Author: Crypto Koryo Source: Substack Translation: Shan Ouba, Golden Finance

Some people say "Wake me up after September ends" and then we have a surge in the fourth quarter? This seems to be the mainstream view at present, but we need to look more closely at the positive and negative factors that follow.

Let's start with some positive factors.

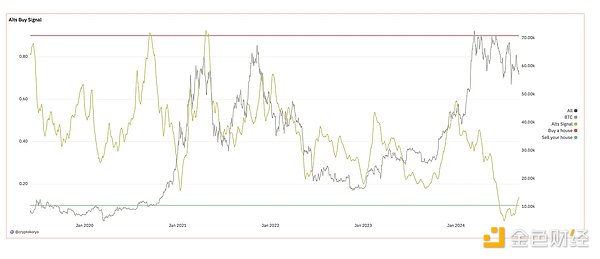

Altcoin buy signals

Altcoin buy signals are currently at multi-year lows, almost reaching the level of "selling houses to buy coins", which shows that the price of altcoins is at a historical low relative to Bitcoin. The market has been silent for about 8 months since the last altcoin season, which is a considerable time. Judging from historical patterns, this chart suggests that the altcoin season may not be far away, both in terms of time and price.

But the question is, do these historical patterns still apply today? Because the current altcoin market history is less than 5 years old, the macro environment may also be different.

Before discussing macro, let's look at the cycles of cryptocurrencies.

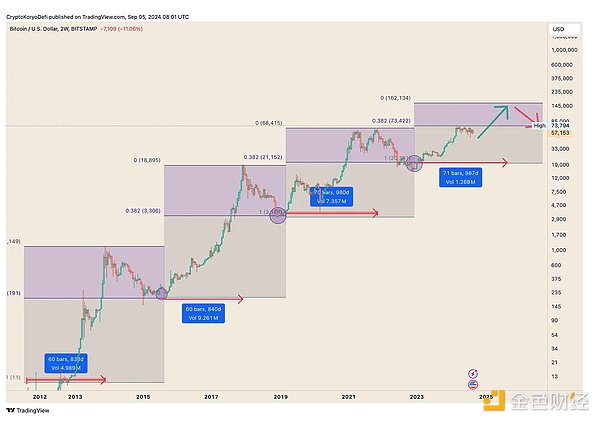

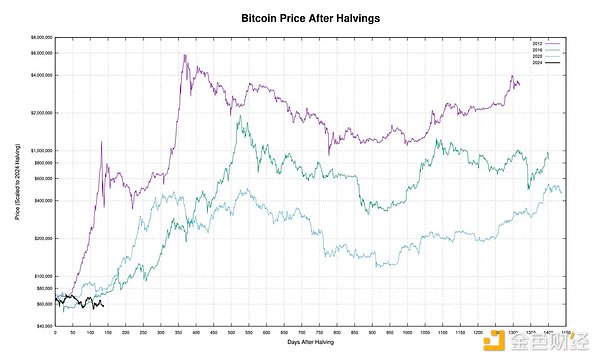

4-year cycle

If we look back at the 4-year cycle, this cycle has not been broken so far, and we are still on track for a bull market in 2024/25.

The Bitcoin halving tracker shows that the current cycle is underperforming. Every cycle is different, and this cycle's typical post-halving consolidation range is slightly longer than in the past. However, if the pattern of the past three cycles repeats, then the best is yet to come. While the market may go sideways for longer, or the length and magnitude of the bull run may be shorter, there is still reason to expect some form of bull run over the next 15 months.

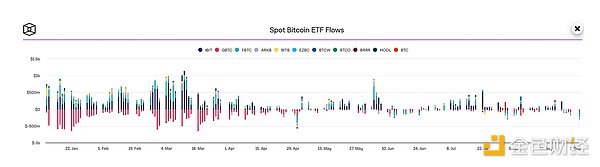

Institutional influence

The last positive factor is that, unlike past cycles, Bitcoin is now accepted by institutions. In 2024, we will usher in Bitcoin and Ethereum spot ETFs. Although demand has declined compared to the first quarter, once market sentiment turns positive, a large amount of capital may quickly flow into Bitcoin.

