Recently, there's been a lot of hype about Base on the Ethereum blockchain, focusing on the claim that, because Base's centralized collator earns significant revenue annually from Ethereum community users, it's essentially an unlicensed centralized exchange.

Coinbase's Chief Legal Officer, Base's founder, and Vitalik have all spoken out to refute this hype.

Coinbase's Chief Legal Officer, paulgrewal.eth, stated that calling Layer 2 collators like Base exchanges misrepresents their function as markets:

The SEC defines an "exchange" as a marketplace connecting buyers and sellers of securities. However, Layer 2 is a general-purpose blockchain that operates as infrastructure. They process messages into code (calling smart contracts) and batch all transactions (payments, calls, messages), deferring any formal order interaction/matching rules (AMMs, CLOBs, auctions) to the application's smart contracts and frontends.

Think of off-chain infrastructure like AWS. Like Base, infrastructure like AWS runs code provided by developers. This code can encompass a wide variety of content—payments, calls, messages, transactions—but the code executes deterministically. If an exchange runs on AWS, is AWS an exchange? Bottom line: L2 collators enable scalable and secure on-chain transactions, thereby expanding Ethereum's computational power and enabling widespread adoption in the new global economy. Mislabeling them spreads FUD (fear, uncertainty, and speculation) and ignores the critical role they play in scalability. Base founder Jesse explains how the Base collator works, attempting to dispel some of the FUD surrounding its role: First, what is an L2 collator? For Base, the collator collects user transactions, sorts them by first-in, first-out order, computes the resulting state changes, and batches them onto Ethereum's L1 for final settlement, which is faster and cheaper than transactions on L1. There are two key points to note about this design: First, the sorter is merely a "fast lane" to access the Base network. Users can also transact directly on the Base network at any time through the Ethereum network. This mechanism gives the Base network the full decentralization and censorship resistance of Ethereum's validator network. Therefore, Base is not an unlicensed stock exchange. It is critical infrastructure for scaling the global on-chain economy. Over the past two years, we completed the first phase of Base's decentralization and enabled permissionless block proposals. Today, we are actively progressing on Phase 2. Ethereum founder Vitalik has also published a statement supporting Base: Base is operating the right way: as an L2 on top of Ethereum, leveraging its centralized capabilities to provide a more powerful user experience while remaining tightly integrated with Ethereum's decentralized foundational layer for security. Base doesn't hold user funds, so they can't steal them or prevent you from withdrawing them (this is part of the L2beat Phase 1 definition).

This is what we mean by Layer 2 being non-custodial: they're extensions of Ethereum, not glorified servers that happen to submit hashes.

Phase 1 means that a Security Council, with a 75% vote, has the power to overturn on-chain code. However, Phase 1 also explicitly requires that a sufficient number of members on the committee (≥26%) must be outside the governing body responsible for managing the Layer 1 (the underlying public chain) to prevent a quorum.

Thus, the governing body cannot unilaterally censor or steal funds through a Security Council vote, and therefore is not a custodian (of user funds).

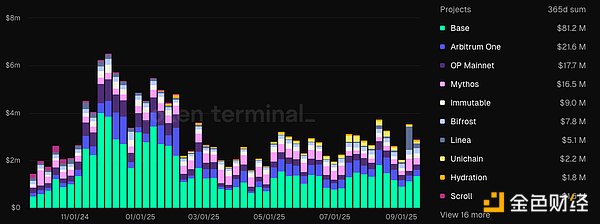

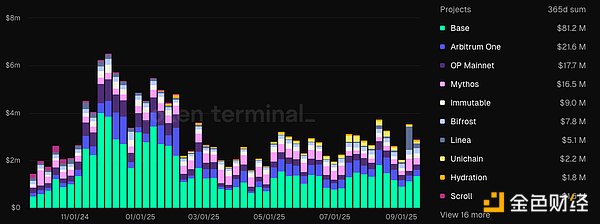

In Stage 2, even with 100% approval from the Security Council, it cannot overturn functioning on-chain code. Although Base's founder and Vitalik have both refuted claims that Base is not an unlicensed exchange, L2's centralized collators have long been criticized by the crypto community. There's no doubt that Ethereum's major L2s are a massive money-printing machine, continuously raking in wealth between end users and Ethereum's L1, with Base leading the pack. According to Token Terminal data, Base's collator revenue reached $81 million over the past year. Arbitrum, in second place, generated $21 million, nearly four times as much.

Weatherly

Weatherly