Written by AJC, Messari Compiled by Luke, Mars Finance

Main Points

BNB Chain launched several new incentive programs and initiatives, including Gas-Free Carnival for stablecoin transfers, Gas Grants Program, and the fourth phase of the TVL Incentive Program.

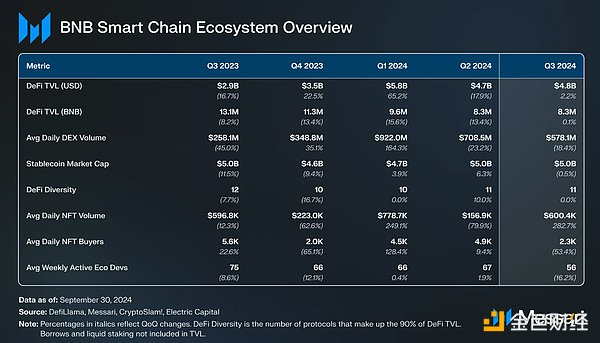

DeFi TVL on BNB Smart Chain rose slightly to $4.85 billion, maintaining its ranking as the fourth highest chain by TVL. Venus Finance and Avalon Finance achieved the largest growth, with Venus' TVL increasing by 13% month-on-month and Avalon increasing by more than 300% after joining the BNB Incubation Alliance.

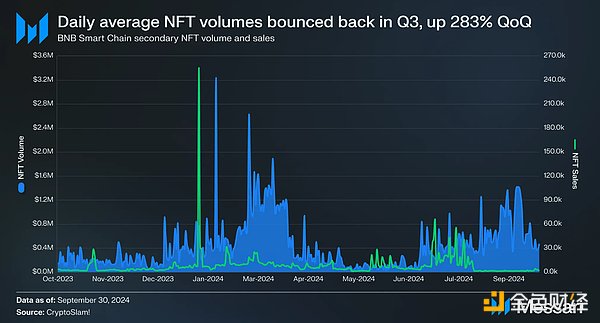

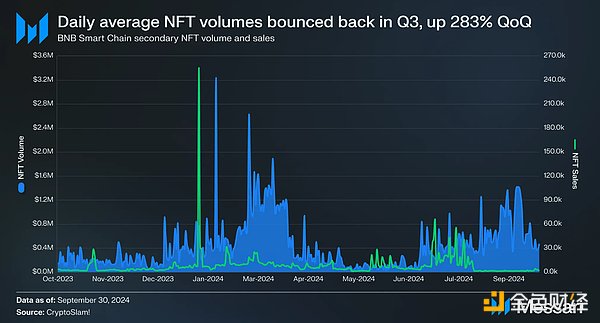

NFT activity saw a resurgence, with average daily volume up 283% month-over-month to $600,400, though this growth was driven primarily by large individual traders.

BNB Chain furthers its multi-chain strategy with the continued launch of BNB Chain Bridge, facilitating cross-chain transfers and improving liquidity across the ecosystem.

Overview

BNB Chain (BNB) is a blockchain ecosystem where each chain has a specific function. The three core components of BNB Chain are as follows:

BNB Smart Chain (BSC): Smart contract layer and DeFi hub.

BNB Beacon Chain: The current staking and governance layer (its functionality will be migrated to BSC and deactivated to improve the efficiency and security of the ecosystem).

Note: As of the time of writing, BNB Beacon Chain is in the final deactivation phase.

BNB Greenfield: A decentralized storage network. As an important part of the One BNB paradigm, Greenfield focuses on real-time, valuable data, allowing users to create their own personal data marketplace.

opBNB: High-performance optimistic rollup. opBNB is ideal for Dapps that require high-frequency transactions, such as fully on-chain games. It offers the lowest gas fees in L2, with transaction costs of <$0.0001. It has very high performance and can handle 5,000 to 10,000 TPS.

The metrics in this report are primarily focused on BNB Smart Chain (BSC). BSC is an EVM-compatible Layer-1 blockchain secured by the Proof-of-Staked-Authority (PoSA) mechanism, which combines the features of Proof-of-Authority (PoA) and Delegated Proof-of-Stake (DPoS). In BSC’s PoSA, the size of the validator set is fixed and elected by stake weight (staking plus bonding). Additionally, validators must continue to stake assets to secure the network, while validators selected to produce blocks are rotated (not based on stake weight). For a full introduction to the BNB Chain ecosystem, see our Ecosystem Report.

