Author: Xiao Sa lawyer

Since March, the crypto asset industry has been full of big news, but only a few people have noticed that our neighboring country, Vietnam, is carrying out a cryptocurrency reform that is not loud but may have far-reaching impact -from a "one-size-fits-all" ban to gradual relaxation and compliance supervision.

In early March this year, according to the requirements of Vietnamese Prime Minister Pham Minh Chinh, all ministries must propose a cryptocurrency legal regulatory framework within March. Nguyen Duc Chi, Deputy Minister of Finance of Vietnam, said that the Ministry of Finance will report to the government on the legal framework for digital currency within March, including allowing the pilot operation of digital currency trading platforms. At the same time, the Ministry of Finance of Vietnam and the State Bank of Vietnam are also stepping up research on the legal framework for the management of digital assets and digital currencies.

This reform may become a "test service" for future legislation in our country.

Today, the SA Jie team will start from the historical evolution of Vietnam's crypto assets and combine it with Vietnam's financial regulatory system to talk to you.Is it possible for it to develop into a "Poxian" alternative for people in the currency circle in the future, or even an optimal choice for going overseas?

01 From prohibition to liberalization, how is Vietnam's crypto assets managed?

As a typical developing Southeast Asian country, Vietnam has a population structure dominated by young people and abundant labor force. About 35% of the population is under 20 years old, and there are many newborns. It has long been regarded as a cost "value depression" by various overseas companies. At the same time, Vietnam has also benefited from the dividends of industrial transfer. In recent years, it has maintained a high economic growth and a relatively stable political situation, making it one of the preferred overseas investment destinations for Chinese companies.

As we all know, the younger the population structure of a country, the greater the cryptocurrency holding rate and trading volume. Coupled with Vietnam's strict foreign exchange control system and the continued depreciation of the Vietnamese dong, Vietnam's crypto asset penetration rate in recent years is actually much higher than we imagined. However, due to the country's insufficient technological innovation capabilities and backward Internet technology development, it is often a "little transparent" role in the currency circle and has little say. But there is no doubt that Vietnam is becoming an increasingly large and vibrant market in the crypto world.

(I) Strict regulation of crypto assets in Vietnam

Vietnam has always adopted a strict regulatory system similar to that of my country for crypto assets. It neither recognizes that crypto assets can be circulated in the market as a general equivalent nor recognizes their property attributes, but in judicial practice, it recognizes that they can be used as a criminal object in the sense of criminal law.

Vietnam's legislation is a civil and commercial separation type. That is to say, Vietnam is different from my country. It has both a "Civil Code" and a "Commercial Code", but neither of them has clear provisions for crypto assets, a special asset.

First, according to the existing Vietnamese legal provisions, crypto assets do not belong to the "valuable objects, money, documents and property rights" stipulated in Article 105 of its "Civil Code" and are not a kind of property in the legal sense. Secondly, crypto assets do not belong to the "services" stipulated in Article 9 of Vietnam's Commercial Law.

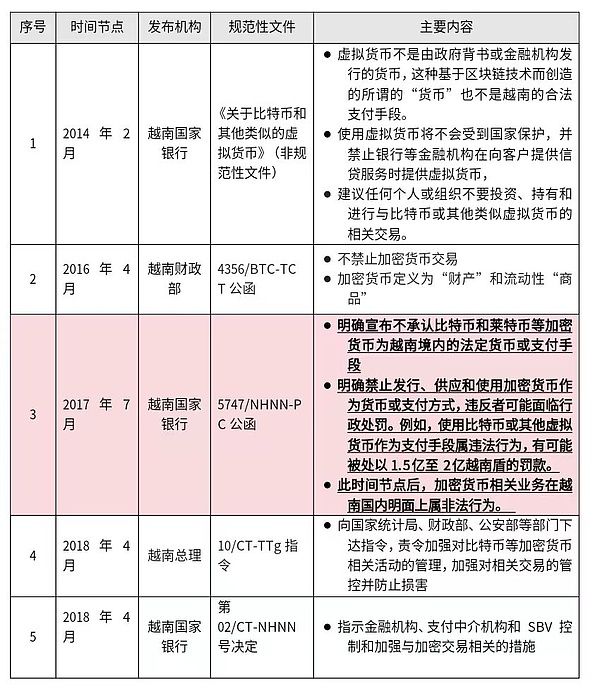

Vietnam has always maintained a high-pressure state in the actual regulatory measures for crypto assets, and some of the time nodes and practices are quite similar to those of my country. Specifically, it is as follows:

It can be seen that after my country issued the "9.4 Announcement" in 2017 to clearly include ICO behavior as a criminal act,Vietnam also banned crypto assets across the board at the same time node and stipulated a high fine. However, it can be seen from practice that the implementation of relevant administrative orders in Vietnam may not be good. According to Triple-A's public data, Vietnam has more than 17 million crypto asset holders, ranking 7th in the world. Based on Vietnam's population, its national crypto asset holding rate is about 17%, which is twice the global average.

