First principles of blockchain: Sui and Arweave AO as examples

The first principle of blockchain is a decentralized accounting method, and "blocks" and "chains" are not necessary.

JinseFinance

JinseFinance

Author: JacobZhao

Pendle is undoubtedly one of the most successful DeFi protocols in this crypto cycle. While many protocols have stagnated due to liquidity depletion and declining narratives, Pendle, with its unique yield splitting and trading mechanism, has successfully become a "price discovery platform" for yield-generating assets. Through deep integration with yield-generating assets such as stablecoins and LST/LRT, it has established its unique position as "DeFi yield infrastructure."

In the research report "The Intelligent Evolution of DeFi: The Evolutionary Path from Automation to AgentFi," we systematically sorted out and compared the three stages of DeFi's intelligent development: automation tools, intent-centric copilots, and AgentFi (on-chain intelligent agents). In addition to lending and yield farming, two of the most valuable and readily implementable use cases, Pendle's PT/YT yield rights trading is considered a high-priority application that is highly compatible with AgentFi in our high-level vision. Pendle's unique "yield splitting + maturity mechanism + yield rights trading" architecture provides a natural platform for intelligent agents to orchestrate strategies, enriching the possibilities for automated execution and yield optimization. I. Pendle's Basic Principles Pendle is the first DeFi protocol focused on yield splitting and trading. Its core innovation lies in tokenizing and separating future yield streams from on-chain yield-generating assets (such as LST, stablecoin certificates of deposit, and loan positions), allowing users to flexibly lock in fixed returns, maximize yield expectations, or engage in speculative arbitrage. In short, Pendle builds a secondary market for the "yield curve" of crypto assets, allowing DeFi users to trade not only "principal" but also "yield." This mechanism is highly similar to the zero-coupon bond + coupon split in traditional finance, improving pricing accuracy and trading flexibility for DeFi assets. Pendle's Yield Split Mechanism Pendle splits a yield-bearing underlying asset (YBA) into two tradable tokens: PT (Principal Token, similar to a zero-coupon bond): represents the principal value that can be redeemed at maturity, but no longer accrues yield. YT (Yield Token, similar to a coupon right): represents all earnings generated by the asset before maturity, but returns to zero after maturity. For example, a deposit of 1 ETH stETH will be split into PT-stETH (redeemable for 1 ETH at maturity, with the principal locked) and YT-stETH (receiving all staking earnings before maturity). Pendle goes beyond simple token splits; it also provides a liquid market for PT and YT (similar to the secondary liquidity pool in the bond market) through a specially designed AMM (Automated Market Maker). Users can buy and sell PT or YT at any time to flexibly adjust their yield risk exposure. PT's price is typically below 1, reflecting its "discounted principal value," while YT's price depends on market expectations of future returns. More importantly, Pendle's AMM is optimized for assets with maturity dates, allowing PT/YT of different maturities to form a yield curve in the market, highly similar to the bond market in traditional finance. It's important to note that among Pendle's stablecoin assets, PT (principal token, fixed-income position) is equivalent to an on-chain bond. A fixed interest rate is locked in at a discount upon purchase, and it can be redeemed for stablecoins at a 1:1 ratio upon maturity. This offers stable returns and low risk, making it suitable for conservative investors seeking certainty in returns. Meanwhile, the Stablecoin Pool (liquidity mining position) is essentially an AMM market-making platform. LP income comes from fees and incentives, resulting in larger APY fluctuations and the risk of impermanent loss. It's more suitable for active investors who can tolerate volatility and pursue higher returns. In markets with active trading volume and strong incentives, Pool returns can potentially be significantly higher than PT fixed income. However, in markets with low trading volume and insufficient incentives, Pool returns are often lower than PT, and may even result in losses due to impermanent loss. Pendle's PT/YT trading strategies primarily cover four main paths: fixed income, income speculation, inter-period arbitrage, and leveraged income, catering to investors with varying risk appetites. Users can lock in fixed returns by buying PT and holding it until maturity, effectively earning a guaranteed interest rate. Alternatively, they can buy YT, betting on rising yields or increased volatility, thereby speculating on returns. Investors can also leverage the price differential between PT and YT of different maturities for cross-period arbitrage, or use PT and YT as collateral