Author: Revc, Golden Finance

Foreword

As a bellwether in the crypto space, the a16z accelerator has been leading the industry's innovation. This fall, a16z selected 21 of the most innovative projects from many startups around the world, covering a variety of fields such as artificial intelligence and decentralized finance. This article will analyze representative projects and reveal the future development trends of the crypto market.

Project Overview

Anera Labs——Building a liquidity infrastructure that unifies all on-chain liquidity

Anera Labs is a liquidity infrastructure built for user intent, introducing a new concept in decentralized systems. Instead of specifying specific operations, users express the results they want through signature conditions. This allows specialized solvers to determine the most effective way to achieve intent, separating "what" from "how."

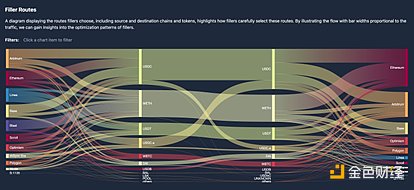

Anera Labs uses two auction mechanisms to activate liquidity: First Come First Served (FCFS) and Request for Quote (RFQ). FCFS prioritizes speed and will accept the first qualified bid regardless of price. RFQ, on the other hand, allows competition among fillers, potentially resulting in better prices, but takes more time.

Fillers play a vital role in these protocols, acting as intermediaries between users and the network. Their competition drives better execution quality and lower user fees. However, the potential for censorship by protocols and fillers remains a concern in decentralized systems. Protocol censorship occurs when off-chain components are involved in the execution process, introducing centralization and potentially compromising the fairness of the system. Filler censorship occurs when fillers selectively refuse to service certain orders, limiting user choice and potentially leaving them financially stranded.

Blocksense -Enables the creation of oracles that can leverage internet data andCPU/GPUcomputing

BlockSense is an oracle network designed to overcome the limitations of traditional data feeds on the blockchain. By leveraging zero-knowledge proofs and a decentralized network of nodes, oracles are made more efficient, secure, and transparent.

BlockSense’s Merkle-tree-based extensions enable cost-effective data publishing and access. Flexible fees and potential chain subsidies promote the DeFi ecosystem. Anyone can create a data feed, become a data provider, and access the entire world of data. Encryption mechanisms also ensure data integrity and minimize trust requirements. Guaranteed data availability and censorship prevention.

Cork Protocol——Risk Pricing Protocol for Accelerating On-Chain Credit

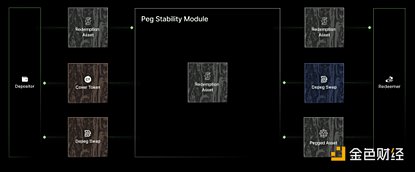

Cork is a protocol designed to simplify the creation and trading of pegged asset collateralized swaps. Similar to credit default swaps, Cork's depegged swaps allow users to hedge against volatility in various markets in DeFi.

Cork users deposit Redeemable Assets (RA) into the Cork Pegged Stability Module (PSM). The PSM creates Depegged Swaps (DS) and Collateral Tokens (CT) for specific Pegged Assets (PA). DS holders can redeem their PA for RA during a depegging event. DS and CT are traded on AMMs, setting prices and returns for buyers and underwriters. At the same time, the liquidity vault provides passive income for liquidity providers.

Cork's PSM ensures that users can redeem their original principal even in the event of decoupling. And provide cheaper pricing and rewards for liquidity providers. Users can buy, sell and hedge their positions freely. Cork provides a solution for managing risks and maximizing returns in the DeFi ecosystem.

Kuzco - LLM Inference Market

Kuzco is a decentralized GPU cluster based on the Solana blockchain, designed to provide efficient and economical inference services for large language models such as Llama3, Mistral, Phi3 by utilizing idle GPU resources contributed by network participants. Users can easily access these models through an API compatible with OpenAI. Kuzco's distributed architecture enables it to fully utilize the computing power of the network to achieve inference of large-scale models. At the same time, users are encouraged to contribute idle resources through a reward mechanism.

OpenGradient——Building a blockchain designed to bring world computing to the chain

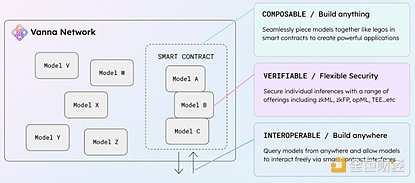

OpenGradient is building an EVM-compatible blockchain network that aims to become a scalable and secure execution layer for AI.

Because the OpenGradient Network provides access to inference AI models directly through pre-compilation in smart contracts, it is able to maximize the composability of smart contracts. Simply stringing inference calls to different models in smart contracts can create powerful use cases.

