Author: insights4vc Translation: Shan Ouba, Golden Finance

For the past few months, we have been supporting a fast-growing, bootstrapped company that has generated over $20 million in revenue in two years. Because the team has not raised any external funding and has focused on business building, they only recently began to engage with venture capital funds. The company operates in the crypto industry. This sector is gradually becoming more institutionalized, but gray areas still exist. Careful selection of partners and the depth of interaction are crucial.

In today's article, we want to remind everyone that scams have become extremely sophisticated. Even under pressure, it is important to make calm and rational decisions.

What Happened

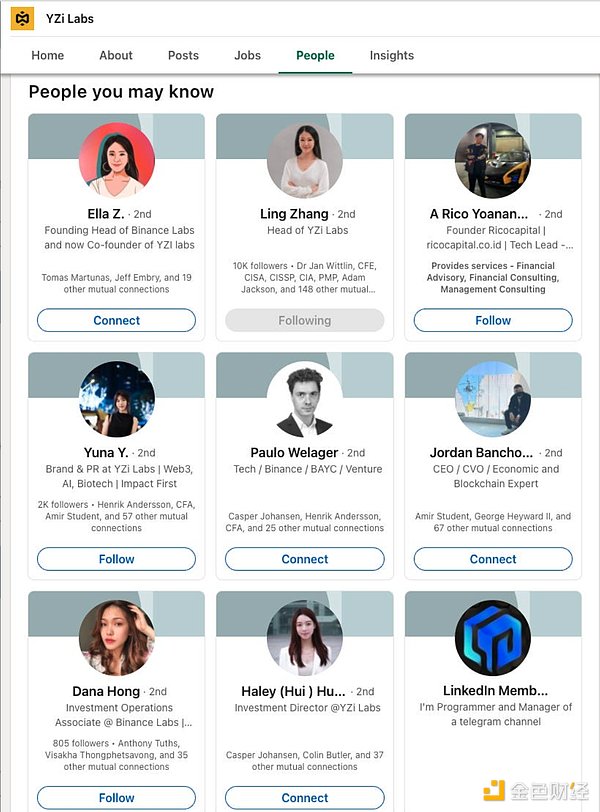

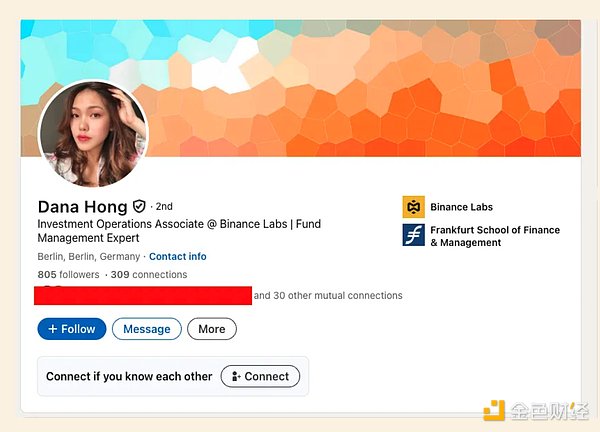

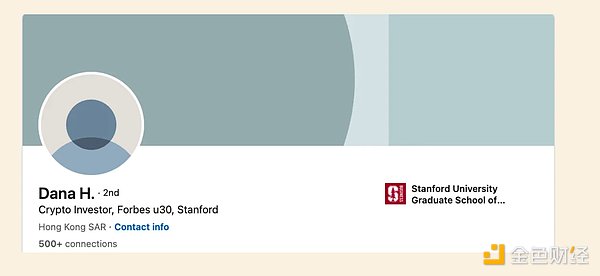

One of the funds we contacted was YZi Labs (formerly Binance Labs), which claims to be the venture capital arm of the world's largest cryptocurrency exchange. We contacted several investment partners, including someone who called himself Dana H. At first, everything seemed normal, we received positive feedback, and we even scheduled a call.

Further investigation revealed that “Dana H.” had two different online profiles. One corresponds to a real person who worked at Goldman Sachs and has a Stanford MBA; the other fake version claims to have studied at a university in Frankfurt.

