Author: Pavel Paramonov, blockchain researcher; Translator: Golden Finance xiaozou

1. Preface< /h2>

In the crypto space, there are countless activities that people can engage in, such as investing in assets, purchasing tokens and NFTs, doing research, developing decentralized applications, and participating in Airdrop mining, etc. However, the thread that ties all stakeholders in the crypto space together is transactions. Almost every user participates in transactions, whether it is long or short positions on an exchange, the exchange of assets in a liquidity pool, or the exchange of non-fungible tokens on the NFT market. Interestingly, even illiquid assets are traded in the crypto space primarily through peer-to-peer (P2P) processes.

Due to the lack of liquid markets for illiquid assets, trading of items such as crypto points, airdrop allocations, and whitelists are often conducted in the over-the-counter (OTC) market. In this case, people dialogue and negotiate deals with each other regarding the transaction process. However, there are significant challenges in the form of trust between actors. Trust is critical because one must rely on the certainty that a specific user owns specified assets and will deliver those assets after a transaction. This creates the possibility of malicious activity, which creates risks.

What if we could build a trustless third party that facilitates secure transactions between both parties, provides security, and prevents fraudulent activity? This is exactly the goal of Whales Market.

2. Airdrop 101

Most of us know that airdrop is to select The process of sending free tokens to users whose wallet address or who meet certain criteria (complete certain activities within a certain time period). But how did it all begin?

The first cryptocurrency airdrop occurred in March 2014, when Iceland launched Auroracoin. Every citizen received free tokens, increasing from the initial 31.8 AUR to 636. The purpose of these airdrops is to create a market for the token and increase awareness. However, it’s worth noting that sending tokens requires a gas fee, which becomes expensive as gas prices and ETH prices increase.

Then the airdrop will be converted into a claim for free tokens. Recipients can receive the tokens for free, but must pay transaction gas fees. The gas cost is usually small compared to the token value, so it's usually not an issue. However, as the project grew, they realized that it would be harmful to distribute the tokens to random users who might sell them off. Initially, launching a token early allows a project to gauge potential user interest and secure funding. But later, after a lot of investment, it became clear that distributing tokens to random users would do no good and might even harm the project.

In September 2020, Uniswap made a significant impact by airdropping UNI tokens to more than 250,000 addresses. These addresses are eligible because they interacted with the platform before September 1, 2020, and earned at least $400 in UNI tokens. The airdropped UNI tokens provide voting rights (which remains their primary use), allowing users to vote on protocol changes and proposals.

This has led to the emergence of a new user group called airdrop farmers. They will make transactions that don’t contribute much to the value of the protocol but allow them to rank higher in airdrop rewards. For example, if the airdrop rules were based on the number of transactions in a wallet, they would create a large number of transactions by repeatedly trading the same amount, even if this incurs a cost.

In order to cope with airdrop mining, the project has implemented more advanced strategies and mechanisms. The Optimism L2 platform launched a double airdrop. Users must actively participate in the governance of the protocol to qualify for the second round of airdrops. The second round of airdrops will not start until 9 months later. The Blur NFT market uses a multi-layer airdrop mechanism to capture market share from OpenSea. They require users who list NFTs on other platforms to also sell on Blur at a lower or equivalent price and take advantage of certain protocol features such as NFT series bidding. In the latest round of airdrops, users were even asked to delist their NFTs on other markets to receive the most BLUR airdrops.

3. Points 101

Each project is adopting a "points system". Points can be earned by contributing to the community. Founders are increasingly integrating off-chain points programs into their applications, such as:

Rainbow Wallet uses points to reward Ethereum usage

Friend .tech builds sticky loops based on points

Blur launches L2 Blast Points as incentives for funding bridging (since November TVL has exceeded US$800 million).

This trend is part of a broader exploration of product-market compatibility within the crypto industry and comes amid market downturns part of your user attraction strategy.

There will be discussions among users about the possibility of converting these accumulated points into project tokens, a trend observed in recent high-profile airdrops.

4. Illiquid encryption trading market

There are many things in the encryption field that are not decentralized Exchanges are available for trading, such as whitelisting, pre-TGE airdrop distribution, P2P trading of points, tokens and NFTs, etc.

For a long time, these transactions have usually been completed through communities, private messages and centralized platforms. However, these methods often lack security measures, which exposes traders to the risk of fraud, where scammers fail to deliver the coins they promise to deliver.

The main reason is that these transactions do not require commitment from the relevant parties because the transaction paths between them are isolated.

While there is no decentralized market for these transactions yet, such a market could increase liquidity and benefit both buyers and sellers. To achieve this, a solution is needed to integrate a trustless system that prevents malicious behavior.

5. Introduction to Whales Market

Whales Market is designed to solve the above problems. Create a marketplace that makes the trading of illiquid assets more secure, trustless, and accessible to everyone.

Whales Market solves this problem by integrating OTC trading on a unified platform. Here, both buyers and sellers can conduct mutually agreed upon on-chain transactions. Funds are securely protected within smart contracts and are only paid out to the relevant parties after a successfully completed transaction. This feature not only simplifies the transaction process, but also significantly reduces potential financial losses caused by fraudulent activities.

Whales Market is developed by the same team that developed LootBot. The protocol was created in the summer of 2023, when Telegram Bots were gaining popularity. The concept is simple yet functional, a Telegram bot designed to simplify most of the arduous tasks in airdrop mining.

Using the successful experience gained on LootBot, the team decided to create a more ambitious and complex product-Whales Market.

6. Product Overview

Whales Market supports 3 main types of markets: Pre-market Release market, OTC market, points market. Let's look at it in detail.

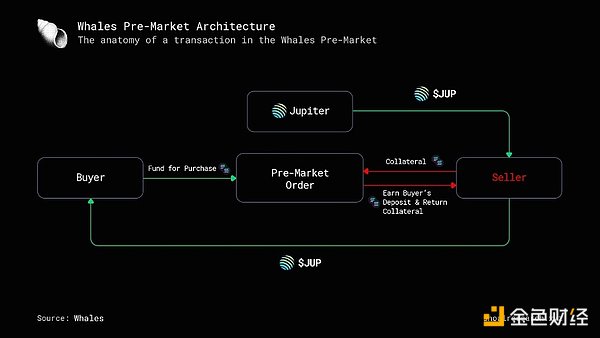

(1) Pre Market (pre-release market)

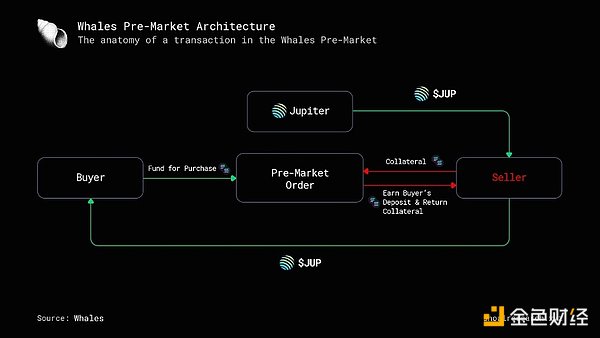

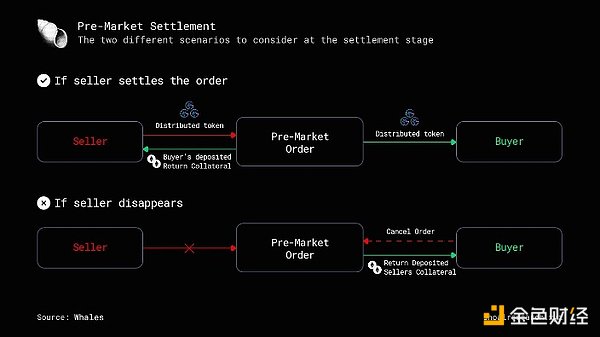

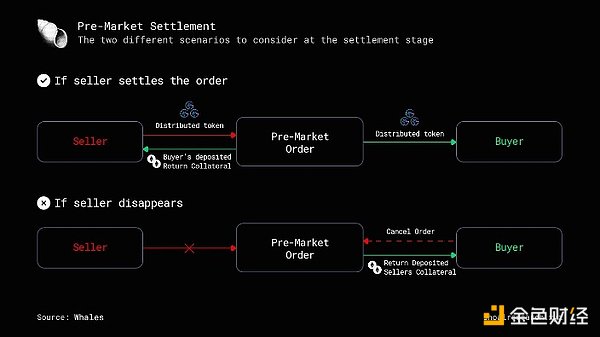

On Whales Market The core system for conducting pre-listing token trading relies on collateral. Sellers lock assets as collateral, guaranteeing buyers that they will receive the tokens once they are officially launched. If the seller fails to fulfill the order, its collateral becomes the property of the buyer as compensation.

However, this system is not without potential drawbacks, especially when dealing with a points system.

We have previously written about pre-issuance perpetual futures contracts and how perpetual futures contract exchanges enable traders to take advantage of trading assets that have not yet been released.

However, the Whales Pre Market is different in that it allows for the purchase of TGE’s pre-token allocation. Most of us know that this is common in different private communities and some centralized platforms. These methods often fall short in terms of security, leaving traders vulnerable to fraud or failure to deliver promised tokens. Whales Market changes this process by using smart contracts to support on-chain transactions agreed upon by buyers and sellers, preventing fraudulent activities.

< /p>

< /p>

There are two ways to buy and sell tokens:

Both buyers and sellers need to wait for a token generation event (TGE) before settling or canceling an order. When TGE occurs and tokens are released by the foundation, settlement between buyers and sellers will enter a 24-hour countdown. If the seller fails to settle in a timely manner, they will lose their collateral funds. If the buyer decides to cancel the order, these funds will be transferred to the buyer.

< /p>

< /p>

(2) OTC Market (OTC market)

The OTC market has always been conducted through various informal channels such as chat rooms, social media sites and private messages. P2P trading of tokens and non-fungible tokens (NFTs).

While these methods are convenient, they lack strict security measures, leaving traders vulnerable to fraud and scams. Similar to the pre-release market, Whales Market uses smart contracts to address vulnerabilities to reduce potential risk of loss.

In order to ensure user safety, Whales Market maintains a list of tokens that can be used for OTC market transactions. These tokens are select tokens that have reached a minimum liquidity pool of $300,000 on decentralized exchanges.

Users can also trade tokens that are not on the list, but the platform will display a warning sign prompting users to verify their minting address before proceeding with the transaction.

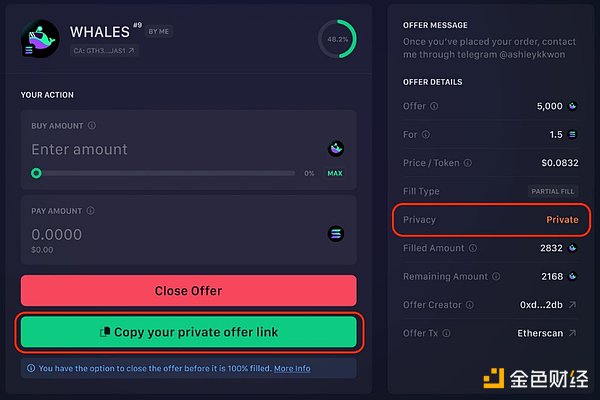

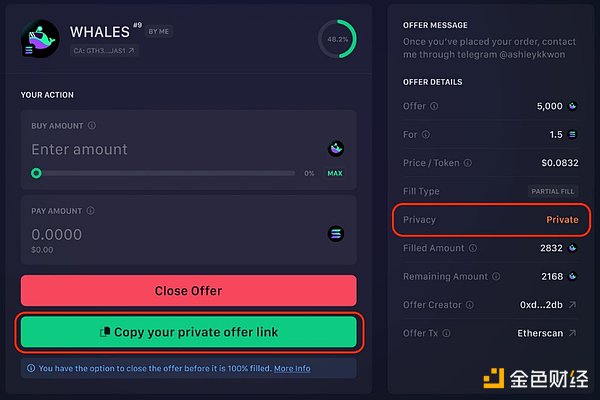

To protect the privacy of transaction creators’ quotes, Whales Market has implemented a new feature. This feature allows them to share the quote access link individually with the people they want to trade with. Therefore, private offers are not visible on the public market and can only be accessed through the unique offer link provided by the creator.

< /p>

< /p>

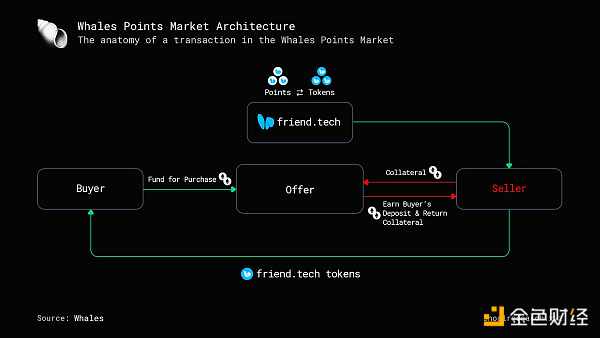

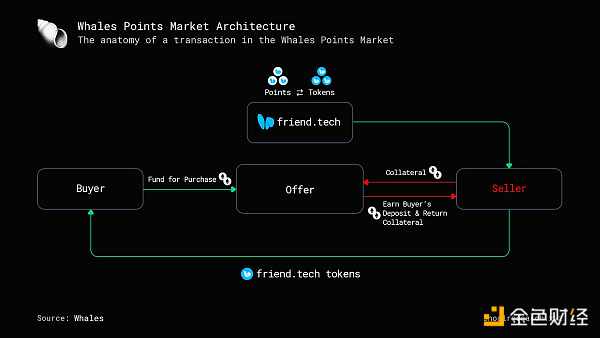

(3) Points market

Similar to the OTC market, the points market Supports secure peer-to-peer transactions. The number of projects using the Points System is growing every day, and as most of us know, with growth comes room for speculation. Whales Market uses smart contracts to support agreed-upon on-chain transactions between buyers and sellers.

Once The foundation issues tokens and the 24-hour settlement countdown will begin. After the token is released, Whales Market will automatically convert the points into the corresponding token according to the foundation’s announcement.

Once The foundation issues tokens and the 24-hour settlement countdown will begin. After the token is released, Whales Market will automatically convert the points into the corresponding token according to the foundation’s announcement.

Risks involved

Points orders must be set up in advance. But the final token conversion rate will not be announced until TGE. This may result in sellers ending up with points that significantly exceed the value of the tokens they receive, potentially resulting in adverse consequences for the seller.

Currently, Whales Market supports Friend.tech’s point transactions. In the future, they plan to add these features to protocols such as MarginFi, Kamino, EigenLayer, and Rainbow.

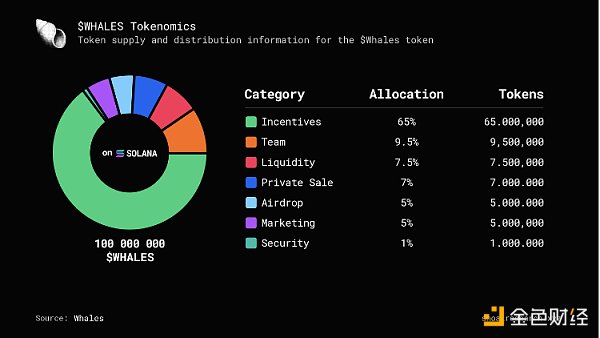

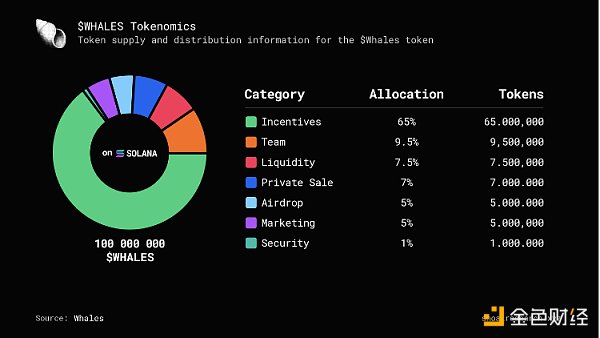

7. Token Economics

The entire ecosystem of Whales Market revolves around Its native token WHALES runs. The main utility of WHALES tokens include:

Revenue sharing: 60% of the fees collected will be redistributed to WHALES token stakers

Development fee: 20% To pay for ongoing development expenses

Repurchase and destruction: 10% is used to repurchase tokens and destroy tokens, create Deflation mechanism

LOOT revenue sharing: 10% is distributed to LOOT pledgers and xLOOT holders.

To ensure that it contributes to the growth of the protocol, token distribution is tied to specific key performance indicators (KPIs) related to transaction volume . WHALES holders have the ability to participate in voting on these KPIs.

Whales The Market team has demonstrated their long-term commitment to the development of the protocol with a 9-month cliff period and a 36-month vesting period, allocating themselves only 9.5% of the total supply.

Whales The Market team has demonstrated their long-term commitment to the development of the protocol with a 9-month cliff period and a 36-month vesting period, allocating themselves only 9.5% of the total supply.

(1) Staking

Whales Market collects fees from the OTC market Earn revenue, with 60% of fees distributed to WHALES stakers. When users stake WHALES, they will receive xWHALES rewards, which serve two purposes: to capture a portion of the proceeds, and to act as collateral in all OTC markets.

The pledge mechanism works as follows:

The staking contract includes a pool of two types of tokens: WHALES and xWHALES.

Participants stake their WHALES tokens and receive xWHALES tokens in return.

Holding xWHALES tokens allows stakers to receive more and more WHALES rewards.

To achieve this, the contract uses the revenue created to continuously buy WHALES tokens and then adds them to the staking pool .

The exchange rate of xWHALES to WHALES increases, benefiting stakers.

This mechanism also prevents selling of WHALES tokens after claiming rewards, since rewards are gradually distributed over time.

(2) Reward distribution

According to the blockchain (EVM, SOL, etc.) and Depending on the specific market, fees will be charged for different assets. To simplify the process of claiming rewards, the protocol periodically converts collected tokens into $WHALES tokens.

These transactions can be easily observed on the protocol’s dashboard. The distributed WHALES tokens will then be divided equally among stakers as rewards.

Stakers have the flexibility to withdraw their xWHALES tokens and exchange them back for WHALES tokens at any time.

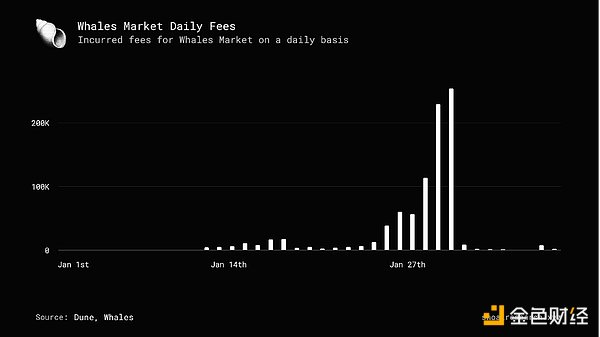

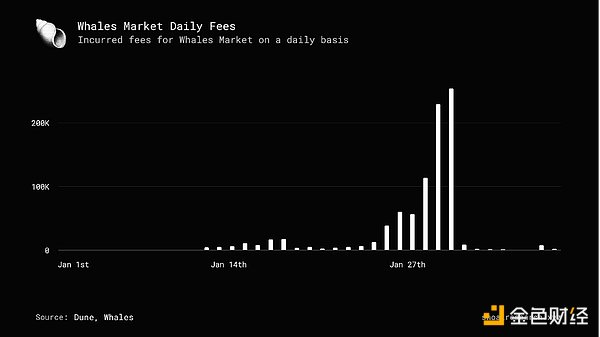

8. Income

As we mentioned in the Token Economics section, WhalesMarket passes Earn revenue from fees on their markets (Pre-release Market, OTC Market, and Points Market). Let’s take a look at their fees and which operations require payment.

On the pre-release market, certain operations, such as closing quotes, settling orders, purchasing tokens, and canceling orders, require fees. If you choose to close the quote, you will need to pay a 0.5% platform fee. For settlement orders (buy), a 2.5% platform fee will be charged. When you make a buy offer or fulfill another user's sell offer, there is also a platform fee of 2.5% on the total tokens purchased. If you cancel a token buy order, for example because the seller suddenly disappears, a 2.5% platform fee will be incurred.

In the OTC market, Whales Market only charges listing and sales fees. Whenever you create an offer, whether to buy or sell, there is a 0.1% fee and is included in your total deposit. When you complete a purchase offer by selling tokens, a fee of 0.1% applies and will be deducted from the amount of tokens you receive.

In the points market, users pay fees for closing quotes (buy or sell), settling and canceling orders, and purchasing points. If you choose to close the quote, the platform fee is 0.5%. For all other cases, the fee payable is 2.5%.

9. Valuation

In order to determine the fair valuation of Whales Market, we will Use three key indicators for comparative analysis:

These metrics will be compared to two major competitors : Uniswap and Blur. Uniswap was selected as the most popular decentralized exchange currently, while Blur was selected as the most popular NFT market with its own points system, significantly surpassing OpenSea.

By comparing these metrics, we aim to gain insight into Whales Market's valuation relative to established players in the blockchain space.

(1) Profit to TVL ratio

The current profit to TVL ratio is as follows:< /p>

Whales Market:0.02

Blur Marketplace: 0.36

These charges are incurred since the inception of the Agreement. While Blur's ratio is much higher, it's worth noting that Blur is much older than Whales Market, which only launched in early January 2023.

However, when we examine the data for the past two months and compare earnings over this period to TVL, we get significantly different results:

p>

Whales Market:0.02

Blur Marketplace: 0.02

Obviously, they are currently in equal proportions, which suggests that they generate almost the same percentage of fees. Blur's current FDV is $2.26 billion, while Whales Market's current valuation is $264.33 million, which means there is almost a 10-fold gap between the two.

(2) Market capitalization to TVL ratio

Now, let us compare Whales Market The market capitalization to TVL ratio of , Blur and Uniswap:

Whales Market: 1.35

Uniswap: 1.13

Blur: 5.94

As we can see, Blur has the highest ratio, This suggests that it may be overvalued compared to Uniswap and Whales Market.

It is worth mentioning that TVL under market capitalization is slightly different. In Whales Market, it is called total custody value (TVE: Total Value Escrowd), acting as an escrow between the parties. The mechanism of Uniswap is slightly different from other decentralized exchanges.

(3) Pledged assets to market capitalization ratio

This indicator only applies to Blur and Whales ;Market. So, let’s take a closer look at the current pledged assets to market capitalization ratios between these protocols:

< li>Whales Market: 35%

Blur Marketplace: 30 %

Basically, this means that the Whales Market still has a lot of growth in terms of pledged assets in the protocol Space, the ratios of these protocols are very close, but we should also note that Whales Market is only 3 months old.

10. Conclusion

In short, Whales Market is illiquid and decentralized The cryptocurrency market offers comprehensive solutions. Through its product overview, it provides support for various markets, including OTC markets, pre-release markets, and points markets. Additionally, token economics, staking options, and revenue streams ensure the ecosystem is sustainable and profitable. Overall, Whales Market offers a promising platform that solves the challenges faced by P2P traders in the cryptocurrency market.

JinseFinance

JinseFinance

< /p>

< /p> < /p>

< /p> < /p>

< /p> Once The foundation issues tokens and the 24-hour settlement countdown will begin. After the token is released, Whales Market will automatically convert the points into the corresponding token according to the foundation’s announcement.

Once The foundation issues tokens and the 24-hour settlement countdown will begin. After the token is released, Whales Market will automatically convert the points into the corresponding token according to the foundation’s announcement.  Whales The Market team has demonstrated their long-term commitment to the development of the protocol with a 9-month cliff period and a 36-month vesting period, allocating themselves only 9.5% of the total supply.

Whales The Market team has demonstrated their long-term commitment to the development of the protocol with a 9-month cliff period and a 36-month vesting period, allocating themselves only 9.5% of the total supply.