Author: ignasdefi Translation: Shan Ouba, Golden Finance

Last cycle, when ETH fell 50% (from $4,300 to $2,150, around June 2021), I sold all my holdings.

I am exhausted by the bull market, researching and working non-stop without any rest. Mentally exhausted, I want it to stop. When my portfolio dropped 50%, I thought it marked the beginning of a bear market. I sold and felt relieved.

Then ETH corrected and rose 125% to $4,800. I missed out, but at least I made a nice gain on the stablecoin.

I think we are in a similar phase now, but I feel much stronger mentally this time. So I hold on to my holdings and wait for a recovery.

But what if I am wrong and this is actually a bear market?

Fear dominates the sentiment: Trump’s tariffs, stocks at all-time highs could plummet, and cryptocurrencies will follow. Then, you read that Warren Buffett is holding a lot of cash (maybe he knows something you don’t, you think). Smart people on X release bad news, claiming this is the end.

Given this, I refuse to be drowned in FUD (fear, uncertainty, and doubt) and want to share market charts and insights for reference.

Is BTC Still in a Bull Market?

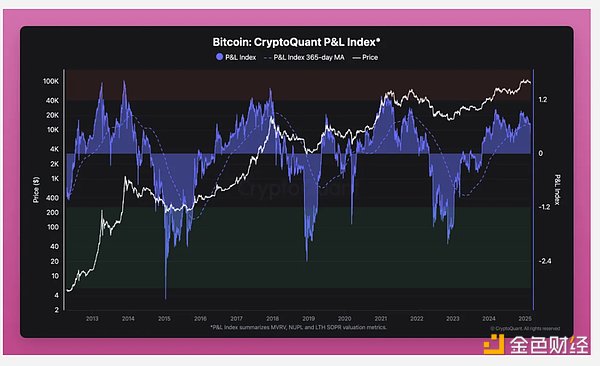

The following dashboard is from CryptoQuant and is used to determine whether Bitcoin’s price is overvalued (expensive) or undervalued (cheap).

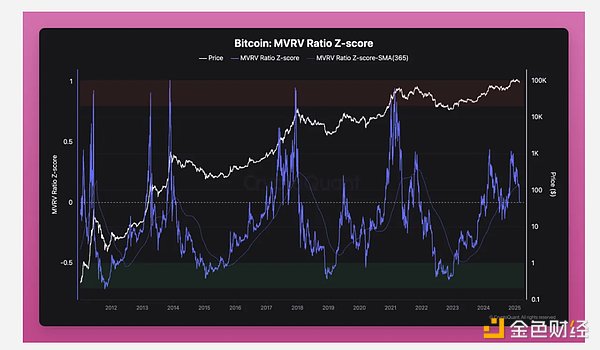

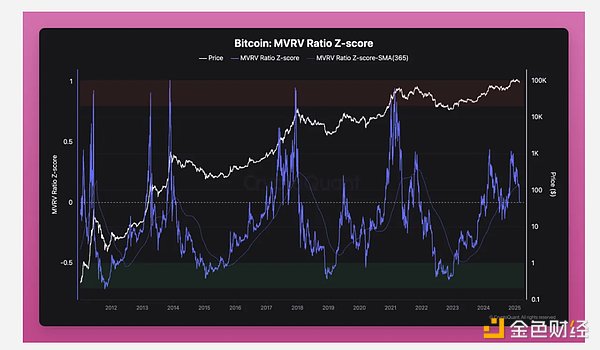

MVRV Z-Score

It shows when Bitcoin is overvalued (red area) or undervalued (green area) based on historical trends.

Bitcoin is not in overvalued territory, but well above undervalued levels.

There is still room to rise, but we are in the middle of the cycle, not early.

