"Depletion" situation (replenishment responsibility):

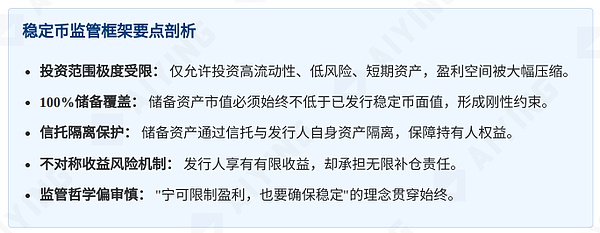

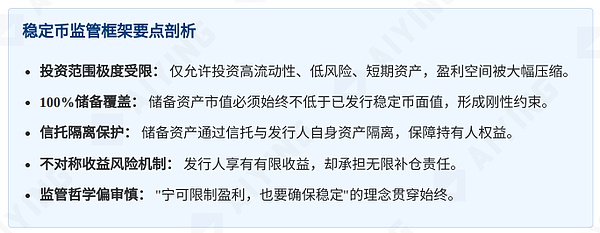

When the value of reserve assets falls below the face value of the stablecoin, the issuer must inject additional funds to ensure that the "bucket is full". This is a rigid responsibility of the issuer. This mechanism makes the issuer of stablecoins face a situation of "limited returns and unlimited risks": in a good market environment, the yield of reserve assets is capped due to investment scope restrictions; but in times of market turmoil, the issuer needs to bear the potential unlimited margin call liability. 5. Redemption rights and bankruptcy protection The Draft Guidelines also clearly stipulate that stablecoin holders have the right to redeem at par at any time and claim the difference from the issuer when the issuer is insolvent. This provides a certain degree of legal protection for stablecoin holders, but there is still uncertainty in the actual implementation.

Prudence first: the tug-of-war between safety margin and profit margin

The HKMA's regulatory strategy for stablecoins reflects the concept of "prudence first". The theoretical basis of this concept can be traced back to the conclusion of its 2022 research report "An Event Study on the Collapse of the Stablecoin Market in May 2022": "Among crypto-collateralized stablecoins, those with stricter borrowing requirements (i.e., higher collateral ratios) better resisted bank runs in May 2022, highlighting the importance of having sufficient safety margins." The lessons learned from this study directly affect the current regulatory thinking: It is better to limit profitability than to ensure stability. This approach can indeed provide stronger risk resistance in the face of "black swan" events such as the UST/Terra collapse.

However, the question is:Will over-emphasizing safety margins kill the commercial viability of stablecoin issuers? From a business perspective, the design of any financial product needs to strike a balance between risk and return. If regulation controls risks too strictly, making it difficult for issuers to make a profit, the market will lack sufficient commercial motivation to provide such products.

This is like requiring a restaurant chef to use only the safest but most basic ingredients and cooking methods. The result may be a high degree of safety, but the dishes are too monotonous, customers are not interested, and the restaurant is difficult to sustain.

Third, an unavoidable contradiction: it is too difficult to make money and the risks are too great

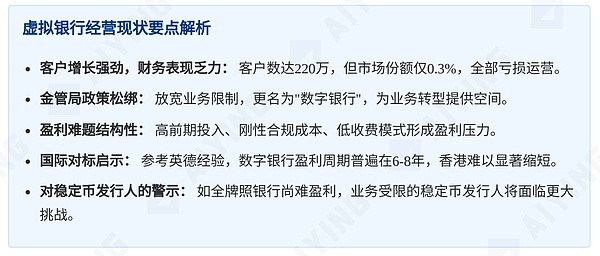

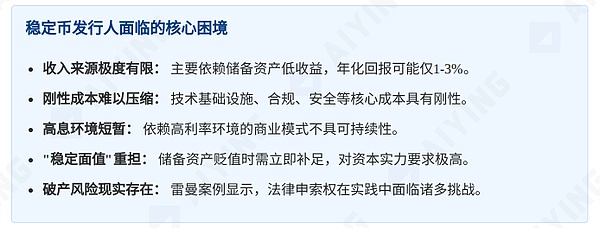

When we examine the profit dilemma of virtual banks together with the regulatory framework for stablecoins, an unavoidable contradiction surfaces:Stablecoin issuers with narrower business scopes and more investment restrictions may have a bleaker profit prospect, but they have to bear a disproportionate amount of risk responsibility.This contradiction not only concerns the sustainability of the business model, but also the long-term stability of the financial market.