in multiple lending agreements to maximize their return exposure. Boros Funding Rate Trading Mechanism: Beyond the yield splitting provided by Pendle V2, the Boros module further assetizes the funding rate, making it no longer simply a passive cost of holding a perpetual contract position but an independently priced and tradable instrument. Through Boros, investors can directional speculate, hedge risk, or capitalize on arbitrage opportunities. This mechanism effectively brings traditional interest rate derivatives (IRS, basis trading) to DeFi, providing new tools for institutional fund management and robust return strategies. In addition to PT/YT trading and AMM pools, and the Boros funding rate trading mechanism, Pendle V2 also provides several extended features. While not the focus of this article, they still constitute an important addition to the protocol ecosystem: vePENDLE: A governance and incentive model based on the Vote-Escrow mechanism. Users obtain vePENDLE by locking PENDLE, thereby participating in governance voting and increasing their profit distribution weight. This is the core of the protocol's long-term incentives and governance. PendleSwap: A one-stop asset exchange portal that helps users efficiently switch between PT/YT and native assets, improving the convenience of fund use and protocol composability. It is essentially a DEX aggregator rather than a standalone innovation. Points Market: Allows users to pre-trade various project points (Points) in the secondary market, providing liquidity for airdrop capture and point arbitrage. This platform is more focused on speculation and buzzword-generating scenarios rather than core value. II. Pendle Strategy Overview: Market Cycles, Risk Stratification, and Derivative Expansion In traditional financial markets, retail investors primarily invest in stocks and fixed-income wealth management products, often finding it difficult to directly participate in the more challenging bond derivatives market. In the crypto market, retail users are also more receptive to token trading and DeFi lending. While Pendle has significantly lowered the barrier to entry for retail investors in bond derivatives trading, its strategies still require a high level of expertise, requiring investors to conduct in-depth analysis of yield-generating asset interest rate fluctuations in different market environments. Based on this, we believe that during different market phases—the early stages of a bull market, the bull market euphoria, the bear market downturn, and the range-bound trading phase—investors should tailor their Pendle trading strategies to their risk appetite. During the bull market upswing: Market risk appetite gradually recovers, lending demand and interest rates remain low, and YT on Pendle is relatively cheap. During this period, buying YT is equivalent to betting on rising future yields. Once the market enters an accelerated upward phase, lending rates and LST yields will both rise, driving up YT's value. This is a typical high-risk, high-reward strategy, suitable for investors willing to position themselves early and capture the potential gains of a bull market. During the bull market euphoria, surging market sentiment drives a surge in lending demand. Interest rates on DeFi lending protocols often rise from single digits to over 15–30%, driving up the value of YT on Pendle and significantly discounting PT. During this period, investors using stablecoins to buy PT effectively lock in a high interest rate at a discount, redeeming it 1:1 to the underlying asset upon maturity. This effectively acts as a hedge against volatility risk through "fixed-income arbitrage" in the late stages of a bull market. This strategy offers the advantages of robustness and rationality, ensuring the safety of fixed income and principal during market corrections or bear markets. However, the trade-off is forgoing the potential for greater gains from holding volatile assets. During a bear market downturn, market sentiment is depressed, lending demand plummets, and interest rates fall sharply. YT returns approach zero, while PT performs more closely to risk-free assets. Buying PT and holding it to maturity during this period means locking in a guaranteed return even in a low-interest environment, effectively establishing a defensive position. For conservative investors, this is a key strategy for mitigating return volatility and preserving principal. During periods of range-bound volatility, market interest rates lack trending and market expectations diverge significantly, leading to frequent short-term mismatches or pricing discrepancies between Pendle's PT and YT. Investors can generate stable price differentials by engaging in inter-period arbitrage between PT/YT maturities of different maturities or by capitalizing on mispricing of income rights caused by volatile market sentiment. These strategies require enhanced analytical and execution skills and are expected to generate stable returns in non-trending markets.