Key Metrics

Financial Overview

Market Cap and Revenue

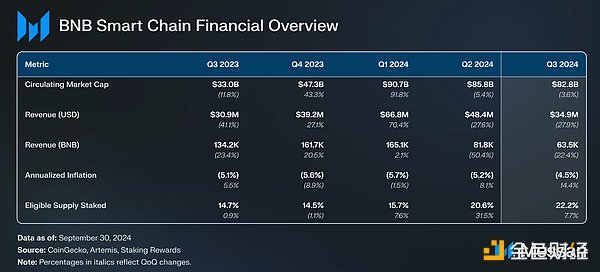

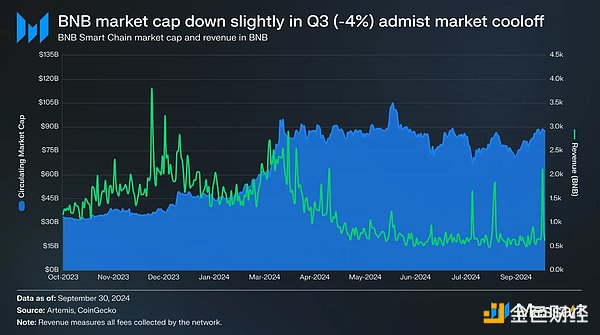

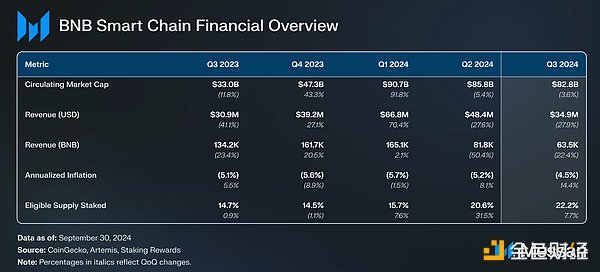

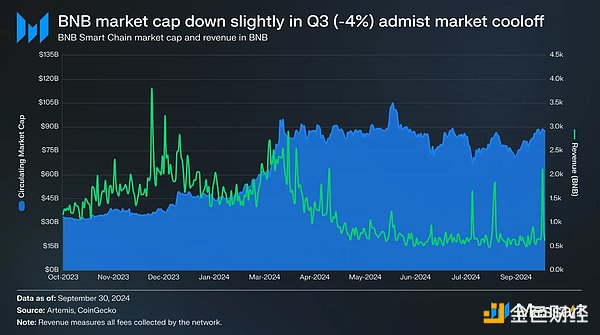

Similar to the broader cryptocurrency market, BNB’s price fell slightly in the third quarter of 2024. At the end of the quarter, BNB's market cap was $82.79 billion, down 4% from the previous quarter. Among all tokens (excluding stablecoins), BNB's market cap ranking remained unchanged at 3rd place, behind only ETH and BTC. In addition, BNB performed slightly worse than BTC in Q3, as Bitcoin's circulating market capitalization increased by 1% during the same period.

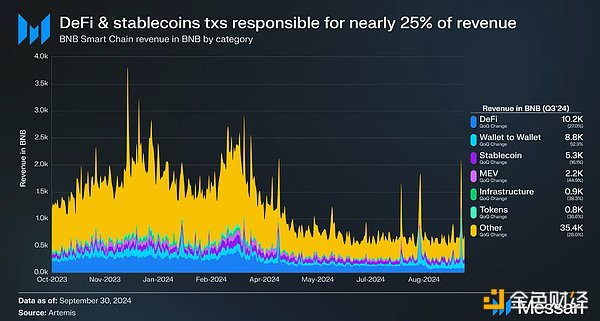

Revenue, which measures all fees collected by the network, fell in Q2. In USD terms, revenue in Q3 was $34.9 million, down 28% from the previous quarter, compared to $48.4 million in Q2. Revenue in BNB terms also fell, down 22% from Q2 to Q3 from 81,300 BNB.

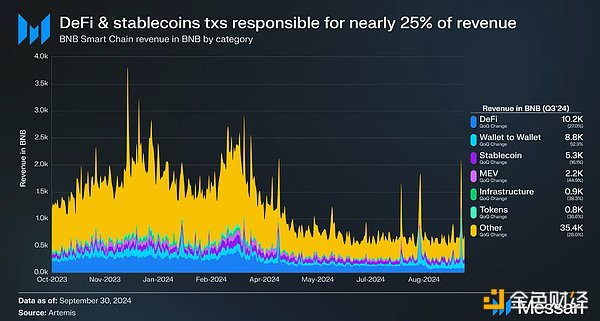

Historically, gas fees paid for DeFi-related transactions have been the largest single contributor to revenue. The third quarter continued this trend, with the DeFi category contributing 10,200 BNB in gas fees (down 27% month-on-month). Notably, DeFi's share of total revenue also fell by 6% month-on-month to 16%. Revenue related to wallet-to-wallet transactions rose 53% month-on-month to 8,800 BNB in the third quarter. In addition, its revenue share rose 97% month-on-month to 14%. Stablecoin's revenue share also increased, rising 8% month-on-month to 8%. All other major categories (MEV, Infrastructure, Tokens, and Other) saw month-on-month declines in both revenue and revenue share.

Supply Dynamics

BNB has an initial total token supply of 200 million (launched in July 2017). BNB achieves deflation through a series of burning mechanisms:

Auto-Burn: An automatic burning mechanism that burns different amounts of BNB every quarter based on the token price and the number of blocks generated on the BNB Chain.

Pioneer Burn: This program counts all BNB accidentally lost by new or careless users towards quarterly burning. The project team will compensate users in accepted cases.

Gas Fees Burn: According to BEP-95, 10% of all gas fees generated on the BNB Smart Chain will be automatically burned. The remaining 90% is distributed as rewards to validators and stakers.

BNB’s circulating supply was 145.9 million at the end of the quarter, giving BNB an annualized deflation rate of 4.5% (up 14% month-on-month). Finally, the 28th quarterly BNB burning took place on July 22. 1.6 million BNB were burned, equivalent to $971 million at the time of the burning transaction. All BNB burned came from the Auto-Burn mechanism.

