REGISTER NOW: Coinlive's Pre-TOKEN2049 Event "The Social Pre-Party’"

Step into an exceptional evening of profound discourse, networking, and inspiration with Coinlive at The Social Pre-Party on 11 September!

Catherine

Catherine

Author: insights4.vc Translation: Shan Ouba, Golden Finance

The shift in Washington policy to support the crypto industry (after the 2024 election) has significantly eased regulatory pressure on the industry. The US Senate passed the "GENIUS Act" with bipartisan support, which aims to clarify the division of responsibilities between stablecoin regulation and the SEC/CFTC, which greatly enhanced market confidence. At the same time, the market's expectation that the Bitcoin spot ETF (sponsored by BlackRock and other institutions) will be approved in late 2024 has attracted a large amount of new capital into the crypto market, with beneficiaries including custodians and liquidity providers. In addition, the Fed's suspension of interest rate hikes (and possible rate cuts in 2025) has improved the overall macro liquidity environment and boosted risk assets, including crypto assets.

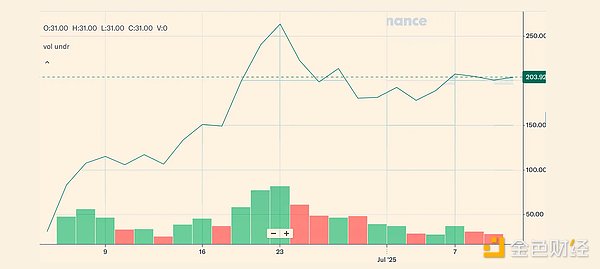

Coinbase and newly listed Circle (ticker: CRCL) are currently the largest crypto equity companies in the United States by market value (approximately $95 billion and $50 billion, respectively). Circle entered the public market through a direct listing in June 2025, and its stock price has risen nearly 4 times due to the popularity of stablecoins, becoming the focus of the market.

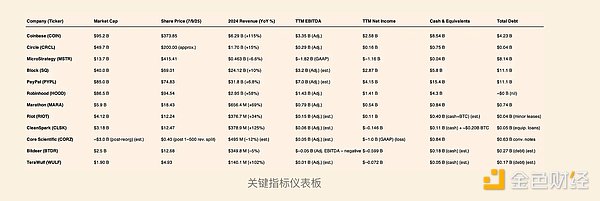

Mining companies are experiencing a wave of consolidation. Marathon and Riot set new revenue records in 2024 (up 69% and 34%, respectively) and achieved GAAP-based profitability. Overall, industry fundamentals improved significantly in 2024-2025: many companies cut costs during the bear market in 2022-2023 and are now benefiting from rising crypto prices and increased on-chain activity. The attached “Key Metrics Dashboard” details the financials of the top public companies (including market capitalization, revenue, profitability, balance sheet, etc.).

The next 12 months will see a strong batch of IPOs, including companies such as Kraken and BitGo. Key trends to watch include: exchange fee compression, mining companies’ diversification into high-performance computing (such as AI workloads), the impact of the US stablecoin bill (expected to be introduced before the end of the year), and the subsequent impact of the 2024 Bitcoin halving on miners’ profit model. Traditional financial companies should be prepared to participate in it through partnerships, strategic investments, or internal R&D, as crypto finance is further integrated with the mainstream market.

Since the beginning of 2024, the US regulatory environment has improved significantly. The new administration openly supports digital asset innovation — President Trump has appointed a number of crypto-friendly regulators and urged Congress to clarify the rules of the crypto market. This process reached a peak in mid-2025: Congress is advancing the Financial Innovation and Technology Act (FIT Act, which clarifies the regulatory boundaries of the SEC and CFTC on tokens) and a stablecoin licensing bill (referenced to the "Stablecoin TRUST Act"). Although these bills have not yet become formal laws, their legislative progress has alleviated the uncertainty caused to the industry by the previous "enforcement instead of legislation".

Of particular note, the Senate passed the "GENIUS Act" (i.e., the National Uniform Stablecoin Standards Guidance and Establishment Act) in June 2025, laying the foundation for federal stablecoin regulatory rules. At the same time, the SEC and CFTC have begun to cooperate under a clear division of labor, such as the CFTC is responsible for most non-security tokens, while the SEC focuses on disclosure supervision of token issuance. This settlement trend, coupled with the SEC's judicial setbacks in several key cases, has reduced legal uncertainty in the crypto market.

After aggressive rate hikes in 2022–2023, the Fed began to pause rate hikes in late 2024 as inflation had fallen significantly. Throughout 2025, the benchmark interest rate remained at around 5%, and hinted that if the economy slowed, it might be cut this year. This "pause + expected easing" stance supported the prices of risky assets. Crypto assets benefited in particular, as the dollar weakened slightly in the first half of 2025 as real yields stabilized.

Institutional allocators who had previously waited on the sidelines during the rate hike cycle re-entered the market, seeking returns and portfolio diversification. An institutional survey in mid-2025 showed that the market's acceptance of crypto assets as "alternative assets" was increasing. In addition, the Bitcoin spot ETF application led by BlackRock, Fidelity and others was tacitly approved, and the first batch of US spot Bitcoin ETFs are expected to be listed in the fourth quarter of 2025. Even in the anticipation stage, a large amount of funds have flowed into crypto investment products (by the end of 2024, more than $5 billion had flowed into BTC futures ETFs and trust products, betting that they would be converted into spot ETFs). These trends have intensified the correlation between crypto assets and the macro liquidity cycle - a major shift compared to the isolation and downturn during the bear market in 2022.

