Author: Jason Jiang, OKG Research Source: medium

In February 2025, Ondo Chain disturbed the tranquility of Wall Street. This L1 blockchain designed for institutional RWA, jointly participated by traditional asset management giants such as BlackRock and Franklin Templeton, has a naked ambition: to create a hybrid architecture that is "both compliant and open", so that trillions of assets of traditional institutions can be safely "on-chain" while enjoying the liquidity dividends of mainstream public chains such as Ethereum.

Ondo Chain is like a mirror, reflecting the collective anxiety of traditional financial giants when they poured into Web3-how to seize the new world on the chain under the regulatory environment? Some people built high walls, some people pioneered wildly, and some people tried to build bridges and pave roads in the cracks. When traditional financial giants entered the market one after another, the differentiation of technical paths was not only a battle of codes, but also a game about the future financial discourse power.

1. How do the rules of the game change when Wall Street goes “on-chain”?

In the 19th century, most of the early financial transactions on Wall Street relied on manual processes and face-to-face transactions. Intermediaries such as brokers and banks were crucial to facilitating transactions. The emergence of electronic trading platforms and the Internet in the 20th century made access to financial information more democratic, reduced barriers for retail investors and reduced transaction costs. The prosperity of financial technology has greatly improved the front-end user experience for investors.

These advances are gratifying, but the fundamentals of the traditional financial market have not changed: centralized systems still dominate, data is still isolated in proprietary databases, and transaction processes also rely on intermediaries for coordination and settlement. Blockchain and tokenization technologies are now trying to change these: by making assets more accessible, more transparent and more interoperable, blockchain and tokenization release the potential for real-time settlement, cost reduction and global accessibility while retaining the integrity and trust that traditional systems have long provided, which may change the way traditional financial markets operate.

However, when the Web3 technology wave swept the world, the choices of traditional financial institutions were not converging, but showed a clear trend of differentiation. Behind the different technology choices is the game between compliance needs and liquidity needs-is it to prioritize security and control, or to pursue open circulation in the global market?

When Wall Street first embraced Web3, permissioned chains were the choice of more financial institutions. When JPMorgan Chase announced in 2024 that it would increase the settlement scale of its Onyx to US$300 billion per year, many people realized that this century-old investment bank that once publicly questioned cryptocurrencies had already quietly reconstructed its moat with blockchain. The Onyx chain is like a carefully designed "digital fortress"-the nodes are controlled by a few institutions, the counterparty information can be hidden, and each cross-border payment is labeled with a compliance label.

Execution architecture for exploring tokenized asset management with Onyx

But the cost of this closed ecosystem is obvious. An anonymous banker involved in the JPM Coin project admitted: "Our on-chain U.S. Treasury tokens can only circulate between partner institutions, and liquidity is like antiques locked in a glass cabinet." Bank of New York Mellon's on-chain custody service is also trapped within high walls. Although the tokenized assets it manages have exceeded tens of billions of dollars, it has never been able to communicate with the DeFi protocol on Ethereum. The inertial logic of traditional finance is clearly revealed here: using control to resist risks, but also killing openness.

So, when the concept of tokenization swept the world and the battle for on-chain liquidity kicked off, asset management giants such as BlackRock and Goldman Sachs began to make more radical choices: more and more tokenization practices turned to public chains, and Ethereum became the first choice for institutional tokenization. BlackRock took the lead and launched the tokenized fund BUIDL on Ethereum: it can not only perform automatic liquidation through smart contracts, but also perform pledges, loans and secondary transactions on the chain. This marks the first in-depth combination of traditional finance and Web3 finance, and also makes the public chain path a new focus of institutional attention.

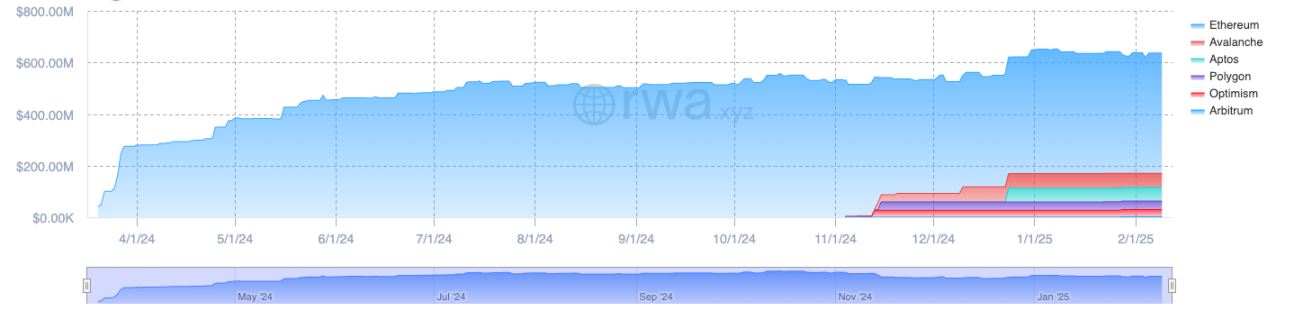

BUIDL tokenized fund management scale exceeds 636 million US dollars

But this does not mean that Ethereum and other public chains can fully undertake the needs of tokenization and other institutional-level Web3 innovations. Although Ethereum is currently the most secure public chain ecosystem after the Bitcoin network, there may be a huge deviation between the security required by institutions and the security we understand. Just like no matter how the market advocates the security of public clouds, many institutions still hope to deploy clouds locally when they have sufficient budgets: technical security does not mean business and asset security.