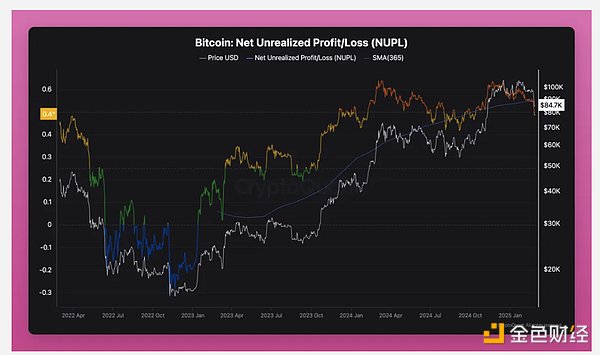

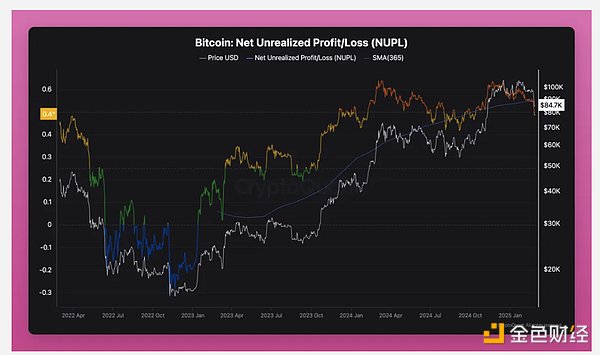

NUPL (Net Unrealized Profit/Loss)

NUPL measures whether the market is in a state of fear, optimism or enthusiasm based on unrealized profits.

Currently in the Optimism/Denial phase (around 0.48), which means most holders are in profit.

Historically, Greed/Enthusiasm (above 0.6) marked market tops.

Long Term Holder SOPR (Spent Output Profit Rate)

SOPR tracks whether long term holders are selling at a profit or loss. Values above 1 indicate profit taking.

It is currently 1.5, which means that long-term holders are taking profits, but not aggressively.

Sustained selling above 1 is normal in a healthy uptrend.

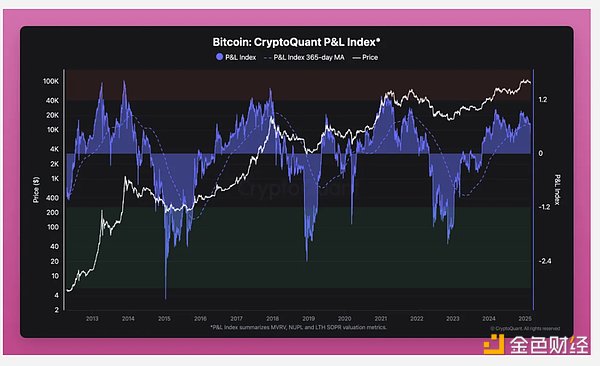

CryptoQuant Profit and Loss Index

The index combines MVRV, NUPL, and SOPR to assess overall market valuations.

Above its 365-day moving average, confirming the continuation of the bull market.

Peaks above 1.0 indicate the risk of a cycle top forming.

Summary: What's next?

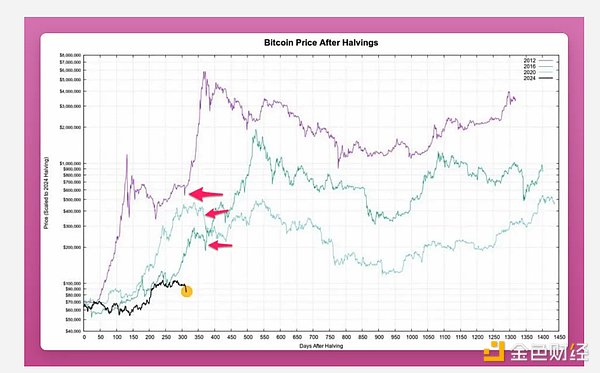

Bitcoin is in the middle of a bull cycle.

Holders are taking profits, but extreme enthusiasm has not yet occurred.

Prices can still rise before becoming overvalued.

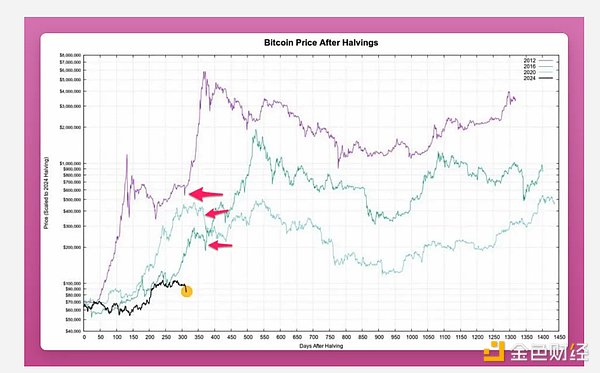

If history repeats itself, Bitcoin still has room to rise before reaching a major cycle top. Interestingly, the chart shared by CZ on X is exactly how I feel about where we’re headed next:

Bitcoin is a confirmed bull market, but we haven’t reached the levels of frenzy seen at the tops of past cycles yet. On-chain data suggests there’s still room to go, but some profit-taking is happening.

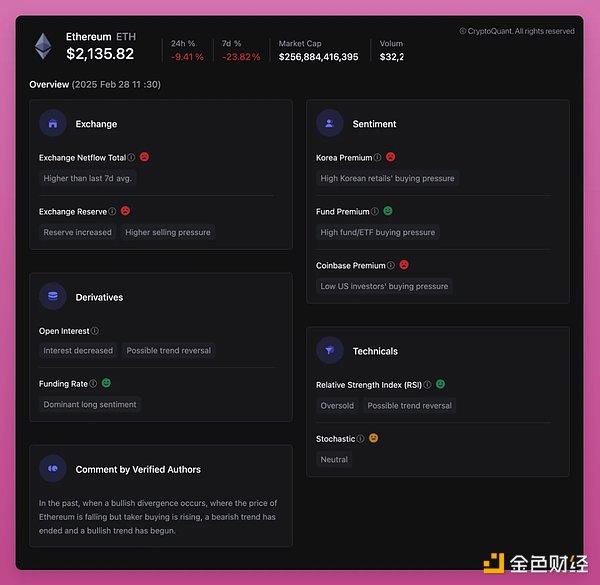

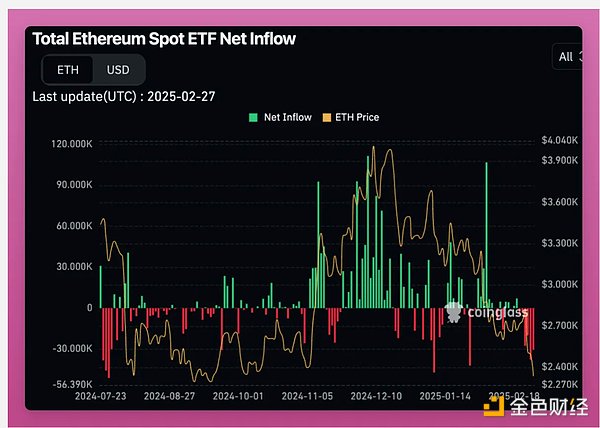

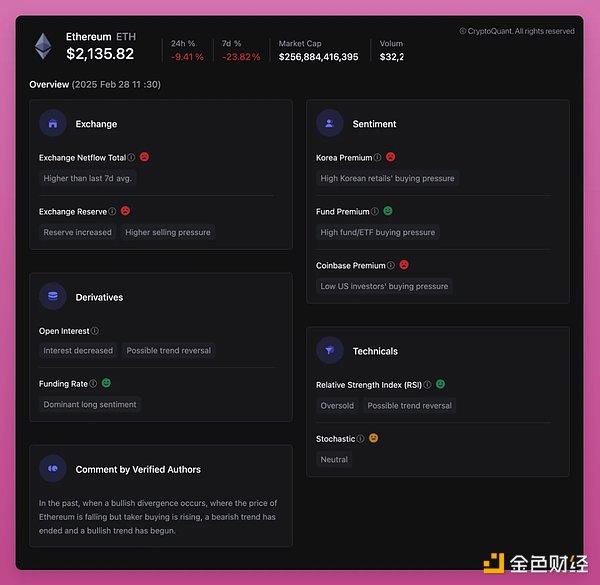

Ethereum

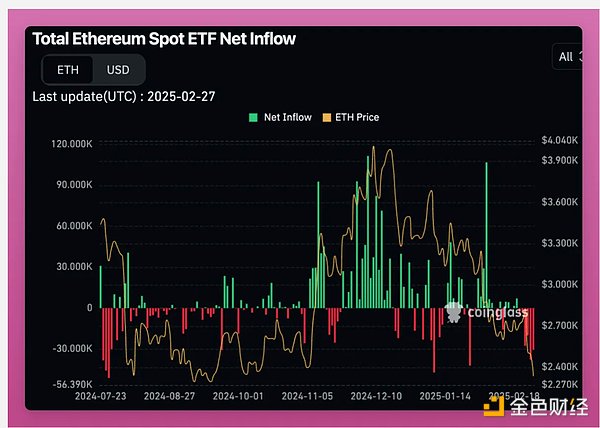

ETH is down 70% against BTC over the past two years. That’s down 48% since December 2024 alone! Outflows from ETH ETFs also don’t show any bullish signs.

