Compiled by: Aiying Team

Cryptocurrencies are revolutionizing the landscape of investment and digital assets and driving economic growth in many regions. Realizing this potential, many countries have adjusted their regulatory frameworks and introduced a series of legal measures to actively attract crypto businesses and startups. In 2024, crypto-friendly countries are rapidly emerging around the world, and some countries stand out for their positive attitude in promoting the development of crypto companies.

Through socialcapitalmarkets research, it was found that countries like Switzerland and Singapore have been recognized as the most friendly encryption business environments, while countries such as Estonia, Malta and the United Arab Emirates have also made significant progress in this field. . After in-depth analysis of the regulatory policies, tax frameworks and business environments of these countries, they selected the ten most promising countries in the world for the future development of crypto businesses.

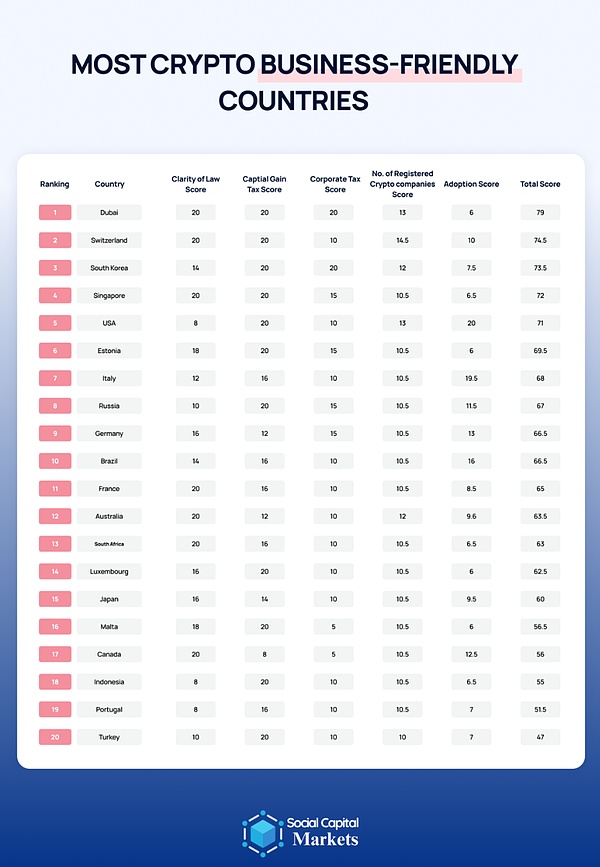

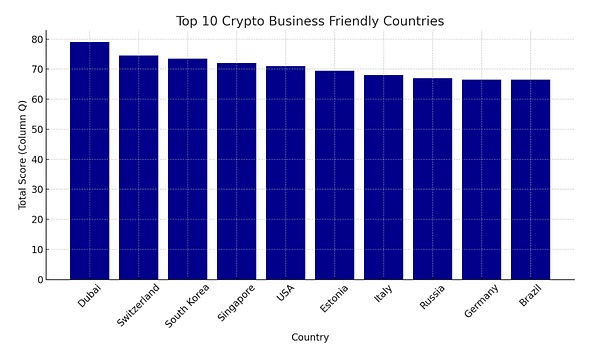

Country composite score overview:

Dubai (score: 79) : Dubai is a top destination for crypto businesses with leading regulatory clarity, zero capital gains tax, 9% corporate tax, and low business license fees.

Switzerland (score: 74.5): Switzerland ranks second with 900 registered crypto companies and a capital gains tax of just 7.8%, which is extremely beneficial to investors.

South Korea (score: 73.5): South Korea ranks third and plays an important role in the global crypto space.

Singapore (score: 72): Singapore is tied for fourth place, with the government providing $8.9 million in blockchain support funds to crypto companies Strong support.

Brazil (score: 66.5): Brazil ranks tenth, 12.5 points behind Dubai, but still maintains a strong presence in the global crypto ecosystem feel.

Germany (score: 66.5): Germany has the same score as Brazil and offers similar policy conditions for crypto businesses.

United States (score: 71): The United States leads the way in crypto adoption, with 5,968 businesses accepting cryptocurrency payments, scoring in this category Full marks (20/20).