As for interoperability, sinceOpenGradientisanEVMcompatiblenetwork,smartcontractsonOpenGradientareabletointeractwithcontractsonotherchainsthroughcross-chain queriesandcross-chain callsfacilitatedbymajorityofthemainchains.TheOpenGradientteamisalsoplanningforpersonalAI(Data+Agents)

ThePINAIplatformisneeringonthepersonalAI(Data+Agents)

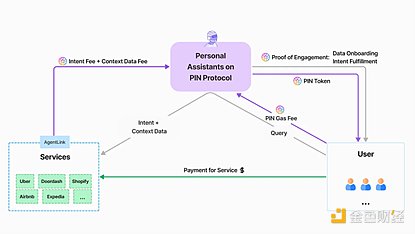

ThePINAIplatformisdesignedtorevolutionizethepersonalAIspacebycombiningcryptoeconomicsecurity

The PIN protocol consists of three key components: a data connector and on-chain registry, a private storage and compute layer, and an agent link and intent marketplace. These components work together to ensure privacy, data ownership, and efficient matching of user intent with AI agents. PIN AI’s architecture is designed to balance privacy, performance, and personalization through its hybrid model and personal indexing. By combining on-device processing with cloud-based computing and leveraging a structured knowledge graph, PIN AI delivers contextually relevant, personalized responses while maintaining user privacy.

The PIN economy is driven by a two-sided marketplace where users and their personal AIs can access services from external AIs. Data connectors and proxy services play a vital role in facilitating this exchange and are incentivized through the PoE (proof-of-engagement protocol).

Term Labs - A DeFi Lending Platform Matching Borrowers and Lenders at Fixed Rates

Term Finance Protocol is a transparent and scalable non-custodial fixed-rate liquidity protocol for digital assets.

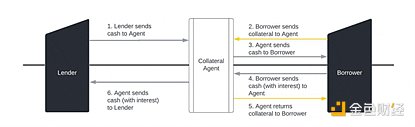

Supports on-chain non-custodial fixed-rate mortgages (Term Repos), which are modeled similar to the tri-party repo arrangements commonly seen in TradFi.

Borrowers and lenders are matched through a unique periodic auction process (Term Auctions), where borrowers submit sealed bids and lenders submit sealed offers, which are used to determine the interest rate that clears the market for the participants of that auction. Participants who bid above the clearing rate will receive a loan, and participants willing to lend below the clearing rate will provide a loan, with the interest rate in each case being the market clearing rate. All other participants' bids and offers are referred to as "pending".

At the end of the auction, borrowers receive loan proceeds and lenders receive ERC-20 tokens (Term Repo tokens), which lenders will redeem for principal and interest at maturity. The protocol smart contract services these transactions by recording repayments and monitoring collateral health and liquidation.

Term supports the deployment of periodic repo. A term repo is a specific on-chain implementation of a fixed-rate collateralized loan modeled after a tri-party repo in the TradFi environment. The main features of a term repo include:

Fixed term, fixed rate: A term repo involves a fixed-term, fixed-rate loan, rather than an open-ended floating-rate loan common in DeFi. The borrower must repay the loan on the maturity date or repurchase date, and must repay within the repurchase window.

Irredeemable: A term repo agreement is non-redeemable, meaning that the lender cannot redeem it before the maturity or repurchase date, and the borrower cannot repay it.

Collateralization: A term repo is designed to meet short-term liquidity management needs and is conducted in an over-collateralized manner backed by liquid digital assets (e.g. wBTC, wETH, USDC, USDT).

Non-custodial: The collateral of a repo is not held in custody, but is locked in a decentralized smart contract, which can be verified in real time by both borrowers and lenders. At the same time, collateral re-pledge is not allowed, and can only be accessed by users using private keys and strictly abiding by the terms of the smart contract arrangement. Each repo has a separate repo "locker" associated with it.

Auction mechanism: The interest rate of a repo is determined by an auction mechanism, the so-called "periodic auction". Each repo has its own "periodic auction".

Summary

Through the a16z accelerator project, we can clearly see two major trends, namely infrastructure innovation and the deep integration of AI and blockchain. The crypto industry is expanding from simple digital currency transactions to a wider range of applications.

With the continuous advancement of technology and the improvement of supervision, cryptocurrency will gradually be integrated into our daily lives, bringing more innovation and change to society.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Dante

Dante XingChi

XingChi Joy

Joy JinseFinance

JinseFinance JinseFinance

JinseFinance Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph