Author: Wu Zhijian

As the world's number one superpower, the United States is declining at a speed visible to the naked eye.

Some friends may ask, the US stock market value is the world's first, and the stock index has repeatedly hit record highs. American companies are still rampant all over the world, and almost monopolize cutting-edge technologies such as artificial intelligence and high-energy chips. Where does the decline you are talking about come from? This is a good question. The key to the decline of the United States that the author is talking about here lies in the decline of its democracy and rule of law.

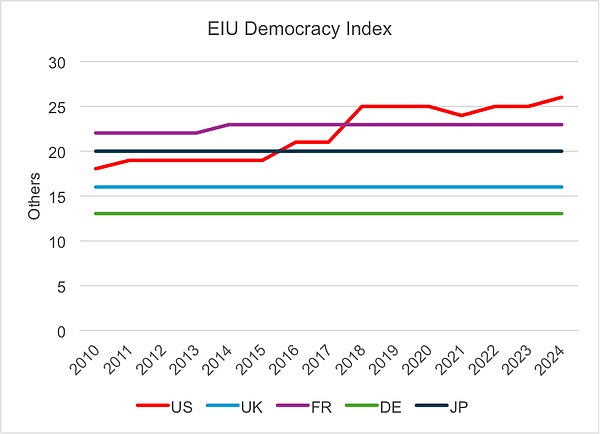

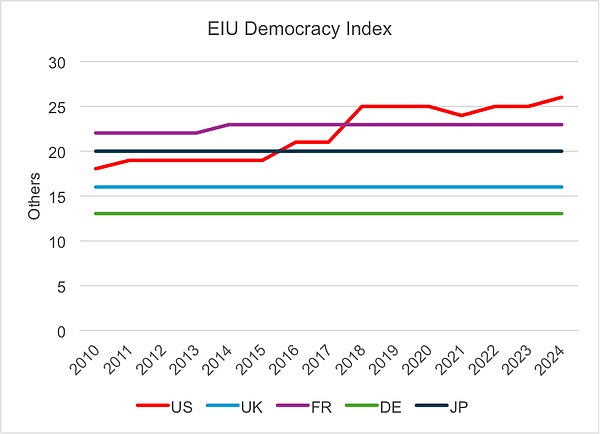

Data source: Economist

For example, the above figure shows the changes in the global historical rankings of the EIU Democracy Index of some developed countries (the United States, Germany, Japan, the United Kingdom, and France) from 2010 to 2024. The US ranking dropped from 18th in 2010 to 26th in 2024. In fact, the US is the only developed country that has experienced such a significant decline in the past 15 years. The US's democracy index ranking is now behind France and Japan.

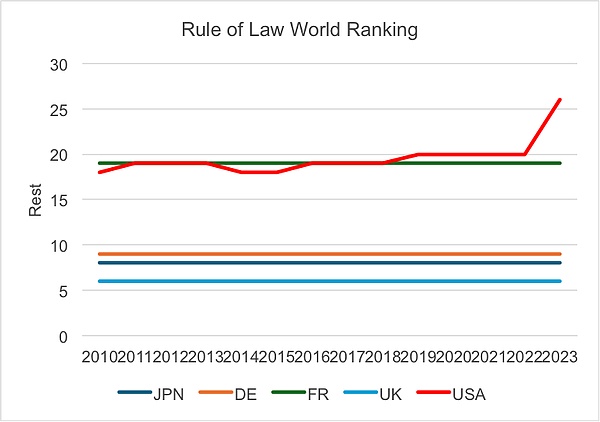

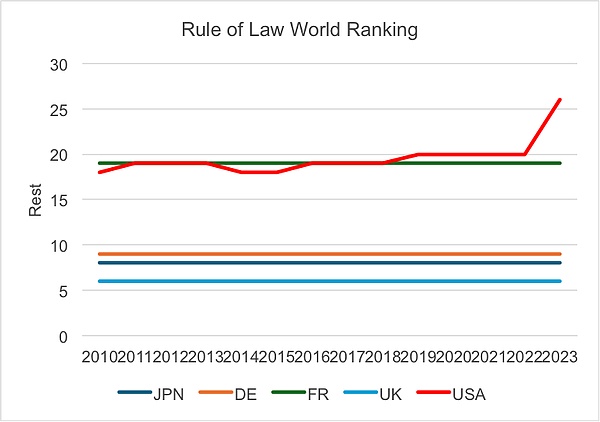

Data source: WJP Rule of Law

Next, let's take a look at the changes in the global ranking of the WJP Rule of Law Index since 2010. From the above chart, we can see that the ranking of Western European countries (France, Germany, and the United Kingdom) in the top ten is relatively stable, but the US ranking has dropped significantly, from 19th in 2010 (better than Japan) to 26th in 2024 (behind Japan).

If a country's rule of law index continues to decline, it is very worrying. The most typical example in this regard is that former US President Biden "preventively" pardoned his family members before leaving office. On December 1, 2024, Biden also pardoned his son Hunter Biden for illegal gun possession and tax crimes.

If a country's former president deliberately pardons the most important people in his life (his own blood relatives) before leaving office, it means that he has no confidence in his country's legal system. He does not believe that his country's courts can guarantee justice and that his family will not be politically persecuted. If a country's former president thinks so, then what reason do we foreigners have to believe in the US legal system and fairness? If a country's legal system cannot give people confidence and cannot make people believe that everyone is equal before the law, then in the long run, the country will lack competitiveness.

In my opinion, the decline of democracy and the rule of law in the United States will directly affect the long-term value of US stocks and treasury bonds. Let's talk about treasury bonds first. In essence, government bonds are IOUs written by a government to investors. If any person or institution wants to borrow money from others, the key is to rely on their own credit, that is, they need others to believe that they can borrow and repay, and have the ability and willingness to repay the interest and principal.

So for a government, how to prove its credit? There are several key points:

First, there are checks and balances between power agencies, rather than any one individual having the final say. This kind of checks and balances is very important to avoid high-risk mutations due to the decisions of a certain individual, such as starting a war. To put it bluntly, investors need to see a responsible government so that they dare to lend money to it (that is, buy the bonds it issues). Secondly, the country's legislature (Congress) and judiciary (courts) can maintain their independence, rather than succumbing to the deterrence of the executive branch (the White House) and obeying the White House to make irresponsible decisions, such as excessive debt leading to default or hyperinflation. Therefore, if a country's democratic rule of law declines, bond investors should be vigilant and pay close attention to its future trends.

Next, let's talk about stocks. If a country wants a long-term and healthy stock market, it needs to meet a key condition, that is, the country has an effective capitalist market economy. Specifically, she needs to meet the following conditions: First, the market is free and fair, and is not controlled by some dominant monopolist. Second, there is a high-quality rule of law, that is, everyone is equal before the law, rather than the big fish eating the small fish and the small fish eating the shrimp. Third, there is a healthy legal and cultural environment to encourage innovation and reward entrepreneurs. Fourth, the government's tax and regulatory policies are friendly and supportive of enterprises, rather than competing with them or plundering their resources.

The current political ecology of the United States shows signs of oligopoly. The billionaire group represented by technology giants (such as Bezos of Amazon, Musk of Tesla, Cook of Apple, etc.) obviously has a huge influence beyond their business scope. The interests of the Trump administration and the technology giants are highly bound together. Trump needs them to show loyalty and be consistent with Trump on issues such as public opinion control and opposition to DEI, while the technology giants need the US government to protect these giants on antitrust issues, from antitrust lawsuits, and destroy their monopoly in their own advantageous industries. This situation is somewhat similar to the "Robber Baron" era in the second half of the 19th century: every industry is controlled by a wealthy tycoon who maintains their monopoly through brutal business competition and exploitation, and has produced a large number of robber barons who are as rich as a country: such as steel tycoon Carnegie, railroad tycoon Vanderbilt, oil tycoon Rockefeller, financial tycoon Morgan, etc. It is no exaggeration to say that the wealth and influence of today's Musk, Bezos, Zuckerberg and others are comparable to Rockefeller and Carnegie in the 19th century.

The decline of American democracy and the rule of law mentioned above is enough reason for us investors to start worrying about the US stock and bond markets. Of course, no empire can collapse overnight, and the United States is no exception. Over the past 100 years, after a long period of accumulation, especially two world wars that took place outside its homeland, the United States has accumulated a lot of wealth, talents and technological advantages, so even if the United States begins to weaken, it will not fall apart overnight. The world ranking of the United States in terms of democracy and rule of law has only fallen from a dozen to more than 20. There are about 38 developed countries (OECD member countries) in the world, so the decline in the US ranking only means that it has fallen from the top developed countries to the middle developed countries. However, due to the huge economic scale and huge capital market of the United States, this change deserves our attention as investors. If the decline trend continues and cannot be reversed, then investors should prepare early and make timely adjustments to protect their assets and investment security.

Weatherly

Weatherly