Philippines SEC bans Binance, sparking worry among Filipino crypto investors

The Philippines SEC's ban on Binance raises concerns among investors, highlighting compliance issues and the SEC's commitment to protecting investors.

Miyuki

Miyuki

Author: Insights4.vc Translation: Shan Ouba, Golden Finance

The origins of modern venture capital can be traced back to the post-World War II period. In 1946, George Doriot founded the American Research and Development Corporation (ARDC), one of the earliest venture capital firms. ARDC was a publicly traded investment vehicle that raised capital from sources beyond the traditional circle of wealthy families and introduced institutional funds for the first time - a revolutionary idea at the time. ARDC's landmark success story was its investment in Digital Equipment Corporation (DEC) in 1957: they received 70% equity for $70,000 and provided a $2 million loan. After DEC went public in 1966, the investment was rewarded several times over. This proved the potential of the venture capital model: high-risk equity investments in technology startups can bring excess returns.

However, ARDC was not a "fund" in the sense of today; it was more like an evergreen investment company that even held a majority stake (such as 77% of DEC). The first limited partnership funds created by ARDC alumni and other investors in 1958-59 really laid the template for today's VC fund structure. Notably, Draper, Gaither & Anderson (DGA), founded in 1959, established a $6 million fund - a 10-year limited partnership fund that charged an annual management fee of 2.5% and retained 20% of the performance fee (carried interest) for the general partner (GP). This "2 & 20" fee model and 10-year lifespan became the blueprint for almost all venture capital funds thereafter. The incentive mechanism was also very clear: GPs could only make significant profits if their investments were successful and generated distributable income (carry), thereby aligning the interests of limited partners (LPs). DGA's success inspired more to follow suit: In 1961, Arthur Rock co-founded Davis & Rock, another fund that used the "2 & 20" model and invested in Fairchild Semiconductor and later Intel. In 1965, ARDC veterans founded Greylock Partners, which also adopted a limited partnership structure. By the end of the 1960s, the basic economic model of venture capital (management fees, performance fees, fixed-term funds) and governance norms had been formed.

The genes of early Silicon Valley were deeply influenced by these original VC practices. For example, when Arthur Rock helped the "Traitorous Eight" who left Shockley Laboratory to establish Fairchild Semiconductor in 1957, a key condition was to allow technology founders to have equity - this broke the common practice of large companies. This philosophy of offering founders and early employees large equity stakes (and later stock options) became the governance norm for Silicon Valley startups, aligning the interests of talent and investors at the company level, just as GP/LP incentives are aligned at the fund level. In addition, early venture capital deals established the practice that VCs would typically take board seats and actively guide companies—a model that Doriot himself was an advocate of, teaching entrepreneurship courses at Harvard. Reinvestment (“recycling”) of proceeds also appeared early on: as a public VC firm, ARDC could recycle its profits over and over again, and new limited partnership funds had provisions written into the fund’s life to reinvest early recycled proceeds in new projects. These practices—active governance, equity incentives, and long-term capital commitments—together laid the cultural and structural foundations of venture capital.

All of these lessons have proven prophetic in the crypto era, as crypto projects need to address the problem of how to align the interests of decentralized teams and investors in new ways.

Venture capital was still a relatively small, closed industry until the late 1960s, but it was about to expand significantly. A number of key policy shifts in the 1970s unleashed institutional money and transformed venture capital into a mainstream asset class. A major turning point was the U.S. Revenue Act of 1978, which slashed the capital gains tax rate from 49.5% to 28%, greatly increasing the after-tax returns of successful venture investments. Almost immediately, money began to pour in: new subscriptions to VC funds jumped from a mere $68 million in 1977 to nearly $1 billion in 1978. Then in 1979, the U.S. Department of Labor clarified the “prudent man rule” of the Employee Retirement Income Security Act (ERISA), explicitly allowing pension funds to invest in venture capital. This is a truly game-changing decision - huge pools of capital (pensions, insurance funds) that were previously prohibited can now pursue VC's high returns. By 1983, the annual new commitments to VC funds exceeded $5 billion, an increase of more than 50 times from the mid-1970s. In short, policy catalyzed the VC boom: a friendly tax system and the participation of pension funds provided the industry with an unprecedented long-term capital base. (Additional background information: Many LPs that are now configured in crypto funds, such as endowment funds, family offices, etc., first entered the venture capital field in this era of legalization and high returns.)