But is ETH the best risk/reward opportunity in crypto right now? I shared on X that catalysts for ETH are slowly forming:

Leadership changes at Ethereum Foundation (EF) (Aya leaves, but new ED is TBD)

Decision to scale L1, starting with gas limits, but the mindset shift is important in itself.

Pectra brings EIP-7702 (goodbye ratification) and EF’s new open intent framework to improve L2 UX.

Tired of memecoins, community hopefully moves to fundamentals.

Hype around MegaETH shows 1) people still like innovative L2s, 2) successful L2s validate modularity theory.

Base just announced block time from 2 seconds to 200ms and L3 (similar to MegaETH in theory). I don’t like Base much though.

Ethereum is the best chain for asset tokenization. BlackRock promotes it heavily.

ETH fell a lot.

The problem is these changes take time: L1 scaling will take years, and UX improvements will require multiple partners to adapt (Base’s open intent framework is conspicuously lacking).

My biggest concern is that ETH will completely miss this bull run and will only become a good buying opportunity in the next bear run.

However, sentiment could turn quickly. If EF and the broader community see real signs of 1) scaling L1, 2) improving L2 modular UX, 3) shifting Ethereum loser mentality, then ETH could rebound and dominate the second half of this cycle.

Currently, SOL has a market cap 3.8x lower, offers a superior user experience, and benefits from a growing Lindy Effect (as long as it stays online). These factors will challenge ETH's dominance in the smart contract space.

Altcoins: What to Consider?

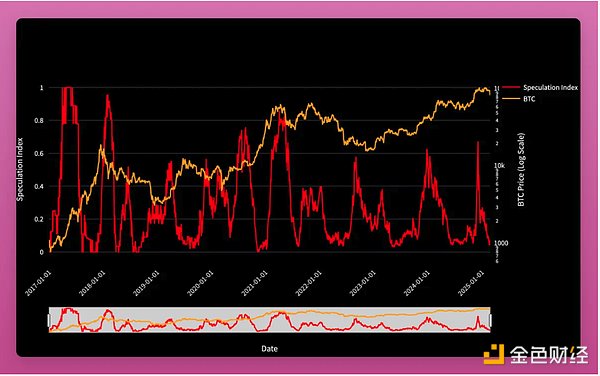

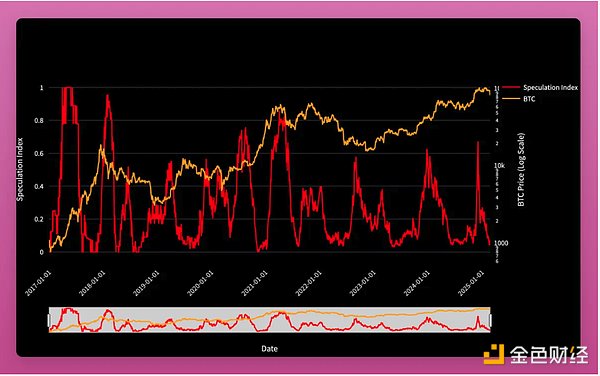

The Robust Speculative Index measures whether altcoins outperform Bitcoin over multiple timeframes.

Currently at lower levels (around 0.0-0.2), this means BTC is outperforming most altcoins.

Historically, altcoin rallies have followed periods of low speculative activity.

