Author: Oliver, Mars Finance

In the ever-changing world of investment, the real opportunities are often not hidden in the noisy K-line of the market, but hidden under the seemingly boring policy texts in Washington. When the giant wheel of regulation changes its course, the ripples it stirs up are enough to define the flow of wealth in the next few years. Recently, the speech of Atkins, the new chairman of the U.S. Securities and Exchange Commission (SEC), at a conference on "DeFi and the American Spirit" is just such a "treasure map" worthy of repeated study.

The influence of this conference fermented rapidly, so that Binance founder CZ (Changpeng Zhao) publicly stated on social media: "June 9 will be remembered as DeFi Day." This assertion gave a historic footnote to the whole event. Industry observers have also keenly captured the unusual atmosphere in the air and believe that a new round of "DeFi Summer" may be ready to go. This is not groundless. Looking back at the passionate summer of 2020, DeFi grew wildly in the vacuum of regulation and created countless legends. Now, Atkins' speech seems to be paving the way for a more compliant, stronger "DeFi summer" that may be jointly participated by institutions and retail investors.

This is not an ordinary official speech, but a profound reflection and systematic correction of the "enforcement priority" regulatory philosophy of the Gensler era. In this new regulatory blueprint, we can follow the map and discover three "wealth codes" that are enough to reshape the industry landscape and ignite the summer fire. Now, let us interpret the deep meaning behind this with a heart of pulling out silk and cocoon.

The market moves at the news: the positive response of the DeFi sector

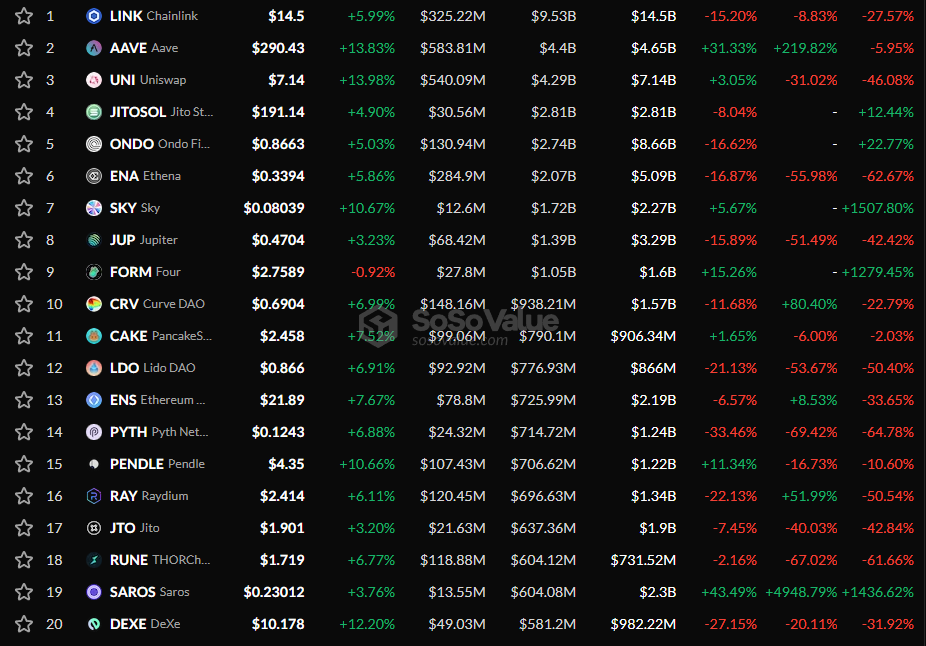

After the details of Chairman Atkins' speech were disclosed, the capital market quickly gave the most direct and frank feedback. Mainstream DeFi protocol tokens rose in response, forming a beautiful landscape, as if collectively cheering for the arrival of this new regulatory trend.

According to market data, blue-chip projects in the DeFi field have all recorded significant gains. Decentralized lending giant Aave (AAVE) and top decentralized exchange Uniswap (UNI) both soared by more than 13%, and Chainlink (LINK), the industry infrastructure oracle leader, also rose by nearly 6%. In addition, the liquidity pledge protocol Jito (JITOSOL) and Ondo Finance (ONDO), which focuses on real-world assets (RWA), also rose by more than 5%. This set of data is not a coincidence, it accurately confirms the value of the three "wealth codes" that we are about to interpret. The logic of the market's reaction is clear: the strong rebound of AAVE and UNI represents the capital's recognition of the prospects of DeFi core applications after the regulation becomes clear; the rise of LINK shows that the market is optimistic about the revaluation of the entire infrastructure layer; and the rise of Jito and Ondo respectively corresponds to the huge potential of the Staking ecology under "autonomous custody" and the RWA track in the "Innovation Sandbox". It can be said that the market has cast a vote of confidence in the positive impact of Atkins' new policy with real money.

The first wealth code: "Innocence" of code - the soil for recreating the big explosion of innovation

In Atkins' speech, the first and most core code is hidden in his new definition of developer responsibility. He used a subtle analogy: "It is irrational to hold the developers of self-driving cars responsible for third parties using cars to violate traffic rules or rob banks." Behind this sentence is the official coronation of the principle of "code neutrality."

This is the fundamental premise for the outbreak of the DeFi summer in 2020 - "innovation without permission." Developers at that time could freely release experimental protocols without worrying about being responsible for potential abuse of the code. However, the Gensler era was marked by the Tornado Cash incident, which brought this free spirit of innovation to an abrupt end, and everyone in the developer community was in danger.

Atkins's argument accurately lifted the alarm for this innovative soil. He clearly shifted the subject of responsibility from the "creator" of the tool to the "user", which is a strong defense of the cornerstone concept of the open source world, "code is speech". When the focus of supervision shifts from reviewing code to tracing evil deeds, the underlying logic of the entire industry becomes clear, and an environment that allows developers to boldly experiment and iterate quickly is returning.

This light of wealth first illuminates the infrastructure tracks that pave the way for the crypto world. Whether it is the public chain of Layer 1 and Layer 2, or the teams that provide development kits (SDKs), the largest negative variable in their valuation models has been removed. At the same time, it opens up space for value repair for the decentralized privacy track. When the neutrality of technology is recognized and "privacy" is no longer equated with "original sin", the market will re-evaluate those privacy projects that have solid technology and are committed to protecting the legitimate rights of users. This is undoubtedly a declaration that the certainty of investment infrastructure and developer ecology has reached an unprecedented height.

The second largest wealth code: the "return" of property rights-the core engine of detonating liquidity

If the first code liberates productivity, then the second code provides the core fuel for detonating liquidity. Atkins emphasized that "the right to self-manage private property is one of the basic values of the United States, and this right should not disappear because people log on to the Internet." This sentence is a royal certification of the concept of "self-custody" in the crypto world.

In the summer of DeFi in 2020, the core gameplay is yield farming, where users pledge and lend their assets in various protocols to obtain returns. All of this is based on the user's absolute control over their own assets. However, the crackdown on centralized staking services in the Gensler era once cast a shadow on the compliance of this model.

Atkins' speech was a thorough declaration of "return of property rights". He shifted the focus of the narrative from the platform's "services" to the user's "rights", and explicitly supported users to directly participate in on-chain financial activities through their personal wallets. This is not only a technical recognition, but also a confirmation of the sacredness of the golden rule of the crypto world, "Not your keys, not your coins", from the height of the core values of the United States.

This password unlocks an extremely large ecosystem of Staking and its derivatives. The legitimacy of the business model of the Liquidity Staking Protocol (LSD) represented by Lido and the Restaking track centered on EigenLayer have been fundamentally guaranteed. Previously, the market's biggest doubts about it (whether it would be characterized as an unregistered security) have basically disappeared, which has opened the door for them to trillions of asset allocations from mainstream financial institutions. At the same time, the strategic value of all wallet service providers has been greatly enhanced, and they are becoming the "super application" entrance to the next generation of the Internet.

The third wealth code: the "sandbox" of innovation - the official incubator for the birth of new species

After clarifying the two fundamental issues of "code innocence" and "property sanctity", Atkins gave the third and most constructive code - the establishment of an "Innovation Exemption" framework. This marks that the SEC's regulatory thinking is shifting from "passive defense" and "after-the-fact strike" to "active guidance" and "pre-planning".

The summer of DeFi in 2020 witnessed the "Cambrian explosion" of countless new species (such as AMM DEX, decentralized lending, and algorithmic stablecoins). But this explosion took place in a wild land of supervision. Atkins' "Innovation Sandbox" attempts to provide an officially certified and safer "incubator" for the next species explosion.

This is a wise art of regulation. It recognizes that using the laws of the last century to rigidly apply the ever-changing digital finance is itself a kind of cutting one's feet to fit the shoes. Therefore, under the premise of keeping the core bottom line such as "anti-fraud", giving new things a space for trial and error, iteration and growth in the real market environment has become an inevitable choice.

This password has opened up a new testing ground for all entrepreneurs with dreams and investors with discerning eyes. Whether it is a pioneer committed to tokenizing real world assets (RWA) such as real estate and bonds, or a dreamer who imagines the future of decentralized social networking, they all have a predictable "green channel" to quickly verify their ideas. For venture capital institutions (VCs) and early investors, this means that the biggest systemic risk in the portfolio - the risk of regulatory mutation - has been greatly reduced.

Future Outlook: Prelude to "DeFi Summer 2.0"

Chairman Atkins' speech, like a key, opens the door to understanding the SEC's new policy. These three "wealth codes" - code exoneration, the return of property rights, and the sandbox of innovation - are linked together to build a clearer, friendlier, and more dynamic new regulatory paradigm.

If the DeFi summer in 2020 was a bottom-up grassroots carnival driven by geeks and adventurers, then what Atkins' new policy foreshadows may be a "DeFi Summer 2.0" jointly participated by developers, retail investors, and Wall Street giants. It will no longer be a wild growth, but an orderly prosperity under clear rules.

This is not only about the short-term benefits of several tracks, but also a profound long-term value reassessment. It indicates that the United States is reshaping its leadership in the global crypto economy with a more confident and open attitude. For everyone in this industry, understanding these signals and turning them into profound cognition may be the key to traversing the bull and bear markets and grasping the pulse of the next era. The gears of history have begun to turn, and a new chapter of more mature and prosperous crypto is slowly unfolding.

YouQuan

YouQuan

YouQuan

YouQuan Joy

Joy YouQuan

YouQuan YouQuan

YouQuan Brian

Brian Joy

Joy Joy

Joy Brian

Brian Jixu

Jixu Jixu

Jixu