Author:Zhang Yin, ACAMS Anti-Financial Crime Compliance Strategy Consultant

I. Introduction

Against the backdrop of globalization and the rapid development of the digital economy, virtual currencies, with their unique cross-border convenience and anonymity, have gradually become an important channel for global criminal money laundering. Mainland China and Southeast Asia present complex connections and interactions in virtual currency money laundering activities. The Chinese government attaches great importance to the risks brought by virtual currencies, and in 2021 issued a document that clearly pointed out that "virtual currency speculation disrupts financial order and breeds illegal and criminal activities such as fraud and money laundering." Although virtual currency transactions are strictly prohibited in mainland China, huge amounts of "stolen money" generated by crimes such as cyber fraud and telecommunications fraud are still transferred overseas with the help of virtual currencies.

Currently, the academic and practical circles have gradually increased their research on cross-border money laundering of virtual currencies, but there is still a relative lack of systematic research on the specific region of mainland China and Southeast Asia. This paper aims to present the cross-border money laundering chain and the current regulatory framework through classification, chain analysis and case studies, and provide more targeted research results and practical references for related fields.

II. Sources and transfer links of criminal funds in mainland China

(I)Sources of criminal funds

In mainland China, new telecommunications network fraud, online gambling, illegal sale of citizen information, pyramid schemes, gambling and other criminal activities are the main sources of illegal funds. For example, CCTV once reported a case of "dark web" personal information trafficking. The criminal gang used virtual currency to launder more than 2 billion yuan in one year. The stolen money generated by these upstream crimes was initially in the form of cash or digital currency. The criminals collected the funds through domestic bank accounts and third-party payment tools to lay the foundation for subsequent transfers. (II) Fund transfer link Fund generation and collection: The stolen money generated by upstream crimes, whether in cash or digital currency, needs to be concentrated through certain channels. In the form of cash, criminals may deposit it in multiple bank accounts to evade the bank's large-scale transaction monitoring; for digital currency, they use wallet accounts to collect it and prepare for subsequent exchange and transfer.

Exchange and dispersion:

In order to convert RMB cash into virtual currency that is easy to transfer across borders, criminals usually use underground banks and cross-border exchange channels. Through these illegal channels, RMB cash is quickly exchanged into stablecoins (such as USDT) or encrypted assets such as Bitcoin. At the same time, in order to evade supervision and tracking, criminal suspects will open multiple bank accounts and wallet accounts, and frequently exchange virtual currencies in a "fast in and fast out" manner, making the flow of funds more dispersed and complicated.

Virtual currency exchanges and P2P transactions:

Decentralized exchanges and peer-to-peer (P2P) trading platforms have become important places for criminals to convert currencies. After they exchange RMB for USDT, BTC or other digital assets, they use external channels to transfer funds to overseas platforms. In this process, the cross-border capital flow characteristics of exchanges and the relative anonymity of P2P transactions facilitate the transfer of criminal funds.

Mixers and anonymous services:

In order to further increase the difficulty of fund tracking, some criminals will use technical means such as mixers (such as Tornado Cash) or cross-chain bridge protocols. These technologies can mix criminal funds with other funds, change the flow and characteristics of funds, and make it difficult for regulators and law enforcement agencies to trace the true source of funds.

To sum up, the basic path of virtual currency money laundering can be summarized as:

Criminal proceeds → RMB account → Cryptocurrency exchange (including stablecoins) → International transfer

This process involves multiple links and multiple means. Each link has the possibility of evading supervision, and it is necessary to further combine on-chain tracking analysis to reveal the typical patterns.

III. The role and usage of stablecoins in the money laundering process

(I)Advantages of stablecoins

The reason why stablecoins (such as USDT) play a key role in cross-border money laundering is due to their unique advantages. First, stablecoins are pegged to the US dollar or legal currency, achieving relative stability in value. This allows illegal funds to avoid the risk of drastic price fluctuations in cryptocurrency during cross-border exchange and value preservation, making it easier for criminals to operate funds. Second, stablecoins have extremely strong liquidity and global acceptance. Through the blockchain network, they can achieve instant cross-border transfers without going through traditional financial systems such as banks, greatly improving the efficiency of fund transfers.