In the 1980s and 1990s, venture capital grew and developed with the maturity of the computer and Internet industries. The Bayh-Dole Act of 1980 further spurred innovation (and indirectly increased VC deal flow) by allowing universities and small businesses to own and license patents resulting from federally funded research, leading to waves of startups spun out of academia (particularly in biotech and computer science). VCs actively invested in these technology transfer companies to bring lab innovations to market—setting a precedent for later crypto VCs to support open source protocol developers spun out of research labs and hacker communities. VCs grew steadily throughout the 1980s, then entered a frenzy in the 1990s. The IPO boom of the early 1980s (e.g., Genentech in biotech and Apple in personal computing) provided examples of successful exits at scale, validating the venture capital model. In 1980 alone, 88 VC-backed companies went public. While the 1987 stock market crash brought a brief downturn, by the 1990s the “dot-com bubble” wave was in full swing. Venture capital exploded in the late 1990s, peaking in 1999—the era of Pets.com and Webvan—when total U.S. venture capital (in 2021 dollars) reached an unprecedented level of about $105 billion. Venture capital went from a cottage industry to a driver of economic growth, and Silicon Valley became synonymous with high-growth startups. Crucially, the “limited partnership” structure of venture capital proved remarkably resilient: even as fund sizes grew from tens of millions of dollars in the 1960s to hundreds of millions of dollars in the 1990s, 2% management fees/20% performance fees and fund lifespans of about 10 years remained standard, tightly tying GPs’ high returns to company success. Funds created during this period (e.g., Sequoia, Kleiner Perkins, Accel, NEA, etc.) institutionalized investment committees, rigorous due diligence processes, and portfolio management techniques (e.g., setting aside funds for subsequent rounds), which were later adopted by crypto funds seeking to professionalize.

One specific structural innovation is the employee stock option pool. In Silicon Valley in the 1980s, startups would typically reserve about 10–20% of their equity as options to attract and retain talent. This practice stems from success stories such as Apple and Microsoft, which made many of their employees millionaires, thereby attracting a large influx of technical talent into the startup space. This “broad stock ownership” philosophy is deeply embedded in the DNA of tech companies, aligning the interests of employees with investors and founders. Later, crypto projects followed suit through mechanisms such as allocating tokens to core contributors—essentially “token options.” From stock options in the Fairchild/HP era to modern token vesting plans, the DNA of incentive alignment is consistent.

Governance norms are also evolving: VCs in the 1980s and 1990s became more deeply involved in company strategy, often obtaining board seats based on the proportion of shares held. They emphasized setting milestones, hiring professional managers (sometimes even replacing founders), and staged financing (releasing funds in batches based on the achievement of KPIs). Although these highly interventionist practices are somewhat in conflict with the decentralized, founder-led philosophy emphasized in the crypto field, its core principles - active investor support and supervision - have been inherited. Even today's crypto funds usually include board observer rights in SAFEs/SAFTs agreements, or participate in on-chain governance, reflecting the concept of "capital accompanied by guidance and accountability" - a norm established in the institutional VC era.

Key inflection points and lessons:An important lesson from the institutional era is that venture capital is highly cyclical and extremely sensitive to changes in policies and the macro environment. The “dot-com bubble” of the late 1990s and its burst highlighted the fact that surges in investment volume often precede painful corrections — 2000 became a “high water mark” before overall venture capital investment reached similar levels again in 2020. After the bubble burst, many VC funds and LPs suffered negative returns, leading to a sharp contraction in funding in the early 2000s. This memory has echoes in the crypto space: 20 years later, the ICO boom and the 2021 bull market followed a similar “boom-crash-investor retreat” cycle. The lesson for long-term LPs is to consistently allocate to asset classes throughout the cycle and be wary of hype during the overheated phase — something that is equally true for crypto VC allocations today. More importantly, those regulatory and structural innovations (prudent man rules, capital gains tax rate adjustments, university technology transfer policies) set precedents for how external factors can unlock venture capital — just as today’s clear crypto regulation or new financial instruments (ETFs, etc.) may bring new capital to the crypto market. By 1999, the venture capital industry had spread around the world, with mature best practices and a proven track record, which soon provided inspiration for the first funds focused on the emerging technology of "cryptocurrency".

The bursting of the Internet bubble at the turn of the millennium was an important inflection point.After 2000, venture capital contracted sharply, and the Nasdaq crash and failed startups triggered a funding drought in 2001–2003. Total venture capital investment plummeted by about 80% from 2000 to 2002, and many funds in the late 1990s had dismal returns. This painful reset is exactly the same as the 2018 "crypto winter" and the decline in 2022 in the crypto field - soaring markets can also suddenly collapse, and the real returns often appear in the next cycle. Indeed, venture capital gradually recovered in the mid-2000s, driven by Web 2.0 (social media, SaaS) and later the mobile internet revolution (smartphones, apps). By 2007–2008, companies like Facebook and YouTube had already emerged, and the launch of the iPhone in 2007 by Apple kicked off the new app economy. However, total venture capital investment did not exceed the 2000 peak again until 2020, a reminder of the need for patience—and for crypto investors, a warning about the 2021 high and subsequent 2022–2023 downturn.

A key shift in the 2000s was that startups stayed private longer. In the 1990s, IPOs typically occurred within 4–5 years of founding; by the late 2000s, companies like Facebook took about 8 years (2004–2012) and Uber even longer.