(II) Vietnam has made it clear: embrace crypto assets

Perhaps it is due to the recent hot bull market in crypto assets, perhaps it is because Vietnamese regulators have found that crypto asset business can also help its economic development, or perhaps it is a compromise with the reality - blocking is worse than unblocking... Vietnamese Prime Minister Pham Minh Chinh made a clear requirement that all ministries must propose a legal regulatory framework for cryptocurrencies within March. The Vietnamese Ministry of Finance immediately released a rumor: to build a sandbox space to allow the pilot operation of digital currency trading platforms. This move is actually similar to the move made by Hong Kong two years ago to issue the "Web3 Declaration".

Although the Vietnamese government has not yet given specific regulations on the legal supervision of cryptocurrencies, we can judge from its recent regulatory cooperation trends that Vietnam is likely to adopt a regulatory framework similar to that of Singapore. On March 12, the Vietnam Securities Commission and the Monetary Authority of Singapore (MAS) reached a consensus on cooperation and signed a letter of intent (LOI). Both parties agreed to carry out capacity building cooperation in building and improving Vietnam's digital asset regulatory framework.

Therefore,

Sister Sa's team predicts that if Vietnam can successfully pass relevant legislation today, it will soon open the application for "box entry" of encrypted asset trading platforms. Partners can pay attention to relevant information. 02 For people in the Chinese currency circle, is Vietnam a "po county" substitute?

First of all, the conclusion:Sister Sa's team believes that investing in crypto asset platforms in Vietnam at this stage is a coexistence of risks and opportunities.

Opportunities.First, Chinese currency circle people investing in cryptocurrencies in Vietnam can effectively combine domestic technological advantages with Vietnamese market advantages. If related businesses can be carried out smoothly, the platform transaction volume will be guaranteed. Secondly, my country's investment channels in Vietnam are relatively mature and unobstructed. In addition to professional agents, most domestic law firms can provide full-process accompanying landing services. Thirdly, Vietnam has given a large number of tax incentives and customs incentives to overseas investors to encourage overseas investment.

In addition, holding a compliant crypto asset exchange license can also participate in the asset disposal business involved in the case that my country and other countries will carry out in the future, which is also attractive to crypto asset exchanges.

Risk aspect. Vietnam has always been a country with strict foreign exchange controls, but at the same time it is a financial regulatory "lowland" where money laundering is rampant and various funds are mixed. Since the Global Anti-Money Laundering and Counter-Terrorist Financing Financial Action Task Force (FATF) added Vietnam to the "grey list" on June 23, 2023, the country has maintained a stable performance and has not been "cancelled" to this day, and will continue to be on the list in 2025.

This means that the financial activities of companies registered in Vietnam and Vietnamese users will be subject to very strict scrutiny, and most banks and financial institutions in the world need to perform enhanced customer due diligence on funds entering and leaving Vietnamese crypto asset trading platforms. As a result, Vietnamese crypto asset exchanges may encounter various difficulties in providing users with cross-border crypto asset services, especially virtual currency and legal currency exchange services, and the platform's compliance costs may increase significantly.

03 Written at the end

In general, if Vietnam wants to become a "Po County" alternative, it still has a long way to go. In the short term, Vietnam's insufficient infrastructure construction and backward Internet technology development are unfavorable factors for the crypto industry. It is not easy to join Vietnam's regulatory sandbox to open a crypto asset exchange. As we all know, there are certain invisible barriers to developing emerging businesses in Southeast Asian countries. Without good government relations, it is difficult to reap the first wave of dividends.

The above is today's sharing, thank you readers!

Alex

Alex

Alex

Alex Joy

Joy Brian

Brian Kikyo

Kikyo Joy

Joy Alex

Alex Joy

Joy Joy

Joy Brian

Brian Kikyo

Kikyo