Adoption

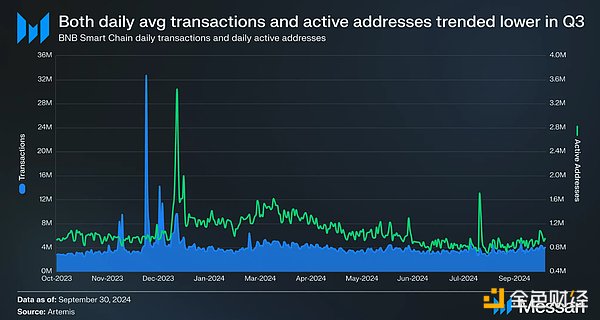

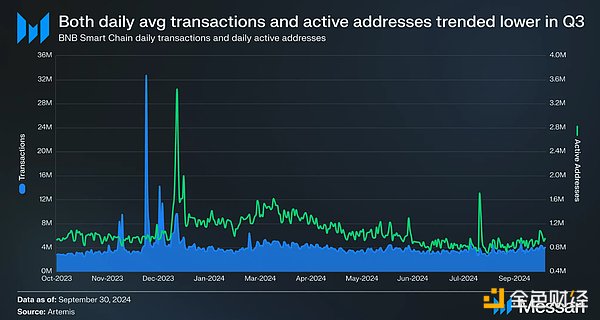

BNB Smart Chain saw a slight decline in on-chain activity in Q3. Average daily transaction volume trended downward in Q3, down 8% from 3.7 million to 3.4 million. Average daily active addresses also trended downward in Q3, down 19% from 1.1 million to 868,300. After an active first half of the year, most smart contract platforms saw a decrease in on-chain activity in Q3.

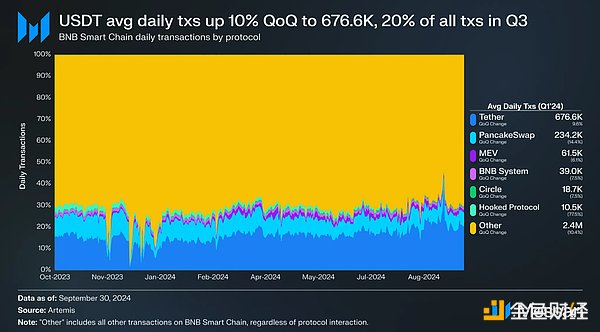

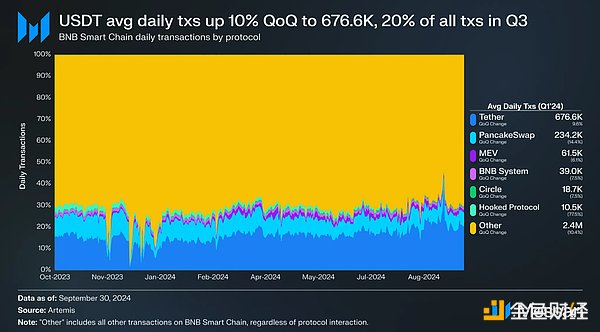

Tether’s USDT became the most traded token associated with a single protocol on BNB Smart Chain in Q3. It had an average daily transaction volume of 676,600, up 10% from 617,300 on a month-on-month basis. Nearly 20% of transactions on BNB Smart Chain in Q3 were related to USDT. USDT’s trading volume was more than double that of the second-largest protocol by volume, PancakeSwap, which averaged 234,200 daily trades, down 14% month-over-month (from 273,600). 7% of trades were associated with PancakeSwap.

Except for USDT, no other protocol among the top six saw month-over-month growth in trading volume. However, MEV (up 2% month-over-month to 2%), BNB System (up 1% month-over-month to 1%), and Circle’s USDC (up 1% month-over-month to 0.5%) all saw increases in trading share. Similar to trading, Tether’s USDT became the single protocol with the most active addresses on BNB Smart Chain in Q3. USDT ended the quarter with an average of 294,000 daily active addresses (up 8% quarter-over-quarter from 271,800). The second largest protocol by active addresses was PancakeSwap. PancakeSwap’s average daily active addresses remained largely unchanged at 94,600. USDT and Tether together accounted for nearly 45% of all active addresses in Q3. No other single protocol had an average of more than 10,000 daily active addresses.

Security and Decentralization

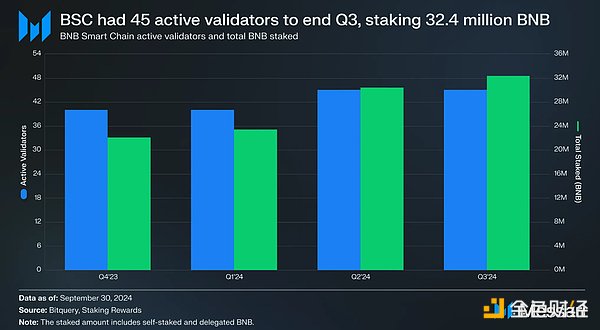

BNB Smart Chain adopts the Proof-of-Staked Authority (PoSA) consensus mechanism, and 45 validators are elected every 24 hours to participate in the consensus. The election is based on the total amount of BNB tokens staked by each node. Among these 45 validators, the top 21 with the highest stakes are "Cabinets" and the remaining 24 are "Candidates". Then, 18 of the 21 "Cabinets" and 3 of the 18 "Candidates" are randomly selected to produce blocks for a given epoch. The selected validators take turns to produce blocks based on Ethereum's Clique consensus design.

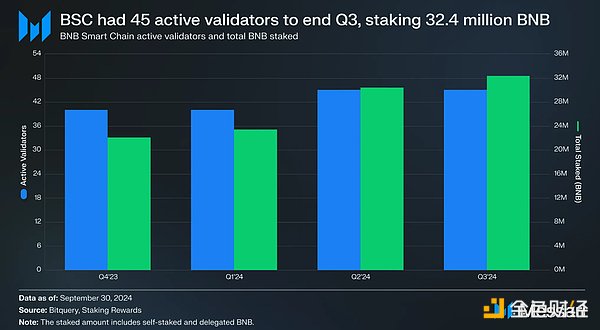

With BNB Chain’s Feynman upgrade on April 18, the maximum number of active validators on BNB Smart Chain increased from 40 to 45. Since the upgrade, there have been 45 active validators on BNB Smart Chain, indicating strong network security and strong demand for operating validators.