The shift in US policy has also reversed the previous trend of crypto capital outflows. In 2023, due to the tough US regulation, the UAE, Hong Kong and Europe once attracted a large amount of talent and capital. But since 2024, the United States has begun to regain its advantage: the expectation and clear regulations of spot ETFs have prompted several large crypto funds to move their registered places back to the United States, while venture capital investment in US startups has also increased significantly (in the first half of 2025, US crypto VC financing was about US$4.8 billion, which is expected to exceed the level of 2022).

Internationally, the EU MiCA Regulation came into effect in 2024, providing a comprehensive (but strict) regulatory system for crypto service providers. US companies such as Coinbase are actively applying for EU licenses to adapt to MiCA, but the requirements for the "travel rule" and stablecoin reserves are significantly stricter than the proposed US regulations.

In addition, geopolitical factors (such as sanctions against Russia) have caused governments to continue to pay close attention to the role of encryption. In early 2025, the US Treasury Department's Office of Foreign Assets Control (OFAC) issued clearer guidance on sanctions compliance for crypto transactions, alleviating the concerns of US exchanges and mining companies about legal liability. This progress is generally regarded by the industry as a positive incentive for "responsible innovation."

In terms of monetary policy, the current government has almost abandoned the plan to issue CBDC (central bank digital currency), leaving room for the development of private stablecoins - which has further enhanced the market's optimism about companies such as Circle.

On the whole, the shift in macro and regulatory policies has created a more favorable environment for U.S. crypto companies. In July 2025, analysts from several brokerage firms generally predicted that the industry's revenue growth will be higher than last year, partly due to the release of institutional demand due to clear regulation. However, there are also views that the accelerated growth of global computing power and competition from overseas low-cost mining companies may put pressure on the profit margins of U.S. mining companies (such as the expansion of mining companies in the Middle East and Asia). In addition, key bills related to stablecoins and market structure have not yet been finally passed, and if the bills are shelved or delayed, they will still pose a risk factor. Overall, the current policy tone is the most constructive in recent years, which has significantly reduced the "regulatory discount" of crypto equity.

Coinbase (COIN) remains the largest cryptocurrency exchange in the United States. Its revenue in 2024 doubled year-on-year to $6.3 billion, benefiting from increased trading volume and interest income, and net profit reached $2.6 billion. Coinbase's market value has risen to approximately $95 billion, reflecting the market's confidence in its diversified business (including subscription services, Layer-2 network Base) and ETF-driven trading growth.

Robinhood (HOOD) Although a multi-asset platform, about 18% of its revenue in the first quarter of 2025 came from crypto business. Benefiting from high interest rates, Robinhood's interest income from customer cash has increased significantly, driving its net profit to $1.41 billion in 2024. Its stock price (market value of about $85 billion) has risen, driven by earnings growth and regaining favor with technical traders (including crypto traders).

Circle (CRCL) As the issuer of USDC, it entered the public market through a direct listing in June 2025 and has a current market value of about $50 billion. After the listing, the stock price soared, and its revenue in 2024 was $1.7 billion (a year-on-year increase of 15%), mainly from interest income on USDC reserves. However, due to the interest sharing with distribution partners, its net profit fell 42% to $157 million. The listing highlights the core position of stablecoins in crypto infrastructure: by the end of 2024, the circulation of USDC reached $44 billion (a year-on-year increase of 80%). Circle is preparing to use USDC for a wider range of payment purposes, waiting for the implementation of stablecoin legislation.

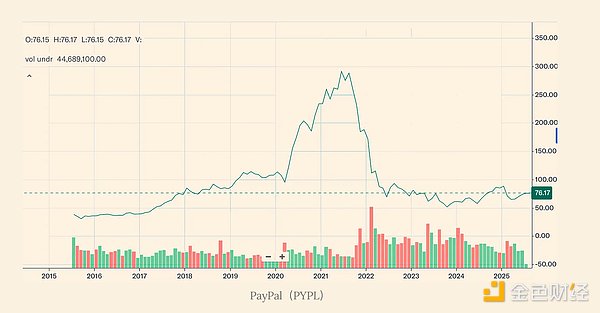

PayPal (PYPL) launched its own dollar stablecoin PYUSD at the end of 2023. By mid-2025, PYUSD will have a circulation of about $1.2 billion, and the adoption rate is still moderate, but it has enhanced the attractiveness of PayPal's crypto wallet. PayPal's crypto trading volume in 2024 was basically flat, but the company's total revenue still increased by 6.8% to $31.8 billion, with a net profit of $4.15 billion. Investors are watching PayPal's next plan for PYUSD and whether it can use its large user base to promote stablecoin payments (regulatory frameworks will play a key role in this).

2024 At the end of the year, as Bitcoin prices soared and a new generation of mining machines improved profit margins, listed mining companies experienced a significant rebound in performance. Marathon Digital (MARA) almost tripled its output after expanding to 23 EH/s computing power. Revenue in 2024 was $656 million (+69% year-on-year), and net profit was $541 million, of which $514 million came from unrealized gains on Bitcoin holdings under the new fair value accounting. Marathon raised $750 million for expansion by issuing 0% convertible bonds in August 2024, with a cash balance of $836 million at the end of the year and a market value of approximately $6.5 billion, the largest among mining companies.

Riot Platforms (RIOT) has more robust growth—revenue of $377 million (+34%) and net profit of $109 million in 2024, and maintains one of the lowest cost structures in the industry (average direct cost per bitcoin is about $12,000). CleanSpark (CLSK) actively acquired other mining companies in the bear market and doubled its computing power by mid-2024. This strategy worked: revenue reached $379 million (+125%) in fiscal year 2024 (ending September), and although it had a full-year net loss of $146 million (mainly due to high depreciation and one-time expenses), it recorded a record quarterly profit of $247 million in Q4 2024 when Bitcoin soared, providing cash reserves for further investment. Its market value is now close to $3.2 billion.