Portugal (score: 51.5): 108 businesses in Portugal accept cryptocurrencies, short-term capital gains tax is as high as 28%, but long-term investors Relatively favorable conditions are provided.

Malta (score: 59.5): Malta’s corporate tax is as high as 35%, but its regulatory framework is friendly and there are 15 authorized crypto companies Operate here.

It can be seen from the performance of these countries that government support in terms of policies, tax incentives and regulatory transparency plays a crucial role in attracting crypto companies. Dubai, Switzerland, Singapore and other places have attracted many blockchain and encryption companies because of their clear policies and favorable tax conditions. Countries with large markets such as South Korea and the United States have achieved outstanding results in adopting and promoting the practical application of cryptocurrency.

Faced with the rapid development of cryptocurrency worldwide, the attitudes and policies of various governments have become key factors. Whether regulations and systems that are conducive to the development of blockchain technology and encryption businesses can be formulated will determine whether these countries can occupy a place in the future digital economy. In the future, the rise and fall of encryption companies in these countries will provide valuable experience and examples for other countries around the world. To sum up, in 2024, Dubai leads the list of crypto-friendly countries, followed by Switzerland, Singapore and other places, which continue to attract the world's most dynamic crypto entrepreneurs and companies. In this global competition for digital assets, whoever can formulate more open and inclusive policies will take the lead in the future digital economy.

Top Ten Encryptions Currency Business Friendly Country

Dubai

Switzerland

South Korea

< strong>Singapore

United States

Estonia

Italy

Russia

< /li>Germany

Brazil

1. Dubai (score: 79)

G20 Member States: Yes

Regulatory Framework< /strong>: Dubai Multi Commodities Center (DMCC), Dubai Financial Services Authority (DFSA)

Legal Transparency: Clear and supportive Strong

Capital Gains Tax: No Capital Gains Tax

Corporate Tax< /strong>: 9% tax on taxable income over UAE dirhams 375,000

Number of registered crypto companies: More than 550

p>Total encryption business friendliness score: 79/100

In recent years, Dubai has gradually become A country that is very aggressive in the crypto space. Dubai’s DMCC (Dubai Multi Commodity Center) has even established a dedicated crypto center and provides a launch platform for companies working in crypto and blockchain technology. As one of the G20 members, Dubai has regulatory agencies like VARA (Virtual Assets Regulatory Authority) and DFSA (Dubai Financial Services Authority). Companies must register with the DFSA and DMCC before they can operate crypto businesses in Dubai. The Dubai government does not impose capital gains tax on the income of crypto companies, which greatly increases its attractiveness to crypto companies. Additionally, Dubai only levies a corporate tax of 9% on corporate income exceeding AED 375,000. Currently, there are more than 550 registered crypto businesses in Dubai.

2. Switzerland (score: 74.5)

G20 member : No

Regulatory framework: Swiss Financial Market Supervisory Authority (FINMA)

-

Legal Transparency: clear and supportive, especially in the Zug region

Capital Gains Tax strong>: 7.8%

Corporate tax: 12% - 21%

Number of registered crypto companies: Over 900

Total crypto business friendliness score: 74.5/100

< /li>

Switzerland has made significant achievements in the field of encryption, and the city of Zug in particular is recognized as one of the global encryption centers. As early as 2018, Swiss Economy Minister Johann Schneider-Ammann announced his vision of turning Switzerland into a “crypto nation.” The Swiss Financial Market Supervisory Authority (FINMA) provides a clear and supportive regulatory environment for crypto companies, especially in the canton of Zug, known as the “Crypto Valley”, which has attracted more than 900 crypto companies to register and settle here. Switzerland has established reasonable tax rates for crypto service providers, with a capital gains tax of 7.8% and a corporate tax rate between 12% and 21%. Additionally, there are more than 400 companies in Switzerland that accept cryptocurrencies as a means of payment.

