Author: Retardiño, Source: IOSG Ventures

This study analyzes the token life cycle performance of Binance’s four major listing channels - Alpha, IDO, Futures and Spot - and tracks their subsequent listings on Bitget, Bybit, Coinbase and Upbit, focusing on return performance, listing rhythm, track preference and FDV range.

1. Performance Review

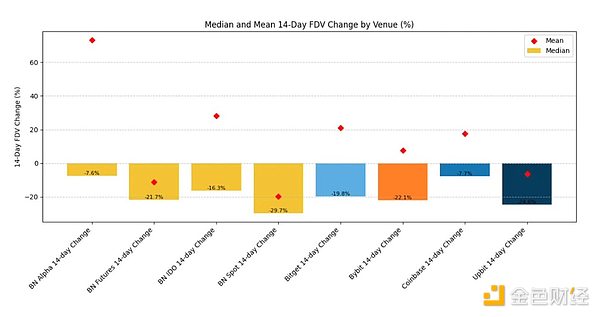

The median 14-day FDV of most channels is negative, reflecting that most projects are valued at high points when they are launched;

Binance Alpha has the most explosive performance (average 220%), but is highly volatile;

Binance IDO has a well-balanced short-term increase and a high conversion rate (to Futures and Spot);

Binance Spot has the weakest short-term performance, perhaps because it has become an exit point for early investors;

Bitget and Coinbase performed well in the secondary market, while Bybit and Upbit were relatively average.

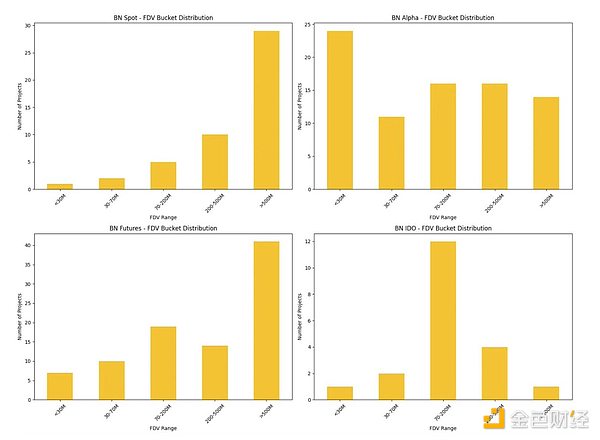

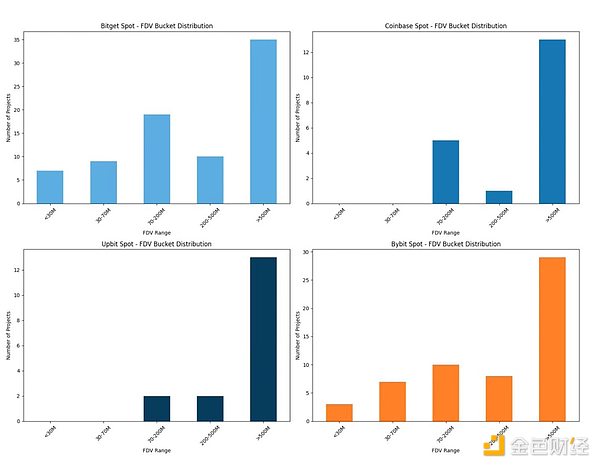

2. Select the platform by FDV range

Binance Spot prefers large-cap projects (>$500M);

Alpha mainly supports early-stage projects of <$200M, which is suitable for testing the waters;

IDO focuses on medium-sized projects of $70M–$200M;

Bitget / Bybit has a flexible range, but prefers projects with growth potential or large market capitalization;

Coinbase / Upbit prefer projects with strong compliance and high valuation.

3. Expected listing time

Alpha → Spot: about 60 days on average;

IDO → Spot: about 17 days on average;

Futures → Spot: only 14 days on average;

Futures may be the fastest channel.

4. Track preference

Alpha: Prefers Meme and AI;

IDO: Prefers Infra and AI;

Spot: Covers Infra, Meme, and AI;

Futures: Broader, focusing on Infra, AI, and Meme;

Project parties need to adjust the narrative direction according to platform preferences.

