When the world's "central bank of central banks" speaks out about crypto regulation, the global financial community listens. Founded in 1930, the BIS, the world's oldest international financial institution, comprises 63 central banks representing countries representing approximately 95% of global GDP. The BIS has always played the role of "the central bank of central banks": "The BIS's mission is to serve central banks in their pursuit of monetary and financial stability, to foster international cooperation in those areas, and to act as a bank for central banks." - Bank for International Settlements The BIS serves as both a platform for central bank cooperation and a center for research and rule-making on global financial stability. As such, its research and publications often serve as important references for regulatory policies in various countries. In August of this year, BIS published "An approach to anti-money laundering compliance for cryptoassets"[1] in BIS Bulletins No. 111. The timing of the publication of this paper is quite delicate - it is at a critical turning point in global crypto regulation, and regulators in various countries are looking for a balance between effectively preventing risks and not excessively hindering innovation. This article will help you interpret this report and, combined with the interpretation of the FATF Annual Examination: Global Crypto Regulatory Report Card, objectively evaluate the current status and future direction of crypto regulation.

BIS research and publications: Why its voice is important

In the financial governance system, BIS research and publications often guide global regulatory trends, and maintain an innovative leadership position in emerging fields.

Its research department not only focuses on monetary policy and financial stability, but also continues to explore new areas, including crypto assets, AI explainability, climate risks, etc. This old institution located in Basel, Switzerland, maintains close cooperation with global central bank researchers and academia, and continues to provide scientific and objective policy recommendations to global regulators.

Especially in the field of cryptocurrency, BIS has demonstrated advanced leadership: from the cross-border crypto asset flow study [2] published in 2025 (covering seven years of data from 184 countries), to the systematic analysis of stablecoins, DeFi, and CBDC, it provides regulators with important references for the crypto regulatory policy framework.

At the same time, BIS's short special research Bulletins have a strong policy-oriented power because they are closely related to hot topics and directly address policy issues. For example:

2021 DeFi Risk Research: Cited by many central banks as a reference for regulatory frameworks[3]

2023 Crypto Ecosystem Report: Systematically expounds on the structural defects of crypto[4]

And this paper on crypto AML is published in this series (No.111), which shows that BIS attaches great importance to this issue.