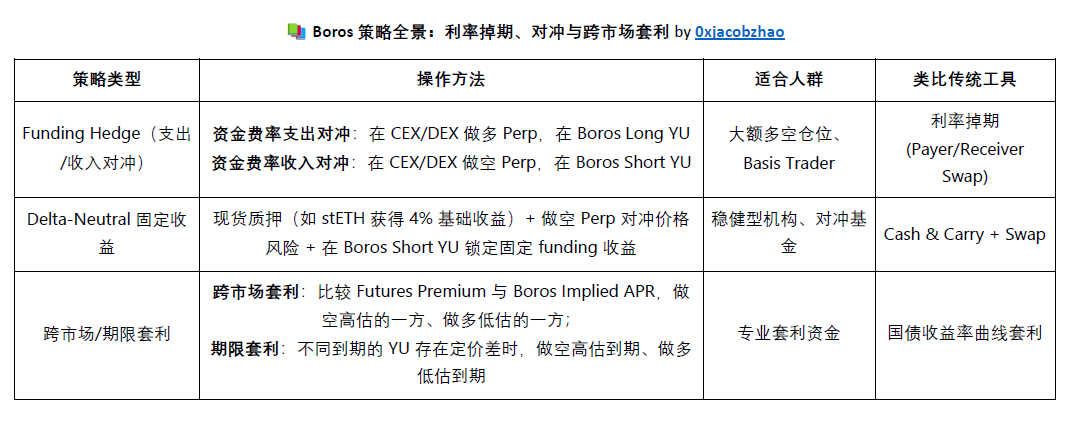

Of course, the above strategies are generally based on stable returns. The core logic is to achieve a balance between risk and return in different market cycles by buying PT, buying YT or participating in stablecoin pool mining. Aggressive investors with a higher risk appetite can also opt for a more aggressive strategy of selling PT or YT to bet on interest rate trends or market mismatches. These strategies require greater judgment and execution, and carry greater risk exposure. Therefore, this article will not elaborate on these strategies, but serves only as a reference. For more information, please see the decision tree below. Of course, the above analysis of Pendle strategies is based on a U-standard perspective. The strategy focuses on how to obtain excess returns by locking in high interest rates or capturing interest rate fluctuations. In addition, Pendle also offers coin-standard strategies for BTC and ETH. ETH is widely considered the best target for a coin-based strategy due to its ecosystem status and long-term value certainty. As the native asset of the Ethereum network, ETH not only serves as the settlement basis for most DeFi protocols but also offers a stable source of cash flow through staking yield. In contrast, BTC has no native interest rate, and its returns on Pendle rely primarily on protocol incentives, making its coin-based logic relatively weak. Stablecoin pools, on the other hand, are more suitable for defensive investments, fulfilling the role of "preserving value while waiting." The strategies of the three asset pools differ significantly across market cycles: In a bull market, the stETH pool is the most aggressive, and YT is the best strategy for leveraging ETH holdings. uniBTC can serve as a supplementary, but more speculative, option. Stablecoin pools are relatively less attractive. In a bear market: stETH's low YT price provides a key opportunity to increase ETH holdings; the stablecoin pool serves as the primary defensive measure; uniBTC is only suitable for small-scale, short-term arbitrage. In a volatile market: stETH's PT-YT mismatch and AMM fees provide arbitrage opportunities; uniBTC is suitable for short-term speculation; the stablecoin pool provides a stable supplement. Boros Strategy Panorama: Interest Rate Swaps, Hedging and Cross-Market Arbitrage

Boros assetizes the floating variable of Funding Rate, which is equivalent to introducing Interest Rate Swaps (IRS) and Basis Trading (Carry Trade) in traditional finance into DeFi, transforming the funding rate from an uncontrollable cost item into a configurable investment tool. Its core certificate, Yield Units (YU), supports three main strategic paths: speculation, hedging, and arbitrage.

For speculation, investors can use Long YU (paying an implied APR and receiving an underlying APR) to bet on rising funding rates, or Short YU (receiving an implied APR and receiving an underlying APR), similar to traditional interest rate derivative trading. For hedging, Boros provides institutions holding large perpetual swap positions with a tool that converts floating funding rates into fixed rates. Funding Rate Hedging: Long Perp + Long YU locks floating funding rate expenses into a fixed cost. Funding Rate Income Hedging: Short Perp + Short YU locks floating funding rate income into a fixed return.

In terms of arbitrage, investors can leverage inter-market (Futures Premium vs. Implied APR) or inter-maturity pricing differences through Delta-Neutral Enhanced Yield or Arbitrage/Spread Trade to obtain relatively stable interest rate spreads.

Overall, Boros is suitable for professional funds for risk management and stable returns, but its friendliness to retail users is limited.

Based on the previous analysis, Pendle's trading strategy is essentially a complex bond derivative transaction. Even the simplest purchase of PT to lock in fixed income still needs to consider multiple factors such as period rotation, interest rate fluctuations, opportunity cost and liquidity depth, not to mention YT speculation, cross-period arbitrage, leveraged combination or dynamic comparison with the external lending market. Unlike floating-yield products like lending or staking, which offer a "one-time deposit and continuous interest," Pendle's PT (principal token) must have a specific maturity date (typically weeks to months). Upon maturity, the principal is redeemed for the underlying asset at a 1:1 ratio, requiring a new position to continue earning returns. This "periodic" maturity constraint is essential for the fixed-income market and fundamentally distinguishes Pendle from perpetual lending protocols. Currently, Pendle does not officially offer a built-in automatic renewal mechanism. However, some DeFi strategy vaults offer "auto-rollover" solutions to strike a balance between user experience and protocol simplicity. Currently, there are three auto-rollover modes: passive, smart, and hybrid. Passive Auto-Rollover: The logic is simple: upon PT maturity, the principal is automatically rolled over into new PT, providing a smooth user experience. However, it lacks flexibility. If the floating rates of Aave and Morpho are higher, forced renewal will incur opportunity costs.

Smart Auto-Rollover: Vault dynamically compares Pendle's fixed rate with the floating rate in the lending market to avoid "blind renewals," increasing returns while maintaining flexibility, better meeting the need for maximizing returns

If Pendle fixed rate > lending floating rate → reinvest in PT to lock in a more certain fixed income;

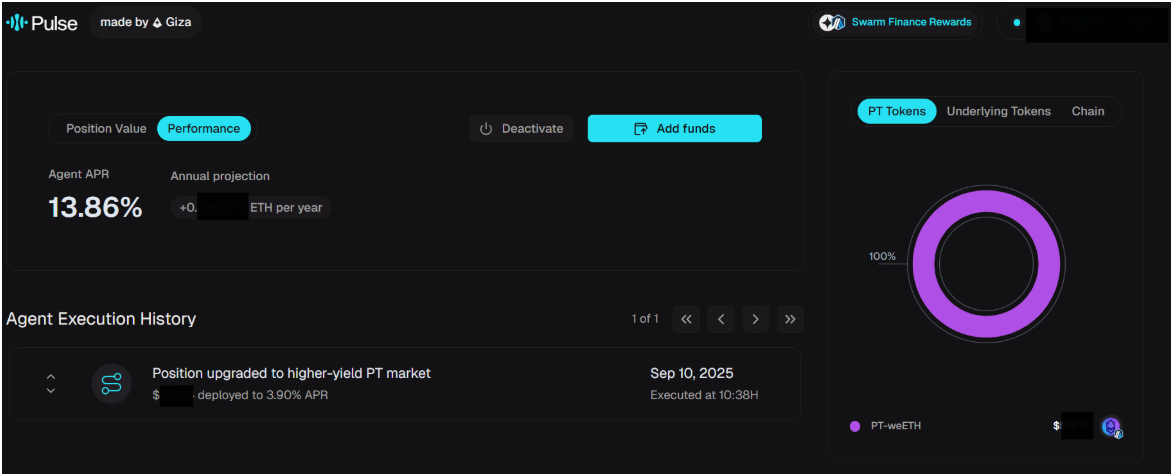

If lending floating rate > Pendle fixed rate → transfer to lending protocols such as Aave/Morpho to obtain a higher floating rate. Hybrid Allocation: Part of the funds are locked into the PT fixed rate, while part flows into the lending market, creating a robust yet flexible portfolio to avoid being "thrown away" by a single interest rate environment in extreme situations. Therefore, AgentFi offers unique value within Pendle trading strategies: it automates complex interest rate trading. Pendle's PT fixed rate and the floating rate in the lending market fluctuate in real time, making it difficult for humans to continuously monitor and switch between them. While standard Auto-Rollovers involve passive rollovers, AgentFi dynamically compares interest rate levels, automatically adjusts positions, and optimizes position allocation based on the user's risk appetite. In more complex Boros strategies, AgentFi can also handle funding rate hedging, cross-market arbitrage, and term arbitrage, further unlocking the potential of professional yield management. 4. Pulse: The First AgentFi Product Based on the Pendle PT Strategy In our previous AgentFi research report, "A New Paradigm for Stablecoin Yields: From AgentFi to XenoFi," we introduced ARMA (https://app.arma.xyz/), a stablecoin yield optimization agent built on Giza's infrastructure. Deployed on the Base Chain, this product automatically switches between lending protocols like AAVE, Morpho, Compound, and Moonwell, maximizing cross-protocol returns and maintaining its position as a top-tier AgentFi provider. In September 2025, the Giza team officially launched Pulse Optimizer (https://app.usepulse.xyz/), the industry's first automated AgentFi optimization system based on the Pendle PT fixed income market. Unlike ARMA, which focuses on stablecoin lending, Pulse specializes in the Pendle fixed income market. Using a deterministic algorithm (non-LLM), it monitors the multi-chain PT market in real time. It dynamically allocates positions using linear programming, taking into account cross-chain costs, maturity management, and liquidity constraints. It also automates rollovers, cross-chain scheduling, and compounding. Its goal is to maximize portfolio APY while managing risk. It abstracts the complex process of "finding/APY/swappable positions/cross-chain/timing" into a one-click fixed income experience. Pulse Core Architecture Components: Data Collection: It captures Pendle multi-chain market data in real time, including active markets, APY, maturity, liquidity, and cross-chain bridge fees. It then models slippage and price shocks to provide precise input to the optimization engine. Wallet Manager: Serves as the asset and logic hub, generating portfolio snapshots, managing cross-chain asset standardization, and implementing risk control (e.g., minimum APY improvement thresholds and historical value comparisons). Optimization Engine: Based on linear programming modeling, it comprehensively considers fund allocation, cross-chain sources, bridge fee curves, slippage, and market expiration to output the optimal allocation plan under risk constraints. Execution Planning: Converts optimization results into a transaction sequence, including liquidating inefficient positions, planning bridge and swap paths, rebuilding new positions, and triggering a full exit mechanism when necessary, forming a complete closed loop. Pulse currently focuses on optimizing ETH-based returns, automating the management of ETH and its liquid staking derivatives (wstETH, weETH, rsETH, uniETH, etc.), and dynamically allocating them across multiple Pendle PT markets. The system uses ETH as the underlying asset and automatically completes cross-chain token conversions to achieve optimal configuration. Currently live on the Arbitrum mainnet, it will be expanded to the Ethereum mainnet, Base, Mantle, Sonic, and others, with multi-chain interoperability achieved through the Stargate bridge. Pulse User Experience: Full Agent Activation and Fund Management: Users can activate the Pulse Agent with a single click on the official website (www.usepulse.xyz). The process includes connecting to a wallet, network authentication, whitelist verification, and a minimum deposit of 0.13 ETH (approximately $500). Once activated, funds are automatically deployed to the optimal PT market and enter a continuous optimization cycle. Users can add funds at any time, and the system will automatically rebalance and reallocate them. There is no minimum deposit requirement for subsequent deposits, and larger deposits can enhance portfolio diversification and optimization.

Data Dashboard and Performance Monitoring Pulse provides a visual data dashboard to track and evaluate investment performance in real time:

Key indicators: total asset balance, cumulative investment, principal and income growth rate, position distribution of different PT tokens and cross-chain positions. Return and Risk Analysis: Supports daily/weekly/monthly/yearly trend tracking, combined with real-time APR monitoring, annual forecasts, and market comparisons to help measure the excess returns driven by automated optimization. Multi-dimensional Analysis: Displays results by PT Token (such as PT-rETH, PT-weETH), Underlying Token (LST/LRT protocols), and cross-chain distribution. Execution Transparency: Complete operation logs are retained, including rebalancing time, operation type, fund size, return impact, and on-chain hashes to ensure verifiability. Optimization Results: Displays rebalancing frequency, APR improvement, diversification level, and market responsiveness. Compare to static holdings or market benchmarks to assess risk-adjusted returns. Exit and Asset Withdrawal: Users can close their Agent at any time, and Pulse will automatically liquidate their PT tokens and convert them back to ETH, charging only a 10% success fee on profits, with a full return of principal. The system will transparently display a detailed breakdown of earnings and fees before exiting, and withdrawals are typically completed within minutes. Users can reactivate at any time after exiting, and their historical earnings records will be fully preserved. VI. Swarm Finance: Active Liquidity Incentive Layer In September 2025, Giza officially launched Swarm Finance, an incentive distribution layer designed specifically for active capital. Its core mission is to directly connect protocol incentives to the intelligent agent network through standardized APR feeds (sAPR), making capital truly "intelligent."

