Author: WOO Research

Background

The crypto market hit a freezing point in 2022, and began to recover in Q4 2023. In 2024, Bitcoin also broke through the high of $69,000 in the previous bull market. As the market recovers, in addition to paying attention to the performance of the currency price, we believe that the overall financing situation in the crypto market is also crucial.

The prosperity of financing activities represents the driving force of industrial development, which will be reflected in:

Promoting technological innovation: Financing is an important driving force for technological innovation. Funds support the research and development and application of new technologies, which can promote technological progress in the entire industry.

Market confidence index: Venture capital represents investors' expectations for the prospects of the crypto market. If the amount and number of overall financing decrease, it can be regarded as the outside investors' conservative or even pessimistic views on the market prospects.

The positive flywheel effect brought by financing activities is particularly obvious:

Increase in financing cases: A large amount of capital inflows has attracted more investors and venture capital, promoting the emergence of more financing cases.

Attracting new startup teams: With the increase in financing opportunities, more new startup teams and companies are attracted to enter the crypto market and invest in the development of new technologies and applications.

The overall ecology has improved: The emergence of new technologies and applications has improved the market ecology and brought more diversification and innovation.

Investor interest increased: Good market ecology and continuous technological innovation attracted more investors' interest, further enhancing market confidence.

In this article, WOO X Research will review the overall financing situation in 2024, and then look at the trends of some well-known VC investment sub-sectors. Finally, we will predict future potential sectors based on financing data.

Overall financing situation in 2024

Financing amount and number: It can be seen that the overall financing market began to pick up in November 2023. The number of financings in a single month in 2024 basically remained above 120 (July has not yet ended), and the monthly financing amount fell between 70 billion and 100 billion. Both the amount and the number of financings have shown significant growth in 2023.

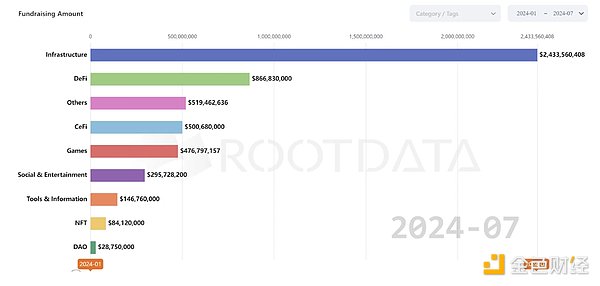

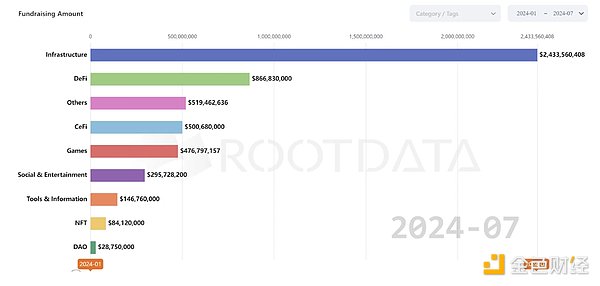

Track Performance: Infrastructure is the most popular among investors, with a total of $2.4 billion raised, far exceeding the second-place DeFi of $860 million. It can also be seen that VCs have little interest in DAO and NFT, ranking last in terms of financing amount.

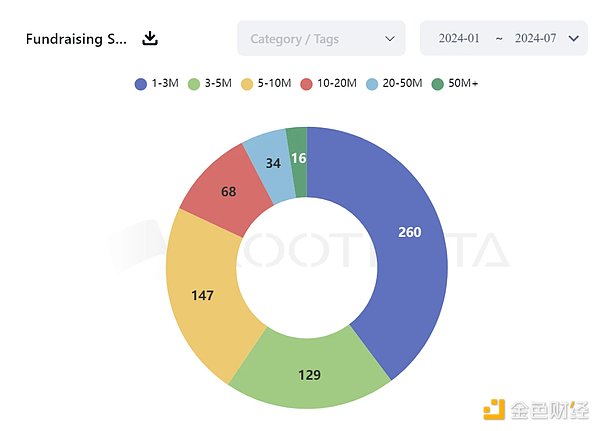

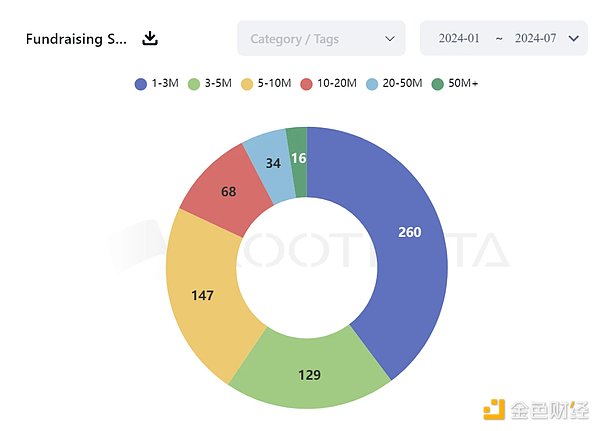

Single Financing Scale: 1 million to 3 million scale accounts for 40% of the highest, 5 million to 10 million accounts for 22% of the second. The financing of 3 million to 5 million scale has decreased compared with 2023, and the reduction has increased in the 1 million to 3 million and 5 million to 10 million ranges, which also means that the middle area of the amount of financing for 2024 projects has decreased, which is more differentiated.