3. South Korea (score: 73.5)

G20 member : Yes

Regulatory Framework: Korea Financial Intelligence Unit (KFIU), part of the Financial Services Commission (FSC)

Legal transparency: gradually improving

Capital gains tax: suspended (0%)

Corporate tax: extension to 2025

Registration of crypto companies: 376+

Total crypto business friendliness score: 73.5/100

As another G20 country, South Korea is gradually becoming a hotspot for crypto companies. Digital asset transactions and services are regulated by the Korean Financial Intelligence Unit (KFIU), which is affiliated with the Financial Services Commission (FSC). Although the current regulatory framework for cryptocurrency is still being gradually improved, South Korea’s efforts in creating a crypto-friendly environment are very significant. Operating an encryption services company in South Korea requires registration with the FSC and compliance with the laws stipulated by it. Although the relevant regulatory framework is still developing, South Korea’s supportive attitude towards the encryption industry has gradually emerged. Currently, South Korea has postponed the implementation of capital gains tax, and the corporate tax code is scheduled to be implemented in 2025. With over 376 registered crypto companies, South Korea is steadily growing to become Asia’s crypto powerhouse.

4. Singapore (score: 72)

G20 member : No

Regulatory Framework: Monetary Authority of Singapore (MAS)

Legal transparency: clear and supportive

Capital gains tax: No capital gains tax

< /li>Corporate Tax: 17%

Registered Crypto Companies: 100+< /p>

Total Crypto Business Friendliness Score: 72/100

Singapore is an important Business hub, also including crypto companies. Businesses need to obtain a license from the Monetary Authority of Singapore (MAS) to establish a crypto business in Singapore. In addition, Singapore supports the industry through the Cryptocurrency and Blockchain Association to help small and medium-sized enterprises grow. The absence of capital gains tax and a corporate tax rate of 17% on taxable income have become important factors in attracting crypto entrepreneurs. Singapore currently has about 100 registered crypto companies, and the country has provided a huge US$8.9 million in funding for the research and development of blockchain technology in Southeast Asia, making it a dominant player in the crypto business field in Southeast Asia.

5. United States (score: 71)

G20 member : Yes

Regulatory Framework: Securities and Exchange Commission (SEC), Financial Crimes Enforcement Network (FinCEN)

Legal Transparency: Transparency varies and varies from state to state

Capital Gains Tax : Varies by state (mostly 0%)

Corporate Tax: 21%

- < p>Registered crypto companies: 474+

Total crypto business friendliness score: 71/100

In the United States,cryptocurrencies are widely accepted. More than 5,000 businesses in various sectors accept cryptocurrencies as a payment method, indicating that cryptocurrencies have become an important industry in this G20 country. However, legal transparency in the United States varies from state to state, creating a diverse regulatory environment. Many states have enacted pro-crypto laws, such as Colorado, which has established a sandbox program for blockchain companies to allow these companies to test new products and services. In terms of taxation, the United States is relatively relaxed towards crypto companies. Currently, there is no capital gains tax on cryptocurrencies, and the corporate income tax rate is 21%. Although government licensing fees are higher, such as the government fee of $176,226, the United States is still an important player in encryption companies with its vast market and innovative spirit, with more than 474 registered encryption companies currently.

6. Estonia (score: 69.5)

G20 member : No

Regulatory Framework: Financial Supervisory Authority (EFSA)

Legal transparency: clear and supportive

Capital gains tax: 20%

Corporate tax: 20%

Registered crypto companies: 1200+

Total Crypto Business Friendliness Score: 69.5/100

Estonia to be established between 2021 and 2022 has adopted strict anti-money laundering (AML) and counter-terrorism financing prevention laws, which has had a significant impact on its crypto service provider market. These laws caused many companies to abandon plans to apply for licenses, and the Financial Intelligence Unit (FIU) revoked the licenses of nearly 482 crypto companies in 2022. Currently, only around 100 crypto companies are licensed to operate in Estonia. Despite strict regulations, favorable tax conditions remain attractive to crypto businesses. There is no capital gains tax in Estonia, but a 20% withholding tax is imposed on income.