The total staked BNB amount rose for the third consecutive quarter, partly due to the transition of staking from BNB Beacon Chain to BNB Smart Chain. The total staked BNB amount increased by 7% month-on-month, from 30.4 million to 32.4 million. Due to a slight drop in BNB price in Q3, the total USD value of staked BNB increased slightly less (up 4% quarter-over-quarter, from $17.7 billion to $18.3 billion). Compared to other PoS networks, BNB Smart Chain had the third-highest USD value of staked funds at the end of Q3. However, the gap to second place (Solana) was $20.7 billion.

MEV

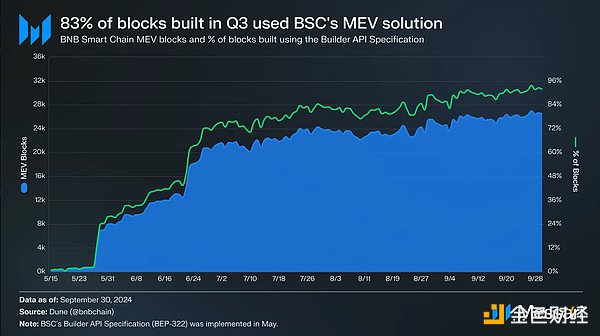

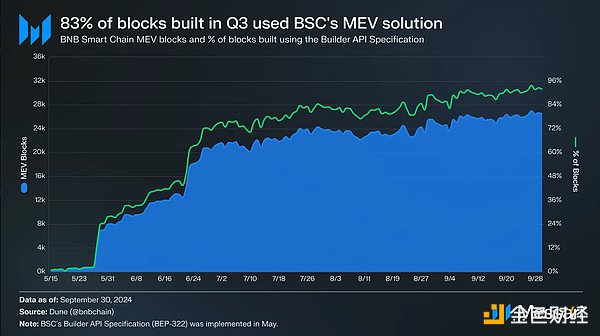

BEP-322, a Proposer-Builder Separation (PBS) proposal for BNB Smart Chain validators, went live last quarter (Q2). BEP-322 was implemented as a builder API specification to address the fragmentation of MEV (Maximum Extractable Value) solutions on BSC. This specification creates a unified MEV market where block proposers (i.e. validators) do not participate in selecting which transactions to include in proposed blocks. Instead, block builders create possible blocks and submit them to validators who propose blocks. Validators then choose the proposed blocks that bring them the most fees. This new mechanism brings stability and transparency to BNB Chain's MEV market, while also promoting healthy market competition among block builders.

BNB Smart Chain's Builder API specification went live in May. Throughout the quarter, 83% of blocks were built using the Builder API specification. On the last day of Q3, 92% of blocks created that day used the Builder API specification. In addition, as of the time of writing, there are 35 different block builders on BNB Smart Chain.

Technical Development

Last quarter, BNB Beacon Chain began the fade-out process. Although BNB Beacon Chain served as the staking and governance layer of BNB Chain, it introduced complexity and some security vulnerabilities due to the bridge between BSC and BNB Beacon Chain. As a result, BNB Chain began migrating the functionality of BNB Beacon Chain to BNB Smart Chain. BEP-333: Chain Fusion will be implemented through four different upgrades.

BNB Beacon Chain First Fade Fork (implemented on April 15) - disabled cryptocurrency issuance and minting functions on BNB Beacon Chain.

BNB Smart Chain Feynman Hard Fork (April 18) - Enabled validator creation and governance features on BNB Smart Chain.

BNB Beacon Chain Second Fade Fork (July 14) - Disabled governance and delegation features on BNB Beacon Chain.

BNB Beacon Chain Final Fade Fork (Scheduled for November 19) - Stopped BNB Beacon Chain and disabled cross-chain communication with BNB Smart Chain.

In the third quarter, BNB Chain also conducted a series of hard forks and technical upgrades unrelated to BNB Chain Fusion:

BNB Greenfield Veld Hard Fork (July 8) - Main features include adding bucket status to bucket migration related events, fixing deactivated buckets that cannot be migrated, fixing the support for delegator values of group names, and ignoring registration channel errors.

BNB Greenfield Mongolian Hard Fork (August 8) - Main features include support for creating strategies through cross-chain, fixing the problem that the initial value of the minimum value comparison should be large enough, and fixing the broken link redirecting from the local repository to the BNB Chain document.

opBNB Wright Hard Fork (August 27) - This upgrade introduced several changes, such as setting the base fee to zero, supporting the bundle feature, and handling persistent IDs when using nodebufferlist. Mainnet Op-Geth nodes must upgrade to Op-Geth v0.4.5 before the hard fork.

BNB Greenfield Altai Hard Fork (September 23) - The Altai hard fork resolves compatibility issues between Greenfield and the Metamask extension.

BNB Smart Chain Bohr Hard Fork (September 25) - This upgrade will introduce the following four BEPs:

BEP-341: Validators can produce blocks continuously

BEP-402: Complete missing fields in block headers to generate signatures

BEP-404: Clear miner history when switching validator sets

BEP-410: Add proxy for validators

Development Roadmap

On January 31, BNB Chain released its 2024 roadmap. The roadmap showcases a strong development plan for BNB Smart Chain, BNB Greenfield, opBNB, and more. Future development efforts aim to unify the current ecosystem and chains through the multi-chain paradigm One BNB to achieve a unified, seamless experience within BNB Chain. Some key highlights include:

BNB Smart Chain - Completion of BNB Chain Fusion, expansion of the validator set to 100, introduction of delegated voting, MEV proposer-builder separation, and a new parallel EVM.

opBNB - Raising the gas limit to 200 million and achieving 10,000 TPS (achieved this quarter), implementing BEP-336 (achieved last quarter), and introducing ZK error proofs and a shared sorter set.

