Author: Crypto Salad

With the continuous improvement and development of the RWA regulatory framework, more and more RWA projects have begun to land overseas. The core of the RWA project is to tokenize real-world assets. Once it comes to the token issuance business, since the laws and regulations of various countries have high compliance requirements for token issuance, the project party must "compliance first" when promoting the RWA project. The choice of the issuer is the basic but very critical point in the compliance of token issuance.

In recent years, due to its open regulatory attitude and perfect institutional framework, Singapore has gradually become a "cryptocurrency paradise" sought after by entrepreneurs and investors in the cryptocurrency industry. It seems that choosing the Singapore Foundation as the issuer of the RWA project has become "natural".

What exactly is the foundation often mentioned in the cryptocurrency industry, and what is the difference between it and the traditional fund?

Why do RWA projects usually choose foundations as the main body of currency issuance? Is the foundation the only choice?

Why do people choose Singapore Foundation as the main body?

In 2025, is the Singapore Foundation still the best main body for the RWA project to land? Are there other regions or other types of entities to choose from?

The Crypto Salad team has been deeply involved in the cryptocurrency industry for many years and has rich experience in dealing with complex cross-border compliance issues in the cryptocurrency industry. In this article, we will combine the legal frameworks of various countries and the team's practical experience to sort out and answer the above questions from the perspective of professional lawyers.

1. What is a foundation? What is the difference between a foundation and a traditional fund?

Although different countries' laws have different definitions and structures for "foundations", most foundations have at least the following characteristics:

Non-profit and public welfare: Foundations are established for public welfare purposes, and the income from operations is only used for reinvestment by the foundation, and benefits cannot be distributed to members. Compared with a company, a foundation does not have shareholders (Shareholders), only members (Members).

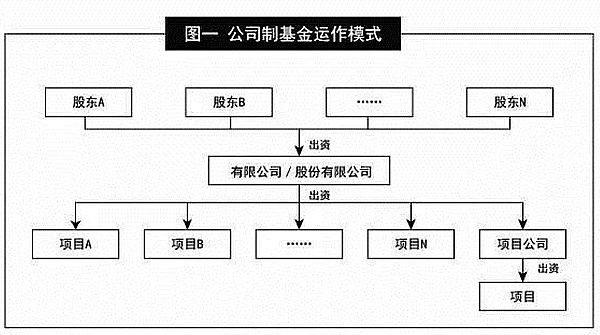

Has independent legal personality: As an independent legal entity, a foundation has its own assets and internal governance institutions. For example, some foundations have a board of directors and a board of supervisors to manage the daily affairs of the foundation's operations.

(The above picture shows the internal governance model of a certain foundation, for reference only)

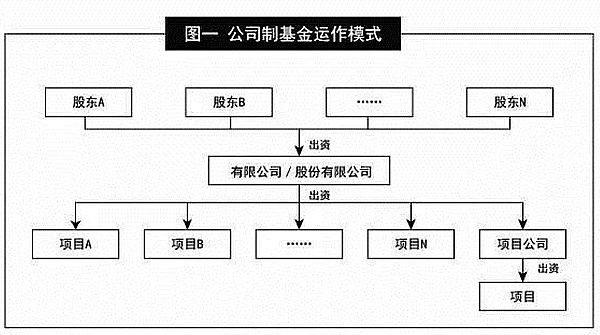

In contrast, the traditional "fund" is essentially an investment tool or a collection of capital pools. The "fund company" commonly seen in the financial industry is actually a type of "fund manager". Fund companies raise investors' funds to form a capital pool by issuing "fund products", and obtain returns for investors by managing the capital pool, and finally complete the "raising, investing, managing, and withdrawing" of the fund, and collect management fees from it.

(The above picture shows the operating model and legal structure of the corporate fund)

From this, we can see that although "Fund" and "Foundation" are similar in daily expression, their meanings at the legal level are very different.

Second, why does the cryptocurrency industry have a special liking for foundations?

First, foundations are usually non-profit and public welfare. The purpose of their establishment is to promote the development of social public welfare, rather than to maximize the interests of centralized institutions or specific natural persons, which corresponds to the decentralized characteristics of the cryptocurrency industry. The foundation will not distribute benefits to the members of the organization. The members only participate in the governance of the foundation as the managers of the foundation. This feature also coincides with the governance framework of community autonomy advocated by the cryptocurrency industry and the Web3 field. Therefore, cryptocurrency entrepreneurs choose the foundation as the main body, which is not only conducive to the packaging and promotion of the project, but also easier to gain the trust of investors and community participants.

