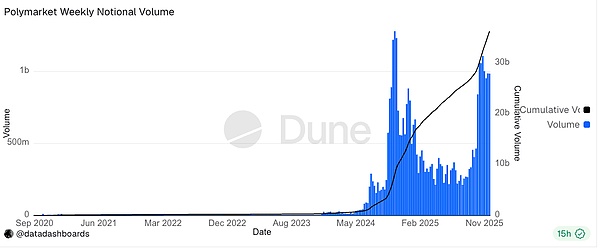

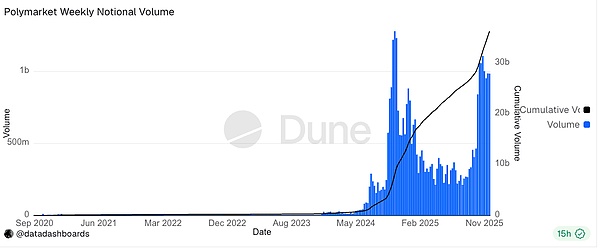

Prediction markets are undoubtedly one of the most watched sectors in the crypto industry. Leading project Polymarket boasts over $36 billion in cumulative trading volume and recently completed a strategic funding round at a valuation of $9 billion. Meanwhile, platforms including Kalshi (valued at $11 billion) have also received substantial capital injections.

▲Source: Dune

However, behind the continuous influx of capital and impressive data growth, we find that prediction markets, as a type of trading product, still face many challenges.

In this article, the author attempts to set aside mainstream optimism and offer some different perspectives. 01 Prediction is event-based—events are inherently discontinuous and unrepeatable. Compared to the price changes of assets like stocks and forex over time, the prediction market relies on a finite number of discrete events in the real world. It is low-frequency compared to trading. In the real world, events that truly garner widespread attention, have clear outcomes, and settle within a reasonable timeframe are very limited—presidential elections every four years, the World Cup every four years, the Oscars every year, and so on. Most social, political, economic, and technological events do not generate sustained trading demand. The number of such events is limited each year, and their frequency is too low to build a stable trading ecosystem. In other words, the low frequency of prediction markets cannot be easily changed by product design or incentive mechanisms. This fundamental characteristic determines that prediction markets will not maintain high trading volumes when there are no major events. 02. Prediction markets do not have fundamentals like the stock market: the value of the stock market comes from the intrinsic value of a company, including its future cash flow, profitability, assets, etc. The prediction market ultimately points to an outcome, relying on users' "interest in the outcome of the event itself." (Of course, this discussion focuses on the product's initial purpose, excluding objective arbitrage and speculative factors; even in the stock market, there are many speculators who may not care about the essence of the underlying assets.) In this context, the amount people are willing to bet on is significantly positively correlated with the importance of the event, market attention, and time frame: scarce and highly watched events such as the NBA Finals and presidential elections attract a large amount of capital and attention. Naturally, an average fan is more likely to care about the outcome of the annual NBA Finals and bet heavily on it, rather than exhibiting the same behavior during the regular season. On Polymarket, the 2024 presidential election accounted for over 70% of the platform's total OI (Original Interest). Meanwhile, the vast majority of events remained in a state of low liquidity and high bid-ask spreads for extended periods. From this perspective, the size of prediction markets is unlikely to expand exponentially. Prediction markets inherently possess gambling characteristics, but they struggle to generate the retention and expansion seen in traditional gambling. We all know that the true mechanism of gambling addiction lies in instant feedback—slot machines cycle every few seconds, Texas Hold'em lasts every few minutes, and contracts and memecoin transactions change rapidly every second. The feedback cycle in prediction markets is very long, with most events taking weeks to months to settle. Events with rapid feedback may not be interesting enough to warrant a large bet. Immediate positive feedback significantly increases dopamine release frequency, reinforcing user habits. Delayed feedback fails to create stable user retention. In some types of events, there is a high degree of information asymmetry among participants. For competitive sports events, besides the teams' theoretical strength, it largely depends on the athletes' performance on the day, thus involving considerable uncertainty. However, political events involve opaque processes involving insider information, channels, and connections. Insiders possess a significant informational advantage, making their bets much more certain. For example, the vote counting process, internal polls, and organizational structures in key regions are difficult for outsiders to obtain. Currently, there is no clear definition of "insider trading" in prediction markets by regulatory bodies, leaving this area in a gray area. In general, in such events, the party at an informational disadvantage is easily exploited for liquidity withdrawal. Due to the ambiguity of language and definitions, it is difficult to achieve complete objectivity in prediction market events. For example, whether "Russia and Ukraine will cease hostilities in 2025" depends on the statistical methodology used; whether "a cryptocurrency ETF will be approved at a certain time" can be fully approved, partially approved, or conditionally approved, etc. This involves the issue of "social consensus"—when both sides are evenly matched, the losing side will not readily concede defeat. Such ambiguity necessitates the platform to establish a dispute resolution mechanism. Once prediction markets encounter linguistic ambiguity and dispute resolution, they cannot rely entirely on automation or objectivity, leaving room for human manipulation and corruption. The main value proposition of prediction markets in the market is "collective intelligence," which, overcoming low trust in media and mainstream discourse, allows prediction markets to aggregate the highest quality information globally, thereby achieving collective consensus. However, before prediction markets achieve widespread adoption, this "information sampling" is inevitably one-sided, and the sample is not diverse enough. The user base of prediction market platforms may be highly homogeneous. For example, in the early stages of a prediction market, it will certainly be a platform primarily composed of cryptocurrency users whose views on political, social, and economic events may be highly convergent, thus forming an information cocoon. In this situation, the market reflects the collective bias of a specific group, and is still quite far from "collective wisdom." Conclusion This article is not intended to predict a bearish market, but rather to encourage us to remain calm during periods of heightened FOMO, especially after the rise and fall of popular narratives like ZK and GameFi. Over-reliance on special events like elections, short-term sentiment on social media, and airdrop incentives often amplifies superficial data and is insufficient to support judgments about long-term growth. Despite this, from the perspective of user education and user acquisition, prediction markets will still hold an important position in the next three to five years. Similar to on-chain yield savings products, they have an intuitive product format and a lower learning curve, making them more likely to attract users from outside the crypto ecosystem than on-chain transaction protocols. Based on this, prediction markets are likely to develop further and, to some extent, become entry-level products for the crypto industry. Future prediction markets may also occupy certain vertical sectors, such as sports and politics. They will continue to exist and expand, but they do not have the fundamental conditions for exponential growth in the short term. We should consider investing in prediction markets with a cautiously optimistic perspective.

Alex

Alex