5. Advanced coin listing path

Alpha → Futures: Conversion rate 37.8%

Alpha → Spot: Conversion rate 12.2%

IDO → Futures: Conversion rate 66.7%

IDO → Spot: Conversion rate 23.8%

Achieving an FDV increase of approximately 40% is a common feature of the platform entering the next stage.

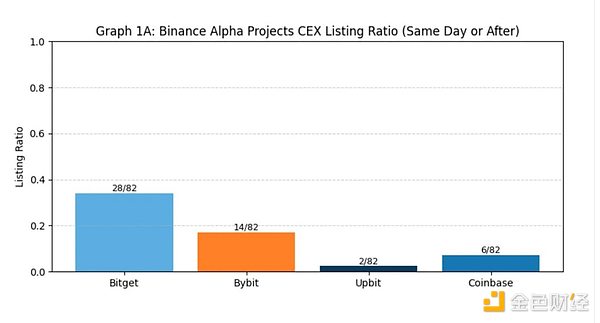

6. Performance of alternative platforms

Bitget is the most capable other CEX, especially friendly to Alpha/IDO projects;

Bybit is also willing to accept IDO projects;

Coinbase / Upbit has very few projects listed, strict review, and a long cycle.

This study focuses on the life cycle performance of tokens in Binance's listing channels (Alpha, Exclusive TGE, which is commonly called IDO in the community, Futures, and Spot), and tracks the subsequent listing paths of these projects on centralized exchanges (CEX) such as Bitget, Bybit, Upbit, and Coinbase. The analysis covers token return performance, launch timing, project track preferences and valuation distribution (FDV dynamics), aiming to provide strategic listing path recommendations for project parties and establish a data-based price discovery and trading strategy evaluation framework for investors.

Term explanation: What do Binance's Spot / Futures / IDO / Alpha listings mean?

Binance Spot (spot) is Binance's most basic trading platform. Users can buy or sell tokens at the current market price. Once the transaction is completed, the asset delivery is completed and can be freely held, transferred or sold.

Binance Futures (contracts) provides cryptocurrency derivatives trading services. Users can go long or short and use leverage to amplify gains or losses.

Binance IDO is a public offering channel for retail users. Users can participate in the token issuance of new projects on the BNB chain by staking BNB or completing Alpha Quest tasks set by the Binance team. This usually happens before the token is officially launched on other platforms.

Binance Alpha is a token discovery platform launched by Binance. It integrates Pancakeswap and other on-chain DEXs on the BNB Chain, supports projects with growth potential in the early stages, and emphasizes experimentality and token diversity.

Research Scope

Exchange Selection: The projects tracked in this study were initially launched on the Binance series of channels, and their subsequent launch performance on Bitget, Bybit, Coinbase, and Upbit was also included in the investigation. These platforms are the most common CEX after Binance.

Time limit: Only launch events after February 2025 are included. This time point is used to filter outdated market logic and is more in line with current launch dynamics.

It is extremely important for both project owners and investors to understand the launch path of tokens:

For project owners, the performance of different platforms will directly affect resource allocation and launch rhythm arrangements;

For investors, the performance of tokens on different platforms is an important basis for formulating position management and judging whether to chase high prices.

1. Price Discovery

1.1 Rate of Return

Indicator Definition: In this section, we measure the rise and fall of FDV within 14 days after the token is launched to evaluate the short-term price discovery ability of different platforms. We use the FDV corresponding to the closing price on the first day of listing as the benchmark and compare the highest FDV within 14 days.

Overall, the 14-day FDV medians of all platforms are negative, indicating that in the current cycle, most projects are at their valuation highs when they go online.

Binance Alpha: The average is about +77%, and the median is -7.6%. Most projects have limited returns, but a few projects have extremely explosive growth, showing the high volatility characteristics of Alpha. Although the performance is differentiated, the downside space is limited, which provides exposure to the project parties and an asymmetric income structure for investors.

Binance IDO and Futures: The medians are -16.3% and -21.7% respectively, but the mean is +28% and -20%. This shows that most projects performed generally, but some individual projects pulled up the overall mean. Futures performed relatively weakly, mainly because most projects were added after a period of time after going online, and the volatility peak has passed.