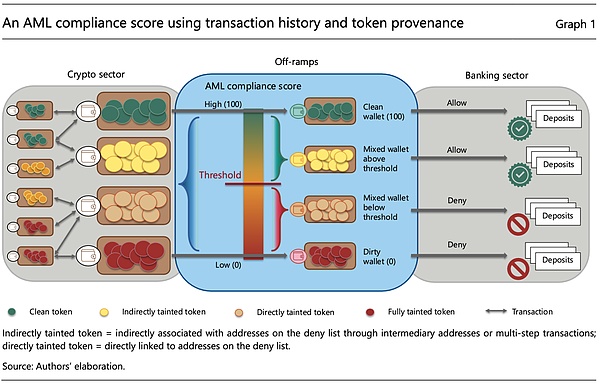

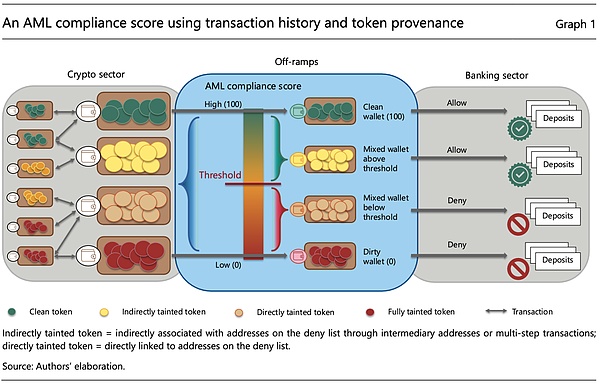

BlockSec Interpretation: What is BIS's new approach to compliance? In its August study, "An Approach to Anti-Money Laundering Compliance for Cryptoassets," the BIS directly addressed the reality that traditional finance's AML/KYC systems face systemic challenges in the crypto world. However, rather than dismissing the issue as "powerless," the BIS proposed an innovative "compliance scoring system." BlockSec Introduction: This BIS research represents a fundamental shift in the focus of compliance: Old Model: "Who are you?" (Identity-based) New Model: "Where does your money come from?" (Behavior-based) Paradigm Shift: From "Identity Verification" to "Fund Tracing" Traditional AML relies on Know Your Customer (KYC) information collected by intermediaries such as banks. However, on decentralized blockchains, users can bypass intermediaries through self-hosted wallets. BIS's main argument is that every on-chain fund has a traceable provenance, which is a new AML lever.

Core idea: AML compliance scoring system

The most important innovation proposed by BIS is the establishment of an AML Compliance Score mechanism:

Scoring principle:

High score (maximum 100 points): Relatively clean funds mainly from “allowed list” wallets

Low score (minimum 0 points): Contaminated funds associated with known illegal wallets on the “denied list”

Dynamic update: Continuously adjusted based on real-time transaction history and risk intelligence

Differences in technical implementation:

Stablecoin (account model): Although it is impossible to track specific tokens, the transaction network that can map wallet addresses

Bitcoin (UTXO Model): The complete history of each satoshi can be traced back to the mining source

Source: An approach to anti-money laundering compliance for cryptoassets

Three implementation strengths:

Strict mode (Allow List): Only tokens with addresses that have passed KYC checks are accepted, similar to the strict identity verification of traditional banks

Medium mode (Multiple Criteria): Combines multiple criteria (holding time, transaction frequency, counterparty history, etc.) for comprehensive evaluation

Loose mode (Deny List): Only tokens from known illegal addresses are rejected, giving users maximum trading freedom.

Redistribution of Responsibility: From Centralization to Layering

BIS distinguishes different tiers of responsibility:

Centralized hubs (fiat currency access points, stablecoin issuers, exchanges): assume the strictest AML/KYC responsibilities.

On-chain activities (DeFi protocols, P2P transfers): rely more on risk monitoring, on-chain traceability, and behavioral profiling.

This design recognizes the practical limitations of the decentralized world while maintaining regulatory control at key points, avoiding a "one-size-fits-all" approach.

The BIS also proposed a controversial concept: user duty of care. This means that users also have the responsibility to check the compliance score of their counterparties before trading. This presents significant practical difficulties, but it also reflects the BIS's vision of building a compliance ecosystem where everyone can participate. The Current Regulatory Dilemma: The Challenge of the Travel Rule and the Evolution of Crime While BIS's new approach is elegant in theory, to understand its context, we must first examine the harsh realities facing the current regulatory system. Currently, global crypto regulation relies primarily on the core tool of the Travel Rule, which requires VASPs to collect and transmit the identity information of senders and receivers when processing transactions exceeding a certain amount. However, this highly anticipated regulatory standard is facing significant challenges. The Current Status of Travel Rule Implementation: A Huge Gap Between Ideal and Reality According to the FATF's latest annual assessment report, "FATF Annual Examination: Global Crypto Regulatory Report Card," released in June of this year, the global implementation of the Travel Rule has been disappointing. Of the 138 jurisdictions assessed, only one (the Bahamas) was rated as fully compliant, 29% were largely compliant, 49% were partially compliant, and 21% were still non-compliant. This data shows little improvement compared to 2024, exposing the systemic failure of traditional regulatory tools in the crypto world.

At the same time, even in the 73% of jurisdictions that have "passed legislation", the implementation of the Travel Rule is uneven. The huge differences between countries on the threshold standards have become the biggest obstacle: the United States insists on the $3,000 threshold established in 1996[5], while the European Union began to implement a zero threshold policy in December 2024[6] (even transfers of 1 euro cent require the Travel Rule). The result of this fragmented approach is that a cross-border transaction may be "compliant" in the sending country but considered "illegal" in the receiving country, rendering the transaction impossible to complete. The fundamental reason for the Travel Rule's ineffectiveness lies in the fundamental conflict between its design assumptions and the realities of blockchain technology. The rule is based on the intermediary model of traditional finance, but in a decentralized environment: self-hosted wallet users can completely bypass VASPs, making their off-chain identity information impossible to track and verify. DeFi protocols also lack traditional intermediaries to enforce identity verification requirements. Cross-chain transactions, involving multiple blockchain ecosystems, remain blurred regulatory boundaries. It is precisely this systemic failure at the technical level that provides greater scope for criminal activity. The Evolution of Crime: A Direct Consequence of Regulatory Failure. The difficulties in implementing the Travel Rule have directly led to the rapid evolution and escalation of criminal methods. Far from being effectively curbed by this regulatory tool, criminals have instead found more covert methods: Stablecoins Become the New Favorite: Amid the massive surge in stablecoins, and due to technical loopholes in the Travel Rule's implementation, stablecoins have replaced Bitcoin as the tool of choice for criminals. Most on-chain illegal activities now involve stablecoin transactions, as they find it easier to circumvent existing regulatory scrutiny. Evolving Circumvention Methods: Faced with the Travel Rule's threshold requirements, criminals have widely adopted smurfing techniques—splitting large transactions into smaller ones to circumvent them. The $1.46 billion stolen from the Bybit exchange by North Korean hackers in 2025 is a prime example. They cleverly exploited differences in regulatory standards and technical vulnerabilities across countries, bypassing centralized platforms and using DeFi protocols to complete the fund transfer. Ultimately, less than 4% of the funds were successfully recovered. This demonstrates that regulation is easier said than done, and the world remains at a bottleneck in implementing these regulations. BlockSec Commentary: The Significance and Policy Value of BIS's New Approach A Paradigm Shift in Global Central Bank Regulatory Thinking This BIS paper shouldn't be judged solely on whether it provides a perfect solution. It marks the first time that traditional financial regulators have formally acknowledged the disruptive impact of decentralized technology on existing regulatory frameworks. For over a decade, regulators have mostly attempted to force cryptocurrencies into traditional financial frameworks. The BIS proposal, however, recognizes the irreversible nature of decentralized technologies and instead seeks a path to achieve regulatory objectives within this new technological landscape. Policy Guidance: Providing a New Template for Global Regulation As the authoritative voice of global central banks, the BIS's recommendations are often deeply referenced and leveraged by regulators worldwide. This paper's theoretical innovations include transforming blockchain transparency into a regulatory advantage, constructing a compliance framework based on behavior rather than identity, and offering differentiated policy implementation paths. These provide regulators around the world with specific technical implementation plans, clarify the responsibilities of different parties, and establish a flexible international coordination mechanism. BlockSec Conclusion: A Historical Opportunity in Regulatory Evolution 2025 is also known as the "Year One of Stablecoin Regulation." Looking back at the global crypto regulatory landscape this year, we can see it's been a process of continuous trial and error and learning: from East to West, from Hong Kong to Europe and the United States, each region is exploring its own regulatory path. The BIS paper may mark a new phase in this learning process—no longer a simple matter of "prohibition and permission," but rather one of "understanding and adaptation." Indeed, it's common for regulation to lag behind technological innovation. Historically, comprehensive traffic regulations emerged only after the widespread adoption of cars, cross-border communications regulatory frameworks were established only after the globalization of telephone technology, and the internet, too, gradually transitioned from its early "unbridled" growth to standardized development. Crypto assets are undergoing a similar historical process. Every adjustment and adaptation along the way is a necessary step in the maturation of the entire ecosystem. The greatest value of the BIS proposal lies in providing a framework for collaboration, rather than confrontation, between the industry and regulators. For the industry, this proposal provides clear compliance paths and technical standards while preserving ample room for technological innovation. For regulators, the new framework strikes a balance between regulatory objectives and technological realities and establishes a technical foundation for international coordination.

In this era of change, excellent regulation should not be a shackle that hinders innovation, but should guide the industry in a healthier and more sustainable direction.

When the world's "central bank of central banks" speaks about crypto regulation

When the Bank for International Settlements (BIS) speaks, the global financial community listens. Founded in 1930, the BIS, the world's oldest international financial institution, comprises 63 central banks worldwide, representing countries accounting for approximately 95% of global GDP. The BIS has always played the role of "the central bank of central banks": "The BIS's mission is to serve central banks in their pursuit of monetary and financial stability, to foster international cooperation in those areas and to act as a bank for central banks." -- Bank for International Settlements The BIS serves as both a platform for central bank cooperation and a research and rule-making center for global financial stability. Therefore, its research and publications often serve as important references for regulatory policies in various countries. In August of this year, BIS published "An Approach to Anti-Money Laundering Compliance for Cryptoassets" in BIS Bulletins No. 111. The timing of this paper's release is quite delicate: global crypto regulation enters a critical turning point, with regulators around the world seeking a balance between effectively preventing risks and not excessively hindering innovation. This article will interpret this report and, in conjunction with the FATF's annual exam: Global Crypto Regulatory Report Card, objectively assess the current state of crypto regulation and its future direction. BIS Research and Publications: Why Its Voice Matters Within the financial governance system, BIS research and publications often guide global regulatory trends, and maintain a leading position in innovation in emerging areas. Its research department not only focuses on monetary policy and financial stability, but also continuously explores new areas, including crypto-assets, AI explainability, and climate risk. This venerable institution based in Basel, Switzerland, maintains close collaboration with global central bank researchers and academia, continuously providing scientific and objective policy advice to global regulators. Particularly in the cryptocurrency sector, the BIS has demonstrated pioneering leadership: from its 2025 study on cross-border cryptoasset flows (covering seven years of data from 184 countries) to its systematic analysis of stablecoins, DeFi, and CBDCs, it has provided regulators with important references for crypto regulatory policy frameworks. Furthermore, BIS's short, thematic research Bulletins, which closely follow current trends and directly address policy issues, have a strong policy-leading impact. For example:

2021 DeFi Risk Research: Cited by many central banks as a reference for regulatory framework

2023 Crypto Ecosystem Report: Systematically explains the structural defects of crypto <span leaf="" para",{"tagName":"section","attributes":{"data-pm-slice":"0 0 []"},"namespaceURI":"http://www.w3.org/1999/xhtml"},"para",{"tagName":"section","attributes":{},"namespaceURI":"http://www.w3.org/1999/xhtml"},"para",{"tagName":"section","attributes":{"data-pm-slice":"0 0 []"},"namespaceURI":"http://www.w3.org/1999/xhtml"},"para",{"tagName":"section","attributes":{},"namespaceURI":"http:// www.w3.org/1999/xhtml"},"para",{"tagName":"section","attributes":{},"namespaceURI":"http://www.w3.org/1999/xhtml"},"par a",{"tagName":"section","attributes":{},"namespaceURI":"http://www.w3.org/1999/xhtml"},"para",{"tagName":"section","att ributes":{},"namespaceURI":"http://www.w3.org/1999/xhtml"},"para",{"tagName":"section","attributes":{"style":"font-size: 15px;letter-spacing: 1px;line-height: 1.85;padding: 0px 8px;color: ;box-sizing: border-box;font-style: normal;font-weight: 400;text-align: justify;","data-pm-slice":"0 0 []"},"namespaceURI":"http://www.w3.org/1999/xhtml"},"para",{"tagName":"section","attributes":{"style":"text-align: unset;letter-spacing: 0px;box-sizing: border-box;"},"namespaceURI":"http://www.w3.org/1999/xhtml"},"para",{"tagName":"p","attributes":{"style":"margin: 0px;padding: 0px;box-sizing: border-box;text-align: left;"},"namespaceURI":"http://www.w3.org/1999/xhtml"},"node",{"tagName":"span","attributes":{"style":"color: ;box-sizing: border-box;"},"namespaceURI":"http://www.w3.org/1999/xhtml"}]'>[4]

And this paper on encrypted AML is published in this series (No.111), which shows that BIS attaches great importance to this issue.

