Source: The DeFi Report; Author: Michael Nadeau; Translation: BitpushNews

Some of the best-performing "altcoins" in this cycle aren't even tokens—they're crypto-asset-related stocks. Robinhood has been the most dramatic performer.

Its stock price has increased 17-fold in less than two years, turning one of our most contrarian investments (HOOD had fallen 80% from its IPO price in '22) into a major portfolio win.

We first accumulated shares during the last bear market (average cost of $21.49) and exited in October, locking in over 550% gains.

Now, with accelerated product momentum and a more diversified revenue structure than two years ago, Robinhood is officially back on our "watch list" (our bear market shopping list).

This report is an update on the company's fundamentals, valuation, and its strategy to further expand into crypto assets and prediction markets, based on data. Disclaimer: The views expressed are those of the author and should not be considered investment advice.

Revenue and Revenue Growth

Data Source: Yahoo Finance, Robinhood

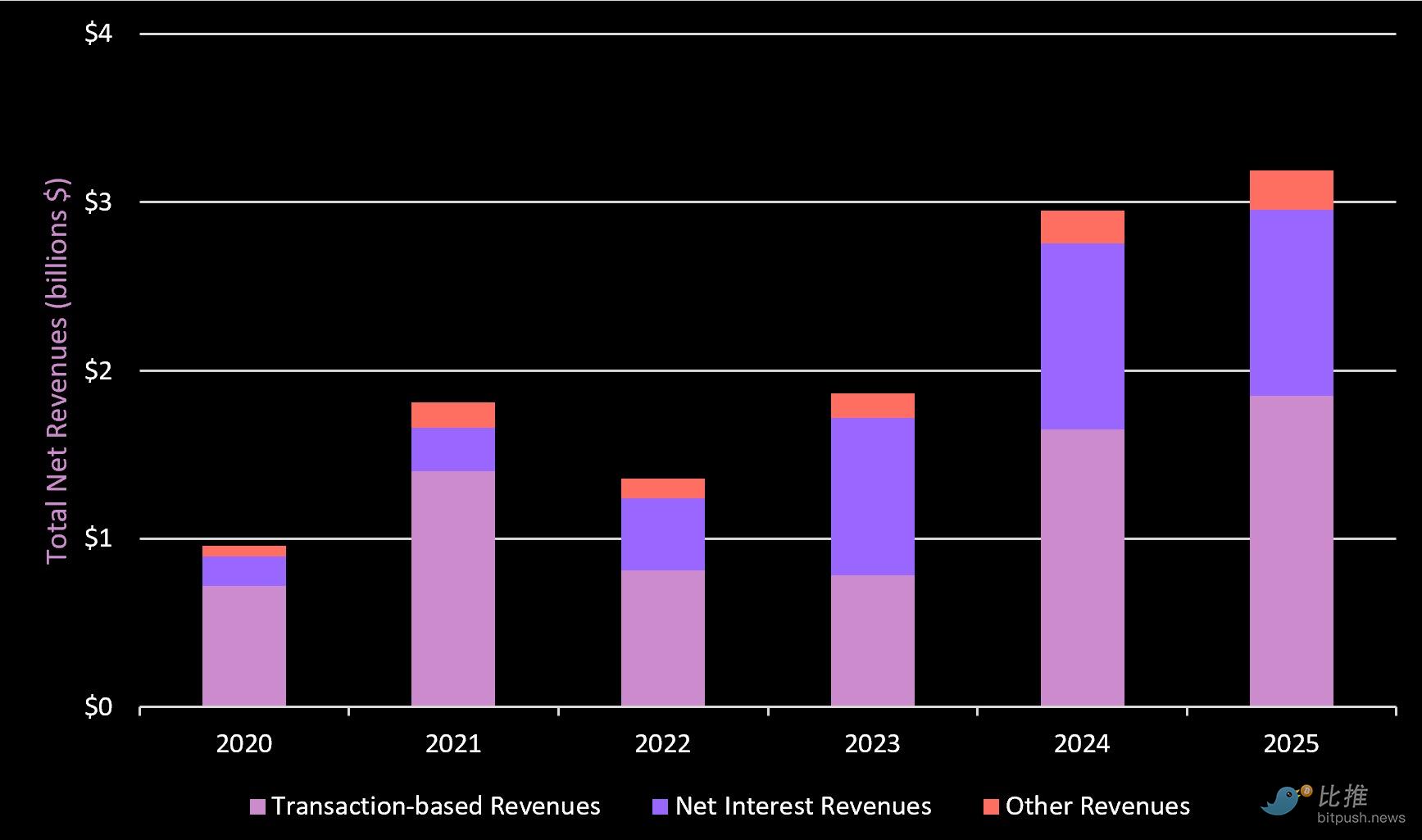

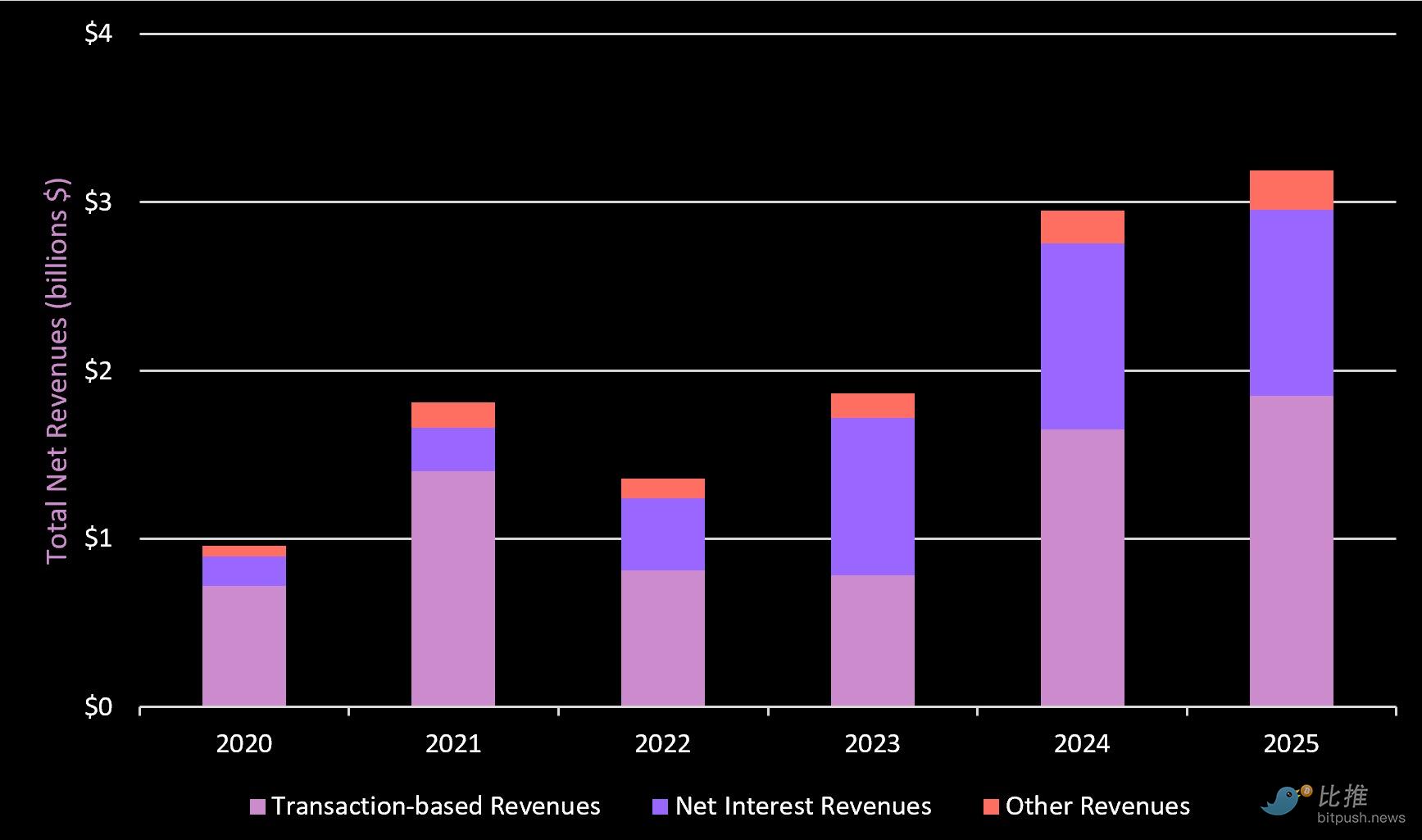

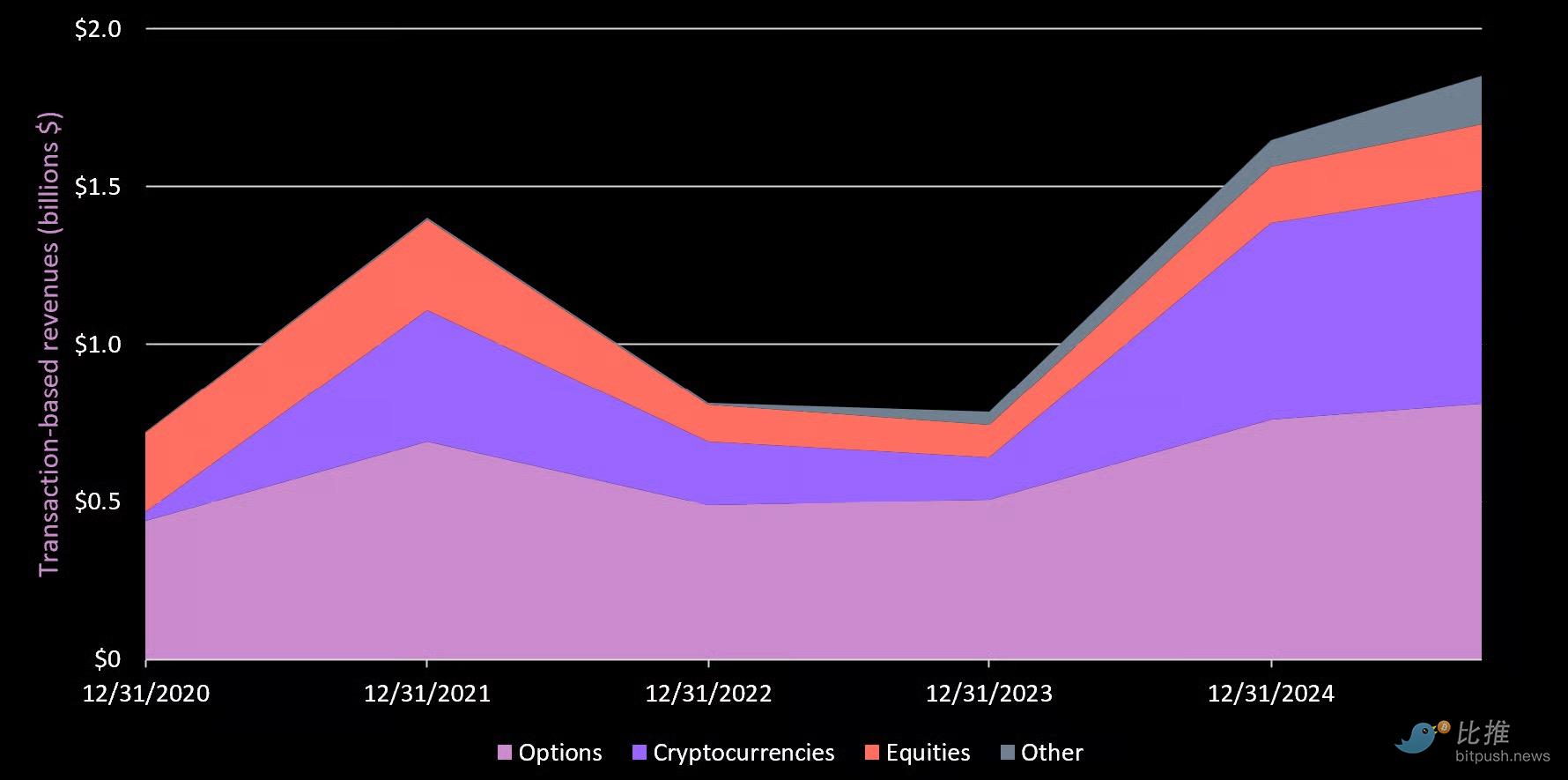

