Author: Dong Jing, Source: Wall Street News

A recent research report from Deutsche Bank shows that the market's expectations for the Fed's next year have changed significantly, and it is expected that the new chairman may promote continued easing.

On June 26, according to the news from the Chasing Wind Trading Desk, Deutsche Bank said in its latest research report that the financial market's expectations for the Fed's policy next year have changed significantly, especially the expectation of interest rate cuts after the new Fed chairman takes office is extremely aggressive.

The term of the current Fed chairman will expire in May next year, but Trump is considering announcing the next Fed chairman as early as this summer, much earlier than the traditional 3-4 month transition period. People familiar with the matter revealed that Trump hopes to let the "shadow chairman" start to influence market expectations and monetary policy trends before Powell's term ends by announcing his successor in advance.

The report also said that since the dovish speeches of Fed Governor Waller and other officials last week, the market has priced in an additional rate cut of about 10 basis points before the end of the year.

Statistical model reveals abnormal pricing next year: "New Chairman Premium" phenomenon emerges

Deutsche Bank said that the really striking changes occurred in the expectation of interest rate cuts in the middle of next year.

The market seems to be increasingly expecting that monetary policy will continue to be loose once the new Fed chairman takes office, the report said. The term of the current chairman Powell will expire in May next year, and this time node has become the focus of market attention.

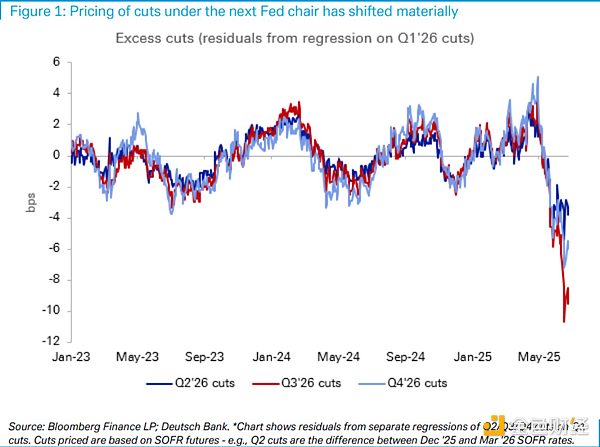

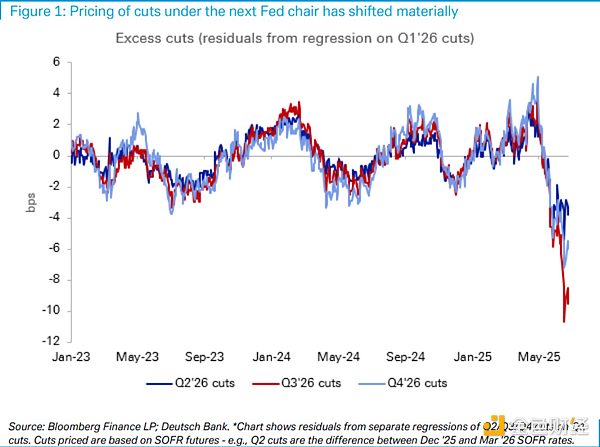

Deutsche Bank found a striking phenomenon through the regression model: the pricing of interest rate cuts in the second, third and fourth quarters of next year was regressed on the first quarter, and the "abnormality" of forward interest rate cut expectations relative to the first quarter was measured through residual analysis.

Deutsche Bank found that these residuals have turned significantly negative in the past month, especially in the third quarter of 2026, when the new chairman took office. This suggests that the market is pricing in an abnormal degree of loose policy during the new chairman's term, and this pricing pattern deviates from the historical norm in recent years.

Note: Residuals refer to the difference between actual observations and estimated values (fitted values). "Residuals" contain important information about the basic assumptions of the model. If the regression model is correct, the residuals can be regarded as the observed value of the error.

However, the report also pointed out that it is cautious about this "new chairman premium". Because the formulation of monetary policy requires the support of the majority of the FOMC, the new Fed chairman needs to convince his colleagues to support a different policy trajectory. This institutional constraint means that the policy pricing discontinuity around the new chairman should be slight.

It is worth noting that even with the above differences, the market's expectations for interest rate cuts in the second, third and fourth quarters of 2026 are still less than in the first quarter, indicating that the market is not expecting a sharp policy shift, but believes that the loose policy under the new chairman will last longer.

Recent market pricing changes: dovish remarks drive expectations of interest rate cuts

The previous article pointed out that on Monday (June 23), Federal Reserve Governor Bowman said when talking about the economy and monetary policy that if inflation pressures remain under control, he would support a rate cut as early as July.

Bauman's reasoning is that risks to the labor market may rise, while inflation appears to be steadily moving toward the Fed's 2% target. Last Friday, Fed Governor Waller said in an interview with CNBC that he might support a rate cut next month because of concerns that the labor market is too weak.

Deutsche Bank pointed out in a report that since last Thursday, the market has priced in about 10 basis points of additional Fed rate cuts before the end of the year, mainly due to the dovish remarks of Fed Governors Waller and Bowman. This change reflects investors' immediate reaction to the softening of the Fed's policy stance.

According to the latest data from FedWatch, the market is betting that the probability of the Fed cutting interest rates in July is 20.7%, which is higher than a week ago (12.5%). Traders have now fully factored in the expectation of a rate cut at the September meeting.

Miyuki

Miyuki