Secondly, more and more project parties use the foundation as the entity of the project, a large part of the reason is also because of the influence of the famous Ethereum Foundation. Ethereum (ETH), as the second largest mainstream cryptocurrency in the world, has also chosen the foundation as its operating entity. Since Ethereum's important position in the cryptocurrency industry is second only to Bitcoin, the Ethereum Foundation naturally has great influence, so it has also influenced many new Web3 industry entrepreneurs and players to choose the foundation as an entity.

Finally, due to the non-profit nature of the foundation itself, in the laws of many countries, the foundation can obtain the right to tax exemption or obtain specific tax benefits after meeting certain conditions or obtaining specific approvals. Therefore, choosing a foundation as the main body of the coin issuance can enjoy tax exemptions or preferential treatment, thereby reducing the operating costs of the project.

In short, after a long period of development abroad, the foundation's own institutional framework has been very complete and mature. And the characteristics of the foundation itself are very consistent with the various practical needs of the cryptocurrency industry. Moreover, since the practitioners and participants in the cryptocurrency industry are showing a very significant trend of younger people, they are also very interested in the foundation, which is a more serious subject form known by the traditional "old money". Therefore, this concept has gradually become a trend in the currency circle, thus attracting more and more attention and attention.

However, it should be noted that from a legal point of view, if you want to complete the issuance of tokens, you do not necessarily need to go through the foundation as a subject. In fact, the RWA project party can also choose traditional private limited companies, joint-stock companies and other profit-making entities as the coin issuance subject. Most project parties choose the foundation as the coin issuance subject, which may be more of a comprehensive decision made from a commercial perspective such as project promotion, operating costs, and tax planning. Therefore, practitioners do not need to be too superstitious about the foundation, which is not the only coin issuance subject of the RWA project. Moreover, as a non-profit organization, although the foundation can receive cryptocurrency assets, it cannot open an account in a commercial bank in many countries or regions. Therefore, if the foundation is used as the issuer of the currency, a private limited company is usually established to match it.

Three,What is a Singapore foundation? Why does the RWA project tend to choose a Singapore foundation as the issuer of the currency?

It should be noted here that the so-called "Singapore Foundation" is more like a customary term in the cryptocurrency industry. From a legal point of view, there is actually no concept of a foundation in the traditional sense in Singapore law. The "Singapore Foundation" often mentioned in the cryptocurrency industry actually refers to a legal entity that is recognized as a "non-profit organization" (Not-for-Profit Organization) according to Singapore law. Many types of legal entities can be recognized as non-profit organizations, such as a public company limited by guarantee, a society or a charitable trust. For the RWA project, the legal entity of a guarantee company is usually chosen. Therefore, the so-called "Singapore Foundation" in the cryptocurrency industry is actually a guarantee company limited by shares that is recognized as a "non-profit organization".

The main reasons why the cryptocurrency industry often chooses Singapore Foundation as the issuer of currency are as follows:

First, the Singapore authorities have been relatively open and tolerant to the cryptocurrency industry entering Singapore in the past few years. This can be specifically reflected in the approval of the registration application of the foundation as the issuer of currency by the Singapore authorities. At that time, many cryptocurrency projects could easily pass the relevant approvals and complete the token issuance in the form of a Singapore foundation.

Second, the Singapore government actively supported the development of blockchain and cryptocurrency in the past few years, providing a world-leading legal framework and regulatory environment for token issuance activities.Not only is cryptocurrency recognized as legal in Singapore, but any contract involving cryptocurrency will not be deemed illegal because it involves cryptocurrency. At the same time, Singapore has also formulated a complete legal framework for cryptocurrencies, and the relevant laws and regulations cover various aspects such as ICO (initial coin offering), taxation, anti-money laundering/anti-terrorism, and the purchase/trading of virtual assets.

Finally, Singapore has a very developed local financial and legal infrastructure, which has long attracted the attention of various international capitals and has a good international reputation. Therefore, setting up a coin issuer in Singapore will make the project more credible and professional. At the same time, Singapore and China are in the same time zone, East 8, and there is no time difference between the two, which is also very friendly to the large number of Chinese players and project parties in the currency circle.

In 2025, can the RWA project still choose the Singapore Foundation as the coin issuer of the project?