This was partly due to the abundance of late-stage capital and the compliance burdens imposed by the Sarbanes-Oxley Act of 2002. Longer liquidity paths gave rise to secondary markets for private equity in 2007–2009, with exchanges like SecondMarket (founded by Barry Silbert) and SharesPost emerging to help investors trade pre-IPO shares of companies like Facebook, LinkedIn, Twitter, etc., especially after the IPO market stalled in the 2008 financial crisis.

SecondMarket initially traded highly illiquid assets, but by 2009 found a niche in private tech stocks, especially Facebook shares. By 2010–2011, SecondMarket and SharesPost were conducting secondary trading on a regular basis, foreshadowing the liquidity model for crypto tokens. These platforms demonstrated a need for liquidity before traditional exits (IPOs) and provided a price discovery mechanism for private assets - they were the prototype exchanges for venture capital assets, similar to modern cryptocurrency exchanges.

More importantly, secondary markets broadened the range of investors participating in the financing stages of late-stage companies (hedge funds, pre-IPO funds, wealthy individual investors, etc.), very similar to how ICOs and token issuances allowed global investors to participate in early-stage technology project financing earlier and faster. ICOs can be seen as an extension of this secondary market trend, achieving liquidity directly and instantly by issuing tokens instead of shares.

In terms of governance, secondary markets also brought friction, prompting companies like Facebook to set transfer restrictions. This forms a mirror to the discussion of "token circulation control" in the crypto world. Regulators also stepped in, such as the SEC's modification of the 500 shareholder rule and the modernization of private equity transactions through Reg A+ and CF expansion, similar to the current regulatory reform efforts for token markets.

The broader 2000s venture capital scene also saw other innovations and challenges. After the dot-com bubble burst, a rethinking of the traditional VC model gave rise to experimental practices such as corporate venture arms and venture debt. Global venture capital expanded rapidly, especially in Europe and Asia, supported by governments, ending Silicon Valley’s monopoly. Crypto’s “innate global” nature amplified this trend, with multinational developer communities and ICO activity forming early on. By 2010, venture capital had accumulated a set of experience playbooks for global expansion, which were later adopted by crypto funds.

Key Points:

The 2000s taught venture capital valuable lessons about how to manage liquidity and adapt to change, which set the stage for innovation in the crypto space. Secondary markets previewed the mechanisms of “token vesting” and “early liquidity”, both of which met investors’ needs for earlier exits than traditional timelines. Innovations from this period (secondary exchanges, private equity trading frameworks) laid the foundations, and 24/7 global trading in the crypto space accelerated them. Those limited partners who studied the 2000s were able to see cyclical patterns and early liquidity mechanisms that are critical to evaluating crypto VC today.

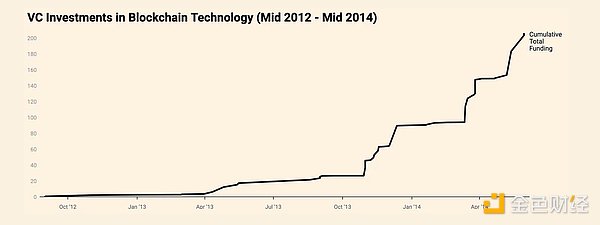

In January 2009, Bitcoin launched during the global financial crisis with a very different concept: a decentralized, blockchain-based digital currency and store of value. Yet in these early stages, institutional venture capital paid little attention. Bitcoin’s rise was driven primarily by cypherpunks, cryptographers, and geeks on forums, not VCs on Sand Hill Road. Funding for Bitcoin-related projects came primarily from personal enthusiasm (early miners reinvested their mined coins) and a few true angel investors. For example, Roger Ver, known as "Bitcoin Jesus," funded several Bitcoin startups in the early days, and Jed McCaleb almost self-funded the creation and sale of the Mt. Gox exchange. But traditional VC funds are basically on the sidelines. In fact, in 2012, the total venture capital received by Bitcoin startups was only about $2 million, which is almost negligible. In contrast, the overall VC investment in the world that year was about $50 billion. Bitcoin is almost "invisible" in mainstream investment portfolios.

Bitcoin and Blockchain Independent Investor of the Year

Why did mainstream venture capital firms initially ignore Bitcoin? There are several important factors:

Perceived as Illegal and Risky:Between 2009 and 2011, Bitcoin was little known outside of niche tech circles and was often associated with illegal activities such as Silk Road. Its ambiguous legal status and decentralized, non-equity structure left traditional investors with a lack of framework to invest in. The concept of buying a token or currency was foreign to traditional investors, and it wasn’t until 2012 that other mainstream tokens other than BTC emerged. Prominent venture capitalists like Union Square Ventures’ Fred Wilson missed out on early Bitcoin investments until around 2013, when clearer entrepreneurial models emerged with the advent of exchanges and wallets—a hesitancy reminiscent of the hesitation experienced by investors in the early days of computing as they waited for concrete business cases.