BNB Greenfield - adds permanent storage and makes it a data availability layer.

DeFi

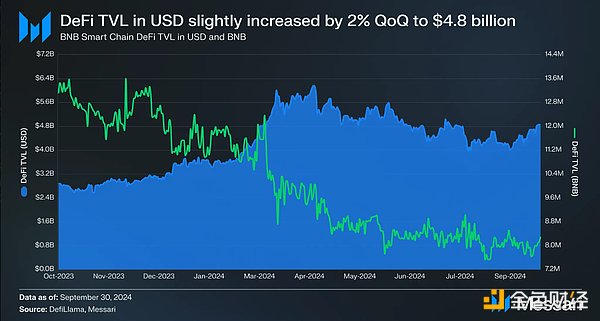

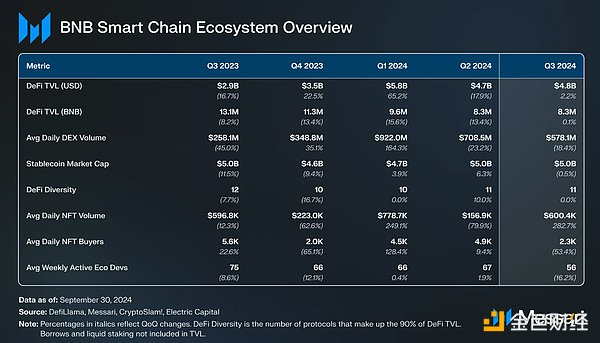

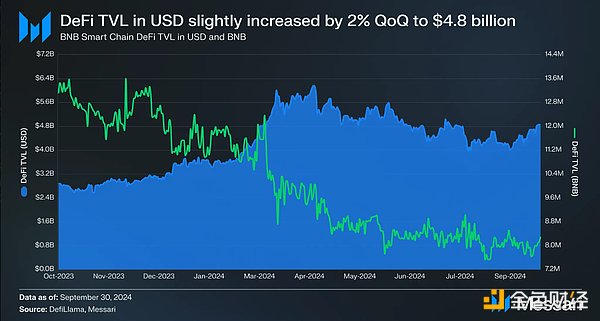

DeFi TVL (in USD) on BNB Smart Chain increased slightly to USD 4.85 billion from USD 4.74 billion in Q2, up 2% QoQ. This puts BNB Smart Chain in fourth place in the TVL ranking in USD at the end of the quarter, down one spot after being surpassed by Solana in July. TVL in BNB remained largely flat quarter-over-quarter at 8.3M BNB (up 10,700 BNB month-over-month). This dynamic suggests that some of the lower TVL in USD was driven by inflows. The top two protocols by TVL on BNB Smart Chain are Venus Finance and PancakeSwap. As the largest protocol by TVL, Venus Finance’s TVL grew 13% month-over-month from $1.59B to $1.79B. It is worth noting that despite the increase in TVL, lending volume fell from $707 million in Q2 to $454 million in Q3, a 36% decrease from the previous quarter. By the end of Q3, Venus Finance had a 37% share of TVL (up 10% from 34% from the previous quarter).

PancakeSwap's TVL fell slightly in Q3, from $1.72 billion to $1.64 billion, a 5% decrease from the previous quarter. PancakeSwap consists of three different AMMs (PancakeSwap AMM, StableSwap, and AMM V3). By the end of Q3, AMM had $1.19 billion in TVL (73% of TVL), StableSwap had $14.7 million in TVL (less than 1% of TVL), and AMM V3 had $379.1 million in TVL (23% of TVL). However, PancakeSwap’s share of TVL dropped to 34% (down 7% from 36% QoQ). In total, Venus Finance and PancakeSwap account for 71% of BNB Smart Chain’s TVL.

Of the top six protocols, the only one to grow TVL besides Venus Finance was Avalon Finance, a protocol that provides lending services for BTC-based assets on multiple networks. Avalon Finance launched its lending market on BNB Smart Chain in May and quickly gained an 8-digit TVL. On July 31, Avalon Finance was announced as one of the winners of the second round of the BNB Incubation Alliance, which fast-tracked it into the BNB Chain’s Most Valuable Builder (MVB) program. Following this announcement, Avalon Finance’s TVL quickly surpassed $100 million and reached $159.4 million at the end of the quarter (up 315% quarter-over-quarter from $38.4 million).

Other protocols in the top six include ListaDAO, PinkSale, and UNCX Network. ListaDAO, a CDP stablecoin lending and liquid staking protocol, saw its TVL drop 38% quarter-over-quarter in Q3, from $317.6 million to $198.4 million (this figure does not include ListaDAO’s liquid staking TVL). ListaDAO has been running a rewards program since Q1. Part of the reason for its Q3 TVL drop can be attributed to short-lived arbitrage funds looking for better yield opportunities. PinkSale, a token issuance platform protocol, fell 11% month-on-month, from $200.2 million to $179.2 million. In sixth place is UNCX Network, a DeFi infrastructure protocol that provides various token services. Its TVL fell 2% month-on-month, from $80.5 million to $79 million.

In Q4, BNB Smart Chain launched the TVL Incentive Program. The program aims to reward projects that deploy and attract a large amount of TVL within the ecosystem. In Q3, the second phase ended, running from June 27 to July 27. The third phase was a two-part program with bonus pools for two categories: Liquid Staking and DeFi. A total of $300,000 was awarded to eight projects:

Liquid Staking - Venus Finance, PancakeSwap, and Kinza Finance.

