Author: Paul Veradittakit, Partner at Pantera Capital; Translated by AIMan@Golden Finance

Everyone thought that Bitcoin ETFs would replace Microstrategy as the best way to invest in Bitcoin in the public market. Last January, analysts predicted that "the premium of Microstrategy shares relative to Bitcoin could fall from about 40% to between 15% and 25%."

But that's not the case. Today, Microstrategy has a market value of $104 billion, just $24 billion less than the total market value of all Bitcoin ETFs. Microstrategy trades at a 70% premium to Bitcoin's net value, and it's clear that the public market believes that Microstrategy offers an unparalleled Bitcoin investment opportunity.

Two months ago, Nasdaq-listed Janover was acquired and renamed DeFi Development Corp. The company, whose stock code is DFDV, announced that they are "the first public company focused on Solana (SOL) accumulating compounding interest." A month ago, SharpLink Gaming announced the closing of a $425 million private placement. The company, trading under the ticker SBET, announced that it would “adopt ETH, the native asset of the Ethereum blockchain, as its primary reserve asset.”

In the past two months, two products similar to Microstrategy have entered the public market - DFDV for Solana and Sharplink for Ethereum. As the lead investor in DFDV and Sharplink, Pantera Capital firmly believes that corporate crypto treasury products can bring unique cryptocurrency investment opportunities to the public market. Now, let’s analyze what crypto treasury (DAT) companies are and what Pantera Capital thinks about them.

Digital Asset Treasury (DAT) Explained

In order to explain the type of exposure to cryptocurrencies that DAT shares have, and how their exposure to cryptocurrencies differs from ETFs, we must first understand how Digital Asset Treasury (DAT) works.

The creation of a DAT is fairly simple on paper. The company simply needs to

raise money from investors in the form of debt or equity

and use the funds raised to purchase the vault asset of your choice. In DFDV's case, you can buy Solana

Since the vault assets are part of the company's balance sheet, owning equity in the company gives you exposure to the financial assets; owning DFDV shares gives you exposure to Solana.

The small size of the operating business helps investors focus on the value of the vault rather than the operating business itself. Therefore, Nasdaq-listed companies with little or no non-vault related operations are best suited for this type of strategy, as the majority of their equity value is derived from vault assets.

Diving Deeper into DATs

As of the end of May, Microstrategy traded at 1.7 times the value of its Bitcoin vault holdings, DFDV at 5.6 times, and Sharplink at 8.1 times. If a company’s value depends on its vault, then why would its stock trade at a premium to the value of its inventory? How do we value a DAT?

Metrics That Matter

Pantera focuses on two valuation metrics – Net Asset Premium and Average Asset Growth Per Share.

Net Asset Premium

NAV represents the net asset value of the vault held by the company. For DFDV, NAV is the value of its Solana holdings. The NAV Premium metric indicates how much an investor is willing to pay for shares of a digital asset vault relative to buying its underlying digital asset directly. It is calculated by dividing the stock’s market value by NAV.

Average Underlying Asset Growth Per Share

To understand what these metrics mean, we first need to understand how the Net Asset (NAV) Premium is created. As Pantera wrote in a previous brief, MSTR has a premium because investors believe that through MSTR, they can hold more Bitcoin (BPS) per share over time than if they bought a single BTC directly. Let's do some simple math: If you buy MSTR at two times the NAV (a premium of 2.00 times the NAV), you will buy 0.5 BTC instead of 1.0 BTC through spot. However, if MSTR is able to raise funds and BPS grows 50% per year (it grew 74% last year), then by the end of the second year, you will have 1.1 BTC - more than if you bought spot directly. In the example above, the average growth rate of the underlying asset per share is 50%. The growth of 0.5BPS to 1.1 BPS is the gain you get, which justifies your purchase of MSTR at a price higher than two times the NAV.

Thus, the average growth in the underlying asset per share reflects the growth in the vault of the token value normalized by the number of shares issued.

DAT Valuation

What is the underlying asset?

In order for a DAT to be attractive to investors, the vault asset should have the following qualities:

A well-known asset.

An asset that people want to get their hands on.

An asset that is difficult to access.

