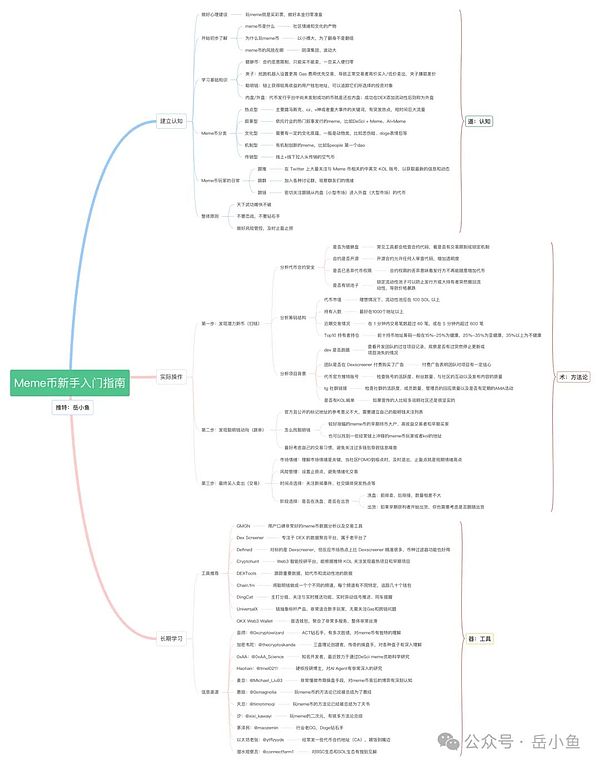

Author: Yue Xiaoyu

Introduction:The Web3 industry is developing too fast, and new things appear every day. Therefore, many daily thoughts are worth recording.

Don't be biased against anything that can make money.

In this cycle, Meme coin is one of the core narratives. No matter how pessimistic you are, you must participate and get involved.

After all, VC coins have fallen again and again, and Meme coins, even in PVP, still have opportunities to make money, and there are even many stories of getting rich quickly.

I am also a new player of Meme Coin. In order to better learn how to play Meme Coin, I will summarize my learning path here and share it with you. Teaching everyone is also a better way to learn.

01 Establish cognition

Before entering an unfamiliar field, you must first establish an overall cognition, otherwise you will be playing entirely by luck.

(1)Be mentally prepared:

Playing meme is like buying lottery tickets. Be prepared for your capital to be zeroed out. Of course, you can improve your chances of winning through a series of learning;

(2)Establish a preliminary understanding:

What is meme coin? Meme coin is the product of community sentiment and culture.

Why play meme coin? To win big with a small investment, to turn things around, not to double up.

What are the risks of meme coins? Full of conspiracy groups and high volatility.

(3)Understand the basics:

Pixiu coin: malicious contract restrictions, can only buy but not sell, once bought, the currency will be reset to zero;

Clamp: preemptive robots set higher gas fees to prioritize transactions, causing normal traders to buy at high prices/sell at low prices, and the clamp earns the difference;

Smart money: the wallet addresses of users who obtain higher returns on the chain, which can track the investment objects they choose;

Internal/external market: coins that have not been successfully launched on the token issuance platform are still in the internal market; coins that have successfully added liquidity to the DEX are called external market;

(4) Meme coin classification:

Hotspot type: mainly uses keywords such as Musk, CZ, Vitalik or major events, has sudden hot spots, and huge traffic in a short period of time

Narrative type: memes issued based on popular narratives in the industry, such as DeSci + Meme, AI + Meme

Cultural type: requires a certain cultural background, usually animal-based, such as sad frog, doge emoticons, etc.

Mechanical type: memes with innovative mechanisms, such as $people’s first dao

MLM type: online + offline pyramid scheme of air coins

(5) Daily life of Meme coin players:

Follow: follow a large number of Chinese and English KOL accounts related to Meme coins on Twitter to obtain the latest information and developments;

leaf="">Follow the group: join various discussion groups and observe the emotions of group members;

Follow the chain: pay close attention to and follow the tokens that enter the outer market (large market) from the inner market (small market);

(6) Overall principle

The only martial arts in the world that cannot be broken is speed

Don’t fight to the end, don’t have diamond hands

Do a good job of risk management and stop profit and loss in time

02 Practical operation: methodology

Step 1: Discover potential new coins (chain sweep)

(1) Analyze the security of the token contract

Is it a Pixiu disk: Common tools will check the contract code to see if there are any transaction restrictions or locking mechanisms;

Is the contract open source: Open source contracts allow anyone to review the code, increase transparency, and prevent developers from opening backdoors;

Whether the token authority has been abandoned: the abandonment of contract authority means that the issuer can no longer increase the number of tokens at will;

Is there a locked pool: locking the liquidity pool can prevent the issuer or large holders from suddenly withdrawing liquidity, causing a price crash;

(2) Analyze the chip structure

Token market value: Ideally, the liquidity pool should be above 100 SOL

Number of holders: preferably more than 1,000 addresses

Recent transaction status: more than 60 transactions within 1 minute, or more than 600 transactions within 5 minutes