DeFi - Solv, BitU, Avalon Finance, KiloEx, and Harbor Market.

On September 4, the fourth phase of the TVL Incentive Program was announced. Phase 4 is a two-part program with prize pools for two categories: Liquid Staking and DeFi. The prize pool for Liquid Staking is $100,000, which will be divided among three winners, while the prize pool for DeFi is a whopping $200,000, which will be divided among five winners. Phase 4 runs from September 12 to October 11.

With the migration of validation and staking services to BNB Smart Chain over the past year, liquid staking has become one of the top priorities for the BNB Chain ecosystem. At the same time, ListaDAO’s liquid staking solution slisBNB has become the most dominant liquid staking solution on BNB Smart Chain. As of the end of the third quarter, the amount of BNB staked on ListaDAO was 406,200 (worth $234.4 million), a 2% decrease from the previous quarter, compared to 412,700 slisBNB (worth $237.3 million) in the second quarter.

On September 15, BNB Smart Chain’s first restaking token protocol YieldNest was officially launched. YieldNest allows users to re-stake slisBNB into ynBNB, which can then be deposited into restaking protocols such as Karak. In the coming quarters, restaking and liquid staking are expected to be growth areas for BNB Smart Chain.

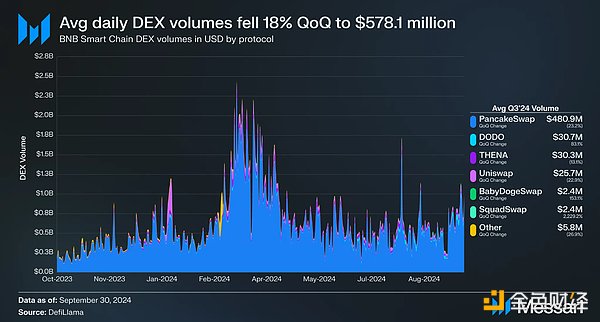

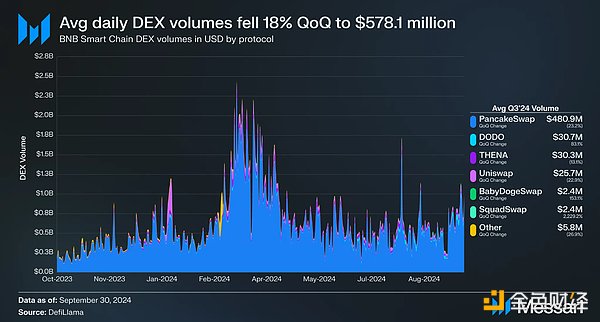

After peaking in March, DEX volumes for most smart contract platforms have been trending downward. This trend continued for BNB Smart Chain in Q3, with average daily volume falling 18% month-on-month from $708.5 million to $578.1 million. In Q3, BNB Smart Chain ranked fourth among all chains in DEX volume ($53.73 billion). Only Ethereum ($138.15 billion), Solana ($121.47 billion), and Arbitrum ($58.53 billion) had DEX volumes exceeding it.

By the end of Q3, there were 69 different DEXs on BNB Smart Chain (up 3 from Q3). Despite the fierce competition, PancakeSwap has been the most dominant DEX on BNB Smart Chain. In Q3, PancakeSwap’s average daily volume was $480.9 million, down 23% from Q3 (from $625.8 million). PancakeSwap’s market share fell from 87% to 83%, down 4% from Q3. The DEX with the largest increase in average daily volume in Q3 was DODO. Its average daily volume increased 83% from Q3 to $30.7 million, making it the second most traded DEX on BNB Smart Chain. The top five DEXs by average daily trading volume in Q3 are as follows:

PancakeSwap ($480.9 million - 83% of BNB Smart Chain DEX trading volume)

DODO ($30.7 million - 5% of BNB Smart Chain DEX trading volume)

THENA ($30.3 million - 5% of BNB Smart Chain DEX trading volume)

Uniswap ($25.7 million - 4% of BNB Smart Chain DEX trading volume)

BabyDogeSwap ($2.4 million - less than 2% of BNB Smart Chain DEX trading volume) 1%)

On May 21, BNB Chain announced the Volume Incentive Program. The program aims to increase the volume on the protocol through a reward-based approach. The total prize pool is $200,000, and the top ten protocols will share the prize pool. The winner is determined based on the total volume and the incremental volume during the period. The program lasts until July 9. Rewards have been issued to the 10 projects with the largest incremental volume: PancakeSwap, THENA, APX Finance, uDEX, KiloEx, WOOFI, Sigma, Velvet Capital, KTX, and Level Finance.