(II)Usage mode

Domestic exchange and transfer:

Criminals in China usually first exchange RMB into stablecoins in the domestic OTC (over-the-counter) market or exchanges. This exchange method is relatively convenient, and the trading entities in the OTC market are relatively scattered, making supervision more difficult. After the exchange is completed, the stablecoins are transferred to overseas wallet addresses through the blockchain network to prepare for subsequent cross-border operations.

Cross-border cashing and swapping:

Overseas, criminals transfer stablecoins such as USDT to trading platforms in Singapore, Thailand and other places, and cash them out for foreign exchange (such as US dollars, Thai baht, etc.) to achieve legal conversion of funds. In addition, stablecoins can also be exchanged with other currencies (such as Bitcoin and Ethereum) on virtual asset platforms. Through multiple exchanges and transfers, the source and destination of funds are further obscured, increasing the difficulty of tracking.

(III)Typical cases and regulatory perspective

From the perspective of regulatory practice, different countries have different attitudes and regulatory measures towards stablecoins. In March 2025, the Thai securities regulator officially allowed USDT and USDC to be used for transactions, recognizing the role of stablecoins in payments and transactions. The Myanmar regulator has disclosed the closure of multiple illegal cases of using USDT to conduct underground money exchanges, which reflects the actual use of USDT in the Southeast Asian money laundering chain. These characteristics of stablecoins make it an important tool widely used by criminal networks for domestic capital outflow and international money laundering operations, and this feature has been further verified in subsequent on-chain case analysis.

@unsplash

IV. On-chain analysis and typical case studies

(I)On-chain analysis tools

Blockchain security platforms such as Beosin play an important role in the on-chain analysis of virtual currency money laundering. These platforms collect public blockchain data, mark suspicious addresses and analyze the flow direction, and can identify abnormal behaviors such as frequent inflows and outflows of funds and participation in exchange deposits and withdrawals. At the same time, combined with powerful data processing, analysis capabilities and artificial intelligence technology, a complete address profiling system has been established. The relevant capabilities have been widely used in anti-money laundering investigations, asset tracking, and encrypted crime intelligence support, providing important data support and technical guarantees for the empirical analysis in this report, and have also become an indispensable technical means in anti-money laundering work.

(II) Typical case analysis

Case 1: Flight information trafficking uses Yibifu for money laundering

Case background:

In the first half of 2024, telecommunications fraud cases targeting airline passengers frequently occurred in China. Fraud gangs used passenger information obtained through illegal channels, impersonated airline staff or insurance claims personnel, and induced passengers to download fake apps, fill in bank card information or directly transfer money on the grounds that "flight delays can be compensated" to commit fraud.

Through multiple channels to find the source of information leakage, it was found that a certain tg merchant publicly sold flight information by the piece. After obtaining the seller's payment address from the tg group, the financial situation was analyzed and it was found that part of its funds entered Yibifu (a virtual currency payment institution located in Southeast Asia, providing legal currency and virtual currency exchange services, claiming that the number of users has reached tens of millions, and is an important channel for domestic illegal and criminal mixed currency money laundering), using Yibifu's centralized accounting and legal currency exchange business to launder money.

Analysis of capital flow pattern:

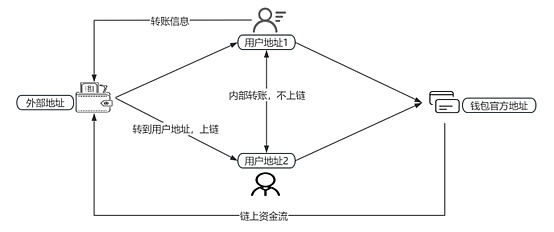

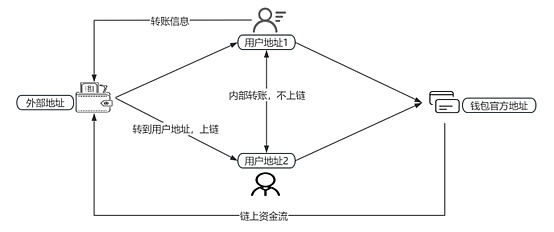

[Figure 1: Analysis of money laundering paths involving Yibipay]

1. The buyer's address is the fraudster. After purchasing the passenger's flight information from the seller, the fraudster contacts the passenger through the contact information reserved by the passenger and defrauds the passenger.