Lack of Startups/Teams: Prior to 2013, there were very few Bitcoin-related companies to invest in. Bitcoin itself had no formal organization, and its initial ecosystem (exchanges, payment processors, mining) relied on informal initiatives. It wasn’t until 2011-2012 that startups like BitPay and Coinbase emerged and created investable vehicles. Prior to this, VCs had no suitable investment targets, as purchasing BTC directly raised custody and compliance concerns and conflicted with the traditional VC model.

Scale and exit concerns: With a market cap of less than $1 billion until 2013, Bitcoin was small and slow-growing for venture capitalists looking for billion-dollar exits. The lack of a clear path to an IPO or M&A made monetization of Bitcoin investments uncertain. Many investors later admitted that they overlooked Bitcoin’s potential business model and value capture, missing out on its early recognition as a new asset class.

While mainstream investors were hesitant, professional investors emerged. In 2012, Barry Silbert founded Bitcoin Opportunity Corp., an early angel fund for bitcoin startups (later renamed Digital Currency Group). In addition, Adam Draper’s Silicon Valley incubator Boost VC provided crucial early support when it launched a bitcoin-focused accelerator in 2013. These entities remained on the fringe until the bitcoin price surged to $1,000 in 2013, when they finally attracted the attention of mainstream venture capital.

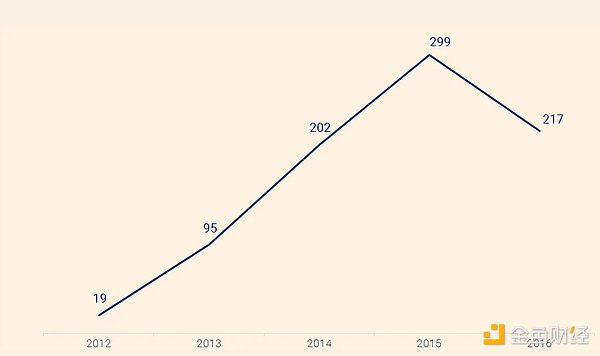

Historical parallels: The situation was similar to the early days of tech entrepreneurship—for example, in the 1930s and early 1940s, when innovation was funded by government grants or amateurs because formal venture capital did not emerge until after World War II. Bitcoin from 2009 to 2012 was nurtured by its community and libertarian/open source ethos rather than venture capital money, highlighting that transformative innovation can be fostered outside of traditional financing channels. For limited partners and observers, this era is a reminder that first movers are not always venture capitalists themselves; sometimes opportunities need to mature. As we’ll see, by 2013, that maturity had arrived, and the first wave of cryptocurrency venture capital began—marking the true beginning of the branching of the venture capital spectrum into blockchain. The First Wave of Cryptocurrency Venture Capital (2013-2016) 2013 was the breakout year for cryptocurrency venture capital. The surge in the price of Bitcoin (from about $13 in January to over $1,000 by December) dominated headlines and forced tech investors to take notice. More importantly, real startups emerged around Bitcoin and other emerging cryptocurrencies, providing investable equity for venture capital. The result: a massive growth in venture capital in the cryptocurrency space. In 2013, blockchain/Bitcoin startups raised about $90 million in venture capital, up from almost $0 the year before. That’s still tiny by venture capital standards, but the trajectory had changed.

Several must-cover nodes in the first wave of crypto venture capital illustrate how traditional venture capital adapts to this new field:

Coinbase: In the summer of 2013, Coinbase (founded in 2012 by Brian Armstrong and Fred Ehrsam) completed a $5 million Series A financing round led by Union Square Ventures (USV) , and Andreessen Horowitz (a16z) followed suit. The deal was highly symbolic: USV’s Fred Wilson was a well-known Web 2.0 investor (Twitter, Tumblr, etc.), and a16z was the preeminent VC firm of the era. Their endorsement signaled that cryptocurrencies had become a legitimate startup space. The investment was a traditional equity round—buying shares in Coinbase, a Delaware C-corporation exchange—which showed that VCs were adopting their usual model (owning part of a company) rather than buying tokens. This was logical, since Coinbase had no native token (still doesn’t), and the regulatory environment for tokens was still unformed. Notably, the terms were standard: preferred shares with rights, a typical feature of any Silicon Valley deal. However, one tweak for crypto risk was a tightened compliance clause—investors needed Coinbase to actively manage regulatory risks (e.g., KYC/AML processes) to protect the company’s legitimacy. The success of the Coinbase deal (valued at ~$70M at the time; valued at over $80B after IPO in 2021) demonstrated to the venture capital community that it was possible to get VC-scale returns in crypto by taking stakes in smaller companies (exchanges, wallets).