Robinhood achieved revenue of $2.95 billion in 2024, a 58% increase over 2023. As of the third quarter of this year, it has generated $3.19 billion in revenue—exceeding its total revenue for the entire previous year.

Over the past twelve months, the company's revenue reached $4.2 billion (a 31% year-over-year increase). Below, we will break down the revenue sources and growth of each business line.

Revenue Composition Analysis

Data Source: Robinhood 10Q

Key Takeaways

Fundamentals

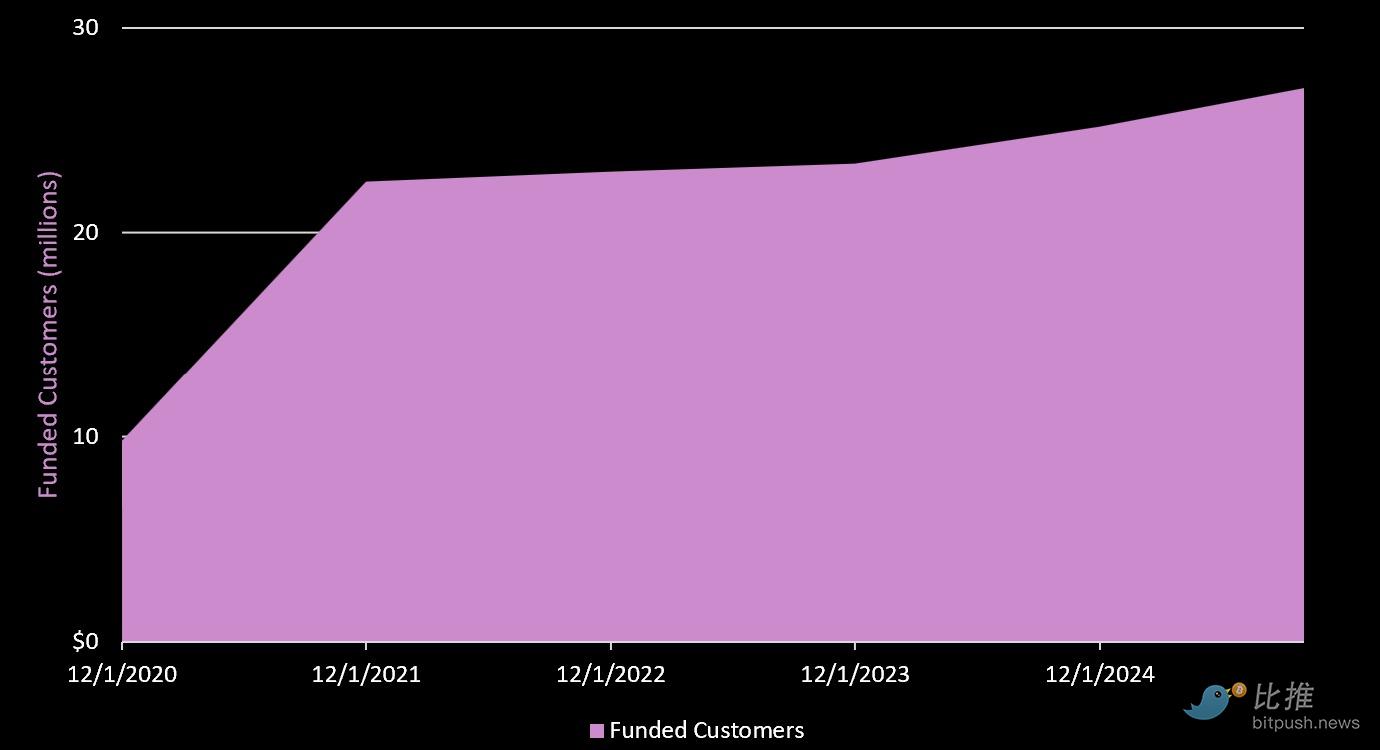

Users

Valuation Comparison

Some Thoughts

Hyperliquid (perpetual contracts + spot trading) crushes all others in trading volume, but generates the least revenue.

