Article Author:Castle LabsArticle Compiler:Blnicorn

Foreword

Some would say that business is business, but when we try to compare more traditional business models with those based on cryptocurrency, we face some challenges.

This article aims to explore how our industry can enhance its business model and evolve towards developing sustainable products with real and rewarding user demand.

The cryptocurrency industry is at a critical inflection point where hype-driven business models are colliding with market realities. While traditional Web2 startups have long focused on revenue generation as the foundation for lasting success, the crypto space has been taking a different tack, resulting in an unsustainable misalignment between sustainability and hype that makes it difficult for projects to survive.

The Underrated Element of Crypto

For traditional startups, revenue is a key strategic priority. The goal is to maximize MRR (monthly recurring revenue) and ARR (annual recurring revenue), justify valuations, and build lasting companies. In crypto, however, the typical path is different: raise money from venture capitalists, maximize hype, launch a token (often with no utility), incentivize (often unnatural) usage, and then hope for the best.

This approach instills a false sense of product raison d’être among users, with many projects viewed as speculative vehicles rather than valuable products, leading to users “GMing” (saying hello) for a few months, getting an airdrop, and then leaving, becoming a sunk cost to the business rather than a long-term customer.

Thus, due to a fundamental misalignment of interests, the primary focus of cryptocurrency projects is not product-market fit and revenue, but rather raising money and building products; whether the product is used is another matter.

The so-called commercial success of the above model in cryptocurrency is based on unhealthy and unsustainable assumptions, with the addition of a major challenge: cryptocurrency activity has always been seasonal and closely correlated with bull and bear markets, making hype-based models inherently unsustainable. Furthermore, most products fail to innovate after the initial hype and fail to provide users with a reason to stay. With cryptocurrency’s extremely low switching costs and volatile cycles, the risk of survival increases dramatically.

If we want to thrive as an industry, we must evolve and mature towards a model where revenue is the long-term key focus of projects, rather than something that happens randomly and is driven by hype. This allows projects to measure real demand and user stickiness, generate cash flow, and ultimately survive and succeed.

