Author: Stephen McBride, Chief Analyst at RiskHedge.com Translator: Shan Ouba, Golden Finance

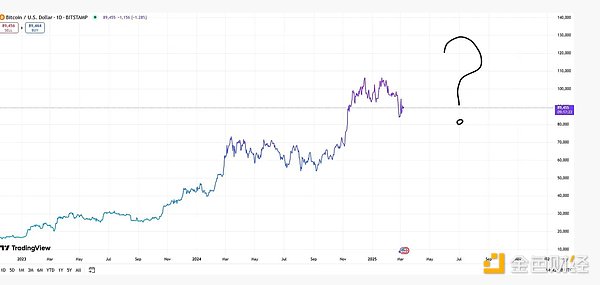

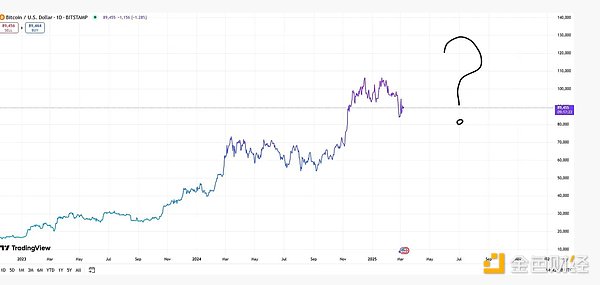

The crypto market is at a turning point. After breaking through $100,000, Bitcoin (BTC) has stalled. Meanwhile, many smaller cryptocurrencies have handed back their post-election gains.

However, for the first time in the crazy history of cryptocurrencies, we are about to get something everyone has been begging for: government support. My research shows that this is the tailwind that will drive the next leg up in crypto prices. It may even break the four-year cycle.

Source: TradingView

Washington’s U-turn has taken crypto from de facto illegal to a national priority

The list of positive regulatory changes we’ve seen in the past month is endless:

Trump signed an executive order laying the groundwork for a pro-crypto regulatory environment. The order ended Operation Choke Point 2.0 and ensured crypto companies’ access to banking services.

The SEC announced a “working group” to develop new rules to clarify the crucial question of which tokens are securities and which are commodities.

The SEC also repealed SAB 121, a vague rule that made it nearly impossible for banks to custody cryptocurrencies for customers.

The “other” main regulator for cryptocurrencies, the Commodity Futures Trading Commission (CFTC), will be led by crypto advocate Brian Quintenz.

Congress is likely to pass a stablecoin bill this year.

Trump’s cryptocurrency czar, David Sacks, said the administration wants to make the U.S. “the crypto capital of the planet.”

A Texas judge overturned sanctions against privacy protocol Tornado Cash, signaling a seismic shift toward more innovation-friendly regulations in the country.

I could spend the next two pages writing about the positive regulatory changes we’ve seen in the past month.

Regulatory clarity is a green light for Wall Street

The world’s largest pools of capital can finally move into crypto.

For example:

Last month, when asked if Bank of America would get into the cryptocurrency business, CEO Brian Moynihan said, “If the rules come out and make it something that you can actually do business in, you’re going to find it very difficult for the banking system to get in.”

Wall Street can finally invest. Entrepreneurs can finally start businesses. As investors, we will take advantage of this massive shift by continuing to hold the best crypto businesses.

Most investors don’t understand how destructive the onslaught of regulation can be. Right now, they’re underestimating how important these changes are to the future of crypto.

The U.S. government, the most powerful entity in the world, is moving from being against crypto to being in favor of it. Investors are blind to this.

For four years, every time we’ve talked about crypto regulation, it’s been bad news. “Oh great, another three-letter agency suing a deal.” Now, it’s the other way around.

Just as sentiment is at multi-year lows, the biggest catalyst in crypto history is about to arrive.

The peak of memecoin is almost over. What’s next is a boom in crypto innovation in the U.S.

The regulatory door is finally open. Wall Street giants will soon be stepping in.

'Flow' is why Bitcoin is still leading this bull run

BlackRock's Bitcoin ETF - the iShares Bitcoin Trust ETF (IBIT) - has taken in $40 billion since its launch a year ago.

Smaller cryptocurrencies don't have these funds behind them. They are running out of money. Most are retail investors buying a few hundred dollars at a time.

The big crypto funds - which used to drive the market - have been unwilling or unable to raise funds in the past few years due to regulatory resistance. This means there are few bidders for small cryptocurrencies, even those with good fundamentals.

That is changing as regulation becomes clearer. I hear there are dozens of funds actively raising funds. They are targeting the end of this quarter, which means we could see a flood of new capital into the market by early summer.

Regulatory clarity could break the four-year cycle

Bitcoin has led this market since crypto prices bottomed in late 2022. At this point in the four-year cycle, flows will start to flow in in smaller tokens. This time, they are still ahead of us. In a normal four-year cycle, we would be ready for a pullback in 2026. The crypto U-turn in Washington has prolonged this cycle. These ETFs have brought tens of billions of dollars of new investor capital into crypto. The changes in Washington, D.C. will bring trillions of dollars.

Our research shows that we are in this cycle earlier than the calendar suggests. By 2025, Bitcoin could be as high as $250,000.

Most investors are still looking back, traumatized by years of regulatory mismanagement. They fail to see what is before us: America is about to become the world’s center of crypto innovation.

YouQuan

YouQuan