.

If scenario applications are the value gold mines of the stablecoin ecosystem, then payment infrastructure is the necessary tool to mine these gold mines. As the market shifts from "who will issue the currency" to "who can create application scenarios", a key question emerges: what kind of infrastructure can truly enable rich and diverse application scenarios?

Through in-depth interviews and demand analysis with dozens of corporate clients around the world, Aiying found that corporate demand for stablecoin payment infrastructure far exceeds the simple "send and receive stablecoin" function. What enterprises really need is a comprehensive solution that can solve five core challenges:

Complex multi-currency and multi-channel management

International enterprises often need to deal with 5-10 different fiat currencies and multiple stablecoins. They need a unified interface to integrate these complexities rather than establishing independent processes for each currency

Opaque foreign exchange conversion costs

text="">:In cross-border transactions, hidden foreign exchange costs are often as high as 2-3% or even higher. Companies need tools that can monitor and optimize these switching costs in real time

Multi-level compliance and risk control requirements

: Transactions in different regions and of different sizes face different compliance requirements. Companies need a solution that can meet strict supervision without excessively increasing operational complexity

Integration barriers with existing systems

: Any new payment solution must be able to seamlessly integrate with the company's existing ERP, financial management and accounting systems, otherwise the adoption cost will be too high

leaf="">Lack of programmable payment capabilities

: Modern enterprises need not only simple fund transmission, but also advanced functions such as conditional payment, multi-level account splitting, and automatic payment based on event triggering

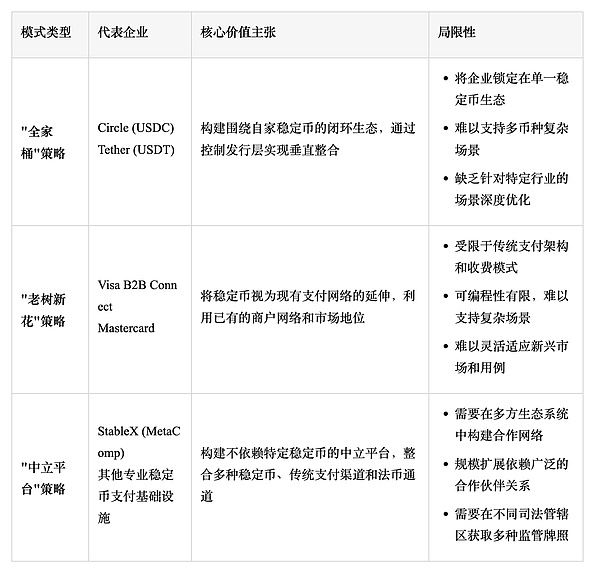

Faced with these complex needs, the market is forming three completely different infrastructure provision models, each of which represents a different strategic positioning and value proposition:

Cross-scenario intelligent optimization capability: The real value lies not in simply providing multiple options, but in being able to intelligently recommend the best path for a specific transaction. For example, a payment from Singapore to Brazil may require different optimal paths under different conditions: using USDC through a specific exchange during period A, while using USDT through another channel during period B, or even falling back to traditional bank channels under specific circumstances. This dynamic optimization capability is the core of scenario value.

Compliance empowerment capability: As the application of stablecoins shifts from simple transactions to broader business scenarios, the complexity of compliance requirements has increased significantly. By integrating various compliance tools and processes (such as KYB, transaction monitoring, suspicious activity reporting, etc.), the neutral platform reduces the cost and complexity of enterprises building their own compliance infrastructure, enabling them to innovate application scenarios under the premise of strict compliance.

In the long run, we foresee that the future stablecoin payment infrastructure will be further specialized, forming a clear layered architecture: stablecoin issuers focus on currency stability and reserve management; neutral payment infrastructure providers are responsible for connecting different stablecoins, optimizing payment paths and ensuring compliance; vertical industry solutions focus on in-depth applications in specific scenarios. This professional division of labor will significantly improve the efficiency and innovation capabilities of the entire ecosystem.

From the present moment, looking forward to the future evolution path of stablecoin application scenarios, we can identify a clear development trajectory: from a simple payment tool to a comprehensive financial infrastructure. This evolution process will unfold in three stages, each of which represents a qualitative change in the value creation model.

Phase One: Payment Optimization (2023-2025)

Currently, we are in the first stage of stablecoin application, and the core value proposition is to solve basic payment problems, especially cross-border payment scenarios. Characteristics of this stage include:

Increased payment speed (from 3-5 days to real time or near real time)

Reduced apparent costs (from an average of 7% to 0.1%-1%)

Enhanced payment transparency (real-time tracking of transaction status)

Optimized foreign exchange processing (reducing losses caused by exchange rate fluctuations)

text="">At this stage, stablecoins are mainly used as a medium for fund transmission, replacing or supplementing traditional payment channels. The focus of competition among market participants is who can provide a faster, cheaper and more reliable payment experience.

Phase 2: Financial Services Embedding (2025-2027)

As basic payment issues are resolved, stablecoin applications will enter the second stage, with the core feature being the deep integration of financial services and payments. This stage will see:

Seamless connection between payment and trade financing (such as automatic provision of accounts receivable financing based on payment history)

Integration of liquidity management tools (such as intelligent fund pool management, optimization of idle fund returns)

Programming of multi-party financial collaboration (such as collaborative automation of buyers, sellers, and financial institutions in supply chain finance)

Real-time asset-liability management (the corporate treasury function shifts from delayed reporting to real-time management)

left;">At this stage, stablecoins are no longer just payment tools, but become the infrastructure for building new financial services. The focus of competition has shifted from simple payment efficiency to who can provide more comprehensive and intelligent financial solutions.