Uniswap faces the biggest challenge in user monetization because historically 100% of trading fees were paid to liquidity providers (recent governance proposals are changing this).

Uniswap faces the biggest challenge in user monetization because historically 100% of trading fees were paid to liquidity providers (recent governance proposals are changing this).

COIN vs HOOD

Coinbase has one-third the user base of Robinhood, but its revenue is almost twice that of Robinhood.

However, in terms of market capitalization, Coinbase is trading at a 53% discount to Robinhood.

Why?

We believe the market favors Robinhood because of:

Its diversified business covers stocks, options, prediction markets, and cryptocurrencies.

Robinhood is seen as a "super app" and is expanding into the consumer/retail financial sector.

Robinhood is seen as a "super app" and is expanding into the consumer/retail financial sector.

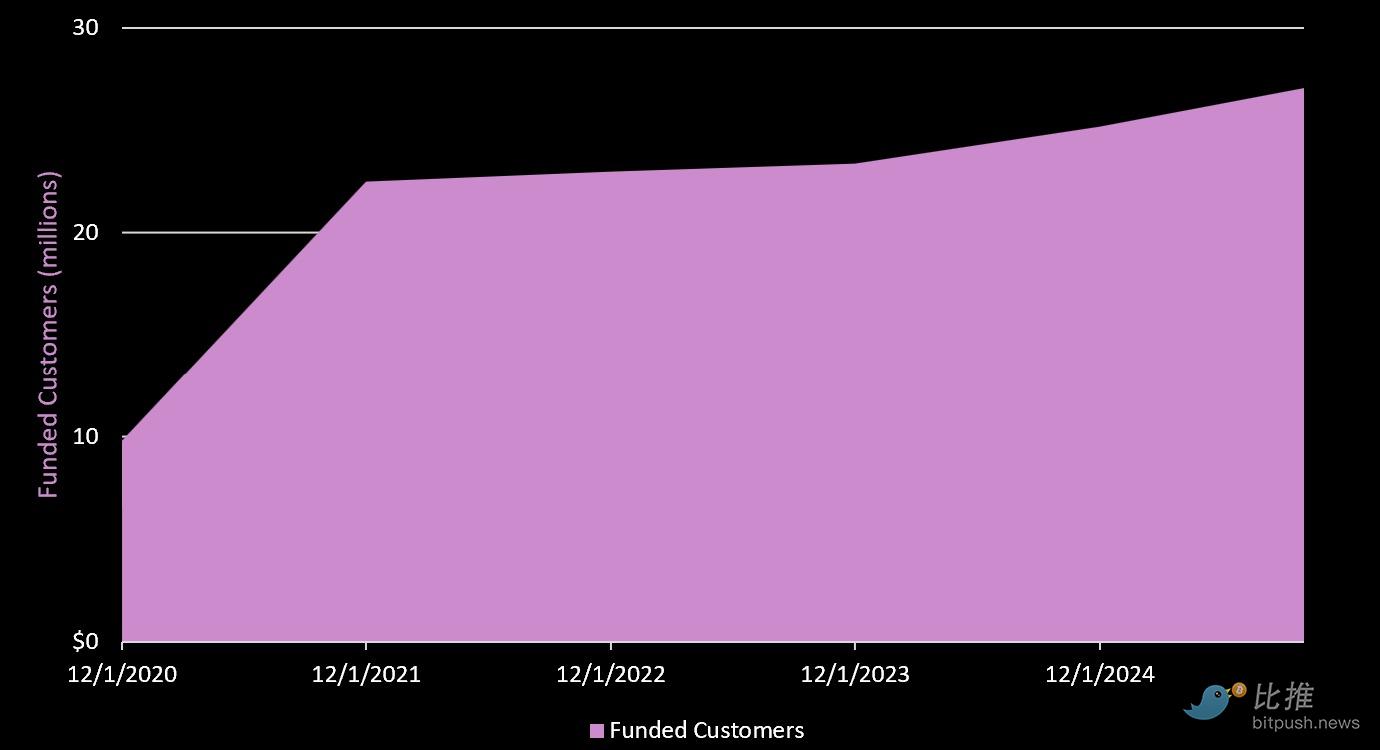

Coinbase is still considered a “cryptocurrency exchange” (although its business extends far beyond that). Regulatory licenses. Robinhood is registered as a broker-dealer and regulated by FINRA and the SEC. Coinbase is not. This means Coinbase cannot offer stocks, options, margin lending, etc. It has a larger, more active user base. Coinbase has struggled with user growth since 2021. Compared to traditional financial companies, Robinhood's revenue over the past twelve months was 18% of Charles Schwab's. Charles Schwab has 38 million active accounts (Robinhood has 27.1 million). Product Roadmap Robinhood's Crypto Development History: 2018: Robinhood officially launched crypto asset trading in select states, initially supporting BTC and ETH. 2019: Obtained a New York State BitLicense, allowing it to offer crypto asset trading in New York. 2020: Crypto asset trading volume increased significantly. This coincided with a substantial increase in Robinhood's user base, as the COVID-19 pandemic marked a period of renewed interest in stocks and crypto asset trading among retail investors. In 2021, Robinhood reported that crypto asset trading accounted for 41% of its revenue in the first quarter, primarily driven by Dogecoin trading (which accounted for 25% of all revenue!). Later that year, Robinhood filed for an IPO, noting that crypto asset trading was a significant part of its business. In 2022, it announced the launch of its crypto wallet feature, allowing users to deposit and withdraw crypto assets. In 2023, it announced the addition of several new crypto assets for trading on its platform and plans to expand into the European Union. In 2024, the company announced a partnership with Arbitrum (an Ethereum Layer 2 network), allowing users to access DEX swap trading on Arbitrum. The team subsequently announced an integration with MetaMask, allowing users to purchase crypto assets on Robinhood and fund their wallets via debit cards, bank transfers, or existing Robinhood account funds. Following this, the company launched a staking service for European customers, as well as a crypto trading API—providing market data access and programmatic order placement capabilities. The company acquired the global crypto exchange Bitstamp, which boasts 4.4 million users and $200 million in revenue. The company also announced support for Base (Coinbase's L2). Become a primary entry point for crypto assets for retail traders (more assets, wallet access, integration, low fees). 2025 Fully integrate with Bitstamp exchange. Launch Robinhood crypto wallet v2 (cross-chain swaps, DeFi connectivity, Arbitrum functionality, potential Base and Solana swaps, Web3 wallet experience). Awaiting US approval for crypto asset staking services. Offer institutional crypto asset services through Bitstamp. Announce plans to build an L2 on Arbitrum.

