Author: Tulip King; Source: X, @0xTulipKing; Translated by: Shaw Jinse Finance

Prediction markets are not yet fully understood, and that's your opportunity. We are witnessing a complete reshaping of how markets work, how information is priced, and most importantly—how the future is shaped. If you ignore this, you will miss the biggest trading opportunity in the market since the digitalization of options.

The iPhone Moment

In every technological revolution, there is a wonderful period when people are unable to perceive disruptive changes because they are stuck in old ways of thinking. In 2007, Nokia executives looked at the iPhone and said, "It doesn't even have a keyboard." They compared it to a mobile phone, ignoring the fact that it should be compared to a computer. The iPhone is not competing with existing mobile phones—it has revolutionized the concept of a single-function device.

This is exactly what is happening in prediction markets today.

People saw Polymarket and thought it was some strange, illiquid betting site. They compared it to DraftKings (a sports betting platform) or the Chicago Mercantile Exchange (CME) and found it inferior. They made a Nokia-esque mistake. Polymarket isn't a better betting site—it's replacing the entire concept of a professional financial market. Consider this: when you strip away all the complexities, what is the essence of each financial instrument? Options: betting "yes" or "no" on price levels; Insurance: betting "yes" or "no" on the occurrence of a disaster; Credit Default Swaps: betting "yes" or "no" on bankruptcy; Sports Betting: betting "yes" or "no" on the outcome of a sporting event. We've built trillion-dollar industries around fundamentally binary questions, each with its own infrastructure, regulatory systems, and monopolistic intermediaries from which it extracts profits. Polymarket simplifies all of this into one fundamental element: creating markets for any observable event, allowing people to trade, and settling accounts when reality determines the outcome. It's not better than DraftKings at sports betting, nor better than CME at derivatives. It does something more fundamental—simplifying all markets to their most basic units and rebuilding them from there. Polymarket is like the iPhone; everything else is just an app. Multi-dimensional Trading When all trading takes place in the same venue, possibilities that didn't exist before are unlocked. Imagine five years ago, if you wanted to construct a position expressing the view: "I think the Fed will raise rates, but tech stocks will rise anyway because Trump will tweet some positive news about artificial intelligence." You would need accounts at different financial institutions, dealing with different regulatory frameworks, and using different leverage. And the "Trump mentions" trade simply didn't exist in the market back then. On Polymarket, this can be done with just three clicks. More importantly, these aren't three separate bets, but rather a coherent worldview expressed through interconnected positions. You could buy a short position on "the Fed pauses rate hikes," a long position on "the Nasdaq hits a record high," and a long position on "Trump will mention artificial intelligence in his next speech." This correlation itself is the key trade.

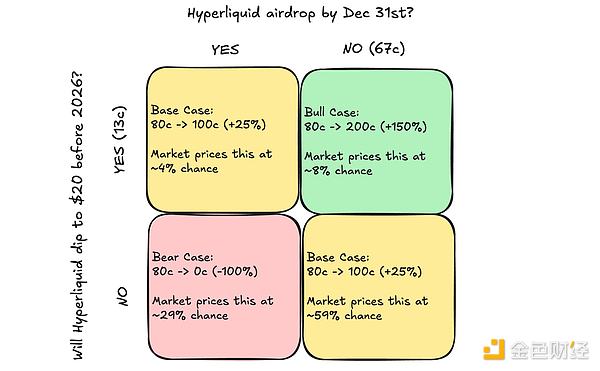

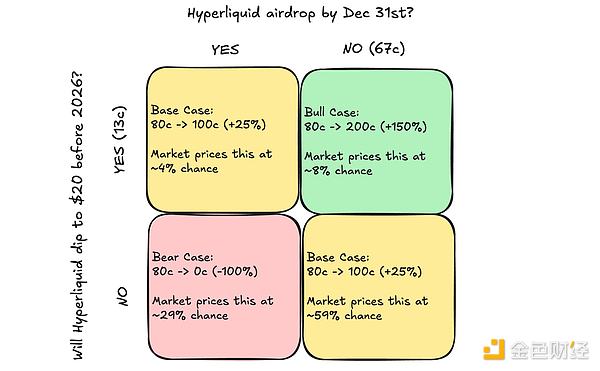

For those who are still following, here's an example. Last month on Polymarket, you could build a position like this: buy a position at 67 cents on "Hyperliquid won't airdrop before December 31st," and at the same time buy a position at 13 cents on "Will Hyperliquid fall to $20 by 2026?". Consider this outcome matrix: **Maximum Profit Scenario:** Hyperliquid doesn't airdrop, and the price drops to $20 this year. Given the current market conditions, this seems like a reasonable assumption, and the price should be 8% higher than the current market value. You are buying this outcome at a low price. **Minor Profit Scenario:** Hyperliquid airdrops, causing the price to drop to $20, or the price drops to $20 without an airdrop. These two scenarios are the most likely, with a probability of 63%. **Full Loss Scenario:** Hyperliquid airdrops, and the price remains above $20. Given the market's significant concerns about the new supply from team unlocks, it seems that airdrops introducing more supply would be met with a very negative reaction. The probability of this outcome is less than 29%, so you're selling this outcome at a high price. This sounds like hedging, but it's much more than that. It expresses a complex view of how the market handles new token supply, a view that's difficult to articulate accurately anywhere else. Traditional markets force you to compress complex ideas into rough directional bets. You might have a complex argument that Nvidia's (NVDA) earnings will exceed expectations, but it will still fall because market expectations are ahead of reality. In the options market, you can only choose between call and put options, perhaps constructing a spread that barely expresses your meaning but is costly. On the Polymarket, you only need to buy the options "Nvidia earnings exceed expectations" and "Nvidia stock price drops 5% after earnings release" to accurately express your view. The real brilliance lies in what you do when you start thinking about cross-market connections that shouldn't exist but do. For example, a hurricane is approaching Florida, while the Tampa Bay Buccaneers are playing in Detroit. Conventional wisdom considers these two events unrelated. But you have an assumption: if the hurricane does hit Florida, the NFL referees will likely favor the Buccaneers, creating a compelling narrative. So, you bet 60 cents on the Buccaneers losing and 20 cents on the hurricane hitting Florida. You're not betting on a particular outcome, but on a connection structure. You profit from understanding how narratives influence referee decisions. This is what I mean when I say prediction markets don't compete with existing markets—they operate on a completely different level of abstraction. All other markets offer only one option, while a polymarket offers an infinite number of options, and more importantly, it allows you to choose specific combinations of options based on your understanding of how the world works. Why are the "savvy" people wrong (again)? The first criticism you hear about prediction markets is always about liquidity. "Oh, you can't trade at scale." "The spreads are too big." "It's just idiots gambling with their lunch money." But that's not a loophole—that's your opportunity.

Think about the reasons for the impending liquidity explosion from a mechanistic perspective. Traditional market making is relatively simple—you usually make markets on things that have a clear correlation with other things. Stock options are correlated with stock prices, futures are correlated with spot prices. Each thing has hedging, correlation, and models that can be relied upon. This is why a few companies like Citadel and Jane Street are able to make markets for thousands of financial instruments.

Predicting the market is more difficult.

Each market type requires its own specialized intelligence: Sports markets need models that can be updated with every score, every injury report, and every weather change. Political markets require natural language processing to analyze polls, speeches, and social media sentiment. Event markets need machine learning systems that can calculate basic probabilities based on historical data. Mention markets require language models trained on thousands of text records. You can't let one market maker monopolize all markets because each market requires completely different expertise. In the long run, this actually benefits liquidity. We will no longer see a few giants monopolizing all market-making businesses, but rather an explosive growth in professional market makers. Some quantitative analyst teams will become the world's best experts at pricing mentions in the market. Other teams will dominate weather-related events. Still others will focus on celebrity behavior. This seemingly weak fragmentation will actually create resilience and depth. In the next five years, we will see a completely new type of financial company emerge—prediction market experts. They won't be making markets in the stock or bond markets, but in reality itself. And the companies that first achieve large-scale success in this will become the bastions of the new financial system. The Disturbing Facts About Truth Now let's put forward some real arguments: prediction markets aren't about prediction itself; they're about creating a financial incentive for truth. We live in a bizarre age where everyone has an opinion on everything, but nobody is really taking risks. Your favorite Twitter analyst has predicted twelve recessions that have only occurred twice in the past. CNBC commentators have botched more accounts than Do Kwon. Yet they retain their platforms, their audiences, and continue making incorrect predictions without consequence. This model is unsustainable, and everyone knows that deep down. The information ecosystem we've built rewards engagement, not accuracy; volume matters more than correctness. Social media has exacerbated this problem—the most popular opinions now prevail, regardless of their accuracy. Those with the most followers become experts, and so-called experts are simply those who get the most likes. Prediction markets have completely disrupted this model. Suddenly, there's a price to pay for both correct and incorrect predictions. The market doesn't care if you graduated from Harvard, have a verified account, or have written books on marketing. It only cares if your predictions are correct. When you build a system that only rewards accuracy, something amazing happens: those who predict correctly suddenly have a reason to speak, while those who predict incorrectly finally have a reason to shut up. But this is not simply a matter of transferring wealth from those who shouldn't have it to those who should. Prediction markets are building a parallel information system whose operating mechanism is drastically different from our current media ecosystem. In the old world: information spreads virally on social networks. In prediction markets: information is priced according to reality. These are fundamentally different selection mechanisms, and therefore produce drastically different results. We have been observing this phenomenon in real time on Polymarket. The predictive power of the political market has surpassed any aggregated poll data. Markets related to the Federal Reserve fluctuate before any economists update their forecasts. The yield market has already priced in results that won't appear in analyst reports for weeks. This is not because traders in the prediction market are smarter, but because their incentives are to ensure accurate predictions, not to chase hype.

Bounty Markets, Not Prediction Markets

Now things are getting really strange, and I think everyone's overlooking the most important dynamic. We keep calling these "prediction markets," but that's like calling Bitcoin "digital gold"—technically correct, but completely ignoring something more important. True prediction markets are passive observers. They price probabilities but don't influence the outcome. Weather futures markets don't change the weather. But polymarkets aren't passive, and that's the key: **any market with human participants contains the potential to change the outcome.**

Let me explain what I mean. Someone placed a bet on whether someone would throw a green object during a WNBA game, and someone calculated the odds:

Buying $10,000 worth of YES at 15 cents per bet.

buying $10,000 worth of YES at 15 cents per bet.

Throw the item yourself.

When the market result is "YES", you receive $66,000.

Net profit after deducting legal fees and lifetime ban: approximately $50,000

The equilibrium dynamics here are very interesting. Theoretically, the WNBA disorderly conduct bounty should be set at exactly this price:

Compensation Amount = Criminal Charges + Social Shame + Lifetime Ban + Required Effort

If the price is too high, it will attract imitators; if the price is too low, no one will pay attention. The market will find the optimal equilibrium price.

The "prediction market" has become a bounty market—it no longer predicts whether someone will throw something, but instead provides a specific amount of money for someone to make that happen. This isn't a loophole, nor is it manipulation; it's the most important characteristic of prediction markets, yet no one mentions it.

Consider this thought experiment. I decide to run for mayor of New York City. The market gives me a fairly reasonable chance of winning, only 0.5%. Based on this probability, I could spend $100,000 to buy 20 bets, each worth $5,000. If I win, each bet would bring in a staggering $1 million.

Catherine

Catherine