BlockSec interpretation:

What is BIS's new approach to compliance?

High score (maximum 100 points): relatively clean funds mainly from "allowed list" wallets

Low score (minimum 0 points): tainted funds associated with known illegal wallets on the "denied list"

Dynamic update: continuous adjustment based on real-time transaction history and risk intelligence

Technical implementation differences:

Stablecoin (account model): a transaction network that cannot track specific tokens but can map wallet addresses

Bitcoin (UTXO Model): The complete history of each satoshi can be traced back to the mining source

Source: An approach to anti-money laundering compliance for cryptoassets

Three implementation strengths:

Strict mode (Allow List): Only tokens whose addresses have passed KYC checks are accepted, similar to the strict identity verification of traditional banks

Medium mode (Multiple Criteria): Combines multiple criteria (holding time, transaction frequency, counterparty history, etc.) for comprehensive evaluation

This design acknowledges the practical limitations of the decentralized world while maintaining regulatory control at key points, avoiding a "one-size-fits-all" approach.

In addition, BIS proposed a controversial concept: the user's duty of care. This means that users also have the responsibility to check the counterparty's compliance score before trading. This presents significant difficulties in practice, but it also reflects BIS's vision of building a compliance ecosystem in which everyone can participate.

Current Regulatory Dilemma:

Travel Rule Challenges and the Evolution of Crime

Although BIS's new approach is elegant in theory, to understand the context in which it was proposed, we must first examine the harsh realities facing the current regulatory system. Currently, global crypto regulation relies mainly on the Travel Rule. Travel Rule This core tool requires VASPs to collect and transmit the identity information of the sender and receiver when processing transactions exceeding a certain amount. However, this highly anticipated regulatory standard is facing major challenges.

The current status of the implementation of the Travel Rule: a huge gap between ideal and reality

According to the latest annual assessment report released by FATF in June this year, FATF Annual Examination: Global Crypto Regulatory Report Card Announced, Travel Rule

The global implementation of the Travel Rule has been disappointing. Of the 138 jurisdictions assessed, only one (the Bahamas) was rated as fully compliant, 29% were largely compliant, 49% were partially compliant, and 21% were still non-compliant. This data has barely improved compared to 2024, exposing the systemic failure of traditional regulatory tools in the crypto world. At the same time, even in the 73% of jurisdictions that have "passed legislation", the implementation of the Travel Rule has been uneven. The huge differences between countries on the threshold standards have become the biggest obstacle: the United States insists on the $3,000 threshold established in 1996 [5], but the European Union began to implement a zero threshold policy in December 2024. [6] (Even a transfer of 1 euro cent requires the Travel Rule). The result of this independent approach is that a cross-border transaction may be "compliant" in the sending country but considered "illegal" in the receiving country, making the transaction impossible to complete. Technical Failures Faced by the Travel Rule The fundamental reason for the failure of the Travel Rule lies in the fundamental conflict between its design assumptions and the reality of blockchain technology. The rule is designed based on the intermediary model of traditional finance, but in a decentralized environment: for self-hosted wallet users, VASPs can be completely bypassed and their off-chain identity information cannot be tracked and verified; for DeFi protocols, there are no traditional intermediaries to enforce identity verification requirements; for Cross-chain transactions involve multiple blockchain ecosystems, and regulatory boundaries remain blurred. It is precisely this systemic failure at the technical level that provides greater room for criminal activities. The evolution of crime: a direct consequence of regulatory failure The difficulties in implementing the Travel Rule have directly led to the rapid evolution and escalation of criminal methods. Not only have criminals not been effectively curbed by this regulatory tool, but they have found more covert methods of committing crimes: Stablecoins have become the new favorite: Against the backdrop of the large-scale outbreak of stablecoins, due to loopholes in the technical implementation of the Travel Rule, Stablecoins have replaced Bitcoin as the tool of choice for criminals. Most on-chain illegal activities now involve stablecoin transactions, as they find it easier to circumvent existing regulatory scrutiny. Evolving Circumvention Methods: Faced with the travel rule's threshold restrictions, criminals are widely using smurfing techniques—splitting large transactions into smaller ones to circumvent them. The $1.46 billion stolen from the Bybit exchange by North Korean hackers in 2025 is a prime example. They cleverly exploited differences in regulatory standards and technical vulnerabilities across countries, bypassing centralized platforms and using DeFi protocols to complete the fund transfer. Ultimately, less than 4% of the funds were successfully recovered. An In-Depth Analysis of the Bybit Theft leaf="">It can be seen that supervision is "easy to understand but difficult to implement", and the world is still in a bottleneck period of institutional implementation.

BlockSec Evaluation:

The significance and policy value of BIS's new ideas

A paradigm shift in global central bank regulatory thinking

This BIS paper should not be judged from the perspective of "whether it provides a perfect solution". It marks the first time that traditional financial regulators have officially acknowledged the disruptive impact of decentralized technology on the existing regulatory framework.

For over a decade, regulators have mostly attempted to force cryptocurrencies into traditional financial frameworks. The BIS's proposal, however, recognizes the irreversibility of decentralized technologies and instead seeks a path to achieve regulatory objectives within this new technological environment.

Policy Direction: Providing a New Template for Global Regulation

As the authoritative voice of global central banks, the BIS's recommendations are often deeply referenced and leveraged by regulators worldwide. This paper's theoretical innovations include transforming blockchain transparency into a regulatory advantage, constructing a compliance framework based on behavior rather than identity, and offering differentiated policy implementation paths. These provide regulators worldwide with specific technical implementation plans, clarify the responsibilities of different participants, and establish a flexible international coordination mechanism.

BlockSec Conclusion:

Historical Opportunities in Regulatory Evolution

2025 is also known as the "first year of stablecoin regulation." Looking back at the global crypto regulatory journey this year, we can see that it is a process of continuous trial, error, and learning: from the East to the West, from Hong Kong to Europe and the United States, all regions are exploring regulatory paths that suit them.

This BIS paper may mark the beginning of a new stage in this learning process—no longer a simple "prohibition and permission," but "understanding and adaptation."

In fact, it is normal for regulation to lag behind technological innovation.

Throughout history, it took the widespread adoption of automobiles for a comprehensive system of traffic regulations to emerge. It took the globalization of telephone technology for a cross-border communications regulatory framework to be established. The internet, too, evolved from its early, untamed growth to a regulated landscape. Cryptocurrencies are undergoing a similar historical process. Every adjustment and adaptation along the way is a necessary step in the maturation of the entire ecosystem. The greatest value of the BIS solution lies in providing a framework for collaboration, rather than confrontation, between the industry and regulators. For the industry, this solution provides clear compliance paths and technical standards while leaving ample room for technological innovation. For regulators, the new framework strikes a balance between regulatory objectives and technological realities and establishes a technical foundation for international coordination. In this era of transformation, excellent regulation should not be a shackle on innovation, but rather guide the industry towards a healthier and more sustainable development. As a member of the BlockSec Our professional compliance monitoring platform, the Phalcon Compliance App, is dedicated to providing a one-stop AML/CFT solution for global crypto companies. We have established deep partnerships with multiple international regulators, including the Hong Kong Securities and Futures Commission (SFC), and have been invited to participate in closed-door discussions with top law enforcement agencies like the FBI. With regulatory paradigms constantly evolving, our on-chain data analysis and risk assessment capabilities will help you find the optimal balance between compliance requirements and business development.

Catherine

Catherine