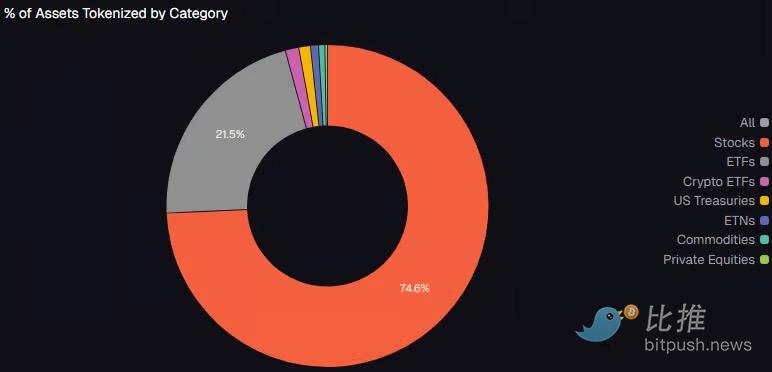

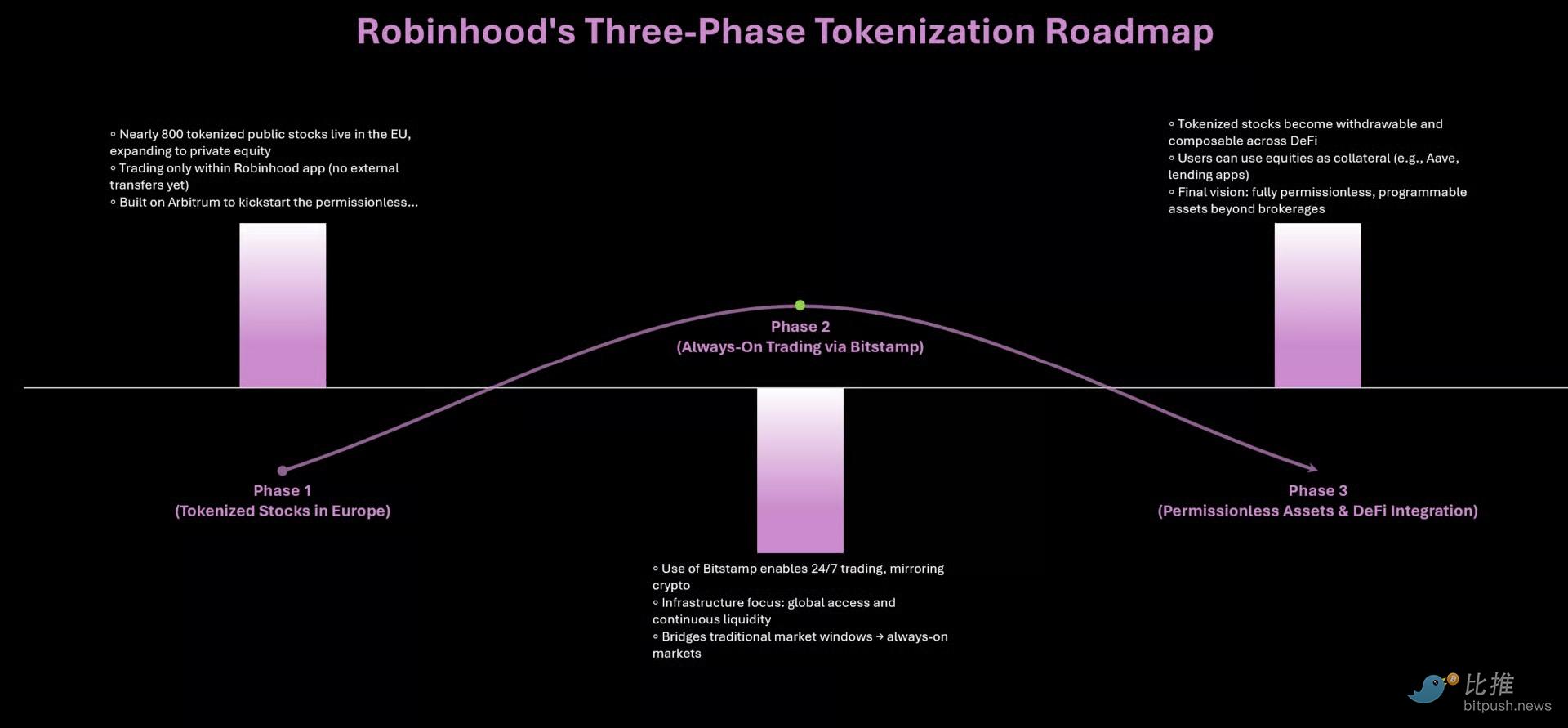

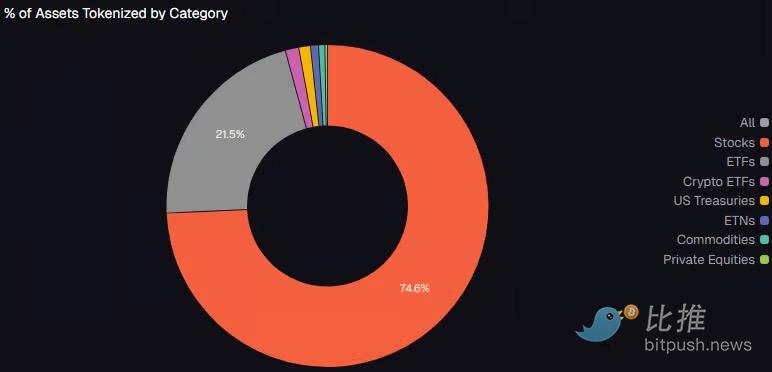

Announced plans to tokenize public and private equity (7/24 trading, instant settlement, DeFi integration, global access for users outside the US, and a lower cost structure compared to traditional brokerage channels). The final point is where Robinhood sows the seeds for "full crypto," leveraging its infrastructure (Bitstamp, Robinhood Crypto, Arbitrum) and user base to encompass: regulated global exchanges; integrated staking custody solutions; tokenization integrated with DeFi; wallets and payments; and deposit/withdrawal gateways. What's the conclusion? Robinhood is building a full-stack tokenization + crypto asset trading and financial services platform.

