By Sunny Shi, Analyst at Messari Enterprise Research

Over the weekend, fears of a massive withdrawal of $1 trillion in yen carry trades caused Bitcoin to briefly fall below $50,000 for the first time since February. On Thursday, less than a week after the crisis, Bitcoin was back above $60,000.

Despite being a cornerstone asset for cryptocurrencies, BTC remains far more volatile than equity indices. We can attribute Bitcoin’s high beta reflexivity to:

The leverage penetration of cryptocurrencies is too high due to futures trading.During the break below $50,000, crypto traders saw over $1 billion in liquidations. Nearly $100 million in BTC shorts were liquidated on Thursday as it rallied to $62,000.

Bitcoin lacks cash flow.Long-term equity managers often trade on a P/E or free cash flow basis, which gives them the comfort of “buying the dip.” Fundamental investors have no reason to sell if macro-driven flows don’t impact their company’s earnings potential. In contrast, Bitcoin’s valuation has no basis.

Cryptocurrencies have a weak institutional foundation.On August 5, retail investors were primarily net sellers of stocks, while institutions were buyers. Typically, institutional holders with vested capital are less likely to sell for risk and panic. In more mature markets, the diversification of investor time horizons helps stability.

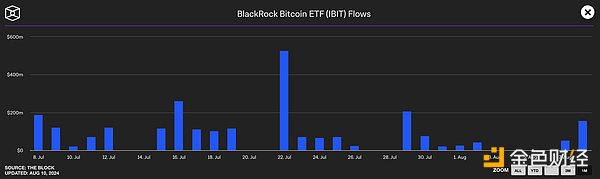

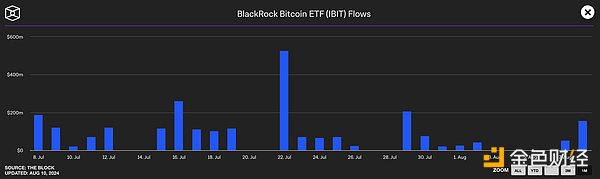

Things may be starting to change for Bitcoin. It is worth noting that BlackRock's Bitcoin ETF IBIT has only seen one day of outflows.

Last week, BlackRock contributed more than $200 million in net inflows to Bitcoin ETFs.This does not mean that BlackRock will never start selling, but now, the asset management company chooses to accumulate Bitcoin.

These developments are largely supportive of the crypto asset class, and continued growth in Bitcoin ETF holdings may be just what we need to escape the never-ending cycle of violent booms and busts. The "baby boomers" may finally save us.

JinseFinance

JinseFinance