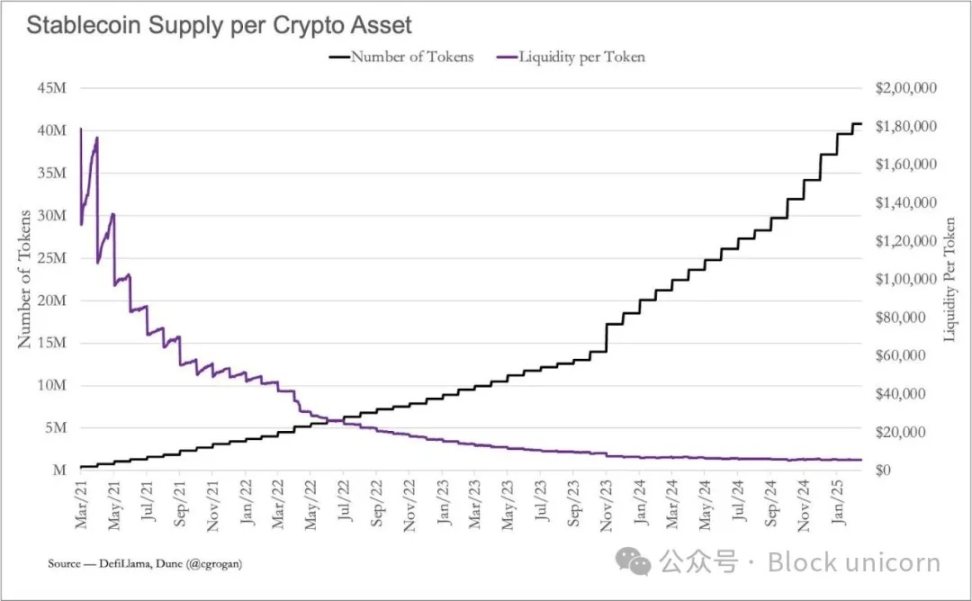

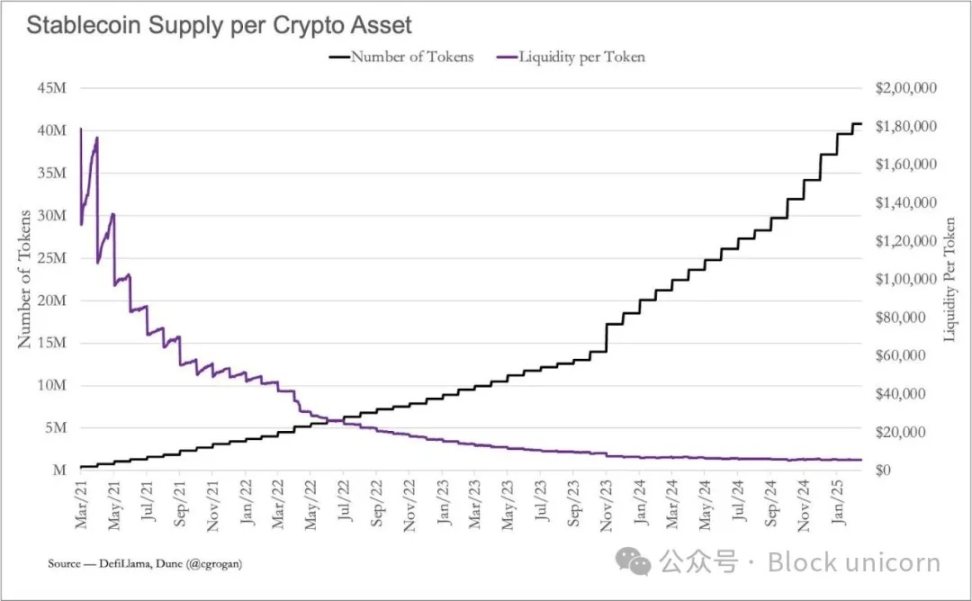

High-level data also reinforces this urgency, as the liquidity of individual tokens has been steadily declining, while the creation of new tokens is outpacing the introduction of new liquidity into the market:

This means that the potential to extract value from existing users is declining, creating a tough environment for projects facing increasing competition and limited addressable capital.

Revenue is the reality check for crypto

As mentioned above, the real problem is a design problem: we are building products that can thrive under certain conditions, relying primarily on hype, rather than building fundamental products that can be used (and paid for) for their quality and functionality, regardless of market conditions.

This is why I believe revenue generation is the ultimate reality check for crypto: projects that adapt to this and work to move from hype-based valuations to fundamentals have a chance to thrive and survive market cycles, while those that rely on speculation will continue to struggle as liquidity becomes increasingly thin.

Going forward, I believe the most promising products will be those that successfully crack the following in their business models:

Focus on a fee model: Charging users for real utility, rather than simply relying on token appreciation, is the right business choice. As an industry, we must abandon the notion that users shouldn’t have to pay fees because there are tokens to sell to keep the company afloat.

Implement strong retention mechanisms: In crypto, switching costs for users are extremely low due to the ease of on-chain fund transfers and the lack of Know Your Customer (KYC) requirements, which is by design, highlighting the importance of crypto projects going beyond one-time interactions and building ongoing relationships where users return for utility rather than speculation.

Measure real metrics: Track revenue per user, customer acquisition cost, and lifetime value instead of focusing solely on token metrics and incentives.

Implement smart buyback mechanisms: Just like in traditional markets, buybacks funded by real revenue are a core part of stock growth strategies, crypto should implement similar mechanisms. One of the best examples is Hyperliquid, where more than 50% of the total protocol revenue is used for token buybacks.

Crypto teams that have successfully cracked the above problems have observed very encouraging metrics and achieved long-term growth. @CryptoFeesInfo is a great place to see which projects are consistently driving revenue and gauge users’ willingness to pay.

Unsurprisingly, @Uniswap and @aave are the top performers:

Note: It’s worth noting that as of now, cryptofees does not fetch data for Solana.

Interest and attention on this topic on CT (Crypto Twitter) is also growing, and it's good to see the industry's recognition of the importance of this project:

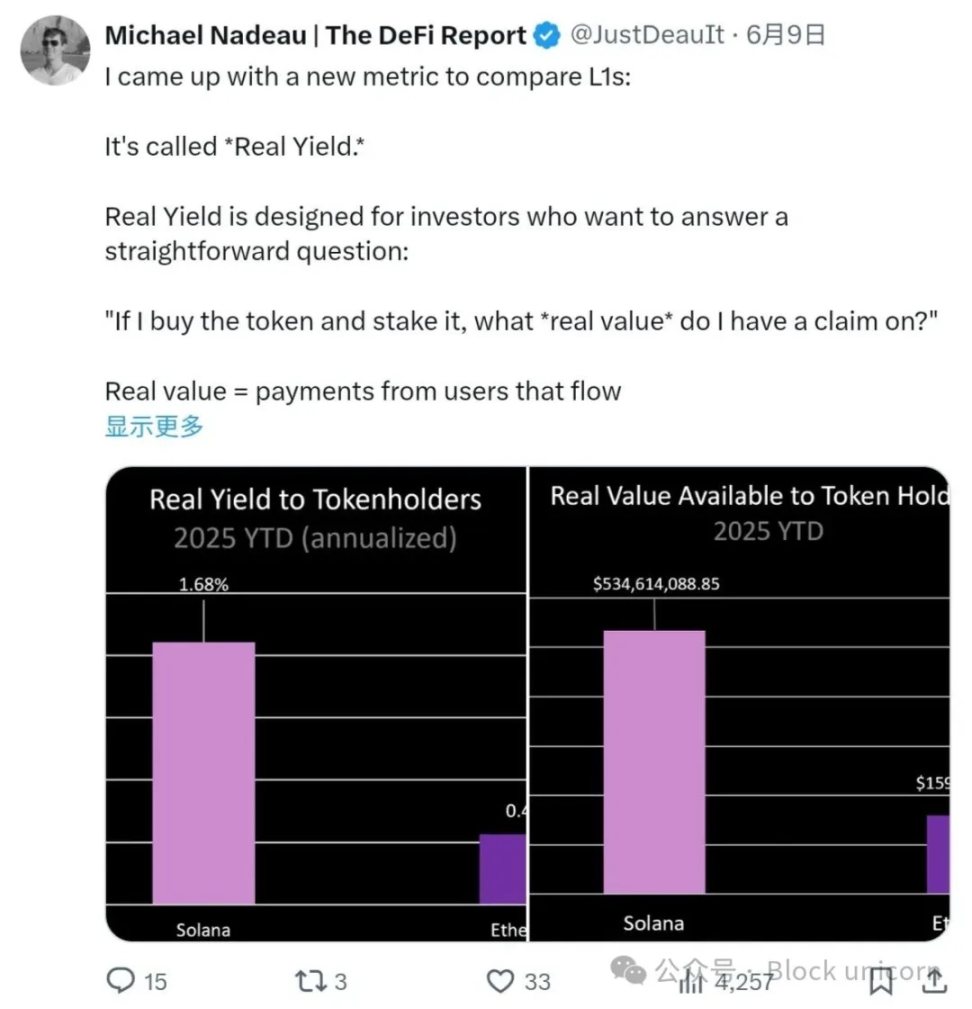

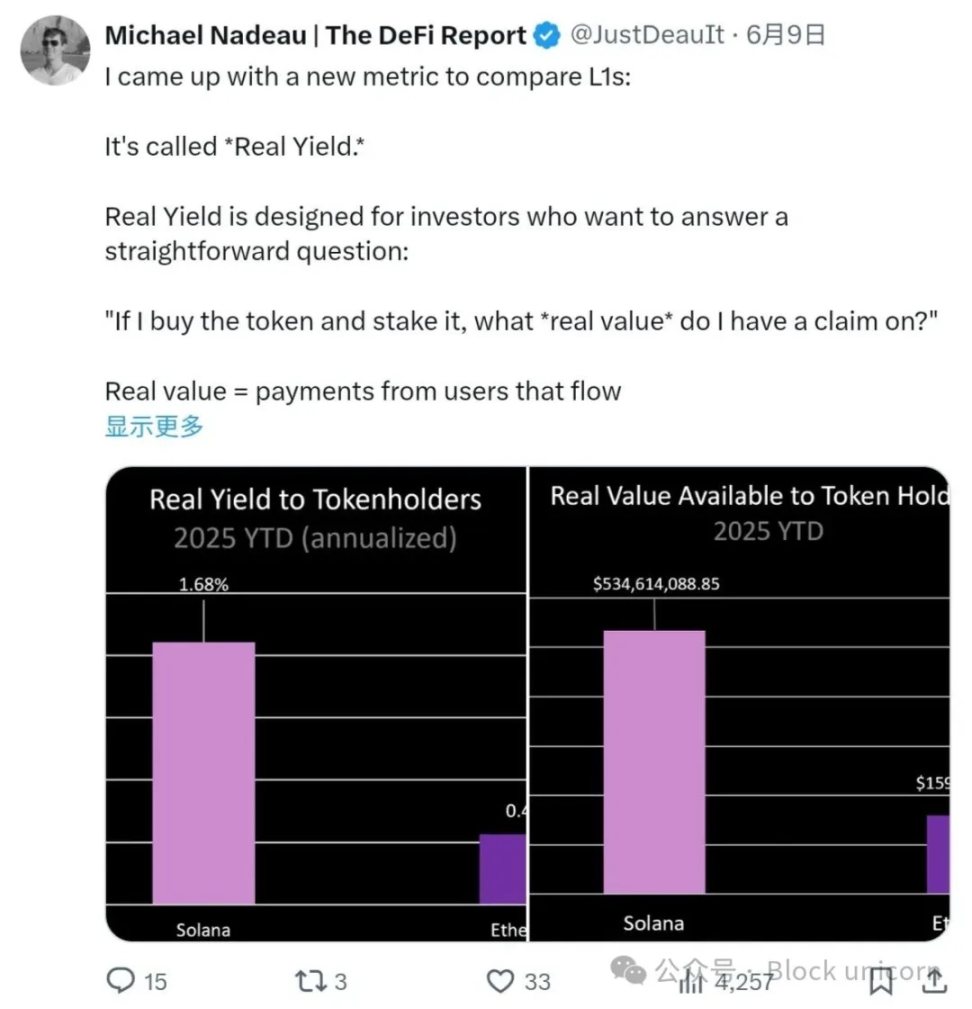

@0xBreadguy did a nice analysis of crypto project's P/E ratios, which is a commonly used metric in finance to measure a project's valuation relative to its earnings. The discussion stems from the growing focus on DeFi profitability, with the latest data from DefiLlama showing that the total locked value in major protocols has increased by 15% since May 2025: @JustDeauIt raises an interesting point: Real Yield is a metric that compares L1 networks by breaking down the real value obtainable by staked tokens, focusing on user payments, MEV (miner extractable value), and network economics. Here is a good assessment of the health of the L1 network:

Revenue Generating DeFi Apps: The Next Potential Success?

Recently, the industry has observed a number of interesting applications that were built from the ground up with a different philosophy, where revenue and strong business models were baked in from the beginning.

DeFi-Based Trading Interfaces

DeFi trading apps and interfaces excel in terms of revenue. With a simple promise and excellent execution, these apps provide traders with a seamless and intuitive experience to interact with a variety of trading venues on multiple blockchain networks.

Traders (their target customers) value execution speed, reliability, and ease of use, and are happy to pay a premium for services that simplify the entire experience because improved usability can make them more money.

Apps like @AxiomTrading fill this need and quickly achieve extremely high profitability (axiom.trade is one of the fastest growing crypto startups of all time, reaching $100 million in revenue in just 4 months).

Mobile Trading Apps Based on Hyperliquid

Another interesting area is mobile-first applications, powered by DeFi. DeFi is one of the most transformative innovations in crypto, but its complexity has made it difficult for the general public to adopt it. But now this is changing.

A new batch of mobile-first experiences based on Hyperliquid infrastructure is emerging, and the experiences are truly amazing.

Apps like @dexaridotcom or @LootbaseX offer a CEX-like experience while maintaining full ownership of assets and trading in a truly decentralized marketplace. I believe these apps will support experimentation with a variety of business models, and I expect users’ willingness to pay will be higher, as portable, secure, and abstracted access to DeFi is something that users will greatly benefit from.

Hopefully, these more mature and forward-looking products, designed for net new user acquisition and sustainable monetization, will drive new adoption in the industry and positively influence other developers to pursue similar paths.

In summary, I believe the next phase of cryptocurrency adoption will be driven by a shift toward revenue-generating apps. These products will lead to more user stickiness, attract more investment, and foster sustainable demand.

Catherine

Catherine