Ripple (OpenCoin): Also in 2013, Andreessen Horowitz made its first investment in crypto, participating in a $2.5M funding round for OpenCoin, a startup developing a version of the Ripple protocol for bank payments. Google Ventures and Lightspeed also participated. Ripple is unique in that it has its own native token (XRP), but the investment is in equity in the company. This raises an interesting question: how to value a company whose product is an open source protocol with its own currency? The VCs were essentially betting that the company could create enterprise software or services around the Ripple network (and potentially hold a large amount of XRP that could appreciate in value). We see here an early recognition that a hybrid value model could exist—part equity value, part token value—even though at the time, tokens were mostly viewed as digital commodities and the VCs were not explicitly including XRP in the deal (beyond any XRP held by the company’s treasury). This highlighted the need to adjust the term sheet: if the future agreement was successful and the value of XRP soared, would shareholders fully benefit? Because of these concerns, some investment agreements included clauses such as “most favored nation” clauses in the token offering to ensure that early investors could opt in when the token offering was later conducted. In 2013-2014, these ideas were still in their infancy; most deals still assumed that value would be realized through equity exits.

The Birth of Crypto-Focused Funds: This period saw the birth of dedicated cryptocurrency venture capital funds, which were often founded by industry insiders. Blockchain Capital (formerly Crypto Currency Partners) was founded in 2013 by Bart Stephens, Bradford Stephens, and Brock Pierce to invest exclusively in Bitcoin and blockchain startups. They raised a small fund of about $10 million, effectively creating one of the first crypto-native VC firms. Similarly, in 2013, Dan Morehead (a former Tiger Fund macro investor) launched the Pantera Bitcoin Fund, which was initially structured more like a hedge fund to hold Bitcoin and invest in startups. Pantera later spun out venture funds as well. These specialized funds bring deep crypto expertise and a willingness to solve problems unique to the crypto space (e.g. digital asset custody, technical understanding of protocols) that generalist VCs still struggle with. They also often negotiate innovative deal structures out of necessity — for example, Pantera sometimes buys equity with token warrants if a startup plans to launch on a blockchain. This marked the beginning of the “equity plus token rights” deals that became common in 2016-2017. Traditional term sheets did not include clauses about token distributions, so lawyers began drafting new ones. Other notable first-wave investments: In 2014, Benchmark invested in Bitstamp, a major European cryptocurrency exchange. IDG Capital, a large Chinese venture capital firm, invested in Coinbase’s Series B in 2014, demonstrating global investor interest. In 2016, Andreessen Horowitz and Union Square Ventures co-invested in Mediachain, a decentralized media attribution protocol, one of the earlier non-monetary blockchain startups. By 2015-2016, projects like Ethereum were emerging in the venture capital space — though Ethereum had raised money in a 2014 ether crowdsale (raising 31,000 bitcoins, or about $18 million), there was essentially no VC involvement in the early days. Some VCs, such as Boost VC and Frontier Ventures, did buy a small amount of ether before Ethereum went live, but this was the first time that VCs were no longer the primary source of funding, but the community. This was a harbinger of the ICO era, but at the time, it was an exception. By 2016, the concept of a “SAFE with token warrants” (convertible notes convertible into tokens) was taking off in the legal community, foreshadowing the ICO wave. Traditional venture capital agreements began to include token clauses sporadically. For example, an investment in a protocol startup might stipulate that if the company issues a utility token, investors either receive a certain share or an option to buy the token at a discount. This is a direct adaptation to the risk of cryptocurrency - the risk that value will shift from equity to tokens that were not initially contemplated. Adjustments to these contracts are still evolving and were not widely standardized until the introduction of SAFTs (convertible notes) in late 2017, but their roots are in these transactions from 2013 to 2016, when pioneers were exploring new territory. ICO boom (2017-2018): Cryptocurrency financing underwent a paradigm shift in 2017 with the explosion of initial coin offerings (ICOs). This niche industry, which was originally driven by venture capital, was transformed as startups discovered that they could raise millions of dollars from the global crowd by issuing tokens (usually with just a white paper). The scale of this unprecedented event marks a major turning point in the venture capital spectrum—like a split in an evolutionary branch.

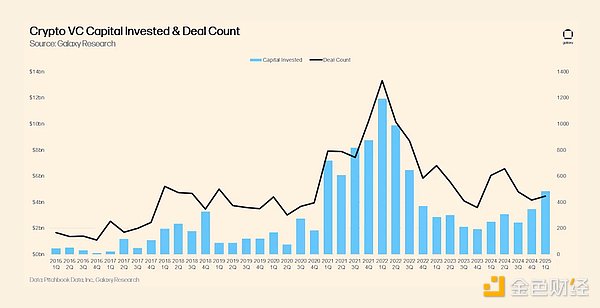

The numbers speak for themselves. In 2017, nearly 800 ICOs raised a total of about $5 billion, an impressive number considering that blockchain startups have only raised about $1 billion through traditional venture capital (and token sales have a cash flow that is 5 times higher than traditional venture capital). This trend accelerated in 2018, with ICOs raising $7.8 billion even during a crypto market downturn. By comparison, venture capital investments in blockchain companies totaled about $4 billion. Entrepreneurs realized they could bypass the traditional “gatekeepers” (VCs) and directly access crypto enthusiasts’ money.