2.After the seller receives the buyer's funds, he will transfer the profit funds, part of which will be transferred to YibiPay. From YibiPay's funding model, it can be inferred thatthe YibiPay user address in the figure should correspond to the seller's private account opened in YibiPay.

3.After the funds enter YibiPay, due to the large number of YibiPay users, the source and destination of funds are complex and difficult to track, thus achieving the effect of currency mixing.the seller can manipulate his accountand withdraw the funds to other on-chain wallets or directly through YibiPay's legal currency exchange business to achieve the purpose of money laundering and cashing out.

The following figure is a simplified diagram of Yibifu’s capital flow model:

[Figure 2: Simple diagram of Yibifu’s capital flow model]

Case Study 2: Money laundering crime using guarantee platform

Case background:

In recent years, the types of crimes involving virtual currencies are diverse and complex. "Pig killing + false investment", "online live broadcast seduction fraud", "illegal information trading", "human trafficking", "gambling" and other previous illegal and criminal businesses involving legal currency have almost all adopted online virtual currency collection and settlement. The channels for fund transfer have become intertwined and hidden, and more and more illegal and criminal activities are transferring criminal funds through the model of "online contact + door-to-door exchange". Guarantee platforms represented by Haowang Guarantee use Telegram as the core operating carrier, and provide one-stop, comprehensive services for black and gray industries such as online fraud by forming groups and related channels. Haowang Guarantee's parent company "Huiwang Group" was included in the list of the US Special Measure: FinCEN 9714 Act and the US Patriot Act 311 on May 1, 2025.

Transaction model analysis:

1.The leading buyer and seller (merchant) creates a public group on the guarantee platform, sets the group name, public group rules, salesperson, advertisement and other information, and continues to conduct business.The guarantee platform charges a monthly fee to provide transaction reporting and accounting services.

2.The client checks the supply and demand information in the guarantee public group, selects the transaction target, and then contacts the "public group salesperson" to arrange a guaranteed transaction. Alternatively, the buyer and seller clarify the transaction content, goods and prices, and after completing the negotiation on their own, contact the "guarantee customer service" to arrange for the transaction group to conduct transaction guarantee.

3.After the buyer and seller confirm the transaction online, the merchant arranges offline personnel (commonly known as "mazai") to meet with the customer at a designated address for face-to-face transactions (usually shopping malls, stations, office buildings and other areas with high traffic to avoid surveillance). The transaction is completed,and the funds are laundered by decoupling online and offline.

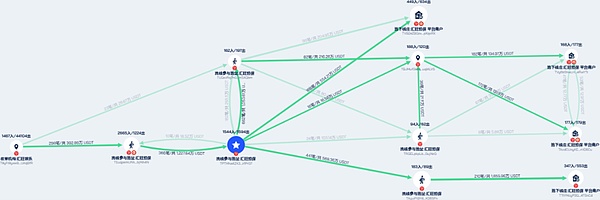

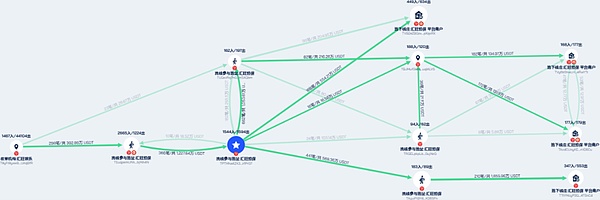

4.The figure below is a real example of a merchant collecting U in offline cash.By tracing its main source of funds, it can be found that a large amount of funds have been received from Huiwang Entertainment.This part of the funds may be the proceeds of illegal crimes after being mixed by gambling platforms.The whereabouts of its funds are even more complicated, flowing directly or indirectly to multiple merchant addresses. Due to the wide range of sources of funds at the relevant addresses, after mixing, the difficulty of tracking the funds has been greatly increased.