Binance Spot: The median is -29.7%, and the mean is -20%. As the most prestigious platform, Spot's launch may become an exit point for early investors, leading to price pressure.

Bitget and Coinbase: The performance is stable, with Bitget's median of -19.8% and a mean of about 21%; Coinbase's median of -7.7% and a mean of about 18%. Both have strong ability to carry momentum after listing on Binance.

Bybit and Upbit: Performance is average, Bybit median -22.1%, mean 8.9%; Upbit median -24.6%, mean -5%. Upbit is usually launched late, the project has faded, and the performance is weak.

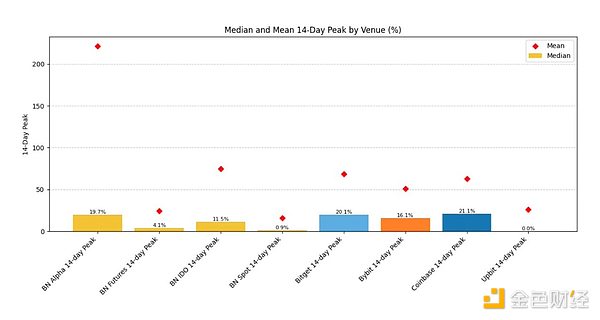

1.2 Rise Range

Indicator Definition: This section measures the ratio of the highest FDV of the token within 14 days after listing to the listing FDV, which is used to evaluate the short-term upward potential provided by each platform.

This indicator helps investors judge the initial growth potential of tokens after they are launched, and also provides a reference for project parties to understand market demand, selling pressure intensity and the price discovery capabilities of various platforms.

Binance Alpha: The average surge was 220%, with a median of 19.7%. Some projects only fluctuated slightly, but many projects also saw a sharp rise after they were launched, showing Alpha's strong short-term speculation and price discovery capabilities, making it the channel with the strongest growth potential among all platforms.

Binance IDO: The average surge is about 75%, and the median is 11.5%. Most projects have good hype after they go online.

Binance Futures: The average surge is 27%, and the median is only 4.1%. There is a certain amount of traffic imported, which has a certain effect on price promotion, and it is a good auxiliary exposure platform.

Binance Spot: The performance is not satisfactory, with an average surge of only 15% and a median of 0.9%. Because market expectations have been fulfilled, the project has encountered strong selling pressure as soon as it went online.

Coinbase: The average surge is 60%, and the median is 21.1%. It has the strongest catalytic effect among all CEXs, mainly benefiting from the US user base, but the frequency of listing is low.

Bybit / Bitget: The average surge is 70–80%, and the median is around 20%. The speculative atmosphere is strong and the short-term fluctuations are obvious. It is a very good choice for listing.

Upbit: The average surge is 35%, and the median is 0%. The trading depth is weak and the user enthusiasm is relatively limited.

2. FDV distribution at listing

This section starts with the FDV distribution of the current projects launched on each platform and provides path planning suggestions for the project party. Projects at different valuation stages are suitable for different launch channels. Understanding the platform's FDV acceptance range will help the team more accurately match the launch rhythm with the platform strategy.

Binance Spot: Over 60% of projects have FDV above 5 Binance Alpha: It covers a wide range, and FDV is mostly concentrated below 200 million US dollars. It is in line with the positioning of Alpha as a "testing ground", suitable for projects with early valuations but potential. Binance Futures: More than half of the projects have FDVs exceeding 500 million US dollars, but there is also a certain distribution in the range of 70 million to 500 million US dollars. Futures is more like a follow-up channel for listed projects, suitable for projects with relatively stable valuations. Binance IDO: FDV is mostly concentrated between 70 million and 200 million US dollars, indicating that it prefers mid-market value projects. It is suitable for public offerings after the product, community and strategy are fully prepared.

Bitget: Covers the complete valuation range from less than 30 million to more than 500 million, with a concentration of 70 million to 200 million US dollars and more than 500 million US dollars. This shows that the platform has a high degree of acceptance, but prefers medium and large-cap projects that are already popular or endorsed by institutions.

Bybit: Nearly half of the projects have FDVs higher than 500 million US dollars, and the 70 million to 200 million US dollars range is also well covered. It has the dual capabilities of taking on short-term popularity and promoting medium-cap projects.

