Author: Cosmo Jiang, Partner at Pantera Capital; Translator: AIMan@黄金财经

Pantera has created a fund to provide investors with Digital Asset Treasury (DAT) opportunities.

Pantera has been at the forefront of this emerging industry and firmly believes that it will become a cornerstone investor in the first batch of DAT projects in the United States, including DeFi Development Corp. (DFDV) and Cantor Equity Partners (CEP). Our due diligence process has led to a number of high-performing investments in a short period of time. Pantera's early role and initial success opened up what has now become a larger trend. As a result, we are fortunate to be the first choice for many potential DAT teams, many of which are in the early stages of conception and seek our strategic guidance to avoid potential risks.

We have abundant opportunities for new capital allocation and are open to investors through the Pantera DAT Fund. Over the past few months, we have received over fifty pitches and observed what factors contributed to the success of certain projects and what factors contributed to the failure of certain projects, which further improved our investment due diligence process and enhanced our ability to support target companies. Pantera's investment strategy is based on prudently supporting high-quality entrepreneurs, and we are excited to continue to practice this strategy in emerging areas.

Window of Opportunity

One of the characteristics of the stock market this year has been the enthusiasm of more traditional investors for digital assets - whether through ETFs, IPOs like Circle, or DATs. Coinbase's inclusion in the S&P 500 index has been a major factor in the stock market's rise. Now all fund managers around the world are forced to include digital assets in their indexes and must pay close attention. We believe that this trend is still in its early stages and will continue to be a long-term and persistent positive factor, extending this round of cycles.

DATs are a new area of public market cryptocurrency investment that benefits from this broader long-term positive. DATs allow stock market investors to gain exposure to cryptocurrencies through familiar tools and intermediaries. We believe that the number of digital asset treasury companies will grow significantly and there is still an opportunity to be a pioneer in this space.

That is why we think the time is right to invest in this fund. Few people get to enter a new field at its infancy, so recognizing this and reacting quickly is critical to seizing investment opportunities.

In our May blockchain investor letter, we detailed our investment philosophy, the fundamental reasons for investing in DATs, and why they can continue to trade at a premium to their underlying net asset value (NAV) (see Jinse Finance's previous report "Pantera: Why we are bullish on digital asset treasury companies"). Based on this, we think it is necessary to further explain why the investment strategy of Pantera DAT Fund is so attractive.

Asymmetric Risk/Reward Potential

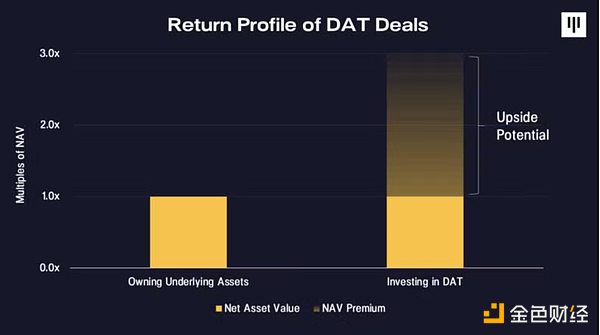

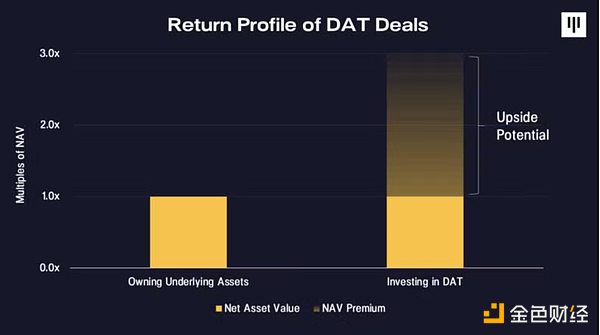

The Pantera DAT Fund has the opportunity to invest in DATs early in their launch. This means we invest at a price equal to or close to the underlying token value (1.0x NAV) or before the DATs trade at a potential premium on the open market. We believe there is an asymmetric risk/reward to doing so, especially in a “heads win, tails not much to lose” scenario relative to holding the underlying token.

Below is a simple visualization of the asymmetric reward profile of DAT trading.

Upside— “Positive Wins”: The short-term upside to a DAT investment is the potential NAV premium (note that DAT peers trade at 1.5x to 10.0x NAV), while the long-term upside comes from the growth in NAV per share and the maintenance of that premium.

Downside Risk – “Not much to lose on the downside”: Downside risk is limited because even if DATs do not trade at a premium, investors investing at approximately 1.0x NAV still receive pro rata returns to the underlying NAV and underlying tokens (e.g. spot BTC, ETH). In addition, we believe that as the space becomes increasingly saturated and DATs begin to trade below 1.0x NAV, opportunities for consolidation exist. An important part of our due diligence process is to screen for management teams that are incentive-aligned so that we can trust that they are not only empire builders, but will make the right choices in downside scenarios – whether M&A or buybacks.

The market is enthusiastic about DATs and they are developing much faster than we expected when we invested in our first DAT. As with any industry, I expect excess returns to attract competition, which will depress returns. This is why this window of opportunity to invest in an emerging category is so timely. DAT price action is and will continue to be volatile, and like any new trend, there will be successes and failures. We firmly believe that with our leading knowledge reserves, value-added strategic guidance, transaction structure and rigorous due diligence process, we will continue to promote the success of DAT.

DAT Market Landscape

On July 2, Tom Lee, Managing Partner and Head of Research at Fundstrat, and Cosmo Jiang, General Partner at Pantera, will take an in-depth look at the rise of DAT. The two guests will explore common concerns surrounding DAT and provide investment cases for this new area of the public market cryptocurrency space.

Pantera is proud to be a cornerstone investor in BitMine Immersion Technologies, where Tom will serve as Chairman and assist with Ethereum Treasury strategy. This is the first of many transactions we expect to be executed by the Pantera DAT Fund. Pantera expects to commit $100 million to the DAT transaction.

JinseFinance

JinseFinance