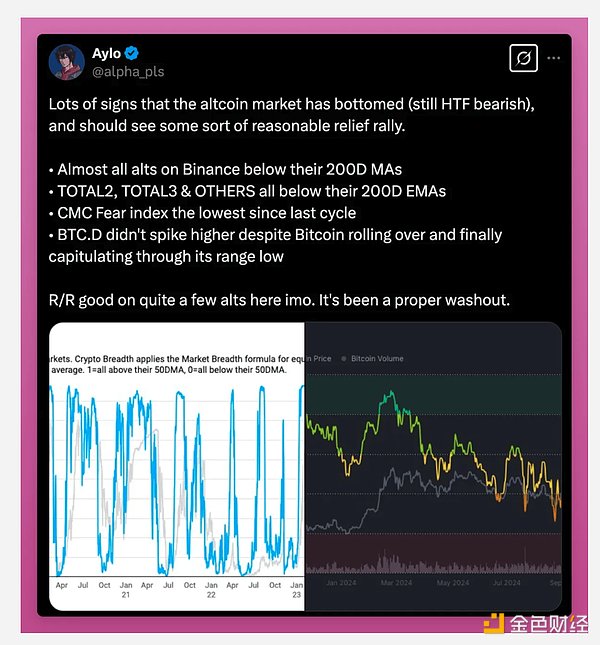

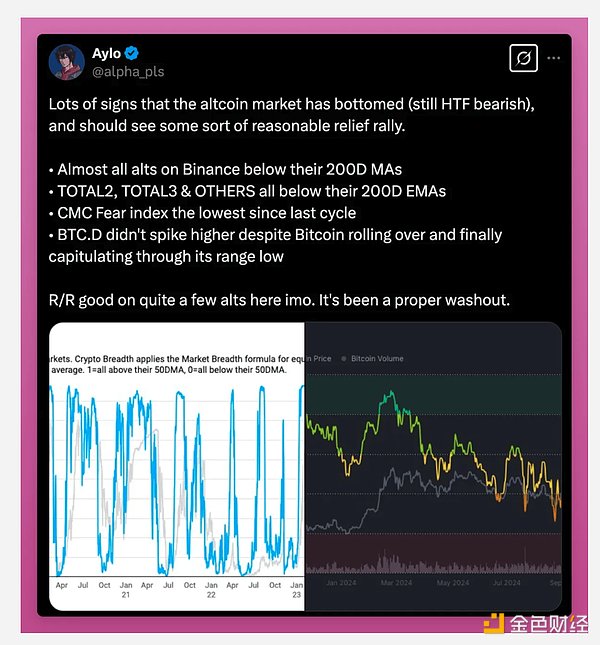

This is similar to the Crypto Breadth chart shared by Aylo on X, which suggests that altcoins have bottomed and we can expect a rebound (if BTC holds).

The question is: what altcoins to buy? I have a few criteria:

No large unlocking in the short term.

Product PMF (Product Market Fit).

Revenue sharing (token buyback) is a big advantage.

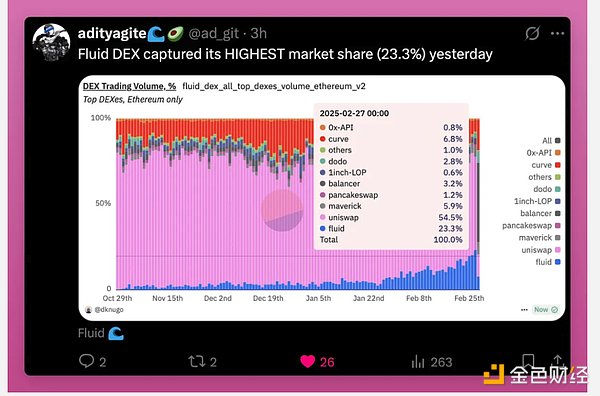

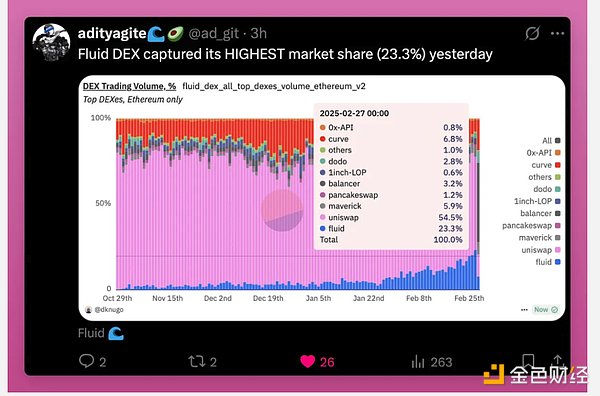

My favorite is FLUID. This lending protocol, which is only a few months old, continues to challenge Uniswap in terms of DEX trading volume. FLUID has announced an upcoming buyback plan.