7. Italy (score: 68)

G20 member : Yes

Regulatory framework: Ministry of Economy and Finance (MEF), Italian Securities and Exchange Commission (CONSOB)

< /li>Legal transparency: clear but still developing

Capital gains tax: 26%

Corporate Tax: 24%

Registered Crypto Companies< /strong>: 73+

Total encryption business friendliness score: 68/100

< p>For a long time, Italy had no regulatory barriers to crypto companies. However, the country has recently tightened its rules and regulations when it comes to crypto businesses. The introduction of the EU’s Markets in Crypto-Assets (MiCA) framework has also impacted how the country regulates crypto service providers. Even so, There are currently 73 approved encryption service companies active in the market in Italy. Although the tax rate is relatively high, it is still low compared to other countries such as Australia or Japan. Italy's capital gains tax rate is 26% and corporate income tax is 24%. 8. Russia (score: 67)

G20 member : Yes

Regulatory Framework: Central Bank of Russia (CBR)

Legal transparency: Clear but restrictive

Capital gains tax: No capital gains tax

< /li>Corporate Tax: 20%

Registered Crypto Companies: 70+< /p>

Total encryption business friendliness score: 67/100

Russia is one of the One of the superpowers, it attracts crypto companies with its favorable tax policies. There is no capital gains tax in Russia and the corporate income tax is fixed at 20%. The country recognizes cryptocurrencies as legal tender, and more than 500 businesses currently accept cryptocurrencies as a means of payment. This speeds up transaction processes, ensures the security of payment data, and most importantly simplifies crypto companies’ operations in the market.

9. Germany (score: 66.5)

G20 member : Yes

Regulatory framework: Federal Financial Supervisory Authority (BaFin)

Legal transparency: clear and supportive for licensed companies

Capital gains tax: 25%

Corporate tax: 15%-30%

Registered crypto companies >: 300+

Total encryption business friendliness score: 66.5/100

Germany was one of the first countries to recognize the potential of blockchain technology and use it for digital transformation. The German Savings Banks Association (a network of 400 savings banks) has even developed a fintech blockchain application to facilitate cryptocurrency transactions. Germany has a supportive attitude towards cryptocurrencies and extends this support to crypto businesses. There is no capital gains tax on long-term crypto income for individuals or businesses, but short-term capital gains taxes range from 0% to 45%, depending on the gain. Businesses also need to pay a 15% income tax. Despite its higher tax rate, Germany’s transparent and robust crypto regulations make it an ideal choice for crypto businesses. Currently, more than 700 businesses in Germany accept cryptocurrencies as a means of payment, further enhancing business convenience.

10. Brazil (score: 66.5)

G20 member : Yes

Regulatory Framework: Central Bank of Brazil

Legal transparency: gradually improving

Capital gains tax: 15.0% – 22.5%

Corporate Tax: 0% – 27.5%

Registered Crypto Companies: 19+

Total Crypto Business Friendliness Score: 66.5/100

Brazil’s Place in the Crypto World Still under development. Crypto service providers must register with the Central Bank of Brazil in order to operate in Brazil. In 2022, Brazil established a framework for the crypto industry and designated the central bank as the regulator. However, as laws and regulations are not yet fully established, this makes Brazil a less restrictive environment for businesses. However, Brazil's high tax rates make it a less than ideal choice for businesses. The country imposes a corporate income tax of up to 27.5%, while short-term capital gains taxes range from 15% to 22.5%.

It can be seen from the performance of these countries that the government’s policies, tax incentives and Support for regulatory transparency plays a crucial role in attracting crypto businesses. Dubai, Switzerland, Singapore and other places have attracted many blockchain and encryption companies because of their clear policies and favorable tax conditions. Countries with large markets such as South Korea and the United States have achieved outstanding results in adopting and promoting the practical application of cryptocurrency.

Faced with the rapid development of cryptocurrency worldwide, the attitudes and policies of various governments have become key factors. Whether regulations and systems that are conducive to the development of blockchain technology and encryption businesses can be formulated will determine whether these countries can occupy a place in the future digital economy. In the future, the rise and fall of encryption companies in these countries will provide valuable experience and examples for other countries around the world.

To sum up, in the list of crypto-friendly countries in 2024, Dubai leads the list, followed by Switzerland, Singapore and other places, which continue to attract the most dynamic crypto startups in the world. investors and businesses. In this global competition for digital assets, whoever can formulate more open and inclusive policies will take the lead in the future digital economy.

Alex

Alex

Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Weiliang

Weiliang Kikyo

Kikyo Anais

Anais Alex

Alex Catherine

Catherine Weatherly

Weatherly Kikyo

Kikyo