Core Scientific (CORZ) quickly benefited from the bull market after completing bankruptcy protection reorganization in early 2024. With revenue of about $495 million in 2024 (down from 2023 as part of the business shifted to high-performance computing services), it posted a huge net loss of more than $1 billion on paper, mainly due to market value fluctuations of stock option liabilities. But from an operational point of view, Core's foundation is more solid - it raised $625 million in new capital, had a cash balance of $836 million at the end of the year, and even attracted a takeover offer: In July 2025, AI cloud service company CoreWeave proposed a stock transaction that valued Core Scientific at about $9 billion, highlighting the cross-border value of mining companies' data center infrastructure in the field of AI.

Bitdeer (BTDR) went public via SPAC in April 2023, but had a tough 2024, with revenues down slightly to $350 million (custody business shrinks) and a net loss of $599 million. Its results are highly volatile - it recorded a one-time fair value gain of $409 million in Q1 2025, but its core mining profitability lags behind its US peers, partly due to higher costs at its international sites (such as Norway).

Finally, the smaller Nasdaq-listed miner TeraWulf (WULF) more than doubled its revenues to $140 million in 2024 as its new nuclear mine came online, but still recorded a net loss of $72 million. TeraWulf's focus on zero-carbon energy may attract ESG-focused investors if it seeks additional financing in the future.

Crypto trading fees are facing downward pressure as competition intensifies. Exchanges' comprehensive fee rates decline during 2024–25, driven by the rise of zero-commission products and increased institutional trading volumes. For example, Coinbase's retail trading commission rate falls to about 1.1% in 2024, compared to about 1.4% in 2023. Robinhood’s commission-free model (subsidized by order flow payments in cryptocurrencies) has forced other platforms to offer loyalty discounts.

Exchanges are responding by diversifying their businesses: subscription services are the focus. Coinbase’s “Coinbase One” membership program offers zero-fee trading and enhanced customer support, with more than 500,000 users in the first half of 2025. Exchanges are also looking for new sources of revenue—Coinbase and Kraken are expanding their derivatives businesses (Kraken acquired a small futures platform and applied for a CFTC clearing license), while Gemini is focusing on developing wealth management products for crypto users (such as staking income portfolios).

Changes in market structure could benefit top players: If the U.S. passes the FIT Act to establish an exchange registration framework, compliance costs could squeeze small platforms, thereby promoting the industry’s concentration on large exchanges such as Coinbase, Kraken, and Gemini that are compliance-friendly and actively participate in policy discussions.

In addition, exchanges are also expanding their asset catalogs (listing more altcoins, tokenized stocks, and ETFs in some jurisdictions) to attract trading interest beyond Bitcoin. The competitive landscape in 2025 is characterized by "low fees and high trading volume": in the first quarter of 2025, spot trading volume on US exchanges increased by about 60% year-on-year, largely offsetting the impact of falling fees. Exchanges with scalable technology and diversified products are most likely to maintain revenue growth in this high-volume, low-margin environment.

Some public companies use their balance sheets to hold Bitcoin as a vault asset, essentially providing investors with a "Bitcoin ETF alternative with a main business." MicroStrategy is a typical representative, holding 528,000 BTC (market value of approximately US$58 billion) as of the second quarter of 2025. Its stock price usually trades at a premium to its net asset value (in May 2025, MSTR's market value was about $108 billion, while its BTC holdings were about $50 billion, a premium of more than 2 times), reflecting investors' optimism about management's continued hoarding strategy and the scarcity of "pure Bitcoin" investment tools in the market.

This premium is more significant after the adoption of fair value accounting: MicroStrategy's earnings fluctuate greatly (it reported a fair value loss of $5.8 billion in Q1 2025, and Q2 is expected to have large gains as BTC continues to rise), but investors generally ignore short-term fluctuations in GAAP earnings and pay more attention to the core indicator of BTC holdings.

Other companies have also adopted similar strategies: Jack Dorsey's Block holds about 13,000 BTC and says it may continue to increase it as a strategic reserve asset. Mining companies Marathon and Riot also retain some of the Bitcoin they mine (Marathon held about 12,300 BTC at the end of 2024, not much less than MicroStrategy's holdings, mainly financed by issuing additional shares).

These enterprise-level Bitcoin vaults bring unique risks and opportunities: in a bull market, holding assets will greatly increase profits. For example, Marathon's net profit in 2024 came largely from $514 million in unrealized crypto gains; but in a bear market, liquidity may be severely squeezed (in 2022, miners had to sell coins at low points to cover costs, which is a lesson learned). Looking ahead, companies are taking more proactive treasury management strategies: some mining companies began to try small-scale BTC lending or yield strategies in 2025 to realize their holdings without selling; MicroStrategy even launched a "Bitcoin yield" indicator (annualized yield of 13.7% in Q1 2025) to increase BTC holdings per share through derivative strategies.

Investors should continue to expect extremely high volatility in such stocks-essentially, they are long positions in Bitcoin with operating leverage. If a spot Bitcoin ETF is approved, the valuation premium of these companies may be eroded because investors will have a more direct alternative; however, management such as MicroStrategy has stated that any additional capital will continue to be invested in buying coins to maintain its attractiveness as an "asset investment stock."

Circle and Paxos have brought the stablecoin business into the core vision of stock market analysts. With rising interest rates in 2023-24, the spread income of stablecoin reserves has become extremely considerable. As the issuer of USDC, Circle earned more than $700 million in interest income in 2024 (about $30 billion in average USDC reserves, with a yield of about 4-5%), contributing a major part of its total revenue of $1.7 billion. However, Circle is required to share 50% of USDC interest income with Coinbase according to the Centre Alliance Agreement, and increased the rebate ratio to other ecological partners in mid-2024, so its net income growth is only +15%. Despite this, the stablecoin reserve spread has proven to be a sustainable profit engine.

As the issuer of USDP (and previously BUSD for Binance), Paxos also received a lot of interest income, although the forced liquidation of BUSD in 2023 may cause its overall revenue to decline in 2024. Both companies are actively lobbying for clear stablecoin regulatory approvals (such as a federal trust license), which will consolidate their reserve compliance status and support business expansion.

Another key theme is the issuance and circulation of stablecoins: Circle's USDC trading volume is mainly dominated by US institutions, while Tether (USDT) still dominates the world (circulation volume of about $80 billion vs. USDC's about $44 billion). Circle's listing and transparency are part of its fight for market share, trying to make USDC a "compliant first choice" stablecoin. Circle is also actively developing revenue models other than interest, such as exploring offline loans under strict risk control and promoting the application of transaction fees through programmable wallet APIs.

PayPal's PYUSD is a new variable. Although it is currently small in scale, PayPal can use its 400 million users to promote PYUSD and earn reserve spread income as a listed company. In general, the business model of stablecoin issuers is shifting from pure volume growth to "maximizing the economic benefits of every dollar": ensuring high-yield reserve allocation (Circle will transfer more reserves to short-term US bonds in 2024) and minimizing revenue sharing agreements. If Congress passes capital adequacy requirements, it may require more collateral or liquidity buffers, slightly reducing profit margins, but the industry generally expects that regulations will establish compliance while allowing banks to custody and earn interest income, thereby preserving most of the profit space.

In the big picture, the market is increasingly viewing stablecoin companies as "digital narrow banks" and giving this model a fairly high valuation (Circle's valuation of approximately US$50 billion means a forward price-to-earnings ratio of >30 times). However, if interest rates fall sharply, this part of the carry income will shrink - investors need to weigh interest rate risk against long-term user growth prospects.

Although the Bitcoin halving in April 2024 will halve the block reward, the Bitcoin mining industry is still in an expansion phase in 2025. The reason is that the price surge after the halving (BTC> $100,000) completely offsets the reward reduction, and miners are racing to deploy the next generation of mining machines to compete for global computing power share before the next halving in 2028. The global Bitcoin network computing power increased by about 70% year-on-year, reaching about 450 EH/s in mid-2025.

Marathon and Riot each had an operational hashrate of over 20 EH/s by mid-2025, and Marathon plans to reach 30 EH/s by early 2026 with new facilities in Abu Dhabi and West Texas. CleanSpark acquired thousands of mining machines at low prices during the bear market and now claims a hashrate of ~16 EH/s, with the lowest total electricity cost in the industry at $0.04/kWh (thanks to a nuclear power contract in Georgia). Core Scientific adjusted its strategy after the reorganization: it is still expanding its own mining (2025 target of 25 EH/s), but it has also transformed some of its campuses into high-performance computing (HPC) data center hosting, such as signing a contract to provide 250 MW of computing power to AI cloud service provider CoreWeave until the end of 2025.

This is part of a broader theme: miners are diversifying into high-performance computing to leverage their infrastructure even during crypto downturns. We’re also seeing a trend toward vertical integration: in addition to Block’s ASIC project, Bitdeer (backed by Jihan Wu) is also developing proprietary farm management software and modular mining machine containers to improve efficiency and potentially sell them externally. The race to expand computing power also brings the risk of overcapacity, especially if prices fall back. Small or highly leveraged miners may be squeezed out — Core Scientific warns that those using expensive grid power will face a “liquidation” before the next halving.

Power contracts are now a key competitive advantage. TeraWulf’s nuclear power farm in Nautilus, Pennsylvania, pays just $0.02/kWh for electricity, supporting a gross margin of more than 80%, while some older farms pay more than $0.07 for electricity, barely breaking even at current BTC prices. Capital markets have placed premium valuations on miners that can lock in low-priced, preferably renewable electricity and have a path to expansion. This race for capacity is expected to continue through 2026, but it could also lead to consolidation, with large players with efficient operations able to acquire struggling competitors and grow even bigger.

An emerging trend for 2025 is the convergence of crypto miners and infrastructure companies with the fast-growing AI computing sector. The CoreWeave-Core Scientific deal is a prime example: an AI startup valued at $2 billion was willing to pay about $9 billion (in stock) for a bitcoin miner’s data center. Why? These facilities have abundant power, cooling, and racks—just what GPU-based AI training clusters need.

Bitcoin mining farms can be transformed into high-performance computing (HPC) workloads during off-peak hours or completely, especially as the efficiency of ASICs increases and the number of physical machines required for mining decreases. Some mining companies have begun dual-purpose businesses: Canada's Hive Blockchain, for example, also runs HPC workloads in addition to Ethereum mining; Applied Digital (NASDAQ: APLD) has transformed from a mining company to an AI cloud service company in 2025.

US listed mining companies are also following suit. Riot is evaluating the possibility of renting part of its large Texas facility to AI customers in 2026. Marathon's CEO also mentioned exploring "computing diversification" - the company is involved in a research alliance to study the synergy between Bitcoin mining and data center power grids (mining machines can be quickly limited and can balance the load on the power grid, which is valuable in large HPC centers).

This convergence suggests that the boundaries between "Bitcoin miners" and "data center operators" may blur. From an investor's perspective, this has the potential to reduce miners' revenue volatility (introducing HPC rental income that is not directly dependent on BTC prices), while also opening up new financing channels for miners (such as HPC equipment loans, cooperation with cloud service providers). The strategic implication is that crypto infrastructure companies are trying to position themselves as part of a broader digital infrastructure system rather than a single-purpose mining company.