【Figure 3: Simple analysis of the cash collection U chain’s capital path】

V. Analysis of countries and regions involved

(I)Mainland China

Mainland China has adopted a strict prohibition policy on virtual currency transactions. Therefore, in order to realize cross-border transfer of illegal funds generated within the country, it is first necessary to convert RMB into encrypted assets through underground banks or OTC markets, and then flow overseas. The focus of the regulatory authorities is to combat illegal fundraising, money laundering and illegal institutions that provide services for virtual currency transactions in the country, while vigorously promoting the digital RMB to regulate the currency circulation system and reduce the possibility of virtual currency money laundering from the source.

(II) Hong Kong Special Administrative Region

As an international financial center, Hong Kong has attracted a large amount of cross-border funds. In order to strengthen the supervision of virtual assets, Hong Kong implemented the VASP (Virtual Asset Service Provider) licensing system in 2023. Any institution that provides virtual asset services must obtain a license from the Securities and Futures Commission. Despite the tightening of supervision, some criminals still use Hong Kong's exchanges and family offices to launder money. For example, some funds in the Singapore case flowed through Hong Kong. This shows that Hong Kong needs to further strengthen the supervision of financial institutions and related service providers in the regulatory process to prevent them from being illegally used.

(III)Singapore

As a global financial center, Singapore has taken strict regulatory measures on virtual assets. The exchange license system will be implemented in 2023. Many platforms have been licensed and need to strengthen KYC/AML (customer identification/anti-money laundering) measures. A large amount of cross-border funds are converted and settled through Singapore. Many local cases have shown that money laundering gangs use the local financial system and virtual asset platforms to hide assets. Singapore's regulatory focus is to strengthen supervision of licensed institutions to ensure that they strictly comply with anti-money laundering regulations, while using its sound financial infrastructure to improve the monitoring ability of cross-border capital flows.

(IV)Thailand

Thailand's regulation is relatively open, and the SEC (Securities and Exchange Commission of Thailand) has included USDT and USDC in its trading products. The Bank of Thailand Payments Act also covers digital asset services, allowing stablecoins to be cleared domestically. In money laundering cases, criminals in the region often exchange USDT for Thai baht or US dollars through Thai exchanges and then transfer funds. While opening up innovation, Thailand needs to strengthen supervision of exchanges and other institutions, improve anti-money laundering measures, and prevent the abuse of stablecoins.

(V)Philippines

The Bangko Sentral ng Pilipinas (BSP) is actively exploring stablecoin regulation and has approved Coins.ph to test the peso-anchored stablecoin PHPC in a regulatory sandbox. The country's regulatory framework encourages innovation and plans to design regulatory guardrails for VASPs and financial institutions to issue stablecoins. In terms of money laundering regulation, the Philippines has previously launched a strict investigation into illegal crypto over-the-counter transactions. The Philippines' regulatory model attempts to find a balance between innovation and risk control, and guides the compliance development of stablecoins by establishing mechanisms such as regulatory sandboxes, while cracking down on illegal transactions.

(VI) Cambodia

In 2025, the Central Bank of Cambodia issued rules allowing banks to hold "qualified stablecoins", but prohibiting banks from operating cryptocurrencies and conducting payment activities. This policy makes it possible for underground channels to take advantage of Cambodia's stablecoin market to conduct cross-border remittances, while formal payment and exchange channels are restricted. Cambodia needs to strengthen the crackdown on underground channels while encouraging the reasonable application of stablecoins, improve the regulatory framework, and prevent stablecoins from being used for illegal money laundering activities.

(VII) Myanmar

The Myanmar government strictly prohibits digital currency transactions and strengthens law enforcement. The Central Bank of Myanmar has banned unauthorized cryptocurrency trading and cracked down on underground banks using USDT (tilleke.com, n.d.). However, due to the frequent border transactions between Myanmar and neighboring countries and the existence of gray operating spaces such as online channels, criminals may still use these channels to launder virtual currency money, and Myanmar's regulatory work faces great challenges.

On the whole,mainland China is the main source of funds, while Southeast Asian countries are mostly used as transit or settlement places for money laundering. The differences in regulatory policies of various countries provide criminals with space for "regulatory arbitrage", affect the choice of criminal paths, and build a complex money laundering network map between regions.