Coinbase: Almost all of the project FDVs are higher than 500 million US dollars, reflecting its compliance threshold and preference for high market value. The platform is more suitable for mature and compliant projects.

Upbit: All the projects launched are above 200 million USD, and most of them exceed the 500 million USD threshold. This shows that the Korean market has high requirements for market capitalization and is more suitable as a later supplementary channel.

3. Platform track preference

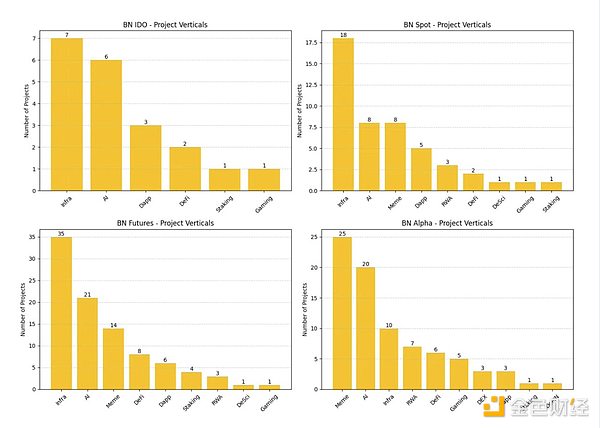

Project parties need to understand the differences in preferences of different platforms in track selection. The following analysis only focuses on the distribution of Binance's four major channels in the track dimension.

In addition, the total number of projects launched on different channels also reflects the difficulty of going online. Generally, the fewer projects a platform has, the stricter its screening criteria.

Binance Spot: About 50 projects launched

Binance Futures: About 90 projects launched

Binance Alpha: About 80 projects launched

Binance IDO: About 20 projects launched

Binance IDO:

Prefers Infra (7 items) and AI (6 items).

The vertical distribution is concentrated, covering only 6 tracks.

It focuses on underlying technologies and emerging application scenarios, and gives priority to supporting infrastructure and AI projects.

Binance Spot:

Prefers Infra (18 items), Meme (8 items) and AI (8 items).

It also covers multiple subcategories such as DeFi, RWA, GameFi, and Dapps.

The vertical distribution is the most balanced, but infrastructure projects still dominate.

Binance Futures:

is the platform with the most projects, covering 35 Infra and 21 AI projects.

Meme (14) and DeFi (8) also account for a large proportion.

It covers a wide range of tracks and prefers projects with active markets and narrative-driven.

Binance Alpha:

It mainly covers Meme (25) and AI (20), highlighting speculative narratives and experimental themes.

There are 10 Infra projects, in addition to RWA (5), DeFi (4) and GameFi.

Alpha is a testing ground for hype and conceptual projects.

Summary:

Project parties need to adjust product positioning and market narratives according to the vertical preferences of each platform.

AI projects are popular tracks supported by all four channels.

Meme projects dominate Alpha and also have good coverage in Spot and Futures.

Infra project is the most inclusive core track besides Alpha.

4. Listing Path Analysis

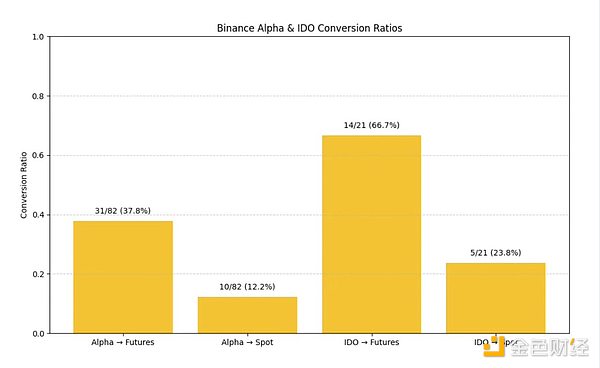

Many project parties will ask a key question: Can Alpha or IDO become a springboard to enter Binance Spot? Let’s look at the data:

Alpha → Futures: The conversion rate is 37.8% (31/82), which is a relatively effective front-end channel.

Alpha → Spot: The conversion rate is only 12.2% (10/82), which is relatively low overall.

IDO → Futures: The highest conversion rate, reaching 66.7% (14/21).

IDO → Spot: The conversion rate is 23.8% (5/21), which is better than Alpha.