Therefore, many institutions with sufficient technical reserves or business needs are exploring more possibilities based on the previous route, just like Ondo Finance is trying to break the barriers between public chains and permissioned chains, and explore hybrid architectures that are more in line with regulatory and market needs. Ondo Chain's hybrid architecture focuses on both the openness of public chains and the compliance of permissioned chains. Among them, the licensed validator network is composed of large institutions such as Franklin Templeton and Wellington Management as nodes to ensure compliance and security, but at the same time open cross-chain interoperability, allowing assets to circulate between mainstream public chains such as Ethereum and Solana. Compared with direct deployment on public chains such as Ethereum, the emergence of Ondo Chain allows Ondo to have higher security control permissions in RWA practice, while solving liquidity problems through cross-chain intercommunication.

However, it is still unknown whether the hybrid architecture can really help Ondo find the best balance between efficiency improvement and compliance. In comparison, L2 may be the "preferable" way to attract institutions to join the game at this stage.

2. L2 to Web3 may be like DeepSeek to AI

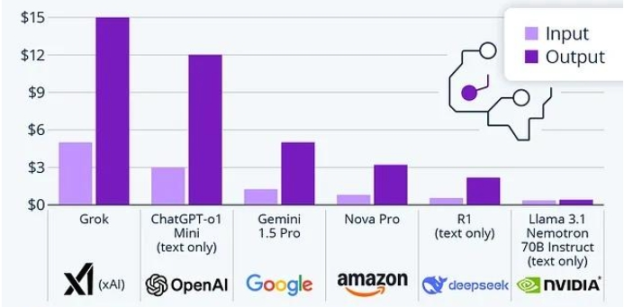

The popularization of any new technology is accompanied by a significant reduction in the cost of use. The reason why DeepSeek can attract global attention in 2025 is that it subverts the market's perception of the cost of AI and makes people realize that high-performance AI does not necessarily rely on expensive computing resources. Taking DeepSeek R1 as an example, the model reduces the price per million tokens from $60 of ChatGPT o1 to $2.19. This nearly 30-fold price difference is changing the trend of AI applications, allowing more companies to conduct AI experiments and innovations more freely without having to worry too much about budget issues.