Structurally, tokens have reshaped the classic VC J-curve. Traditionally, VC funds deploy capital in ~3 years and wait for exits ~5-7 years later, resulting in initially negative returns that later turn positive — the J-curve. Funds in the ICO era saw liquidity in their portfolios in months, not years. For example, a fund that bought tokens in a presale would typically sell them on an exchange soon after launch (3-6 months). During the 2017 bull run, tokens often appreciated rapidly, leading to spikes in NAV and early LP distributions, flattening the J-curve. Conversely, unlike relatively stable illiquid stocks, liquid tokens can quickly lose value during a downturn. Essentially, rapid liquidity and volatility replace steady value growth. Some crypto funds actively manage profits, similar to hedge funds, while others adhere to a venture capital-style holding strategy that was sometimes adversely affected by the 2018 bear market. The ICO wave introduced new fund structures, notably crypto-native hedge funds (open-ended, quarterly liquidity) rather than traditional 10-year closed-end funds. Examples include Polychain Capital, founded in 2016 by Olaf Carlson-Wee, which is venture-backed and uses a hedge fund fee structure (2% management fee, 30% performance fee). MetaStable Capital, co-founded by Naval Ravikant, is similar. They bypassed lengthy due diligence, evaluating code, token economics, and community traction, using SAFTs, SAFEs, and simple token purchase agreements in place of traditional term sheets. Their approach combines venture capital theory with hedge fund strategies, a radical departure from traditional fund structures. Traditional LPs faced challenges adapting to this model, but attractive early returns (often 10x+ per year) encouraged adoption, foreshadowing today’s hybrid VC and hedge fund LP base.

SAFT and Legal Engineering: In late 2017, the introduction of the SAFT (Simple Agreement for Future Tokens), inspired by Y Combinator’s SAFE stock notes, addressed securities law concerns. SAFTs allow accredited investors to participate in private pre-sales, complying with U.S. securities regulations by initially treating these contracts as securities. Filecoin’s ICO in 2017 using a SAFT raised approximately $257 million, becoming the standard practice for token sales in 2017-2018. For venture capitalists, the SAFT provides a familiar private financing structure, although legal clarity remains controversial, especially after the SEC’s 2019 actions against issuers such as Telegram. Nonetheless, the SAFT connects venture capital to the token paradigm, similar to a Series A round, but with liquidity much earlier.

Rewriting the Rules:The ICO Era Reshaped the Norms of Venture Capital:

Due Diligence and Speed:While traditional venture capital due diligence takes months, ICO deals use code and white papers as the primary due diligence tools and are often completed in days or hours. Funds developed smart contract auditing capabilities and assessed the appeal of decentralized communities, hired technical experts, and took greater risks, sometimes resulting in fraud or low-quality projects.

Global and Retail Investor Participation:ICOs attracted thousands of global retail investors, weakening the exclusivity of venture capital. Funds must emphasize added value beyond capital—marketing, exchange listing assistance, developer recruitment, and governance guidance—to prove their importance.

Token Economics and Vesting:Token investing requires understanding new dilution mechanisms, vesting schedules, and comprehensive “token economics” (token supply, inflation, and distribution). Investors often negotiate lock-up periods (6 months to 1 year) to manage immediate liquidity risk, which is tied to IPO lock-up periods and M&A proceeds, applying traditional financial wisdom to token transactions.

DAO and its security risks:The DAO event on Ethereum in 2016, which raised approximately $150 million before suffering a catastrophic hack, ultimately led to a hard fork and regulatory scrutiny. The subsequent DAO report by the U.S. Securities and Exchange Commission (SEC) declared the DAO tokens to be securities, prompting projects to turn to SAFTs and private placements. The event highlighted the importance of smart contract security and governance, making code audits and community engagement critical for cryptocurrency venture capital firms.

In late 2018, the ICO bubble burst; Ethereum prices plummeted, and many ICO startups went out of business. Equity-based cryptocurrency financing subsequently rebounded, highlighting that the strengths of traditional venture capital—due diligence, governance, and long-term support—are key to surviving the downturn. ICOs experimented with venture capital, but did not replace it, highlighting the continued value of professional investment support.

After the frenzy of 2017–2018, the crypto industry entered a “crypto winter.” In 2019, token prices continued to slump, many once-hyped projects disappeared, and regulatory scrutiny (especially from the U.S. SEC) became more stringent. Venture capital did not disappear—it just shifted to “quality over quantity.” In 2019, the total amount of global blockchain-related VC financing was still relatively considerable (about US$2.7 billion, distributed in more than 600 transactions), showing that investors still have serious interest, but valuations are more rational and more return to equity financing.