Head VC investment situation

This article selects A16Z, Coinbase Ventures, Binance Lasbs, Pantera Capital and Dragonfly as reference objects.

From the above data, we can draw the following points:

A16Z (Andreessen Horowitz): Mainly invests in infrastructure, DeFi and games, and also has some investments in NFT and social entertainment.

Coinbase Ventures: The investment areas are diversified, with DeFi and infrastructure as the focus, and it also involves tools and information, social entertainment and DAO.

Binance Labs: Most of the investment is concentrated in DeFi and infrastructure, followed by social entertainment and games.

Pantera Capital: Mainly focuses on DeFi and infrastructure, and some funds are invested in NFT and other fields.

Dragonfly: The investment scope is wide, with infrastructure, DeFi, NFT and tools and information accounting for a large proportion.

As with the initial observation of the overall financing situation in 2024, the investment focus of these five head VCs is still infrastructure and DeFi. Next, let's take stock of their investment projects:

A16Z: 13 external investments, three of which were lead investments (Friends With Benefits, EigenLayer, Espresso System).

The project with the highest amount of financing among the investment projects is the Web 3 social application Farcaster, which raised $150 million in the A round and was valued at $1 billion.

It is worth mentioning that although A16Z did not lead Farcaster in the A round, it played the role of Farcaster in the 2022 seed round.

Binance Labs: 24 external investments, the lead investors prefer to contact the project parties on their own and invest alone, most of which do not disclose the amount, and rarely invest with other teams.

Among the investment projects, it was disclosed that the project that received the highest amount of financing was Ethena, which raised $14 million in the expansion seed round.

Other separately invested projects include: Catizen, Zircuit, Infrared, Rango, Aevo, Movement, BounceBit, StakeStone, Cellula, Derivio, Babylon, RENZO, NFPrompt, Puffer Finance, Shogun, BracketX Protocol, Memeland, accounting for the vast majority, and more than 80% of the projects have not yet issued coins. If they issue coins, they are expected to have the opportunity to be listed on Binance in the future.

Pantera Capital: 18 external investments, 9 of which were led, and the lead rate in 2024 was as high as 50%. The project with the highest amount of financing among the investment projects is the open source AI model Sentient, which raised $85 million in the seed round and aims to compete directly with OpenAI.

Dragonfly: 14 external investments, 11 of which were led, and the lead rate in 2024 was as high as 79%, the highest among the five investment institutions. The project with the highest amount of financing among the investment projects is Polymarket, a betting project praised by even Vitalik, which raised $45 million in the B round.

Looking at the investment projects of the above five VCs, only three projects have two investment institutions jointly investing:

Investment institutions: A16Z, Coinbase Ventures

Investment round: A round

Investment amount: US$11 million

Investment date: May 30

Investment institutions: Dragonfly, Pantera Capital

Investment round: A round

Investment amount: US$25 million

Investment date: June 10

Investment institutions: Dragonfly, Pantera Capital

Investment round: Seed round

Investment amount: US$20 million

Investment date: March 20

It is worth noting that Binance Labs did not invest in the same project with the other four investment institutions.

Potential Sector Expectations: Intention-centric, Modular Blockchain, Parallel EVM

The total market value of the global cryptocurrency market is about 2.5 trillion US dollars. It still occupies a very small share, even less than NVDIA, which shows that the overall cryptocurrency market has great potential for growth. This article repeatedly mentions infrastructure and decentralized finance as VC's preferred investment tracks because these two tracks are the underlying logic of the development of the crypto market.

Infrastructure means supporting the development of the entire ecosystem, usually with a long life cycle, and can bring relatively stable returns; DeFi is the cornerstone of overall market liquidity. If high liquidity can be created, it will attract more liquidity to enter, forming a positive flywheel effect.

Currently, the price performance of infrastructure and DeFi tracks is far inferior to that of meme coins. The reason can be attributed to the fact that the current market has not yet cut interest rates, lacks liquidity, and the rise of meme coins is more of a vote against bad VC coins, but truly excellent projects will still remain in the market. Now the price of coins does not rise does not mean that there is no value.

From the infrastructure, we are optimistic about the three tracks of intention-centered, modular blockchain, and parallel EVM. The common point of these three is that they try to solve the existing blockchain technology problems: intention-centered enhances user experience, modular blockchain can break the impossible triangle, and parallel EVM breaks through the processing speed limit of traditional EVM.

Let's ignore the short-term noise and follow the long-term development of the crypto market.

Bitcoinist

Bitcoinist