Stablecoins and BTC

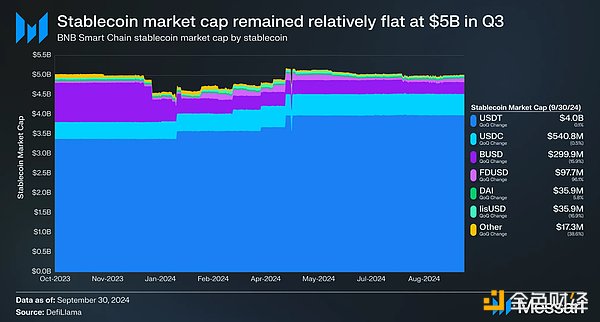

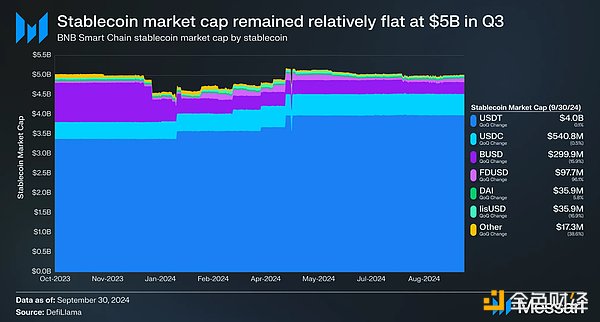

In 2023, the market value of stablecoins on BNB Smart Chain showed a downward trend, mainly due to the reduction in the supply of BUSD. In the first quarter of 2023, NYDFS ordered BUSD issuer Paxos to stop issuing, and various centralized exchanges (such as Coinbase) also suspended BUSD trading. As a result, the market value of stablecoins on BNB Smart Chain declined every quarter in 2023.

However, this trend was basically reversed in the first half of 2024, mainly due to the growth of other stablecoins on BNB Smart Chain. In Q3, stablecoin market cap remained relatively stable, declining slightly from $5.03 billion to $5.00 billion (down $24.9 million). The market cap of USDT, the largest stablecoin on BNB Smart Chain, increased slightly, from $3.97 billion to $3.98 billion. At the end of Q3, USDT accounted for 79% of the BNB Smart Chain stablecoin market (flat month-on-month). The second-largest stablecoin USDC suffered a slight loss in Q3, falling from $543.4 million to $540.8 million.

At the end of Q3, BNB Smart Chain launched the "Gas-Free Carnival" event, which aims to increase stablecoin adoption on the platform. Gas-Free Carnival allows users to transfer stablecoins without gas fees, providing multiple seamless trading options: Gas-Free Stablecoin Transfers: Users can send USDT, USDC, and FDUSD on BNB Smart Chain and opBNB without gas fees, supported by Bitget Wallet and SafePal. Zero-Fee Withdrawals: Participating exchanges such as Binance, Bitget, Gate.io, and SafePal offer free withdrawals of these stablecoins to BNB Smart Chain. Free Cross-Chain via Celer cBridge: Users can cross-chain supported stablecoins to BNB Smart Chain or opBNB network for free via Celer cBridge.

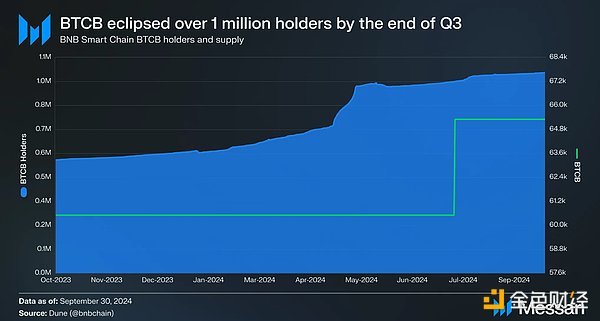

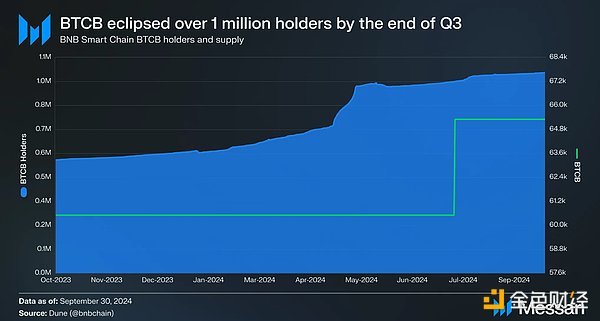

BTCB is one of the largest assets on BNB Smart Chain, second only to BNB and stablecoin. It is the tokenized version of Bitcoin on BNB Smart Chain. The supply of BTCB increased by 8% year-on-year to 65,300 in the third quarter, equivalent to $4.13 billion. The number of BTCB holders increased by 7% year-on-year to just over 1 million. The development of BNB Smart Chain is supported by its emerging BTCFi ecosystem. Projects like Solv Finance, Lorenzo, Lombard Finance, etc. provide BTCB holders on BNB Smart Chain with channels to participate in various DeFi opportunities. opBNB is an EVM-compatible optimistic rollup that helps increase the execution throughput of BNB Smart Chain. Total bridged value (TVB) has been on an upward trend since its launch in mid-Q3. In Q3, $3 million was bridged to opBNB, bringing TVB to $78.9 million (up 4% QoQ from $75.9 million). USDT (up 4% QoQ to $52.1 million) remains the most popular bridged token on opBNB, accounting for 66% of all TVB. In percentage terms, BTCB saw the largest growth in Q3, up 304% QoQ to $774,200.