Bitcoin, Solana, and Ethereum all meet the first two points. Regarding the third point, cryptocurrencies are difficult to access in the public market, but not impossible. However, for a large number of investors, including equity mutual funds and ETFs, their mandates only allow them to purchase operating companies, not assets directly, which prevents them from purchasing BTC, but they can purchase BTC-DAT.

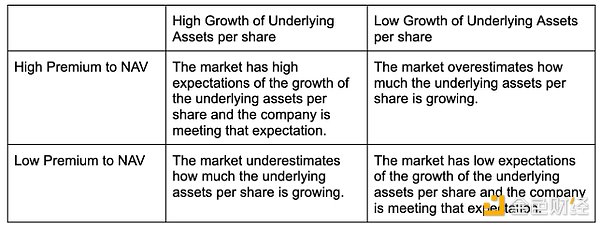

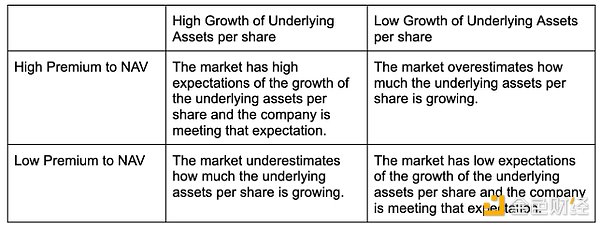

Is the NAV premium and average growth rate of the underlying asset per share justified?

As mentioned in the previous section, people buy DATs at a premium to their treasury net assets in the hope that the company accumulates more tokens so that your stake holds more tokens in the future than if you purchased 1 unit of the underlying token.

We can see that the best choices are those DATs that have a low premium to NAV and a high growth rate of underlying assets per share. But how do we quantify the growth of underlying assets per share? What are some common ways that DATs increase their treasury?

Buy More Crypto

One of the simplest ways to raise more money is to expand the treasury assets. There are many ways to raise money; two common ways include convertible bonds and private equity investments (PIPEs). Private investors can purchase bonds and choose to convert to equity when the share price reaches a certain price, or they can purchase equity.

If a company issues bonds, the number of outstanding shares does not increase, so the amount of underlying assets per share increases. If a company issues equity, the amount of underlying assets per share increases as long as its offering price is above net asset value.

It is worth noting that due to their size, DATs have opportunities that are not available to retail investors. For example, last month, Upexi purchased 77,879 locked SOL at $151.50 per share, totaling $11.8 million. At SOL's current price of $178.26, this represents a built-in return of $2.1 million (17.7%) for investors. Locked tokens are often held by institutional investors who are willing to sell their tokens at a discount to unlock liquidity. DATs like Upexi can take advantage of their demand for liquidity and purchase tokens at a discount.

Validators and Network Participation

Another way for companies to increase their funding is to stake and use their funds to trade. DFDV is a DAT platform that has adopted this strategy - they acquired a staking business and staked 500,000 Solana tokens, generating protocol-native cash flow through self-staking. Since all returns from staking flow back into their funds, staking increases the underlying asset per share.

What are the risks?

What you want to avoid is a situation where the DAT is forced to sell its treasury, thereby reducing the value of the underlying asset per share. There are two main reasons why a DAT is forced to sell treasury: to repay maturing debt or to cover negative operating cash flow.

Therefore, it is important to examine how much of the funds raised is debt and carefully review the debt maturity structure. The operating company must be able to be self-sustaining and not get into a cash burn situation. The ability and reputation of the management team is also critical, as they need to effectively use various capital market tools and effectively market to a wider range of investors.

What’s Unique About DATs

They Don’t Sell

While ETFs are designed to track asset prices and may rebalance or liquidate positions to meet redemptions or regulatory requirements, DATs buy and hold assets like Bitcoin, Solana, or Ethereum as a long-term strategy. For example, MicroStrategy consistently adds Bitcoin to its vaults regardless of market cycles. This belief-based approach contrasts with the more passive management style of ETFs.

Access to Special Opportunities

DATs may also offer special opportunities not typically available to ETFs. DFDV uses its Solana holdings to participate in staking and validator operations, generating yield and supporting network growth. SharpLink’s Ethereum strategy is backed by industry leaders like ConsenSys, opening the door to protocol-level activities like staking and DeFi participation that are not available to ETF investors.

Kikyo

Kikyo