We didn’t suffer serious consequences this time, but under the pressure of communicating with so-called big-name funds, many founders may make costly mistakes.

Red flags we saw

No standard video conferencing link in the calendar invite

Senior investors absent or “joining later” with no reasonable explanation

Lack of substance from the speakers on the call

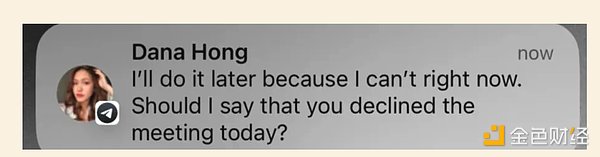

Rapid escalation and creation of a sense of urgency by mentioning well-known funds

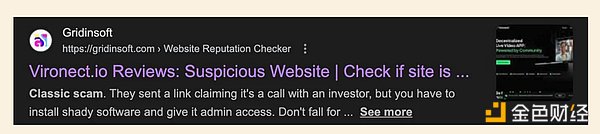

Pressure to switch to an unfamiliar software platform that required a download

Claims of investment in the platform they were promoting

Misleading information on LinkedIn profiles

Dual-Verify Identity: Require the other party to use a work email address at the company's primary domain, and cross-verify by calling the company's main phone number.

Control the Meeting Platform: Use your own Meet, Zoom, or Teams link. Never install new software just minutes before a call.

Pause During Urgency: If someone insists on switching platforms immediately or bringing in "another fund" right away, postpone the discussion until later.

Verify Relationships: Verify names and positions with company websites, recent meeting attendance records, and credible media reports. Watch out for discrepancies in education and work experience.

Keep a record of the incident: Saving invitations, emails, screenshots, and call notes can help the security team intervene and quickly issue external warnings.

Invest in security infrastructure: Strengthen email security, use role-based accounts, conduct anti-phishing training, and implement strict device policies to mitigate risk in multiple ways.

VC scam tactics

Gateway: First call as an "investor," then sell services.

Paid participation: Requiring payment of a "due diligence" or "assessment fee" before being considered—just skip it. Paid roadshows: You're paid to present to investors—if there's genuine demand, you won't be charged for your presence. VC salaries: A small investment with a paid consulting contract that drains your cash. Profit-only agreements: Terms that put you at risk but guarantee them guaranteed profits. Connection bragging: Brokers claim to have deep connections with a fund, but in reality, they're just adding them on LinkedIn. Equity in lieu of fees: 4% equity in exchange for a few referrals—a misaligned incentive.

Require to apply using their app: Fake investors use their own tools to gather information on entrepreneurs.

Last-minute regrets: Their original "agreement" is suddenly reversed when you're short on funds.

Spear phishing: They gain access to your data room and then disappear, purely to gather information.

Accelerator traps: Not all accelerators are scams, but if they don't directly invest money, they're just services, and their value depends on the founder's stage.

Pie in the sky: A higher valuation gives you more money, but comes with stringent priority rights, making the next round more difficult.

Gotcha clauses: Fatal details hidden in investment terms. Anything not negotiated is a potential risk.

Fatal vesting conditions: Tying compensation to funding outcomes over which you have no control—legal but dangerous.

Conference link switching: Temporarily replacing the link before a call can create a phishing risk. Always double-check.

Ten rules for staying safe

Stay skeptical. There's no such thing as a free lunch.

Be familiar with standard procedures and terms. Tie compensation to results whenever possible. Research the portfolio and potential conflicts. Conduct background checks on 3-4 founders before signing. Important commitments must be put in writing. Make roadshow materials non-confidential by default, assuming they will be disseminated. Set up a data room in two phases, with restricted access to sensitive documents. Hire a lawyer with venture capital experience. Don't stop fundraising before funds are in; a term sheet alone doesn't count.

Feel free to share this with anyone who might benefit from it.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin Xu Lin

Xu Lin JinseFinance

JinseFinance CaptainX

CaptainX CaptainX

CaptainX CaptainX

CaptainX