VI. Regulatory policies and legal framework for virtual assets and stablecoins

(I)Mainland China

Official documents of China clearly define virtual currency transactions as illegal financial activities (Central People's Government of the People's Republic of China, 2021). The People's Bank of China Law and other laws and regulations prohibit financial institutions from providing services for cryptocurrency transactions. At present, regulatory work is mainly focused on combating telecommunications fraud, underground banks, and non-bank financial institutions providing virtual asset services. At the same time, the digital RMB is vigorously promoted to replace some virtual currency application scenarios, fundamentally reducing the soil for virtual currency money laundering.

(II)Hong Kong Special Administrative Region

Hong Kong has passed the supplement to the Anti-Money Laundering Ordinance and the VASP licensing system to strictly regulate virtual asset service providers. In May 2025, the Hong Kong Legislative Council passed the Stablecoin Issuers Bill, which established a regulatory framework for the issuance of legal currency stablecoins: all legal currency stablecoin issuers issued in Hong Kong that are anchored to the Hong Kong dollar or foreign currency must obtain a license and meet the requirements of reserve asset management, redemption protection, asset isolation, AML/CFT (anti-money laundering/anti-terrorist financing) (hkma.gov.hk, 2025). This move shows that Hong Kong has taken an important step in the regulation of stablecoins, aiming to regulate the issuance and circulation of stablecoins and prevent financial risks such as money laundering.

(III)Singapore

Singapore's Payment Services Act requires digital token providers to register and fulfill AML obligations. MAS (Monetary Authority of Singapore) has launched a single-currency stablecoin (SCS) framework to regulate the issuance and circulation of stablecoins pegged to the Singapore dollar and major G10 currencies. MAS regards stablecoins as part of the payment system infrastructure and imposes strict requirements on their value stability and reserve requirements to ensure that the issuance and operation of stablecoins comply with financial regulatory standards and maintain the stability of the financial market.

(IV)Thailand

Thailand’s Digital Asset Business Act covers crypto assets and requires exchanges and wallet service providers to register. The SEC approved the use of stablecoins such as USDT and USDC on exchanges in 2025 (coindesk.com, 2025). The Bank of Thailand supports innovative pilots but requires strict compliance with payment stablecoins. While encouraging digital asset innovation, Thailand’s regulatory policy focuses on preventing risks such as money laundering brought about by stablecoins, and strengthens supervision of relevant institutions and stablecoins through registration systems and compliance requirements.

(V)Philippines

The Central Bank of the Philippines issued the Digital Assets Regulations, which stipulate that VASPs must be licensed to operate and can test legal currency stablecoins (such as the peso stablecoin PHPC) in a regulatory sandbox environment (elliptic.co, n.d.). The country encourages banks and payment institutions to participate in virtual asset supervision and innovation, and attempts to achieve a balance between innovation and supervision by establishing a licensing system and a regulatory sandbox, while promoting the development of the virtual asset industry and effectively controlling risks such as money laundering.

(VI)Cambodia

The National Bank of Cambodia (NBC) classifies and regulates crypto assets, classifies qualified stablecoins into "Group 1", and explicitly prohibits the use of stablecoins for domestic payments. Banks must obtain approval before they can operate stablecoin-related businesses. Cambodia's regulatory policy allows the reasonable existence of stablecoins to a certain extent, but strictly restricts their scope of use and the business activities of banks to prevent stablecoins from causing an impact on the domestic financial order and reduce the occurrence of illegal activities such as money laundering.

(VII) Myanmar

The Central Bank of Myanmar has repeatedly reiterated that virtual currency transactions are illegal. The 2024 announcement further warned that individuals are prohibited from participating in any unregulated digital currency transactions and exchange activities. At present, Myanmar does not have a formal crypto asset regulatory system. The regulation of virtual currencies mainly relies on administrative orders and strict prohibitions. This has restricted the legal application of virtual currencies to a certain extent, but it has also made it difficult to completely eliminate underground trading activities.

In general, there are differences in the intensity of supervision of virtual assets in various places: the Hong Kong Special Administrative Region and Singapore are accelerating institutional construction and building a comprehensive regulatory framework; many Southeast Asian countries have strengthened the control of payments and stablecoins. The general trend of supervision is to follow the principle of "same activities, same risks, same supervision", strengthen KYC/AML measures and cross-border law enforcement cooperation to address financial risks such as virtual currency money laundering.