The third stage: financial programmability (2027 and beyond)

Finally, stablecoin applications will enter the third stage: financial programmability. At this stage, enterprises will be able to customize complex financial processes based on business logic through APIs and smart contracts. Specific manifestations include:

Business rules are directly converted into financial logic (such as sales conditions are automatically converted into payment conditions)

Dynamic optimization of financial resources (funds automatically flow between different channels and tools according to real-time conditions)

Automation of cross-organizational financial collaboration (the financial systems of upstream and downstream enterprises in the supply chain achieve programmatic collaboration)

Democratization of financial innovation (enterprises can build exclusive financial tools and processes at low cost)

text="">At this stage, stablecoins will become true "programmable currencies", and financial operations will no longer be independent functions, but deeply embedded in the core business processes of enterprises. The focus of competition will be who can provide the most powerful and flexible financial programming capabilities.

This three-stage evolution will promote the formation of a more professional division of labor system in the stablecoin ecosystem, which is mainly reflected in three levels:

Infrastructure layer: Stablecoin issuers focus on maintaining currency stability, reserve management and regulatory compliance, and provide a reliable value foundation for the entire ecosystem. Participants in this layer will face pressure for standardization and commoditization, and their differentiation space is limited.

Application platform layer: Neutral payment infrastructure providers are responsible for connecting different stablecoins, optimizing payment paths, ensuring compliance, and providing core application functions. Participants in this layer will compete through differentiated technical capabilities, user experience, and ecological integration capabilities.

Scenario solution layer: Vertical industry solution providers focus on deep optimization of specific scenarios and provide highly customized solutions. Participants in this layer will differentiate themselves through a deep understanding of the pain points of specific industries and targeted solutions.

With the deepening of this professional division of labor, we will see changes in the value distribution ratio of each layer: the profit space of the infrastructure layer will gradually shrink, while the application platform layer and the scenario solution layer will gain a larger share of value. This trend is highly similar to the development process of the Internet - from early infrastructure competition, to platform competition, and then to application scenario competition.

The stablecoin market is undergoing a profound value reconstruction: from "who will issue the currency" to "who can create and amplify the application scenarios in the real world". This is not a simple adjustment of the business model, but a redefinition of the way the entire industry creates value.

Looking back at the history of payment technology, we can find a recurring pattern: every payment revolution has gone through a process from infrastructure construction to product standardization, and finally to the explosion of scenario value. It took decades for credit cards to evolve from a simple payment tool to the infrastructure for building a consumer finance ecosystem; mobile payments have also experienced a long evolution from simply replacing cash to deeply integrating various life scenarios. Stablecoins are experiencing the same development trajectory, and we are now at a critical turning point from standardization to the explosion of scenario value.

In this new stage, the key to success is no longer who has the largest issuance or the strongest capital strength, but who can most deeply understand and solve practical problems in specific scenarios. Specifically, market participants need to have three core capabilities: Scenario insight capabilities: The ability to identify and understand the deep pain points and needs in specific areas Integrate and coordinate capabilities: The ability to connect and integrate resources from multiple parties to build a complete solution ecosystem User empowerment capabilities style="text-align: left;">:Can make complex technologies easy to adopt through appropriate abstraction and simplification

For participants in the stablecoin ecosystem, this value migration means an adjustment of the strategic focus: from simply pursuing scale and speed to deepening vertical scenarios and user value. Participants who can establish professional division of labor, build an open ecosystem, and focus on scenario innovation will stand out in this transformation that reshapes the global payment infrastructure.

ParaSwap's community has agreed to use treasury funds to compensate victims of the Augustus V6 contract vulnerability, highlighting the project's commitment to its users' security.

Weiliang

WeiliangTON offers $5 million in Toncoin for palm scan identity verification, aiming to onboard one billion users to the Web3 ecosystem.

Alex

AlexIn the wake of the country's crackdown on Binance, the Philippines' securities regulator has shifted its focus to the online trading platform eToro.

Catherine

CatherineShiba Inu's supply shrinks as a mysterious whale burns millions of coins, while another whale purchases almost 700 billion SHIB.

Miyuki

MiyukiThe interruption stemmed from the incorporation of an incorrect version of a bug fix during the upgrade process.

Catherine

CatherineWith this new feature, users gain the ability to conveniently withdraw cash and make purchases at various point-of-sale locations and ATMs where the service is available.

Kikyo

KikyoArthur Hayes predicts a downturn in the crypto market due to the Bitcoin halving and US Federal Reserve actions.

Alex

AlexSolana network to address transaction failure bug by April 15, targeting implementation issues rather than fundamental design flaws. Concerns over network stability prompt community attention amid soaring market valuation.

Miyuki

MiyukiThe IRS faces criticism for its aggressive tactics in seeking help from blockchain investigator ZachXBT, raising concerns about privacy and professionalism.

Weiliang

WeiliangDonald Trump sees a noteworthy downturn in his cryptocurrency investments with his current crypto holdings valued at $5.3 million —a loss close to $3 million.

Catherine

Catherine