Introduction

In the two recent criminal cases involving virtual currencies, two similar problems were encountered. During the investigation stage, the investigating agency (i.e., the public security agency) indirectly or passively participated in illegal financial activities in the process of disposing of and converting the virtual currencies involved in the case into cash. For the legitimate rights and interests of the parties, defense lawyers will of course put forward our opinions to the relevant departments.

It seems that in the judicial disposal of virtual currencies involved in the case, once the judicial agency "meets the wrong person" and entrusts an unreliable disposal company, it will not only bring hidden dangers to the handling of the case, but also bring risks to the judicial agency itself.

What is an “unreliable” judicial disposal model?

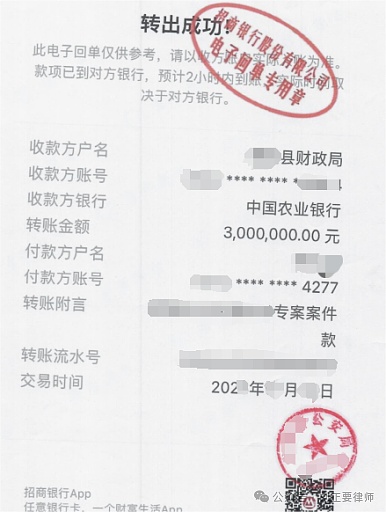

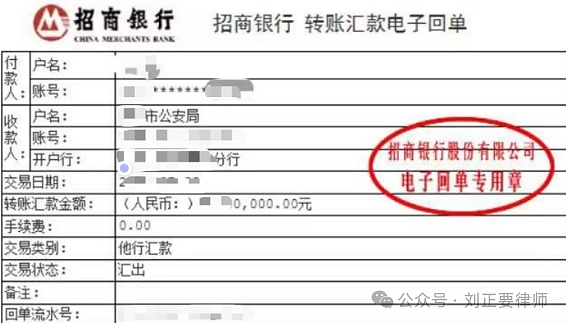

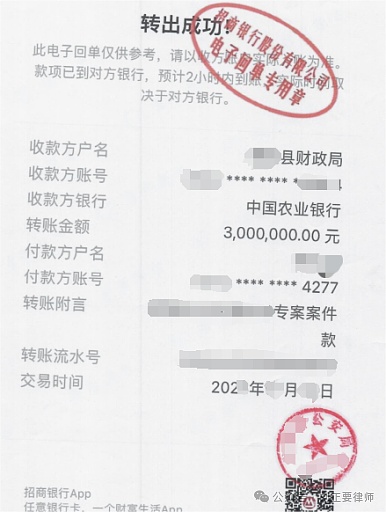

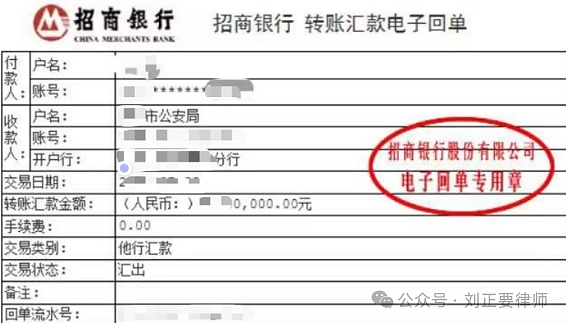

In a certain case involving the opening of a casino involving currency, the local public security organ entrusted Company A to conduct judicial disposal of the virtual currency involved. Company A continued to entrust Company B abroad to conduct disposal abroad. After Company B completed the disposal, it issued a letter of authorization to its employee “Xiao Liu” (a mainland Chinese), entrusting Xiao Liu to directly transfer RMB (i.e. judicial disposal funds) to the Finance Bureau where the judicial organ is located. The total amount was hundreds of millions of RMB. The picture below is only a small part of the transfer.