If successful, the market may give higher valuation multiples (similar to data center REITs or cloud service companies). But the execution is also difficult - transforming a mining farm into a facility for AI workloads is not easy, and the network, security and stability requirements are higher. Nevertheless, it is expected that there will be more news of cooperation between crypto companies and AI companies in the future. For example, Coinbase's cloud service department is rumored to be in talks with an AI startup to use its computing cluster originally used for on-chain analysis to run machine learning tasks. This cross-industry cooperation was almost unimaginable two years ago, but now it is becoming a new growth frontier.

In the coming year, a wave of high-profile crypto companies are preparing to land on the public market. The following is an in-depth analysis of the most anticipated IPO projects and candidate companies:

Kraken is a San Francisco-based cryptocurrency exchange that is expected to go public in the first quarter of 2026 through a direct listing or traditional IPO (it abandoned the SPAC path as early as 2022). In June 2025, Kraken completed a small round of $27 million in Pre-IPO financing, with a valuation of approximately $11 billion, as a strategic supplement to its expansion plan. The company is currently growing steadily: revenue in the first quarter of 2025 was $472 million (up 19% year-on-year), adjusted EBITDA was $187 million, and profit margins were about 40%. This means that full-year revenue in 2025 is expected to be between $1.8 billion and $2 billion, firmly ranking second in the United States, second only to Coinbase.

Unlike Coinbase, Kraken keeps a low profile on regulators (it withdrew from US staking services early on to settle with the SEC, while holding a crypto banking license in Wyoming). This conservative strategy is working: in mid-2025, as some small and medium-sized EU exchanges closed, Kraken's European users increased significantly, while also expanding in Asia (it has obtained a new license in Japan and started operations).

IPO prospects: Co-founder and CEO Jesse Powell has stepped down at the end of 2022, and COO Dave Ripley and co-CEO will lead the IPO process. They said Kraken would go public after the regulatory environment in the United States becomes clear, and this condition has basically been met. If the next Bitcoin ETF is launched and the market environment strengthens, the timing of the IPO will be very favorable.

Investors will focus on Kraken's diversified revenue sources (spot trading, futures trading obtained through the acquisition of Crypto Facilities, overseas pledge business, NFT market, etc.). One point to note is its banking business Kraken Bank, which may bring vertical integration advantages, but may also attract additional attention from banking regulators.

Despite significant investments in security and compliance, Kraken's net profit in 2024 is still estimated to be approximately US$100 million, showing good profitability. Potential risks are: Kraken's fees are higher than Coinbase at some levels, and if the industry as a whole faces fee compression, it may be under pressure. Management may emphasize its user loyalty and global coverage to support its pricing.

In summary, Kraken's IPO will provide U.S. investors with another pure crypto exchange stock, which is widely regarded as "Coinbase's closest competitor". If Coinbase maintains a price-to-sales valuation of about 10 times sales, Kraken's IPO valuation may also fall into the low billion dollar range (depending on market conditions). Management hinted that it will be more capable of acquisitions after the IPO (perhaps acquiring small and medium-sized overseas exchanges or DeFi interfaces). Kraken will create an image of "trustworthy, long-term operation (established in 2011), successfully navigating regulatory cycles, and ready to welcome the next wave of users" in the IPO narrative.

BitGo is a Palo Alto-based crypto custody and infrastructure company that is reportedly in discussions with advisors to launch an IPO as early as the second half of 2025. Founded in 2013, BitGo has grown into a giant in institutional crypto custody: by mid-2025, its assets under custody (AUC) exceeded $100 billion (about $60 billion by the end of 2024), reflecting the soaring demand for safe storage. Its core business is to custody digital assets for institutional clients and assist in asset circulation, and the market's preference for regulated custodians after the collapse of FTX has accelerated its growth.

BitGo's managing director for Asia Pacific said that its AUC grew 67% in 6 months, and about half of its assets have been pledged, which means that BitGo monetizes the custody assets by providing pledge income. Although the company does not disclose revenue data, industry analysts estimate that its revenue in fiscal 2024 will be between $150 million and $200 million, mainly from custody fees, pledge income spreads, and crypto trading and lending services.

BitGo has also been actively acquiring and expanding in recent years - for example, it acquired the wallet security startup Armor in 2024, and acquired the remaining financial technology infrastructure technology after the collapse of Prime Trust to enhance its own platform. BitGo raised $100 million in its Series C financing in 2023, with a valuation of $1.75 billion. Considering the rapid growth of AUC thereafter, coupled with rising interest rates and pledge income, BitGo may seek a valuation of billions of dollars when it goes public.

Its core selling points include:

Compliance advantages: BitGo holds multiple trust licenses in South Dakota, New York, Switzerland and other states, meeting the U.S. and global regulatory standards for "qualified custodians";

Top customer base: It provides custody services for multiple mainstream exchanges (which have received a large number of FTX institutional clients), investment institutions and the Salvadoran government's Bitcoin reserves;

Good security record: There have been no major security incidents so far, and this is particularly critical in the field of crypto custody.

BitGo also benefits from the industry's consolidation trend: small custodians such as Prime Trust have closed down, and Coinbase Custody prefers to serve internal needs, making BitGo one of the few leading companies that still operates independently.

Potential risk factors include:

Custody fees may face compression (if Fidelity Digital Assets or Coinbase decide to grab market share);

Half of the assets are staked assets, which means that the business is highly dependent on the PoS network, and the volatility of staking income or changes in regulatory policies may bring shocks.

Nevertheless, CEO Mike Belshe said that the listing will increase institutional trust (institutions prefer transparent and well-capitalized service providers). The timing of the listing (end of 2025) may also benefit from the introduction of stablecoin regulatory legislation (BitGo is also one of the main stablecoin custodians) and the institutional entry brought by the introduction of ETFs.

In summary, BitGo is building the role of "shovel seller" in the crypto economy - providing security infrastructure to all parties. If successfully listed, it will become an important indicator of institutional crypto market sentiment.

ConsenSys is a Brooklyn-based software company with star products such as MetaMask and Infura. Although the IPO timetable has not yet been determined, it completed an extension round of Series D financing in May 2025 (the amount and valuation were not disclosed) to support business growth, indicating that it is preparing for listing. The previous Series D financing in March 2022 was US$450 million, with a valuation of US$7 billion. According to internal sources, as the product progresses smoothly, the company has recently sought an internal valuation of more than $10 billion.

Its core product MetaMask will have more than 100 million annual active users in 2024, and will begin to monetize (through built-in exchange functions and the launch of institutional versions) from the end of 2023. As of mid-2025, MetaMask's aggregated DEX and staking functions can bring the company about $40-50 million in revenue per quarter, marking a major shift in the business model of this traditional "free software company."

In addition, ConsenSys launched the zkEVM second-layer network Linea in 2023, which has achieved a certain amount of usage in 2025, and plans to issue Linea tokens within the year (if the company retains some tokens, it will further release value). Although specific financial data has not been disclosed, industry insiders estimate that its revenue in fiscal year 2024 will be in the hundreds of millions of dollars (from Infura's API subscriptions, MetaMask exchange revenue, and enterprise blockchain contracts), but due to high R&D expenses, it is still close to break-even.

The attraction of going public is that: ConsenSys is one of the few large companies that is truly focused on Web3 infrastructure, and is a bet on the "decentralized Internet" rather than just crypto transactions. Its future development depends on the continued popularity of self-hosted users (MetaMask is the preferred entry point for many users to enter Web3).

In terms of risks, MetaMask faces competition from new wallets such as Coinbase and Robinhood, which have a smoother user experience. To meet this challenge, ConsenSys made two key acquisitions between 2024 and 2025 to improve MetaMask's user experience - especially the acquisition of Web3Auth in June 2025, which allows users to log in to MetaMask via email/social accounts without a seed phrase, which is a major breakthrough in UX.

This Series D financing is mainly used for the above-mentioned user experience improvement and compliance construction (the company also geographically restricts some services to avoid US regulatory risks until the rules are clearer). If listed, ConsenSys may position itself as an "infrastructure provider" in the Web3 era - analogous to AWS (through Infura) + dominant wallet platform in the blockchain field.

The timing may be later - expected in the first half of 2026 - because CEO Joseph Lubin has hinted that he hopes to launch tokens (whether Linea or MetaMask tokens) before listing stocks to activate its community users.

Although it is still a private company, its financing, acquisitions and commercialization steps have clearly shown that it is moving towards the public market. If it can be successfully listed, it will provide public market investors with a scarce channel to participate in the growth of the Ethereum ecosystem.

Chainalysis, a blockchain analysis company headquartered in New York, has not yet officially announced its IPO plans, but it conducted a major secondary equity transaction in February 2025 to provide liquidity for early investors and employees. The secondary transaction is said to imply a valuation of approximately US$4-5 billion, which is lower than the last major financing valuation in mid-2021 ($8.6 billion), reflecting the overall valuation reset of private technology companies after 2022.

Despite the decline in book valuation, Chainalysis’ business fundamentals remain strong and growing, especially against the backdrop of a sharp increase in government attention to crypto compliance. The company has a backlog of more than $100 million in government contracts, covering the U.S. Department of Treasury, Department of Justice, Department of Homeland Security, and allied governments overseas (it is the go-to service provider for tracking illegal crypto transactions).

In 2024, Chainalysis also expanded its product offerings to the private sector—its “KYT (know your transaction)” compliance software is currently used by more than 200 crypto businesses to monitor wallets in real time. Revenues in 2024 are estimated to be around $200 million, up from about $150 million in 2023, with a significant portion of that being subscription-based recurring revenue for software tools.

The company is not yet profitable (after investing heavily in products and global office expansion, and also laid off about 5% of its employees at the end of 2022 to reduce costs). Still, the company could be close to breakeven on an adjusted basis by 2025.

Chainalysis’ strategic value is huge — think of it as the crypto world’s “fact-checker,” helping law enforcement and exchanges uncover hacks, scams, and sanctions circumvention. Its closest competitor, Elliptic, is much smaller and still private, and some banks frequently buy Chainalysis’ data even as they build their own analytics capabilities.

The timing of its IPO will likely depend on market conditions and the willingness of early-stage VCs (e.g., Accel, Benchmark) to exit; that February 2025 secondary trade suggests they’re willing to wait, perhaps for a full IPO in 2026.

During this period, Chainalysis has also been expanding its business scope: it acquired a government services contractor (Abaxx Associates) in 2024 to enhance its capabilities in federal government procurement, and has been touting its new capabilities to analyze DeFi and NFT markets (as crypto criminals begin to turn to these areas).

Chainalysis's IPO story will emphasize regulatory tailwinds: As global crypto regulations strengthen, the demand for blockchain analysis will only grow. One risk factor is that crypto transactions will become more difficult to track if they move to privacy-enhancing technologies (such as mixers or privacy chains) - but at the same time, regulators are also cracking down on these technologies (for example, OFAC sanctioned mixer Tornado Cash).

Chainalysis' long-term vision is to become the "Bloomberg" of blockchain data - as crypto is integrated into the financial system, it becomes a necessary data layer. If it can maintain revenue growth and improve margins, an IPO in late 2025 or 2026 is possible. Based on current private market valuations, the post-IPO valuation could fall into the mid-single-digit billion-dollar range; but if the crypto market was hot at the time, Chainalysis could also receive a premium multiple similar to that of high-growth SaaS analysis companies.

Bullish Global: This exchange, backed by Block.one and Peter Thiel, attempted to go public through a SPAC in 2021 at a valuation of $9 billion (later canceled). It is still in operation, focusing on institutional liquidity pools, and may restart its listing plans in the future. However, Bullish's trading volume has been limited, and it faces challenges to support its high valuation. If market conditions allow, it is more likely to go public through the traditional IPO route but at a lower valuation. There are reports that Bullish may wait until its "hybrid order book/AMM" model has more empirical data, which will take at least another year of operation. If it does go public, it will focus on its deep liquidity (it uses its own vaults to make markets) and potential regulatory compliance advantages (it is headquartered in Gibraltar and regulated by the Bermuda Monetary Authority). However, in the current landscape, Bullish is a small player, and if it goes public, it may not be as high-profile as other candidates, but will go public "quietly" during the bull market window.

Gemini: Gemini Trust, founded by the Winklevoss twins, is a well-known exchange and custodian licensed by a New York trust company. After the Genesis Earn incident in 2022 (users suffered losses due to the bankruptcy of Genesis), its brand image was damaged and it triggered a legal dispute with DCG. But by mid-2025, these things have largely come to an end (Gemini continues to seek compensation in court, but is also moving forward).

The twins have injected more capital into strengthening their balance sheets, and the company is also expanding internationally (launching a derivatives platform outside the US in 2023 and obtaining an Irish license to serve the EU in 2025).

There are rumors that Gemini may seek external financing or an IPO to drive growth, especially after losing some US market share during the 2022–23 period. Although there are no formal IPO plans at present, the comparison pressure given that its direct competitors Coinbase and Circle are already public companies may push Gemini to consider going public. Any such move may not be until late 2025 or 2026, and depends on whether outstanding legal issues can be resolved (for example, the SEC sued Gemini in early 2023 over the Earn scheme, which needs to be settled first).

If Gemini goes public, it will highlight its compliance history (before the Earn incident, Gemini was considered one of the most compliance-friendly exchanges), its Gemini Dollar (GUSD) stablecoin (although it has a small circulation of about $400 million), and the user base of Gemini credit cards (crypto cashback credit card launched in 2022). But it will need to prove that it can achieve growth again - its trading volume and user numbers have been stagnant for a while.

The Winklevoss brothers may also choose to remain private and try to raise another private round (previously in 2023, they reportedly wanted to raise about $1 billion but failed to reach a deal). For now, if the market environment is hot and it can "clear its record", we see Gemini as a potential candidate.

Paxos: Paxos Trust (issuer of USDP and gold stablecoin PAXG, and white-label crypto brokerage services for PayPal, Interactive Brokers, etc.) is another "behind-the-scenes player" that may seek to go public.

Paxos was on the IPO track as early as 2022, and even submitted a confidential S-1 document, but paused as the market cooled. In February 2023, NYDFS asked it to stop issuing Binance's BUSD (Paxos was the issuer of the coin), which was a setback. Paxos then turned to emphasize its own USDP stablecoin and other services.

Paxos' strengths lie in its regulatory qualifications (it has one of the few NYDFS digital asset trust licenses) and corporate partners. For example, the infrastructure behind PayPal's crypto buying and selling functions is provided by Paxos. It has also built a private, permissioned settlement network, which it has piloted with Credit Suisse and others for stock settlement.

These businesses are mid-sized in terms of revenue—estimated to be around $100 million in 2024 (down from 2022, as interest income from reserves was hurt after BUSD was shut down). The company raised $300 million in a Series D round in 2021 at a valuation of $2.4 billion.

If it were to go public, Paxos would likely wait until the U.S. has a stablecoin bill (which would provide legal validation for its model) and address potential enforcement issues with the SEC (there are reports that SEC staff have considered taking enforcement action against BUSD). In 2025, Paxos is focused on infrastructure (it recently received SEC permission to pilot stock trade clearing as part of its long-term project).

If it were to go public in the future, Paxos would position itself as a “crypto-fintech” company that connects traditional finance with the crypto markets. However, if the market or regulatory outlook is unclear, it may also choose to be acquired or remain private. It is worth noting that any news about Paxos hiring an investment bank or filing an S-1 document will be a strong signal that the "crypto IPO window is truly open."

Since January 2024, there have been almost no new pure mining companies in the United States filing IPO applications - the turmoil of the crypto winter in 2022 has left many mining companies either listed with SPACs or in trouble.

Bitdeer successfully went public through SPAC in April 2023, adding a new face to the industry. But other miners that planned to go public through SPACs, such as PrimeBlock, eventually canceled those plans.

Instead of new IPOs, what we saw in 2024 was consolidation of existing players: for example, Hut 8 and US Bitcoin Corp announced a merger in early 2024 to form a company called Hut 8 Corp and list on Nasdaq—essentially a reverse merger of US Bitcoin using Hut 8’s existing listing status.

There are also rumors that Iris Energy (NASDAQ:IREN) may acquire small private miners to expand its public company platform through reverse mergers.

In summary, the fact that no miners filed new S-1 filings in 2024 is very telling: mining companies seem to prefer to merge or wait for better equity market conditions (such as after China’s flood season in 2025 or when the pre-halving investment cycle starts in 2026–27) before attempting an IPO.

Also, some US private miners found alternative financing channels in 2024–25 (e.g. debt financing from energy companies or sovereign wealth funds), so there is no need to go public.

A relatively niche case is Applied Digital's transformation into AI and successful secondary listing on Nasdaq (it is no longer a pure mining company).

Looking forward, if Bitcoin prices remain at historical highs and stock markets continue to open up, one or two "second-tier miners" may try to go public (e.g. Cipher Mining has been publicly listed since 2021, but may spin off a subsidiary to go public, or private players like Foundry may consider going public).

But overall, we expect more consolidation and strategic M&A rather than a large number of independent mining IPOs. The most dramatic potential "reverse listing" is actually the previously mentioned Core Scientific acquisition - if the deal is completed, the acquirer CoreWeave has said that it may spin off the Bitcoin mining business into a tracking stock. This shows that the mining industry is entering a stage of integration with the broader data center and technology industry, rather than incubating new independent listed entities separately.

Even in the context of favorable conditions, crypto companies still face substantial risks:

Regulatory delays or reversals: Stablecoin and market structure bills may be shelved in Congress or have cumbersome clauses added in the last stage. The political atmosphere in an election year may slow down regulatory clarity; if the SEC unexpectedly intensifies its crackdown or appeals, it may quickly cool market sentiment.

Focus: Closely follow the progress of FIT21 and the stablecoin bill in the committee stage - any delay or threat of veto may trigger market volatility.

Hashrate migration and miner squeeze: If Bitcoin hashrate continues to grow and the price of the currency remains stagnant, block rewards will shrink, and the first to be hit will be high-cost US miners. At the same time, energy price fluctuations (such as the Texas heat wave) and the expectation of halving in 2028 will further pressure.

Focus: If the hashrate continues to outperform the price of the currency for several quarters, it will lead to miners' profit margins being compressed and mining companies with weaker financial conditions may default.

ETF capital flow and potential redemption pressure: Spot Bitcoin ETFs are positive in the early stages of their launch, but if the macro environment turns, there may be rapid capital outflows. Large-scale redemptions will suppress Bitcoin prices, reduce exchange trading volume, and divert funds from GBTC or crypto stocks.

Focus: The inflow and outflow of funds after the ETF is launched, and the net value discount is a weather vane of early pressure.

Stablecoin landscape turbulence: Once the stablecoin bill is passed, new licenses and reserve requirements will be introduced; if legislation is delayed, it may suppress new issuance. The entry of new fintech or bank issuers, as well as falling interest rates, will erode USDC's fee profit margin.

Focus: Pay attention to market share rankings and reserve reports - whether USDC's market value can recover to about $45 billion is the key; any announcement of a new coin issued by a big brand will be a disruptive event.

Cybersecurity and resilience risks: Continuous hacker attacks mean that a major intrusion can instantly destroy user trust. Trading disruptions during periods of extreme volatility can also incur fines and reputational damage.

What to watch for: Rising costs for cyber insurance or more frequent disclosures of security incidents by companies are signs of heightened risk levels.

Macro and correlation risks: An unexpected slowdown in economic growth, a resurgence in inflation, or geopolitical conflict could trigger a safe-haven sell-off in Bitcoin (currently correlated with the Nasdaq at around 0.6). A sudden and sharp strengthening of the dollar could also amplify the pressure.

What to watch for: Sharp moves up in the VIX, credit spreads, or the U.S. dollar index (DXY) typically transmit quickly to crypto prices and volumes.

The U.S. crypto equity market is maturing. Ignoring it at this moment would create a strategic blind spot. CIOs should: 1. Selectively integrate digital assets: Establish custody or trading partnerships (e.g., BitGo, Coinbase Custody) and consider small allocations to crypto equities or ETFs to build internal expertise. 2. Modernize infrastructure and risk management: Deploy real-time risk monitoring, reassess counterparty policies, and run controlled pilots during periods of regulatory easing—e.g., using USDC for internal transfers, permissioned DeFi buybacks, etc. 3. Strive for talent and policy influence: Recruit native crypto experts, join industry organizations, and participate in setting standards. Early involvement not only provides insights, but also influences the rules that future profit margins depend on.

Taking these actions will not only mitigate the risks mentioned above, but also help your organization seize the next phase of crypto-asset adoption. The message from 2024–25 is clear: Crypto assets will exist in the financial system for a long time. Visionary CIOs must view it as an opportunity to innovate, increase revenue diversity, and attract the next generation of customers, rather than a dispensable novelty. The coming year is an excellent window to make strategic arrangements based on clear improvements in the market and regulation. Now is the time to act.

Step into an exceptional evening of profound discourse, networking, and inspiration with Coinlive at The Social Pre-Party on 11 September!

Catherine

CatherineThe decrease in crypto scams could be attributed to the maturation of cybersecurity services in decentralized finance.

Beincrypto

BeincryptoCrypto winter forced scammers to switch their tactics.

cryptopotato

cryptopotatoWhile many believe the crypto bear market season is the time to build, scammers have always viewed it as otherwise.

Bitcoinist

BitcoinistCheck out the guide to be potentially eligible for Scroll's airdrop.

Tristan

TristanCryptocurrency adoption slowed considerably since the onset of the bear market this year but still remains above levels seen before 2021.

Others

OthersHackers are enjoying brisk "sales" this year and the targets seem to be getting aplenty. According to a research, the ...

Bitcoinist

BitcoinistThe Science DAO, a decentralized fundraising platform that offers pre-IPO investment options in breakthrough technologies and projects, debuted on May ...

Bitcoinist

BitcoinistBlockchain analytics firm Chainalysis has launched a new tool to help monitor transactions and tokens across DeFi protocols and multiple blockchains.

Cointelegraph

CointelegraphChandra Duggirala, Portal’s executive chairman, explained that the tokenization of traditional assets sparks the merging of the Bitcoin ecosystem with mainstream finance.

Cointelegraph

Cointelegraph