This stage saw the emergence of crypto-native VC companies and crypto-focused teams in traditional VC companies, which promoted the development of hybrid financing models:

The rise of Paradigm: In 2018, in the bear market, Matt Huang (formerly Sequoia Capital) and Coinbase co-founder Fred Ehrsam founded Paradigm with an initial fund size of US$400 million. The establishment of Paradigm marked the professionalization of crypto VC, combining the rigorous investment methods of traditional VCs with deep crypto technical expertise. Paradigm makes hybrid investments (equity + tokens), also focuses on network governance, and is equipped with internal researchers and engineers, which echoes the "empowerment" support model of traditional VCs in the 1990s. Paradigm emphasizes a long-term perspective, with a layout of more than 10 years to counter the "quick money" mentality of the ICO era.

a16z Crypto and large funds: In mid-2018, Andreessen Horowitz launched a dedicated $300 million "a16z crypto" fund. Despite the market downturn, a16z has increased its investment, claiming that crypto is a transformative computing platform that requires patient capital support. The fund is registered as a financial advisor and can manage token investments in compliance, combining VC and hedge fund management styles. Other top VCs, such as Union Square Ventures, Polychain, and Blockchain Capital, have also raised sizable crypto-specific funds, attracted institutional LP funds, and deployed at reasonable valuations.

Hybrid deal structures: By 2019, it was common to see both equity and token warrants in funding rounds, allowing investors to capture both company and network value. This structure helps align the interests of company management and token holders and reduce conflicts. Lawyers are also standardizing these terms, introducing instruments such as SAFE-T (Simple Agreement for Future Equity/Tokens) that can be converted into equity or tokens at subsequent funding rounds or network launches.

Continued regulatory response: In 2019–2020, regulatory action continued. The SEC filed high-profile lawsuits against some large public ICOs (such as Telegram’s $1.7 billion funding round and Kik’s token sale), cooling public fundraising. Projects turned to private financing and geographically restricted issuance to avoid US jurisdiction. Crypto VC funds also increasingly provide advice to projects on designing compliance structures. Exchanges have raised the bar on listing tokens, creating a more controlled, contract-based environment that is conducive to private VC transactions.

Notable Investments and Themes: Despite the cold market, there are still notable investment cases. For example, Binance has mainly relied on its own funds to develop, but in 2020, it also introduced strategic investments such as Temasek, showing the continued interest of sovereign wealth funds in the crypto industry. The DeFi field has begun to rise significantly (MakerDAO, Compound, Uniswap), and VCs have directly purchased tokens through SAFTs. Although enterprise-level blockchains have attracted VC attention for a time, they have not been widely used, highlighting the value of open networks.

In addition, interesting hybrid models have emerged, such as Digital Currency Group (DCG) and ConsenSys, which are more like "venture studios" than traditional funds. By 2020, even these companies have begun to seek external investment, proving the enduring importance of the GP/LP model.

Impact on LPs: By the end of 2020, early crypto venture funds reported huge paper gains (e.g. a16z crypto fund gained more than 10x after Coinbase IPO). However, market volatility led to significant differences in IRR performance. LPs began to pay attention to indicators such as TVPI and DPI, and some funds even made in-kind distributions, forcing LPs to establish new digital asset custody and monetization policies.

2021 was a record year for crypto venture capital, marking the crypto industry's true "entry into the mainstream" in the eyes of investors. VC funds flowed into crypto and blockchain startups at approximately $33.8 billion, exceeding the total of all previous years. This represents nearly 5% of total venture capital globally, which is staggering for a once-niche sector. Deal volume also hit a new high, with over 2,000 deals—twice as many as in 2020. This “Web3 boom” was fueled by a surge in crypto markets (Bitcoin hit $69,000, Ethereum $4,800), the rise of DeFi, NFTs, and the Metaverse, and pandemic-era money seeking high-growth returns. The influx of “tourist-type” investors who were “unfamiliar with crypto” significantly changed the funding dynamics.

Super-sized rounds and a surge in unicorns:

Crypto startups received an unprecedented number of late-stage, multi-billion-dollar rounds. For example, FTX, founded in 2019, completed a $900 million Series B in July 2021 at a valuation of $18 billion, with investors including Sequoia Capital, SoftBank, Tiger Global, Temasek, and BlackRock—the largest private crypto financing round ever at the time. Similar large financings include BlockFi (crypto lending), Dapper Labs (NFT), and Sorare (fantasy sports NFT). More than 60 crypto unicorns were produced in 2021, a significant increase in number, with a median valuation of $70 million, 141% higher than the median valuation of the entire venture capital market.

New entrants of “tourist-type” investors:

Crossover hedge funds (Tiger Global, Coatue, D1 Capital) actively invested in crypto startups, pushing up valuations, but many quickly withdrew after the market fell in 2022.

Sovereign wealth funds and large asset managers (Temasek, GIC, Mubadala, BlackRock, Goldman Sachs) invested directly to promote compliance.

Corporate VCs and tech giants (PayPal Ventures, Visa, Microsoft M12, Ubisoft) made strategic investments to understand the impact of blockchain on their core businesses.