DeepSeek-R1's significant cost advantage,Source: DoccBot

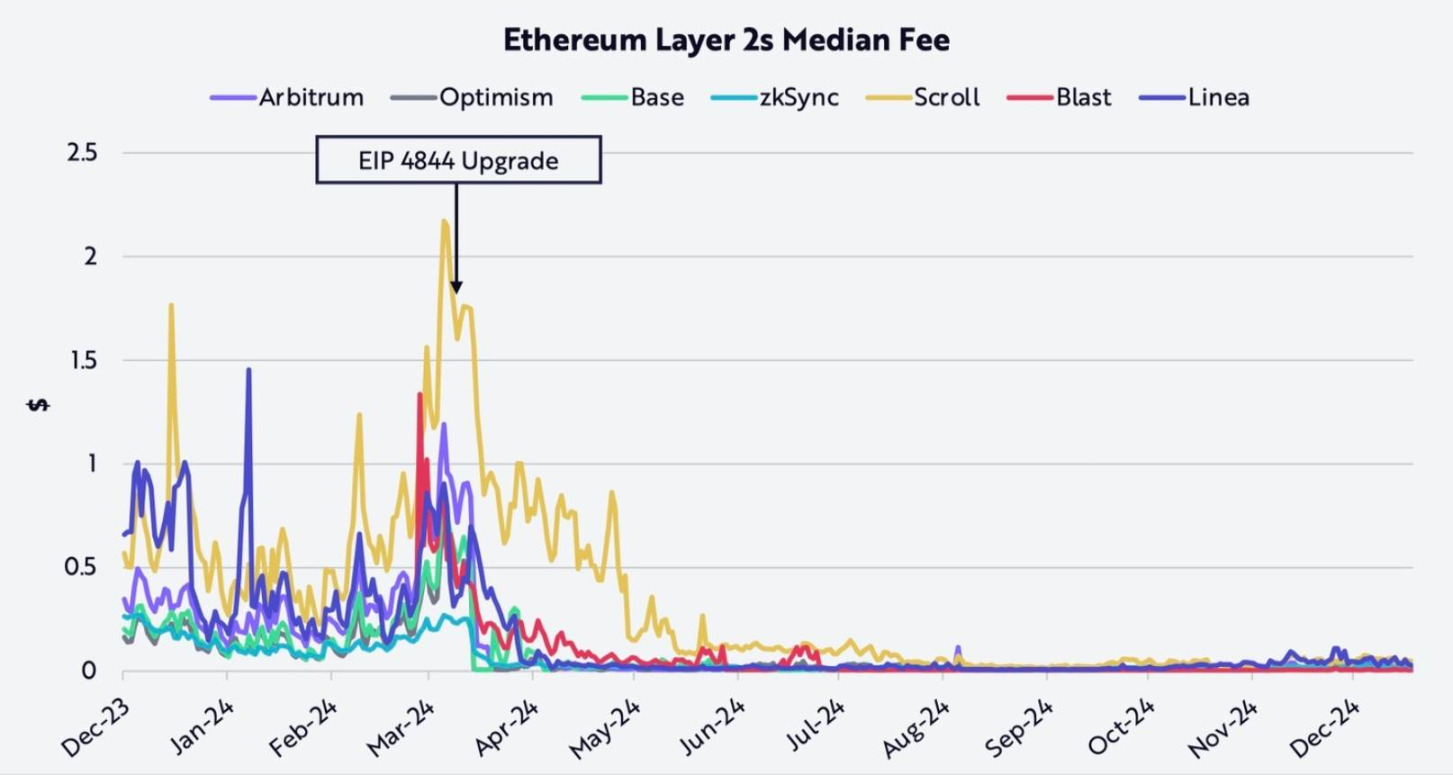

L2 is to Web3 what DeepSeek is to AI. Although not as direct as the short-term impact of DeepSeek, after the Cancun upgrade, L2 has actually reduced on-chain costs: many L2 networks, including OP Mainnet, Base, Arbitrum, Starknet, etc., have seen average costs drop by more than 97% in the past six months. The reduction in transaction costs directly improves the user experience, allowing more users to use L2 more frequently. According to OKG Research, more than 90% of Ethereum-related transaction activities currently occur in the L2 network.

Ethereum EIP-4844 upgrade significantly reduces Layer2 transaction costs, Source: ARK Investment Management LLC

Lower costs also lower the threshold for blockchain technology, allowing more on-chain applications and services to accelerate migration to the L2 network. Payment institutions such as Visa and Stripe are launching a "payment blitzkrieg" through L2: relying on the high-throughput networks of Polygon and Arbitrum, Visa's stablecoin payment channel reduces the cost of cross-border transactions to 1/10 of traditional solutions, with an average daily processing volume of more than 500,000 transactions; Stripe uses L2 to build encrypted deposit and withdrawal channels, so that users can't even perceive the existence of the underlying public chain. "We don't care whether the chain is decentralized, we only care about whether 1 million merchants can seamlessly accept cryptocurrencies." Stripe's Web3 director once said so bluntly.

This may also reveal the most realistic calculations of traditional institutions: when the security risks of the public chain still exist and the open barriers of the alliance chain are difficult to break, Layer2 becomes a seemingly compromise but the most cost-effective option - it can obtain the efficiency and technical dividends of the blockchain network at a lower cost, but it will not be out of control. With the initial success of modular rollup infrastructure, platforms such as OP Stack have significantly lowered the technical threshold for deploying L2. One-click chain issuance has gradually become a reality, and there is no need to guide the establishment of a new consensus network. It can operate healthily without relying on financial incentives from the token system, and has significant advantages over public chains in terms of compliance.

Many traditional institutions are deploying Web3 through L2. The L2 chain Base launched by Coinbase has become the "hottest chicken" in the current Web3 field due to its outstanding performance in the Meme and AI Agent boom. In the future, it may also become an important hub for the issuance of tokenized assets with the traffic brought by the tokenization of Coinbase stocks; traditional technology and financial institutions such as Sony and Deutsche Bank are also accelerating the layout of L2 in order to occupy a place in the future wave of tokenized innovation. For these institutions, if they want to choose the Ethereum ecosystem as the issuance market for RWA assets, it may be wiser to issue an L2 that they can control.

When the cost of innovation is greatly reduced and the application of technology becomes simple and efficient, we may see more institutions and users participating in Web3 innovation through L2.

Conclusion

Today's Wall Street "on-chain" competition is no longer a simple competition of technical advantages and disadvantages. JPMorgan Chase's private chain, BlackRock's public chain ETF, Visa's L2 payment exploration, and even Ondo Chain's hybrid experiment - each technical route is trying to define the power distribution rules of future finance.

But history is always full of irony: while traditional institutions are busy replicating the order of the old world on the chain, DeFi protocols have quietly devoured their territory. The average daily trading volume of Tesla stock tokens on Uniswap has exceeded 100 million US dollars, and Aave's RWA lending pool is attracting more and more "illegal" deposits from institutions... Perhaps it won't be long before this dark battle over technical routes will evolve into a more naked conflict: Whose chain is defining whose Wall Street?

Hui Xin

Hui Xin

Hui Xin

Hui Xin Kikyo

Kikyo Joy

Joy Alex

Alex Davin

Davin Catherine

Catherine Hui Xin

Hui Xin Brian

Brian Clement

Clement Hui Xin

Hui Xin