Future Roadmap

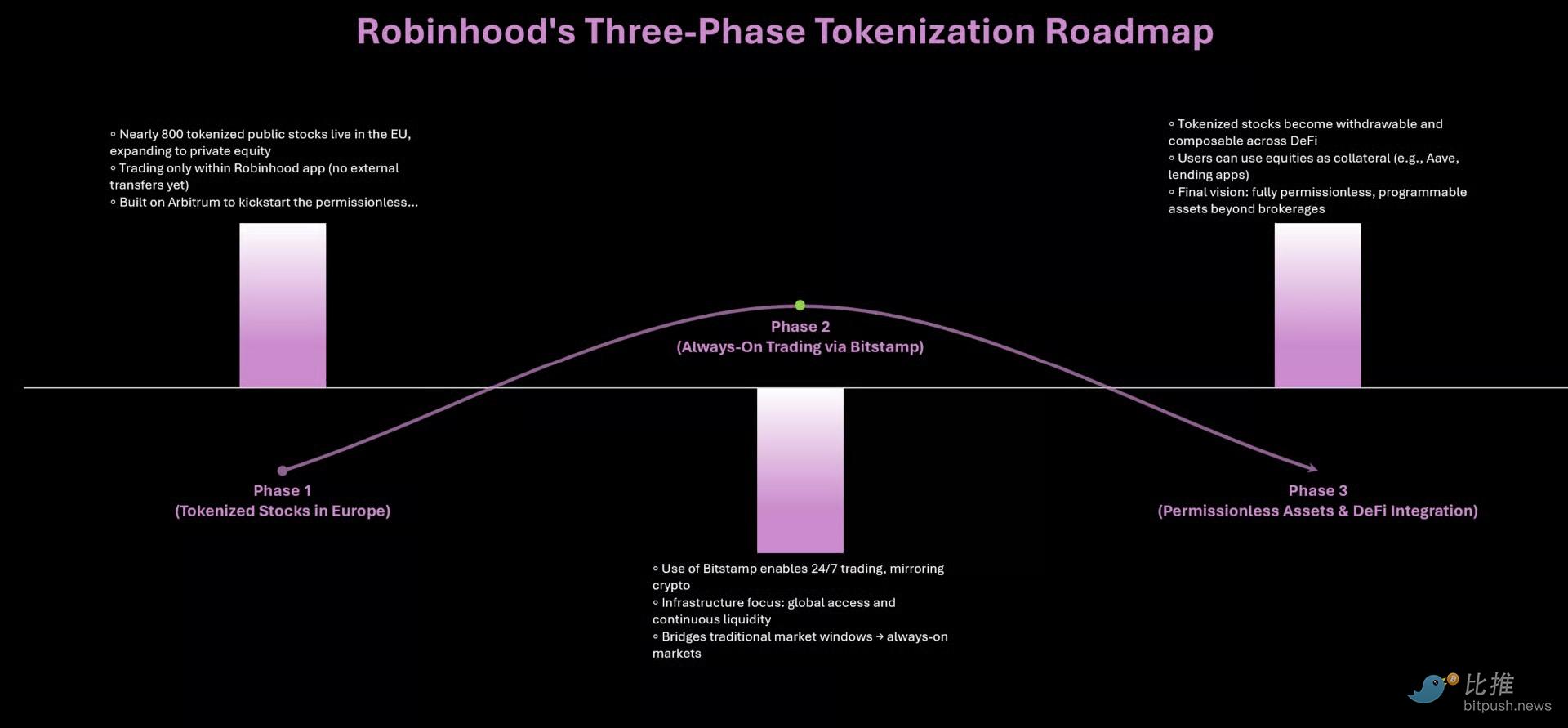

Phase 1 (In Progress)

Nearly 800 tokenized publicly traded stocks have been launched in the EU, and the program is expanding into private equity.

Traded only within the Robinhood app (external transfers are not supported).

Built on Arbitrum.

Building on Arbitrum.

Phase Two (Early 2026)

Leveraging Bitstamp for 24/7 trading, synchronized with crypto asset trading.

Global access + continuous liquidity.

Global access + continuous liquidity.

Every major brokerage and trading platform is currently implementing cryptocurrency trading. Charles Schwab. Fidelity. Interactive Brokers. Webull. E*Trade.

They are all aiming for the **generous cryptocurrency trading fees**. This competition could squeeze Robinhood's profit margins.

Meanwhile, Coinbase is a leader in **crypto-native infrastructure and product suite**.

Execution Risks

The team faces a **daunting task**: combining Robinhood's top-notch user experience and mobile app with a cryptocurrency track, which is no easy feat.

Tokenization Strategy Risks

The real benefit of tokenization is that **actual shares are tokenized**.

Why?

This means that the shareholder's cryptocurrency wallet (which has passed KYC) is the **official record of ownership**. This means that dividends will be paid into the wallet.

Now. **Robinhood cannot decide which shares are tokenized and which are not**. The issuer (company) decides.