Top 10 holders’ holdings: The top 10 holding addresses generally have 15%-25% of chips, which is healthy; 25%-35% is sub-healthy; and more than 35% is unhealthy

(3) Analyze project background

Whether the dev has run away: Check the past project records of the development team to see if there has been a sudden cessation of updates or the disappearance of the project;

Whether the team is on Dexscreener Paid for advertising: Paid advertising shows that the team has a certain degree of confidence in the project;

Official Token Twitter Account: Check the account's activity, number of fans, interaction with the community, and the quality of published content;

tg Community Link: Check the community's activity, number of members, quality of administrators' responses, and whether there are regular AMA activities;

Whether there are KOLs shouting orders: If there are more people promoting it, it means that the community is still very solid

Step 2: Discover the trends of smart money (follow orders)

Official and publicly marked addresses are of little reference value, and you need to build your own smart money attention list.

How to find smart money: early holders of meme coins with better gains, high-yield traders and early buyers. You can also find the addresses of some meme coin players or kols who often charge on the chain.

It is best to consider your own trading habits and avoid paying attention to too many wallets to cause information noise.

Step 3: Final Buy and Sell (Transaction)

Market sentiment: Understanding market sentiment is the key. When the community FOMO reaches its peak, exit in time. When is FOMO at its peak? Look at community sentiment, on-chain indicators, etc. There are more subjective judgments here.

Risk management: Set a stop loss point to avoid emotional trading; people are always emotional and prone to chasing ups and downs. The most important thing is to set a stop loss point and invest in a disciplined manner.

Time point selection: pay attention to news events, sudden hot spots on social media, etc.; technical indicators often fail in Meme coins because they tend to be affected by events, so you need to pay attention to related events and operate at the first time.

Phase selection: whether it is washing the market or shipping; the characteristics of washing the market are selling in the front row and receiving in the back row, and the quantity difference is not much; the characteristics of shipping are that if the early profiteers start to ship, you also need to consider whether to follow the shipment.

03 Long-term learning

Tool recommendation

GMGN: @gmgnai

Meme coin data analysis and trading tools with very good user reputation

Dex Screener: @dexscreener

Focus on DEX

Defined: @definedfi

It competes with Dexscreener, but it is much more accurate in reflecting market hotspots than Dexscreener, and the currency filter function is also easy to use

Cryptohunt: @cryptohunt_ai

Web3 intelligent investment research platform, which can discover the hottest projects and early projects based on Twitter KOL attention

DEXTools: @DEXToolsApp Track important data, such as token and liquidity pool data ChainFM: @chain_fm Make smart money into different channels, each with different characteristics, tracking dozens of wallets DingCat: @dingcatai Featured grouping, attention and real-time push functions, real-time abnormal signal push, same car reminder UniversalX: @UseUniversalX Chain abstraction benchmark product, very suitable for novice players, no need to worry about Gas and cross-chain issues OKX Web3 Wallet: @OKXWeb3_CN Preferred wallet, aggregating many services, the overall very smooth Information channel (selected Meme coin bloggers in Chinese area) leaf="">Wizard: @0xcryptowizardACT Diamond hand, has multiple wins, and earned financial freedom

Crypto Vedic: @thecryptoskanda Creator of the Three Plate Theory, a legendary trader, with an in-depth understanding of various plates

0xAA: @0xAA_Science Well-known developer, recently dedicated to funding scientific research through DeSci meme

Haotian: @tmel0211 Hardcore investment research blogger, recently dedicated to related research on AI Agent

Mr. Mai: @Michael_Liu93 He is very familiar with the market maker's trading methods and has a deep understanding of the game behind meme coins.

Sister Hui: @0xmagnolia The methodology of playing meme coins has been summarized into Hui Jing

Mr. Tian: @timotimoqi The methodology of playing meme coins has been summarized into the Book of Heaven

Mao Zemin: @maozemin An old OG in the industry, with Doge diamond hands

Ethereum Lao Zhang: @ytflzyyds Often send some token contract addresses (CA), feed food to your mouth

汐: @xixi_kawayi A two-dimensional blogger who plays meme and has many methodological summaries

Diving Observer: @connectfarm1 Has unique insights into the differences between BSC ecology and SOL

Juzuo Community: @btc8686 Sends daily reports on SOL Golden Dog every day

Bit Duck: @bitduck_club Focuses on BTC ecology and on-chain local dogs

04 To sum up

For Meme coin trading, putting in more effort can indeed improve your winning rate.

Therefore, senior Meme coin players are very hardworking people, observing the market and trading 24 hours a day.

However, for ordinary users, it is also worthwhile to participate and feel the fast pace of the Meme coin market, not only to make money, but also to perceive the transaction and learn a lot from it.

Finally, I will continue to update my Meme coin learning dynamics, and hope to be of some help to everyone.

(This article is only for communication and learning, and does not constitute any investment advice!)

Anais

Anais