Source: Pantera Capital Blockchain Letter; Compiled by: AIMan@黄金财经

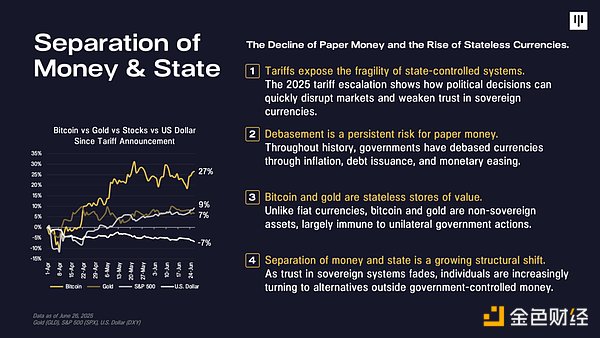

Separation of Money and State

The earliest separation of money and state was gold.

Princes discovered that they could mint their own gold coins. Soon after, they began to devalue their own currencies with inferior metals. The government then realized that paper money was even cheaper than metal. Paper money!!!

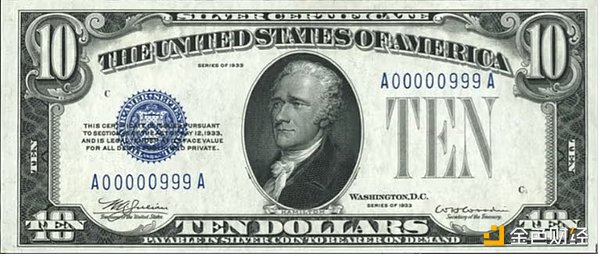

At first it was fully backed by gold and convertible into silver, which in the US it was also convertible into. For example, the old $10 bill was fully convertible into silver (bottom center text).

Then they started printing more paper money than gold and silver. It was so easy!!!

Since two thirds of the Earth's landmass is covered in trees, this couldn't be stopped.

The British pound was apparently backed by one pound of pure silver that was convertible into one pound. Now it takes 315 pounds to exchange for one pound of sterling (silver). 315 state-issued notes to exchange for one pound of old-fashioned currency.

The history of the US penny is a classic example:

For a long time, it weighed 13 grams of copper.

The government was faced with two choices: one hard, one easy. They chose the easy!

They debased the coin with nickel… then tin… then zinc… then each metal became less and less…

Until now, it’s a sad ghost of the past – a piece of it weighing just 2 grams and containing only 2% copper.

The intrinsic value of copper has been devalued by 99.5%.

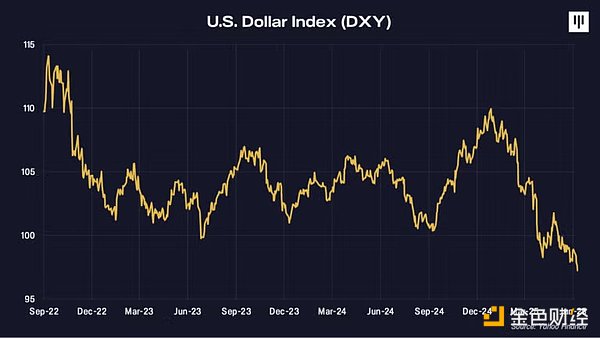

By the way, the latest U.S. Consumer Price Index (CPI) data point is 321.465, according to the Bureau of Labor Statistics (BLS).

1/321.465 – 1 = -99.7% devaluation

This isn’t surprising. What’s really changing is the value of the paper money.

But it’s not enough — the Treasury Department says the penny will be phased out in 2026 because the government is printing so much paper money that it costs 3.69 cents in hard assets to produce each penny.

Here’s the intrinsic value of a penny (in grams) over time: 13.5…10.9…4.7…3.1…2.7…2.5…and now…poof! …it’s gone. Zero.

Today, a penny is little more than a weightless monument to hard currency.

JP Morgan: “Everything Else is Credit”

This exchange is just amazing:

Mr. Untermyer (Committee Counsel): “Is that the basis of bank credit?”

Mr. Morgan: “Not always. That is evidence of banking, but not money itself. Money is gold, and nothing else.”

Mr. Untermyer: “Don’t you know that credit is money?”

Mr. Morgan: “No, credit is not money.”

Mr. Untermyer: “What is money?”

Mr. Morgan: “Gold is money. Everything else is credit.”

left;">– JPMorgan Chase Testimony before the House Banking and Currency Committee, Washington, D.C., December 18-19, 1912

This is wonderful. What can’t be devalued/printed/inflated is money. Everything else is just credit/dross.

The 21st century version of this is:

Gold and Bitcoin/cryptocurrency are money. Everything else is credit.

JP Morgan made another very insightful statement at the end of his testimony, which resonates with today’s crisis of confidence in the markets:

Mr. Untermyer: “In banking, does character matter?”

Mr. Morgan: “It is everything. After all, money is based on reputation and character.”

I know it sounds a little selfish for Bitcoiners to say this, but…

Buy Bitcoin

It is indeed the best place to store wealth when confidence in institutions like the Federal Reserve and the money they print is in crisis.

Everything else is just credit - "propped up" by unsustainable policies.

Alex

Alex

Alex

Alex Brian

Brian Alex

Alex Alex

Alex Kikyo

Kikyo Brian

Brian Alex

Alex Kikyo

Kikyo Brian

Brian Alex

Alex