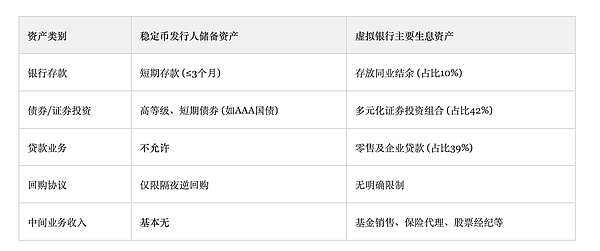

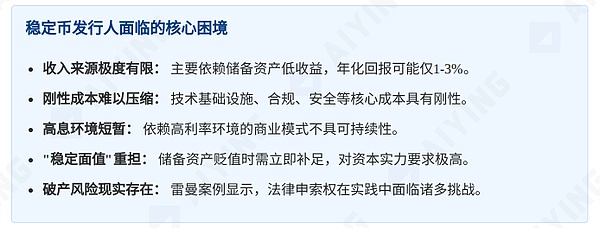

The "income desert" of stablecoin issuers: useless reserve asset income

1. Extremely single source of income

For stablecoin issuers, there are almost only two main sources of income:

Reserve asset management income:

text=""> Due to the limited investment scope, this part of the yield may only be 1-3% annualized (under normal interest rate environment). This means that for every HK$1 billion of stablecoins issued, the annual income may be only HK$10-30 million.

Transaction/redemption fees:

Considering market competition and user experience, these fees are usually low and difficult to become the main source of income.

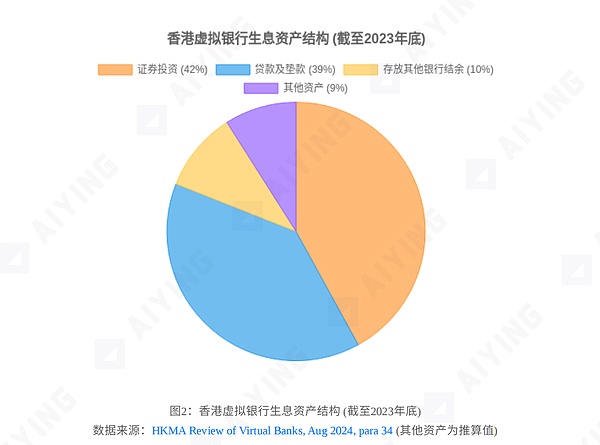

In sharp contrast, the virtual bank's diversified income structure: net interest income (from loans and broader investments), fee income (payment settlement, foreign exchange, etc.), intermediary business income (agent sales of financial products), etc.

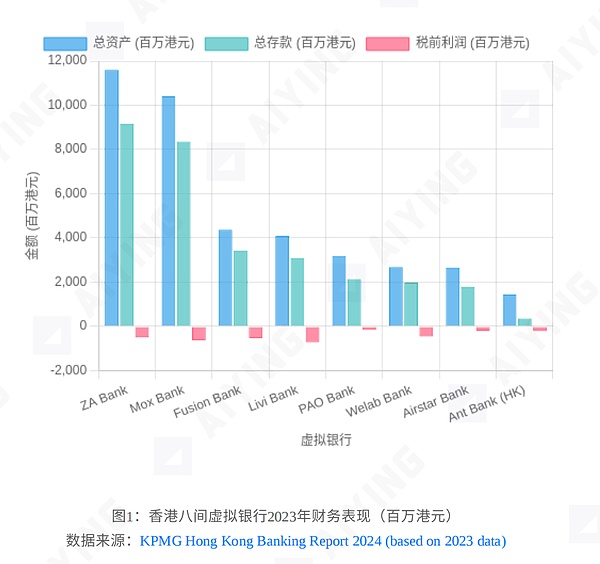

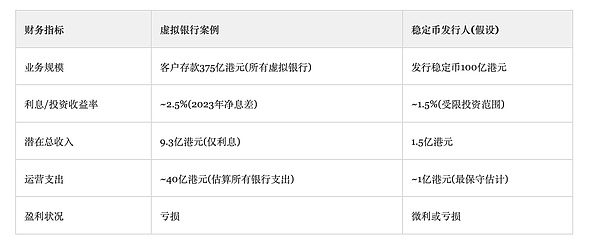

2. Real case: A realistic mirror of the bank's profit dilemma

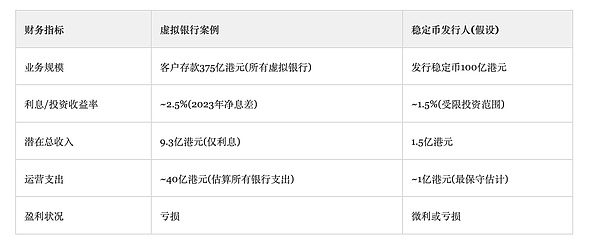

Let's look at some specific data: According to the financial report of ZA Bank, a leading virtual bank in Hong Kong, its net interest income in 2023 was HK$489 million, but its operating expenses were as high as HK$599 million. Even with non-interest income, it still recorded a loss of HK$232 million.

We can compare stablecoin issuers and virtual banks through a simple business model:

Even if we assume that

the operating costs of stablecoin issuers are much lower than those of virtual banks (in fact, core costs such as technical infrastructure, compliance, and security are difficult to significantly reduce), their profitability is still very limited.

3. "The world is bustling, all for profit": the double-edged sword of a high-interest environment

The global interest rate hike cycle that began in 2022 has increased the return rate of fixed-income assets to a certain extent, which seems to be a good thing for stablecoin issuers. However, this double-edged sword of "high interest rates" deserves careful consideration:

Short-term yield improvement:

Indeed, the high interest rate environment has temporarily increased the yield on reserve assets, which may increase from around 1% to 3% or even higher.

Long-term sustainability is in doubt:

Interest rate cycles are the norm in the macro economy. As inflationary pressures ease, many major economies have begun to cut interest rates. Once we return to a low-interest rate environment, the returns on reserve assets will shrink again.

Increased market risks:

In a high-interest rate environment, even short-term government bonds are subject to price volatility risks. In 2022, the US 1-3 year Treasury bond ETF fell by about 5% in one year, posing a challenge to issuers who must maintain a "stable face value".

"Relying on a high interest rate environment to make long-term business plans is like buying refrigeration equipment stocks in the summer, but forgetting that winter will eventually come."

4. The alarm bell of "Ponzi scheme"

In the case of worrying business sustainability, there is a theoretical risk that some issuers may rely on newly issued stablecoins to raise funds to pay redemption requests from early investors. This practice is essentially close to a Ponzi scheme.

The HKMA's regulatory framework is clearly committed to preventing such risks, building a firewall through multiple measures such as capital requirements, trust arrangements, and information disclosure. However, if a healthy profit model cannot be formed in the market, this risk will always exist like an "undercurrent".

"Loss Black Hole": When reserve assets depreciate, who will pay the bill?

1. The arduous mission of "stabilizing the face value"

We can understand the risk of reserve asset depreciation through a simplified scenario:

The issuer issued HKD 1 billion of stablecoins.

The reserve assets are all invested in short-term high-rated bonds (in full compliance with regulatory requirements).

The sudden market turmoil caused the value of these bonds to temporarily drop by 5%, and the market value of the reserve assets dropped to HK$950 million.

At this time, the issuer must immediately inject HK$50 million in funds to maintain the "stable par value".

The question is: Where does this HK$50 million come from? Injected from the issuer's own capital? Obtained from additional capital contributions from shareholders? Or through an emergency credit facility? For issuers that may already be operating at a small profit or loss, such an unexpected need for funds could be a fatal blow.

2. Practical Exercise: Liquidation Scenario Analysis

Consider an extreme but not impossible scenario:

Monday:

The value of a stablecoin issuer's reserve assets is exactly equal to the par value of the issued stablecoins.

Tuesday:

The global financial crisis broke out, and the value of reserve assets (although "safe" assets) fell by 10%. The issuer faced a large number of redemption requests, the capital chain was tight, and it was applied for liquidation.

In this case, can stablecoin holders recover their funds in full? The Stablecoin Regulations give stablecoin holders a claim against the issuer, but how much is the actual value of this claim when the issuer is insolvent?