For users: Funds can be optimally allocated across multiple chains and protocols in real time and automatically, without manual monitoring or reinvestment, to capture the highest return opportunities.

For protocols: Swarm Finance solves the pain point of TVL loss due to maturity redemption in projects like Pendle, bringing more stable and sticky liquidity while significantly reducing the governance costs of liquidity management.

For the ecosystem: Capital can complete cross-chain and cross-protocol migration in a shorter time, improving market efficiency, price discovery capabilities, and capital utilization. For Giza itself, a portion of all incentive traffic routed through Swarm Finance will flow back to $GIZA, kickstarting the tokenomics flywheel through a fee capture → buyback mechanism. According to Giza's official data, Pulse achieved an APR of approximately 13% when it launched the ETH PT market on Arbitrum. More importantly, Pulse's automatic rollover mechanism addressed the TVL loss caused by Pendle redemptions at maturity, establishing a more robust capital accumulation and growth curve for Pendle. As the first implementation of the Swarm Finance incentive network, Pulse not only demonstrates the potential of intelligent agency but also officially marks the beginning of a new paradigm for active liquidity in DeFi. VII. Summary and Outlook As the industry's first AgentFi product based on the Pendle PT strategy, Pulse, launched by the Giza team, is undoubtedly a milestone. It abstracts the complex PT fixed income trading process into a one-click intelligent agent experience, fully automating cross-chain configuration, maturity management, and automatic compounding. This significantly reduces the user experience barrier to entry while improving capital utilization and liquidity in the Pendle market. Pulse currently focuses primarily on ETH PT strategies. Looking ahead, with the continuous iteration of products and the joining of more AgentFi teams, we expect to see:

Stablecoin PT strategy products - providing matching solutions for investors with more stable risk appetite;

Intelligent Auto-Rollover - dynamically comparing Pendle fixed rates with floating rates in the lending market, increasing returns while maintaining flexibility;

Panoramic strategy coverage based on market cycles - modularizing Pendle's trading strategies in different bull and bear stages, covering YT, stablecoin pools, and even more advanced gameplay such as short selling and arbitrage;

Boros strategy-based AgentFi products - achieving a smarter Delta-Neutral than Ethena Fixed income and cross-market/maturity arbitrage are driving further professionalization and intelligentization of the DeFi fixed income market. Of course, Pulse faces the same risks as any DeFi product, including protocol and contract security (potential vulnerabilities in Pendle or cross-chain bridges), strategy execution risk (rollover or cross-chain rebalancing failures at maturity), and market risk (interest rate fluctuations, insufficient liquidity, and incentive decay). Furthermore, Pulse's returns rely on ETH and its LST/LRT markets. If the price of ETH drops significantly, even if the amount of ETH tokens increases, losses may still occur in USD terms. Overall, the launch of Pulse not only expands AgentFi's product boundaries but also opens up new possibilities for the automated and scalable application of Pendle strategies across various market cycles, representing a significant step forward in the intelligent development of DeFi fixed income.

The first principle of blockchain is a decentralized accounting method, and "blocks" and "chains" are not necessary.

JinseFinance

JinseFinanceIt can be said that Restaking is like a double-edged sword. While empowering the Ethereum ecosystem, it also brings huge hidden dangers.

JinseFinance

JinseFinanceAs the blockchain and decentralized application space continues to evolve, new token models and value drivers will emerge, requiring multidisciplinary teams to evaluate and navigate this space.

JinseFinance

JinseFinanceWith the help of technologies such as Taproot and BitVM, more complex off-chain contract verification and settlement can be achieved within DLC, while combined with the OP challenge mechanism, minimization of oracle trust can be achieved.

JinseFinance

JinseFinanceMany people were confused after seeing @zkSync’s new zoo science pictures and texts.

JinseFinance

JinseFinanceTherefore, no matter what choice investors make at this stage, they cannot have the best of both worlds and must face the possible consequences.

JinseFinance

JinseFinanceA little-known Bitcoin ETF hits the U.S. market this month, promising impressive annual returns for its investors.

JinseFinance

JinseFinanceOn January 30, 2024, MIM_SPELL suffered a flash loan attack. Due to a precision calculation vulnerability, the project lost $6.5 million.

JinseFinance

JinseFinance Coinlive

Coinlive The proposed environmentally conscious spot ETF was found to be insufficiently protected against fraud and manipulation, like many ETF proposals before it.

Cointelegraph

Cointelegraph