From a purely legal perspective, the Singapore authorities have not explicitly prohibited the Singapore Foundation from landing in Singapore as a coin issuer. However, the Crypto Salad team learned through the latest communication with local law firms, accountants, and company secretaries in Singapore that in recent years, cryptocurrency companies established in the form of Singapore Foundations have encountered many compliance and regulatory issues. Since then, due to the pressure of public opinion and policy supervision, the Singapore authorities, led by ACRA (Accounting and Corporate Regulatory Authority of Singapore), have begun to significantly tighten the approval of foundations related to the cryptocurrency industry.

Based on the mutual confirmation of multiple news, it can be confirmed so far that ACRA will conduct a detailed background investigation on the foundation when the foundation is registered. Once it is found that there is a possibility of connection between the foundation and the cryptocurrency industry, its registration application will basically not be approved. Therefore, although the RWA project still has legal feasibility to choose the Singapore Foundation as the coin issuer, it has basically been blocked in practice.

Fourth, in addition to the Singapore Foundation, what other coin issuers can the RWA project choose to land?

Based on years of relevant business experience and successful cases, the CryptoSalty team recommends the following two options as the coin issuer:

The first option is American Foundation

In fact, the logic of choosing an American foundation as the coin issuer is basically the same as that of choosing a Singaporean foundation. The biggest difference between the two is that the current attitude of US regulators towards token issuance activities is still relatively open. Moreover, the new President Trump is also supportive of the cryptocurrency industry as a whole.

In addition, the registration cycle of American foundations is relatively fast, and the threshold requirements are simple and have fewer restrictions. Taking Colorado as an example, registering a non-profit foundation in Colorado can generally be completed within a week.

The second option that can be considered is UAE Foundation or DAO Organization

Among them, the overall structure of the UAE Foundation is also similar to that of the Singapore Foundation. However, it should be noted that Singapore and the UAE belong to different legal systems. Singapore belongs to the Anglo-American legal system, while the UAE belongs to the Islamic legal system. There are huge differences between the two in terms of applicable laws and judicial systems. This is very critical when dealing with complex compliance issues across jurisdictions.

The DAO organization (Decentralized Autonomous Organization) is a form of organization based on blockchain technology that achieves autonomy through smart contracts. In response to this novel form of organization, the UAE authorities have issued complete regulations (DAO Association Regulations) and a corresponding regulatory framework. According to relevant regulations, the DAO organization in the UAE has an independent legal personality and is also non-profit.

At the same time, according to the information officially disclosed by Binance Exchange (Binance), Binance has officially reached an investment transaction with Abu Dhabi's investment institution MGX for a total of US$2 billion. This is the first time that Binance has introduced external institutional investors since its establishment. One of the co-founders of the investment institution MGX is the Abu Dhabi Sovereign Fund of the UAE. The strong combination of the UAE sovereign fund and the largest mainstream exchange in the currency circle is expected to further promote the development of the cryptocurrency industry in the UAE. Therefore, in the long run, the development prospects of encryption in the Middle East are indeed worth looking forward to.

In short, the UAE Foundation or DAO organization is also an optional coin issuer. However, the cost of registering a foundation or DAO in the UAE will be relatively high, so it is more suitable for projects of a certain scale.

V. If you choose a US foundation as the coin issuer of the RWA project, what risks and card points should you pay attention to?

First, issuing tokens in the form of a foundation in the United States requires obtaining a corresponding license, such as the MSB license issued by the Financial Crimes Enforcement Agency (FinCEN).

Secondly, due to the tense geopolitical relations between China and the United States, the US regulatory attitude and intensity towards offshore companies often change, which will bring uncertainty to the company's long-term compliance operations.

Moreover, the commercial laws related to finance and companies in the United States are extremely complex, and require a systematic understanding of federal and state laws, so the difficulty and complexity of completing compliance are relatively high.

Finally, the tax review of the US tax agency (IRS) is very strict. As the American proverb says: In a person's life, only death and taxes are inevitable. Therefore, when setting up a foundation entity in the United States, a professional tax planning team is required to support and handle related tax issues, otherwise the company's related persons are at risk of being affected by the long-arm jurisdiction of the United States.

Six, Crypto Salad Interpretation

At a time when the regulatory prospects of the global cryptocurrency industry are still unclear, Chinese project parties must adhere to "compliance first" when landing RWA projects. Therefore, the RWA project party needs to actively cooperate closely with a professional cryptocurrency industry lawyer team to jointly promote the implementation of the project.

Weatherly

Weatherly