The bankruptcy of Lehman Brothers in 2008 provides a mirror: despite the legal claims, holders of "mini bonds" issued in Hong Kong at that time only recovered about 70% of their investment amount on average, and they went through several years of legal procedures. And the recovery process at that time was jointly pressured by Hong Kong and US regulators to settle financial institutions, rather than relying solely on judicial channels.

3. Isolation does not mean value preservation: the limitations of trust arrangements

The trust isolation arrangement of reserve assets does provide important protection to ensure that these assets will not be misappropriated or mixed into the bankruptcy property of the issuer. However, this isolation cannot prevent the market value of the assets themselves from fluctuating.

For example, during the "new crown crisis" in March 2020, even ultra-safe assets such as US short-term Treasury bonds experienced liquidity constraints and price fluctuations. At that time, the bid-ask spread of US Treasury ETFs once widened to more than 10 times that of normal times. In such a special period, even isolated reserve assets may be difficult to quickly realize at par.

Lessons from the past: the revelation of the collapse of UST and the echo of the Lehman incident

History has never lacked challenges to the myth of "stability". In May 2022, UST, known as the "algorithmic stablecoin", collapsed from $1 to 26 cents, causing investors to lose about $40 billion in just a few days. Although the mechanism of UST is fundamentally different from the fiat-backed stablecoins under Hong Kong regulation, its collapse provides an important warning: financial products that claim to be "stable" are not necessarily stable.

The "minibond" crisis triggered by the bankruptcy of Lehman Brothers in 2008 is even closer. At the time, these structured investment products were marketed as "safe" investments by many banks, but as Lehman collapsed, investors found that the value of their "safe" assets had shrunk significantly, and the recovery process was long and complicated.

From a practical perspective, the actual risks of financial products are often not revealed in calm periods, but exposed during extreme market fluctuations. Therefore, stablecoin issuers not only need to meet the minimum regulatory requirements, but also build a sufficiently strong risk buffer to cope with the "once-in-a-century" market storm.

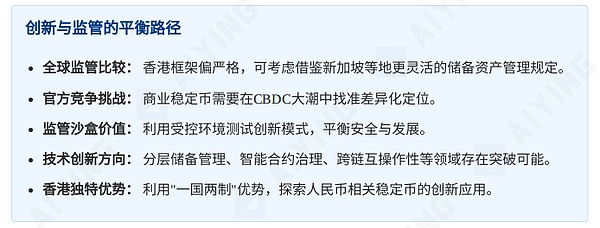

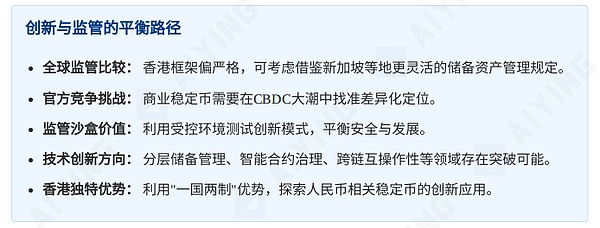

Fourth, the delicate balance between innovation and regulation: the future path of stablecoins

The balance between financial innovation and prudent regulation is like an acrobat walking on a tightrope. It should not be too conservative and stagnant, nor too radical and fall into the abyss of risk. Hong Kong's stablecoin regulatory framework was born in this context. It embodies both tolerance for innovation and vigilance against risks. However, how will this framework evolve in the future, and how will it affect the global digital financial landscape?

Global Perspective: Regulatory Convergence and Differentiated Competition

Major financial centers around the world are actively exploring stablecoin regulatory frameworks, and have formed different regulatory ideas and focuses:

Singapore:

The Payment Services Act introduced in 2022 explicitly includes stablecoins in the scope of supervision, but the restrictions on reserve assets are relatively flexible, allowing for more diversified asset allocation.

UK:

The Financial Services and Markets Act (FSMA 2023) gives the UK Financial Conduct Authority and the Bank of England the power to regulate stablecoins, with a focus on transparency and consumer protection.

US:

There is a lack of a unified framework at the national level, and there are significant differences in regulation among states. New York State's BitLicense requirements are the most stringent, but the investment scope restrictions on reserve assets are relatively moderate.

Hong Kong's regulatory framework appears to be relatively strict in international comparison, especially in the management of reserve assets. This strictness is conducive to building market confidence and preventing systemic risks, but it may also be at a disadvantage in global competition.

More importantly, with the rapid development of central bank digital currencies (CBDCs) around the world, commercially issued stablecoins will face competition from official digital currencies. China's digital RMB and the EU's digital euro projects are accelerating. Against this background, if commercial stablecoins cannot provide clear differentiated value, their living space will be further squeezed.

Financial Technology Innovation: Regulatory Sandbox and Structural Breakthrough

Faced with the tension between regulation and innovation, the "Regulatory Sandbox" model provides a balanced path. As early as 2016, the Hong Kong Monetary Authority launched the Fintech Regulatory Sandbox, allowing banks to test innovative solutions in a controlled environment.

For stablecoins, the following innovative directions may be worth exploring:

Layered reserve architecture:

Divide the reserve assets into a core layer (high liquidity) and a value-added layer (moderately expand the investment scope), while ensuring basic security and improving overall returns.

Smart contract-driven automated governance:

Use blockchain technology to automate and make reserve management transparent, reducing the risk of human intervention and operating costs.

Cross-chain interoperability:

Design stablecoins that can be seamlessly transferred between multiple blockchain networks to improve ease of use and application scenarios.

Customized risk management tools:

Develop risk hedging tools specifically for stablecoins, such as stablecoin insurance products or derivatives, to provide additional protection for issuers and holders.

Hong Kong has a mature financial market and an active technological innovation ecosystem, and is fully capable of pioneering in these areas. For example, the Hong Kong University of Science and Technology has established a laboratory dedicated to the study of stablecoins and digital currencies to explore various possibilities for technological innovation.

In addition, Hong Kong's unique "one country, two systems" advantage provides potential opportunities for exploring RMB-related stablecoins. As Hong Kong develops into a global offshore RMB business hub, compliant, secure and efficient RMB stablecoins may become an important bridge connecting the Chinese market with international investors.

Conclusion: Smart ways to participate in the stablecoin ecosystem

Looking back at the full text, we see that the Hong Kong stablecoin regulatory framework has a firm stance on safeguarding financial stability, and also recognizes the severe business challenges that stablecoin issuers may face. In such an environment, how should market participants act wisely?

A Practical Guide for Market Participants

1. Survival Strategies for Stablecoin Issuers

For issuers interested in entering the stablecoin market, the following strategies are worth considering:

Scale effect is key:

Given the limited yield on reserve assets, sufficient issuance scale is a prerequisite for profitability. It is difficult for small participants to survive in this market.

Establishing ecosystem advantages:

It may be difficult to make a profit by issuing stablecoins alone, but using stablecoins as part of the overall financial services ecosystem can provide more profit opportunities. For example, using stablecoins as an entry point to carry out compliant value-added services such as payment, settlement, and international remittances.

Adequate capital is crucial:

Not only must the regulatory minimum capital requirements be met, but there must also be sufficient capital buffers to cope with extreme market fluctuations.

Investment in technology and professional talents:

Stablecoin is a fusion product of finance and technology, which requires a cross-disciplinary professional team, especially experts in risk management, asset management, compliance and blockchain technology.

Transparency construction is the first priority:

On the basis of sound internal control, build a sound information disclosure mechanism, regularly publish audited reserve certificates, and establish market trust.

Aiying believes thatoperating a stablecoin is like opening a beverage store that can only sell boiled water. You must find value creation points in other aspects, otherwise the costs will not be covered at all. 2. A wise choice for investors For individual and institutional investors who are considering using or holding stablecoins: Don't be confused by the word "stable": The risks of stablecoins essentially depend on the qualifications, strength and quality of the issuer's reserve assets. "Licensing" does not mean "zero risk". "

2. A wise choice for investors For individual and institutional investors who are considering using or holding stablecoins: Don't be confused by the word "stable": The risks of stablecoins essentially depend on the qualifications, strength and quality of the reserve assets of the issuer. "Licensing" does not mean "zero risk". text="">Understand the differences between different types of stablecoins:

Different stablecoins, such as fiat-backed, crypto-collateralized, and algorithmic, have very different risk profiles.

Alex

Alex