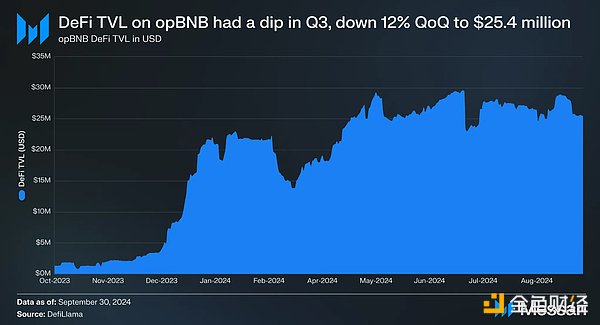

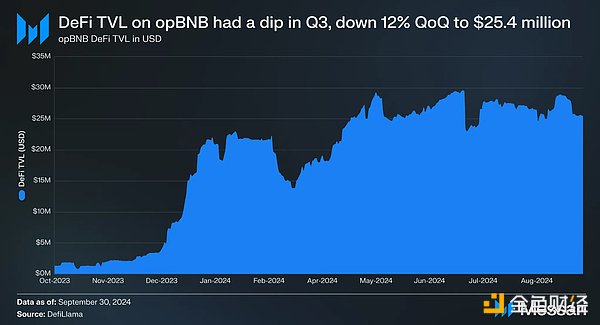

In 2024, DeFi TVL on opBNB has been on an upward trend, partly due to the launch of various TVL incentive programs during 2024. In the third quarter, DeFi TVL on opBNB fell slightly, down 12% month-on-month from $28.9 million to $25.4 million. DeFi TVL on opBNB is mainly supported by two projects: KiloEx (TVL of $17.4 million) and PancakeSwap (US$6.5 million). These two projects accounted for 94% of the TVL on opBNB in the third quarter.

NFTs

After a sluggish performance in the second quarter, NFT activity rebounded in the third quarter. Average daily NFT trading volume increased by 283% month-on-month, from $156,900 to $600,400. Average daily sales also increased, increasing by 47% month-on-month to 8,900. However, the average number of daily buyers fell 53% month-on-month to 2,300, indicating that NFT activity in the third quarter was mainly driven by "big players" rather than small users.

Ecosystem Growth

BNB Chain continues to support new projects within the ecosystem through its Most Valuable Builder (MVB) Accelerator Program. In August, BNB announced the results of the seventh season of MVB. There were over 700 applications in total, with five different projects receiving investments from Binance Labs:

Aggregata - AI data and model platform

Blum - Telegram-based cryptocurrency trading app

O.LAB - Dynamic prediction markets

SideKick - Social hub for games and more

Vooi - Cross-chain aggregator for perpetual DEX

MVB Season 8 was also announced at the end of August. The eighth season of the BNB Chain MVB project provides a four-week intensive acceleration for early-stage Web3 projects, with Binance Labs, CMC Labs, and BNB Chain continuing to collaborate.

In addition to the MVB Accelerator Program, BNB Smart Chain also held a hackathon in the third quarter. The application submission period was open from July 31 to August 28, and nearly 200 different applications were received. The total prize pool was $500,000, with three different tracks: games, social, and payments. The winners of the hackathon were announced on October 2:

1st Prize ($15,000) - zkGraph

2nd Prize ($10,000 each) - Siren and CryptoBed

3rd Prize ($5,000 each) - The Witch Credit Card, GreenPress, and Bakeland

BNB Chain also launched a number of community and ecosystem initiatives in Q3:

BNB Chain Telegram Mini Games Report (August 2) - BNB Chain highlighted the rise of Telegram Mini Games within its ecosystem, noting their growing popularity as an onramp to Web3. These mini-apps integrate seamlessly into Telegram, allowing users to access Web3 services, including decentralized exchanges and NFT marketplaces, without leaving the app. Notable projects include Eggdrop by GombleGames, which features token-based gameplay, and Let's Throw Slime by SkyArk Chronicles, an interactive game based on NFTs.

BNB Incubation Alliance (BIA) Winners (August 6) - Last quarter, BNB Chain announced its BNB Incubation Alliance, an incubator program for early-stage ecosystem projects seeking BNB grants and investments from Binance Labs. At the BNB Incubation Alliance during Bitcoin 2024 in Nashville, the winners were Avalon Finance and Bedrock. At EthCC in Brussels, winners included Balloon Dogs, Blackwing, and Payman.

Meme Coin Innovation War Round 3 (August 13) - This program offers up to $150,000 in rewards to promote the meme coin ecosystem on BNB Smart Chain. It focuses on launching new meme coins and enhancing liquidity for existing meme coins, providing customized marketing and access to a $900,000 liquidity pool to support growth. Meme coin launchpads four.meme, MyShell, Flap, and Burve also offer additional incentives.

Gas Grant Program (August 19) - This program offers over $1 million in rewards over three months to incentivize projects on BNB Smart Chain or opBNB that meet specific criteria, such as daily active user requirements and passing security audits. Up to $440,000 will be distributed monthly based on participants’ gas fee generation and user engagement, with top projects eligible for up to 80% gas fee refunds, capped at $50,000 per project.

BNB Chain Bridge (August 28) - Developed in partnership with Celer, deBridge, and Stargate, BNB Chain Bridge enhances liquidity, connectivity, and user experience on BNB Smart Chain. It simplifies cross-chain transfers, allowing users to easily navigate between popular tokens and bridges. In addition, liquidity pools support faster and more competitive asset transfers.

Summary

In the third quarter, BNB Smart Chain demonstrated solid progress, with important developments in DeFi, staking, and cross-chain initiatives. Despite a slight decline in BNB’s market cap (down 4% QoQ), network activity remained strong with 3.4 million daily transactions, albeit down slightly from Q2. BNB Chain’s DeFi TVL grew 2% QoQ to $4.85 billion, solidifying its position as the fourth largest chain by TVL. Venus Finance led the pack with a 13% increase in TVL, while newer projects such as Avalon Finance also saw significant growth after joining the BNB Incubation Alliance. The launch of liquid staking solutions and opBNB rollup helped drive engagement and bridge TVB, improving BNB Chain’s liquidity and user experience.

Ecosystem growth is also reflected in a wide range of development initiatives, including the ongoing Most Valuable Builder (MVB) Accelerator and hackathons. User engagement was further boosted by a series of community initiatives, including Gas-Free Carnival, Telegram mini-games, and the cross-chain BNB Chain Bridge.

Weatherly

Weatherly