Alpha is more suitable as an early test channel, with more than 30% of projects successfully entering Futures, but to be promoted to Spot, it still requires strong fundamentals and market performance. In contrast, IDO projects are more solid in brand recognition and community foundation, and have higher promotion potential. Project parties should regard Alpha and IDO as the starting point for entering the Binance system, not the end point.

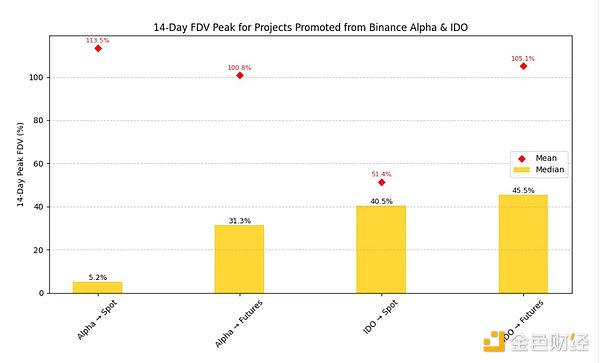

4.1 Project Performance Threshold

How did the projects that successfully advanced from Alpha/IDO to Binance Spot perform in the early stages? Are there any rules that can be learned?

Alpha → Spot: The median of the 14-day high-rising rate of the project in the Alpha stage is only 5.2%, which is much lower than the 30–50% of other paths, but its average is as high as 113.5%, the highest among all paths. This shows that the performance of the projects is extremely differentiated. Some projects have strong explosive power, but most of them have limited gains. The launch of Binance Spot does not rely entirely on market hype, but pays more attention to hard indicators such as product quality and user data.

Alpha → Futures and the two IDO paths (→ Spot and → Futures) have relatively concentrated medians of 30–45% in the 14-day highs, and the average is between 51%–105%, showing stable performance.

Overall, if a project can achieve a 40–50% FDV high within two weeks after the launch of the front-end platform, it is more likely to gain further favor from Futures or Spot. This can be used as a reference standard for project parties to evaluate the potential for subsequent listings.

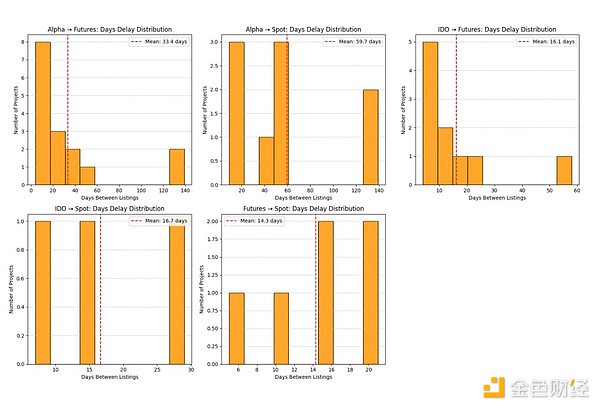

4.2 Waiting time

Project parties also need to set reasonable expectations: How long does it usually take from Alpha or IDO to Binance Spot listing? Lack of clear time planning may lead to missing the market window or losing community attention.

Alpha → Spot: The average waiting time is about 60 days, and some projects even exceed 120 days. The overall distribution is relatively wide, indicating that this path is not predictable and is more suitable as a platform for the exploration stage rather than a springboard directly to Spot.

Alpha → Futures: It only takes 30 days on average, which is significantly faster than Spot and has stronger market response efficiency.

IDO → Spot and IDO → Futures: The average waiting time is 17 days, and most projects can be completed within 1 month after listing. Thanks to its strong community mobilization and unified rhythm arrangement, the IDO project has a relatively controllable rhythm in the subsequent listing path.

Futures → Spot: It is the fastest of all paths, with an average of only 14 days, and the time distribution is highly concentrated.

If the team's goal is to quickly achieve Binance Spot listing, Futures is the most certain transit path currently observed.

5. Alternative path: Entering other CEXs

Not all projects have Binance Spot as their only goal. More and more projects are turning to mainstream platforms such as Bitget, Bybit, Coinbase, and Upbit after Alpha or IDO. Some platforms are quick to respond and have considerable liquidity, becoming actual alternative options.

5.1 Number of listings

After Alpha or IDO, how many projects have successfully entered other mainstream CEXs?

Alpha → Bitget: The launch rate is 34.1% (28/82), far ahead. Bybit is 17.1% (14/82), Coinbase is 6% (6/82), and Upbit has only launched 2 related projects.

Bitget has the highest acceptance of Alpha projects, probably due to its open attitude towards emerging projects and its flexible launch threshold. Bybit also showed some interest in the Alpha project.

Compared with Alpha, IDO projects are more attractive on other platforms, which may be related to their stronger brand building and community potential. Bitget and Bybit also have stronger capabilities to undertake IDO projects, and are extension paths that are worthy of key consideration by project parties.

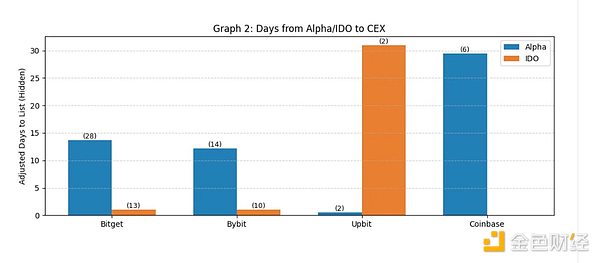

5.2 Waiting time for listing

After a project is listed on Binance from Alpha or IDO, how long does it usually take to follow up and list on mainstream CEX?

Bitget: Alpha projects take an average of about 14 days, and IDO projects are faster, only 13 days. Many IDO projects are launched simultaneously on the day of TGE.

Bybit: Alpha project is about 13 days, IDO is also launched on the day of TGE.

Coinbase: Only Alpha project is launched, with an average of about 29 days.

Upbit: Only IDO project is launched, with an average of about 31 days.

Bitget and Bybit have a faster pace and are suitable for fast-paced launches; Coinbase and Upbit have a slower pace and need to cooperate with local compliance and community pace.

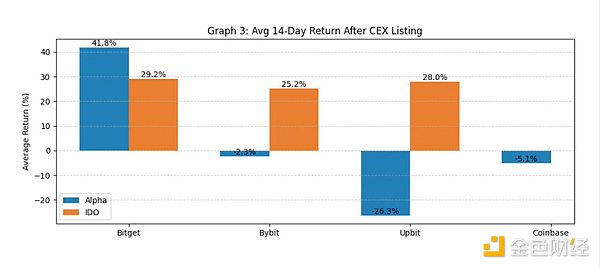

5.3 Price discovery ability of other CEXs

The following figure shows the average increase of Alpha and IDO projects in each CEX within 14 days after listing:

Bitget: Alpha project returned 41.8%, IDO project 29.2%, the best performance.

Bybit: Alpha projects are -2.3%, IDO projects are 25.2%, preferring IDO.

Coinbase and Upbit: The sample projects are 6 and 4 respectively, with large statistical deviations and are not representative.

Bitget and Bybit have performed stably in undertaking Binance projects and are important platforms for project parties to consider when planning TGE routes.

Conclusion

Overall, Binance Alpha and IDO are good front-end platforms within Binance:

Alpha is more like a test field, with a low entry threshold, suitable for early project exposure;

IDO has a stronger brand endorsement, and the conversion rate of Futures and Spot is also higher.

However, Spot conversion is still scarce: the final promotion rate of Alpha projects is only about 12%, and IDO is only 24%. Project parties need to manage the pace well:

Alpha → Spot takes an average of about 60 days,

IDO → Spot takes 17 days,

Futures → Spot is the fastest, taking only 14 days.

In addition, the preferences of different platforms for project FDV also release key signals:

Spot prefers large-cap projects with a valuation of more than $500M;

Alpha mainly accepts early-stage projects with a valuation of less than $200M;

IDO is mostly concentrated in the $70M–$200M range, suitable for medium-sized projects with clear preparations.

Project parties should choose appropriate channels according to their own valuation stage to match liquidity expectations and market rhythm.

Brian

Brian

Brian

Brian Kikyo

Kikyo Brian

Brian Joy

Joy Alex

Alex Kikyo

Kikyo Brian

Brian Alex

Alex Kikyo

Kikyo Brian

Brian