@unsplash

VII. Challenges and Policy Recommendations

(I)Challenges

High difficulty in law enforcement:

Virtual currencies have the characteristics of strong cross-border liquidity and outstanding anonymity, which makes it difficult to track and locate criminal funds. The decentralized nature of blockchain technology also increases the difficulty for regulators to obtain complete information on capital flows, and traditional law enforcement methods face great challenges when facing virtual currency money laundering.

Inadequate regulatory coordination:

Countries and regions differ in virtual currency regulatory rules, standards and practices, and criminals may use these differences to conduct "regulatory arbitrage" and choose regions with looser regulation to conduct money laundering activities. In addition, the cross-border law enforcement cooperation mechanism has not yet been fully established, and information sharing is not smooth, resulting in low efficiency in combating transnational money laundering cases.

Special risks of stablecoins:

Stablecoins are large in scale and have obvious payment attributes. Their value stability and issuance mechanism directly affect the stability of the financial market. If the capital reserves of the issuer of stablecoins are insufficient, the asset anchor is not firm, or the redemption mechanism is defective, it may cause financial risks. At the same time, the widespread use of stablecoins also facilitates illegal activities such as money laundering, and regulatory authorities need to find a balance between innovation and risk.

(II) Policy Recommendations

Strengthen international intelligence sharing and technical cooperation:

Establish and improve international intelligence sharing mechanisms, and strengthen cooperation and communication between regulatory agencies and law enforcement agencies of various countries. Jointly develop and promote blockchain analysis technology to improve the ability to track and monitor virtual currency capital flows. For example, countries can share information such as suspicious wallet addresses and transaction patterns to form a global anti-money laundering network.

Promote regional regulatory coordination and standard unification:

Refer to the recommendations of international organizations such as FATF (Financial Action Task Force), promote the unification of travel rules, suspicious transaction reporting standards and other regulatory requirements in countries and regions in the region. Strengthen inter-regional regulatory coordination, reduce the space for "regulatory arbitrage", and form a consistent regulatory force. It is possible to consider establishing a regional virtual currency regulatory coordination agency, hold regular meetings, and coordinate regulatory policies and actions.

Strengthen stablecoin supervision and risk control:

Implement strict capital reserve, audit and information disclosure requirements on stablecoin issuers to ensure the authenticity and stability of their asset anchoring and protect investors' redemption rights. Strengthen the supervision of stablecoin trading platforms and usage scenarios, require relevant institutions to strictly implement KYC/AML measures, and conduct real-time monitoring and reporting of abnormal transactions. At the same time, study and establish a risk warning mechanism for stablecoins to promptly discover and deal with possible financial risks.

Use technical means to assist law enforcement and supervision:

Encourage regulatory agencies to cooperate with professional chain analysis companies to introduce advanced chain tracking technologies and tools to achieve real-time monitoring and analysis of suspicious capital flows. Use big data, artificial intelligence and other technologies to mine and analyze massive blockchain data, identify potential money laundering patterns and abnormal trading behaviors, and improve regulatory efficiency and accuracy.

Strengthen compliance constraints and public education:

Increase the punishment of unlicensed VASPs, trading platforms and underground banks, increase the cost of violations, and form a strong legal deterrent. Improve the cross-border recovery mechanism and strengthen the recovery and return of criminal funds. At the same time, strengthen public education, improve the public's awareness and risk awareness of illegal activities such as virtual currency money laundering, and guide the public to consciously abide by laws and regulations and not participate in illegal virtual asset activities.

VIII. Conclusion

The study shows that despite the strict ban on crypto assets in mainland China, the money laundering chain can still be completed through underground banks, domestic and overseas trading platforms and stable currency networks. Hong Kong Special Administrative Region, Singapore and other places have strengthened VASP and stablecoin supervision, and some Southeast Asian countries are also constantly improving regulations or strengthening law enforcement. However, virtual currency money laundering still faces challenges such as high difficulty in law enforcement, insufficient regulatory coordination, and special risks of stablecoins.

Anais

Anais