Uncertainty factors

Why is market sentiment not positive enough?

We have finished talking about the positive factors, and now we are talking about the negative factors.

Interestingly, most of the negative factors have nothing to do with cryptocurrencies, but involve the broader financial markets and the macroeconomy.

S&P (SPX)

Many expected the S&P to continue its bear market, but it has actually had a stunning rebound since October 2023 (rallying at about the same time as crypto markets).

But right now, it looks like the S&P could be forming a double top pattern and has a significant bearish divergence on the RSI, which means the S&P could retrace to the 0.382 or 0.618 Fibonacci levels. Especially with the current macro uncertainty (discussed in more detail later), such a retracement is possible.

Unfortunately, while cryptocurrencies decouple from the S&P when it rises, they are still affected when the S&P falls.

If macro uncertainty causes the S&P to fall, the probability of a bull run in cryptocurrencies in Q4 is low, as the market remains illiquid and it remains a “player-vs-player” game.

US Election

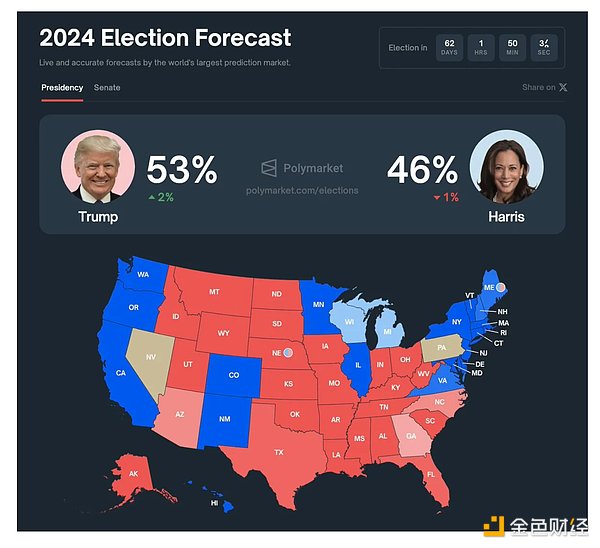

It is clear that the US election has a major impact on cryptocurrencies.

In short, the consensus is that a Trump win is good for cryptocurrencies, while a Harris win is likely to be bad for cryptocurrencies.

On Polymarket, Trump still leads in the polls, but in some other surveys, Harris is ahead. The situation remains tense.

Next Tuesday's debate will be a very important event to watch.

Macroeconomics

Talks about an impending recession have been going on since 2022, but there seems to be more and more data to support this view. I am not a macroeconomic expert, but almost everyone is expecting the Fed to cut interest rates in September. Although inflation is still above target, it is improving. Overall GDP growth in the United States is still on an upward trend, while the labor market is beginning to show signs of weakness. The upcoming macroeconomic data this month, including non-farm payrolls and unemployment (released tomorrow), CPI and PPI data (released next week), and finally the Fed statement in two weeks, will provide us with clues on the future direction of the market.

If the Fed cuts rates by 25bps in two weeks, the crypto market could see a bullish trend in the fourth quarter; if it cuts by 50bps, the market will be more bullish.

Summary

Current market conditions suggest that macroeconomics will determine the performance of cryptocurrencies in the coming months. We need new liquidity to drive token prices higher. Macro events in the next two weeks (and the Trump/Harris debate) will provide direction for the market in the fourth quarter.

Rather than predicting the outcome of these events, it is better to wait for a clear trend and direction. Even if it means buying at higher prices, or adding to positions on the decline if there is bad news.

However, I believe that current levels are already very good buying opportunities for long-term (>6 months) holders.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Jixu

Jixu Clement

Clement The Block

The Block Beincrypto

Beincrypto Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph