My friends have begun to learn about stablecoins through Circle.

After Circle went public, its stock price soared from $31 at the time of issuance to more than $200, attracting a lot of attention to stablecoins.

The market's recognition of Circle, on the one hand, shows how much Wall Street values stablecoins, and on the other hand, the most important thing is that stablecoin-related targets are very scarce.

If you want to know more about stablecoins, you still need to first understand the path that Circle has taken: How did Circle get all the way to where it is now?

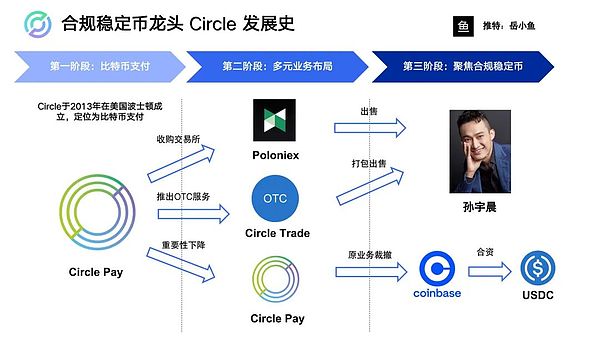

Overall, Circle’s development history has been full of twists and turns, going through three major stages:

The first stage was in 2013,Circle was founded in Boston, USA, and was initially positioned as a Bitcoin payment, similar to “Bitcoin Alipay”.

The name of this product is “Circle Pay”.

The second stage was in 2018, Circle has become a very diversified company.

Circle now has three major business lines: cryptocurrency trading platform Poloniex, over-the-counter trading OTC, and the original payment business Circle Pay.

The third stage was in 2019, Circle closed all three main lines of business and only retained the stablecoin business USDC.

What happened in between these stages? Why are there changes in these stages?

We can dive in together and explore it in detail.

1. From Bitcoin Payment to Diversified Business Layout

First, in the first stage, that is, around 2013, Bitcoin fluctuated violently, and its price often soared and plummeted, so it was not suitable as a stable payment medium.

By 2017, the cryptocurrency market entered a bull market, the price of Bitcoin rose to nearly $20,000, and other cryptocurrencies such as Ethereum also rose rapidly.

The ICO (Initial Coin Offering) craze and the surge in blockchain projects have driven the demand for exchanges and trading services.

Circle also took advantage of the opportunity to enter the exchange business field. In 2017, Circle acquired the US compliant exchange Poloniex for approximately US$400 million.

At that time, Poloniex had a market share of approximately 60% in the United States and was the number one exchange, which also became the core of Circle's business.

After having such an exchange, Circle expanded its OTC services, which is actually the over-the-counter trading business, helping institutions to match large-scale cryptocurrency transactions over the counter.

As a result, Circle has formed three major business lines: exchanges, OTC, and payment services.

2. Shrinking from diversified businesses to stablecoins

The good times did not last long. From 2018 to 2019, the cryptocurrency market experienced a very bleak crypto winter.

Before Circle acquired Poloniex, Poloniex's market share in US compliant exchanges was around 60%.

However, by the second half of 2019, Poloniex's market share in the entire US compliant exchange was less than 1%.

And at that time, the entire crypto market in the United States was in a sensitive period of policy. They had to remove many trading pairs that were considered to be suspected of securities, so at that time, the trading business was actually struggling and Circle was on the verge of bankruptcy.

In 2018, Circle raised $3 billion, but by 2019, its valuation in the secondary market was only $700 million or $800 million.

There are opportunities in crises.

In 2017, the Chinese government issued 94 bans, suspending the operations of all Chinese exchanges, resulting in the emergence of a large number of offshore exchanges in the market.

Offshore exchanges have become the main trading venues for cryptocurrencies, and the stablecoins issued by USDT have become a particularly popular product in these exchanges.

A large number of trading pairs have changed from direct transactions between fiat currencies and cryptocurrencies to direct transactions between USDT, a stablecoin, and cryptocurrencies.

The stablecoin business really saw its first growth from the launch of Tether in 2014 to 2017. @Tether_to

So all parties with this resource hope to explore the stablecoin business, and stablecoins have become a very popular business for the first time.

Although all offshore exchanges are using USDT, there is a lack of a compliant stablecoin.

Circle also saw this track at the time. Circle felt that it could occupy a track and promote some of their other businesses at the time, so it decided to do USDC.

However, the stablecoin USDC is only a product issued by a joint venture between it and Coinbase, and its main business line at the time was the cryptocurrency trading platform Poloniex.

Therefore, when entering the crypto winter from 2018 to 2019, the stablecoin USDC, as a marginal business, became Circle's only growing business.

So, Circle made a very important move: it sold Poloniex to Justin Sun and divested all its businesses, leaving only the USDC-related business.

At this point, Circle entered the third stage: focusing on stablecoins.

3. Completely turning to the stablecoin business

When Circle and Coinbase established a joint venture company Center as the issuer of USDC, the two companies basically held Center's equity and control on a 50-50 basis, and the two companies shared equally in all aspects of the issuance and governance of USDC. @coinbase

But strictly speaking, in the past few years, the main promoter of USDC and its operation has been Circle, because Coinbase's main business is still the exchange.

In the second half of 2023, Coinbase and Circle closed the joint venture Center, and all control and governance rights were given to Circle, basically letting Circle take full responsibility for the operation of USDC.

After the DeFi Summer of the last cycle, and then the resurgence of Solana, USDC experienced a wave of rapid growth.

Now, with the implementation of crypto-friendly policies after Trump took office, USDC has grown rapidly again, with an increase of 80% in the past year.

Circle took the opportunity to go public and became the first compliant stablecoin on the US stock market, bringing a very strong demonstration effect and benchmark effect.

To sum up

No company's development is smooth sailing. Even Circle, the first compliant stablecoin, has experienced twists and turns, and was even on the verge of bankruptcy before.

What did Circle do right?

First, it was because Circle was able to keenly grasp the potential market trends and laid out the stablecoin business in advance when the exchange business was booming.

Although it can be said that Circle does whatever is hot, it is also because it can move forward with the market trend, so it can also seize a glimmer of life in the crisis and rise again.

There is no company that can last forever. Only by seeing the market development trend and responding to the market quickly can it continue for a longer time.

Many large platforms/tracks/trends have developed from a single point, from point to surface, and finally to scale.

Therefore, we must find a specific scenario and a clear type of user, serve this group of users well, and verify the feasibility of our business logic, and there will be unlimited possibilities in the future.

Let's encourage each other.

Kikyo

Kikyo

Kikyo

Kikyo Brian

Brian Brian

Brian Brian

Brian Joy

Joy Brian

Brian Alex

Alex Alex

Alex Alex

Alex Kikyo

Kikyo