In addition to this case, we often see in other currency-related cases that third-party disposal companies entrusted by judicial authorities directly use the domestic RMB payment model in actual disposal business and transfer disposal funds to the judicial authority’s bank account or special fiscal account. Based on the confidentiality requirements of information in criminal cases, we have coded the payer, payee, transaction amount, serial number and other information.

This mode of directly using domestic RMB for payment is the most primitive and non-compliant way of disposal. According to current regulatory regulations, it is the most unreliable and purest illegal financial activity.

What is the distance between judicial disposal and illegal financial activities?

The reason why "judicial disposal" is named "justice" is because it is a judicial activity. Virtual currency, especially the property attributes of mainstream virtual currency (such as Bitcoin, Ethereum, Tether, etc.), has been widely recognized in my country's current criminal justice practice. Just like traditional property involved in the case, such as real estate, vehicles, and even stocks and bonds, judicial disposal can be carried out.

However, virtual currency is different from traditional property involved in the case.

According to the "9.24 Notice" ("Notice on Further Preventing and Dealing with the Risks of Virtual Currency Speculation and Trading") issued by ten national ministries and commissions (the Supreme People's Court, the Supreme People's Procuratorate, the Ministry of Finance, the Central Bank, the State Administration of Foreign Exchange, etc.) in September 2021, all virtual currency-related business activitiesin mainland China are illegal financial activitiesand must be strictly prohibited and resolutely banned in accordance with the law. Those who engage in related illegal financial activities that constitute a crime shall be held criminally liable in accordance with the law.

So what are the business activities related to virtual currency?

First, the exchange business of legal currency and virtual currency;

Second, the exchange business between different virtual currencies;

Third, buying and selling virtual currency as a central counterparty;

Fourth, providing information intermediary and pricing services for virtual currency transactions;

Fifth, conducting token issuance financing (i.e. ICO) and virtual currency derivative transactions.

For judicial disposal, the essence is to convert the virtual currency involved into legal currency, and then impose fines on the converted legal currency. Based on the provisions of the "9.24 Notice", judicial organs cannot directly exchange the virtual currency and legal currency involved in the case. In practice, they entrust third-party companies to do so, and third-party companies cannot directly exchange virtual currency and legal currency. The current common operation mode is that third-party companies entrust overseas disposal entities to dispose of and convert the virtual currency into legal currency overseas (in practice, there are also methods such as overseas auctions or direct recycling of virtual currency by the issuing company).

The most basic knowledge point here is: no matter which disposal mode is used, the exchange/conversion of virtual currency and legal currency cannot be carried out in China, and it is entrusted to individuals to carry out through RMB transfers, because this mode is essentially a domestic individual directly purchasing virtual currency from judicial organs. Once a disposal company does this, it is essentially engaging in illegal financial activities. For the judicial authorities that cooperate with such disposal companies, they have collected funds exchanged for illegal financial activities, or actually sold the virtual currency involved to individuals within the country. They should be deemed to have directly or indirectly participated in illegal financial activities. According to the provisions of the "9.24 Notice", the legal consequence is that they should be "strictly prohibited and resolutely banned in accordance with the law; those who engage in related illegal financial activities that constitute a crime shall be held criminally liable in accordance with the law." text="">As a web3 criminal defense lawyer, Lawyer Liu strongly recommends that judicial authorities must be extremely cautious in cooperating with third-party technology companies and disposal companies in handling criminal cases involving virtual currencies. We also understand that some judicial authorities, especially grassroots judicial authorities, may not have professional technical knowledge of virtual currencies and blockchains, so they need the assistance of third-party companies, but this assistance in handling cases should be established within the prescribed boundaries of laws, regulations, and regulatory policies.

If judicial authorities ignore compliance and believe that the natural correctness of combating criminal offenses can overcome the violations or even illegalities in judicial disposal, then once they encounter a professional web3 criminal lawyer (Lawyer Liu does not dare to claim to be professional, but there is no problem with qualification), he will definitely bring out the illegal acts in the judicial disposal activities for argumentation, and then the judicial authorities will inevitably fall into an embarrassing situation. (END)

Catherine

Catherine