Other altcoins that look good:

ENA: Survived the Bybit hack and multiple liquidation waves. Most recent round of $100M at a price of $0.4…More and more protocols/CEXs are implementing sUSDe, which makes me very optimistic. Problem? Lots of ENA unlocked.

$SKY (formerly $MKR): Great post by Taiki.

• $30M buybacks per month (~1.9% of supply)

• USDS (formerly DAI) supply near all-time highs

• SPK mining = more demand and revenue

• Stablecoin regulation could provide a tailwind

$KMNO: Dominates the SOL lending market with $1.8B TVL, while MC is only $85M. The problem? Solana chain users are traders, not yield farmers. But that could change at any time.

Sonic’s $S: Growing DeFi ecosystem (Aave and other key protocols deploying), 200M S airdrop, great UX, growing mindshare on X, no big unlock…

HYPE: Lots of talk about great token economics and strong community on X

PENDLE: When fundamentals matter and investors seek yield, Pendle is the way to go

AAVE: Going through token economics changes with Aave 3.3 upgrade and strong revenues.

What else did I miss?

Additionally, I am excited about the upcoming MegaETH, Monad, Farcaster, Eclipse, Initia, Linea, and Polymarket token airdrops.

Macro, Macro, Macro

I truly believe in the Bitcoin story as digital gold. I prefer Bitcoin to gold due to its self-custody and transferability features.

The current macro environment is the perfect testing ground for Bitcoin. Tariffs, wars, fiscal deficits, money printing… you name it.

In my blog post Crypto Truths and Lies in 2025, I shared BlackRock’s research that Bitcoin sometimes sells off at the start of large macro events. However, the potential for chaos, turmoil, money printing is bullish for BTC.

I believe that is exactly what is happening right now. Trump’s sudden decision to deviate from the established world order has caused panic in the markets. However, people will quickly adjust to these new global realities.

Nothing that has really changed in the world will undermine cryptocurrencies. In fact, quite the opposite is happening. Day after day, we see bullish actions from the SEC – dropping lawsuits, introducing new cryptocurrency bills, and an overall positive stance from the government towards cryptocurrencies.

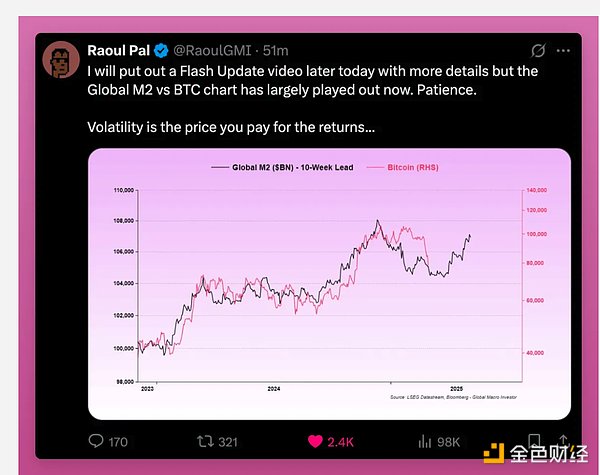

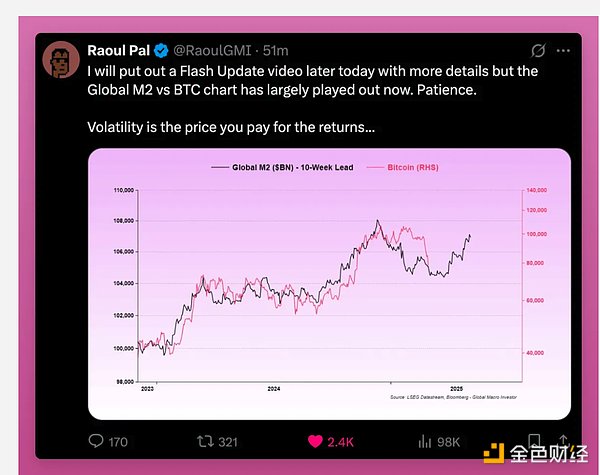

But Ansem is right that when good news fails to drive prices higher, that’s bearish. It will take some time for the market to adjust. However, I expect the market to correct itself faster than his bullish prediction for 2026/27. If Raoul Pal’s charts and insights are correct, then BTC price should catch up to global M2 supply sooner than 2026.

I am still bullish and I believe patience will be rewarded.

Joy

Joy