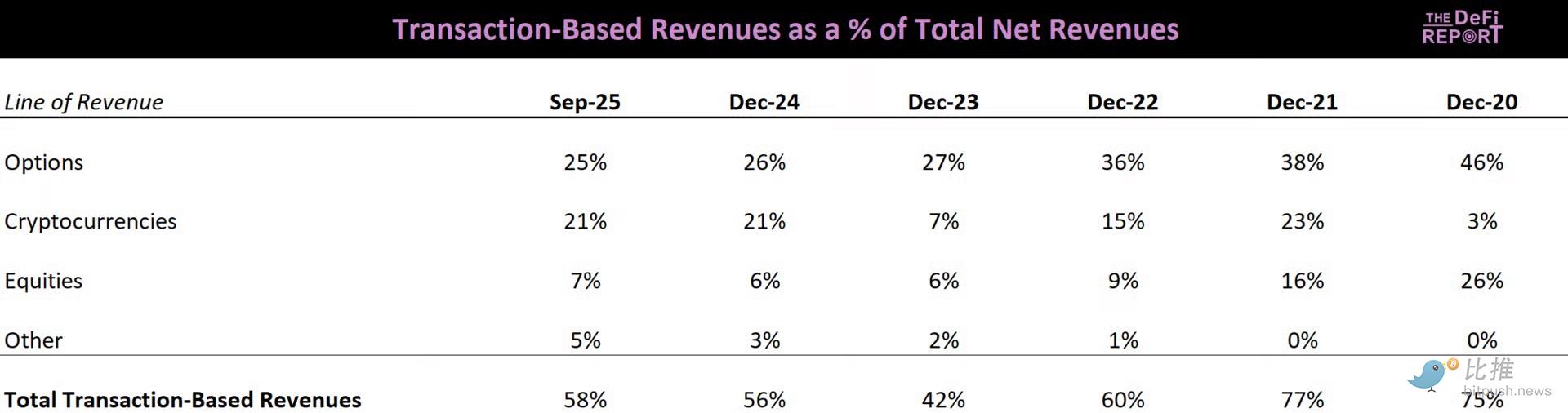

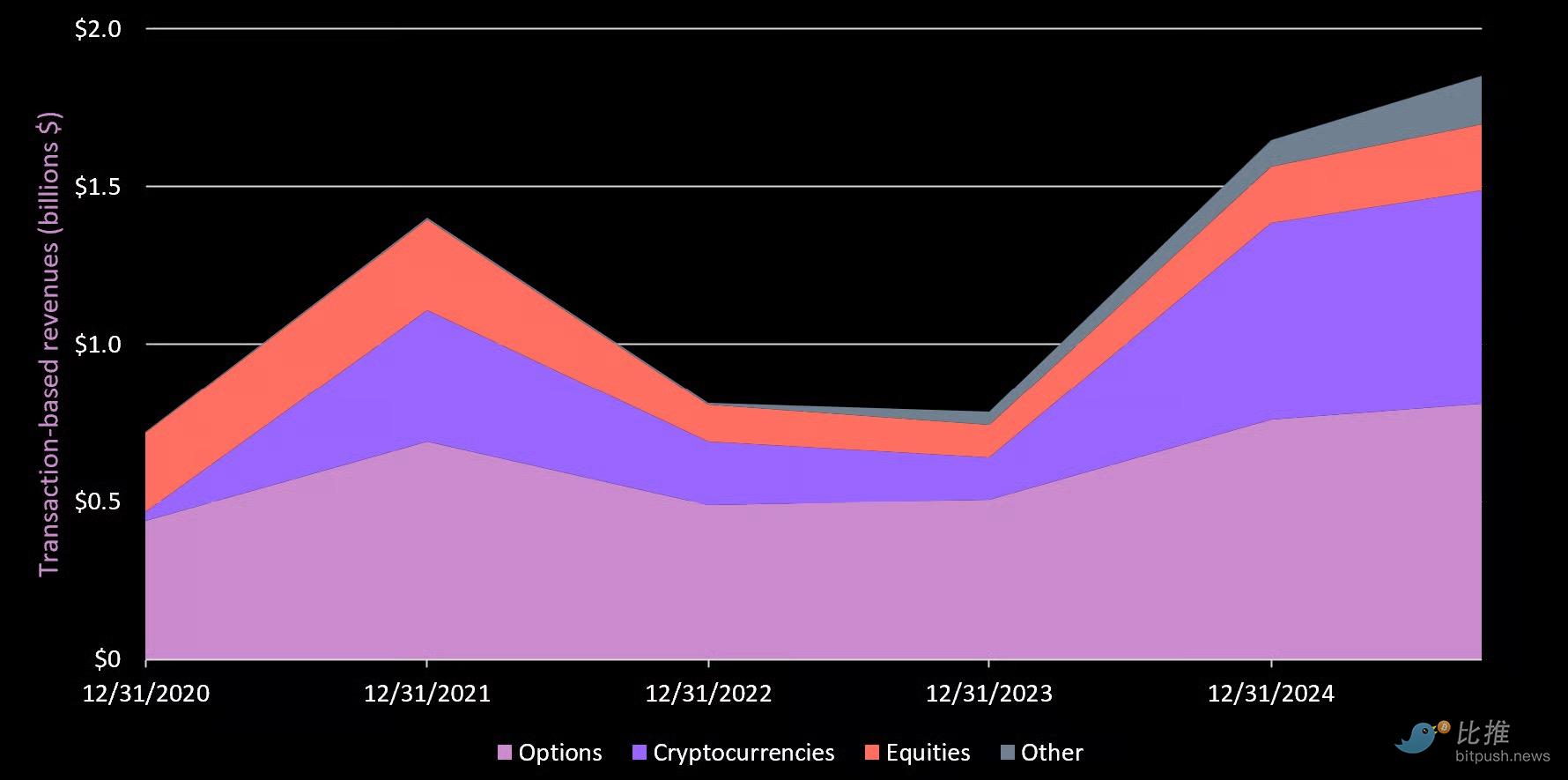

Do they have the incentive to tokenize today? In our view, this is **uncertain**. We believe that if they can: **reduce issuance costs**, **expand distribution channels**, **improve liquidity**, **reduce settlement friction**, and **unlock new investor groups globally**, then they will want to tokenize. Today, these benefits are insufficient to incentivize large, existing companies to tokenize. **Definitely not** before new regulations are introduced. Furthermore, their shareholders are not demanding this today. And we believe that existing service providers, such as transfer agents, prime brokers, custodians, clearing networks, market makers, and fund administration/back-office staff, are opposed to this. The key takeaway is? Robinhood has a strong incentive to push for tokenization. However, they have limited control over issuer adoption of tokenization. We believe this will take longer than the market currently expects. In summary, Robinhood's revenue has grown at a CAGR of 34% over the past five years. In recent years, growth has come from all trading lines (cryptocurrencies, stocks, and options). The additional revenue from Robinhood Gold, prediction markets, and cryptocurrency services (wallets, staking, transfers, European expansion, cryptocurrency-linked cards, Arbitrum L2) points to a promising revenue outlook. We love this leadership team, their track record of delivering an excellent user experience, and their vision of moving towards “full crypto.” By using this product to transfer assets (seamlessly and quickly) and by offering incentives for asset transfers (2-4% cash rewards based on asset value), Robinhood is effectively launching a vampire attack on Charles Schwab, Fidelity, Coinbase, and others. Simultaneously, they are now challenging Coinbase in cryptocurrency-native services and leading the way in tokenization strategies. We believe Robinhood has the potential to become a leading financial institution of the future. That said, it is currently trading at 56 times its earnings. We believe that cryptocurrency revenue (which now accounts for a significant 21% of revenue) will be hit in the near term, along with the generally risk-averse sentiment among retail investors. Given that revenue declined by 25% in 2022 and was on an 80% pullback, we are likely to see a similar significant correction in a risk-averse environment. We believe this could present an excellent buying opportunity for long-term holding. This is why HOOD is on our watchlist.

Anais

Anais