Broader LP base: Endowments, pensions, charitable foundations, and family offices are also beginning to publicly support crypto funds. a16z raised $2.2 billion Crypto Fund III in 2021, and Paradigm successfully raised an oversubscribed $2.5 billion fund.

Hot sectors – NFT, Metaverse, DeFi:

NFT platforms (OpenSea, Dapper Labs) have seen valuations soar after high-profile sales such as Beeple’s $69 million work.

DeFi and Web3 protocols have attracted diverse VC investments, involving equity, tokens, and hybrid investment models.

Infrastructure companies (wallets, analytics, hosting, APIs, scaling networks) also received funding and are seen as more robust long-term bets.

"Tourist" investor behavior: Experienced crypto investors warn that many projects that were not fully vetted were also able to get money during the craze. By mid-2022, many "tourist" investors quickly exited after the market fell.

Why is the influx so crazy?Investors are driven by FOMO (fear of missing out), a zero interest rate environment, strong crypto returns in 2020, and optimistic expectations for the unique prospects of Web3. In addition, the participation of large VCs has played a "network validation effect", encouraging more institutions to join.

Results: By the end of 2021, crypto VC had deeply integrated with mainstream VC. The success stories of the year (OpenSea, Dapper, Solana, FTX, etc. at the time) highlighted the commercial value potential of crypto projects, but this excessive prosperity also laid the groundwork for necessary adjustments in 2022.

In 2022, the feast of crypto VC suffered a blow. Macro headwinds and crypto-specific disasters triggered a sharp contraction in financing and a return to conservative terms - a classic "post-bubble hangover" phenomenon.

Macro and market crash: Surging inflation and aggressive rate hikes have hit risk assets hard. Bitcoin and Ethereum prices are down about 75% from their all-time highs, and the overall crypto market cap has shrunk from $3 trillion to less than $1 trillion. Despite a decent performance in the first quarter of 2022, by 2023, total crypto venture investment had plummeted by about 68% to about $10.7 billion, well below its 2021 peak.

Catastrophic events unique to the crypto industry

Terra/Luna collapse (May 2022): Over $40 billion evaporated in a few days, causing the bankruptcy of multiple hedge funds and lenders.

FTX collapse (November 2022): A “Lehman-like” shock forced top VCs (Sequoia Capital, Temasek, etc.) to write down hundreds of millions of dollars in investments in full, severely undermining institutional trust.

The bankruptcy of Celsius, BlockFi, Genesis and the “contagion effect” of the Solana ecosystem further shook confidence.

SEC lawsuits against Ripple, Binance, and Coinbase have heightened legal uncertainty.

These events have triggered a “flight to quality”: Investors prefer projects with clear use cases, solid teams, and revenue, and stay away from speculative or Ponzi-like projects.

Compression of valuations and deal terms:

The median valuation of early-stage financing has dropped from more than $30 million in 2021 to about $10-20 million in mid-2023.

Down rounds and financing extensions have become common, and unicorn valuations have generally been cut by 50-70%.

Investor-friendly terms return: higher liquidation preferences, stronger anti-dilution protection, stricter governance and board control.

LPs are putting forward higher requirements on fund economic models (lower management fees, introduction of performance thresholds), making the fundraising environment more difficult for new crypto fund managers.

Differentiation and survival of market participants:

"Tourist-type" VCs are exiting; crypto native investors are doubling down and focusing on reasonably valued and longer-term transactions such as seed and Series A rounds.

Eco-funds (such as Binance's funds) rescue or acquire projects that have good prospects but are running out of cash.

Talent and developer activity further concentrated on stronger chains and companies.

Regulatory clarity coexists with regulatory crackdowns:

The United States strengthened law enforcement, and the European Union passed the MiCA regulation.

Hong Kong, the United Arab Emirates, and Singapore introduced more friendly crypto regulatory frameworks.

The proportion of transactions in the United States has declined slightly, as entrepreneurs prefer regulatory-friendly jurisdictions and VCs also diversify geopolitical risks.

Regulatory due diligence (token classification, exchange compliance, and judicial risks) has become as important as valuation.

Despite the downturn, there are “green shoots” emerging in mid-2023,with talk around AI-crypto convergence, institutional ETF adoption, and tokenization of real-world assets all hinting at new catalysts. Historically, downturns have often delivered strong returns, prompting experienced LPs to urge investors to participate actively and invest selectively.

The downturn has cleared out weak structures: many 2021 SAFEs were repriced or converted, exercise periods extended, and token economics sustainably redesigned. Funds have built deep token economics expertise that rivals the rigor of private equity capital structures.

Entering 2024 to the second quarter of 2025, crypto venture capital is in a recovery phase, although its form is very different from the "disorderly frenzy" of 2021. The industry has experienced a mature process in adversity, traditional and crypto-native venture capital practices are increasingly converging, and investors are beginning to lay out for their expected next round of upward cycle - whether it is driven by new technological convergence, macroeconomic recovery, or the rhythm of the innovation cycle itself.

After the market clearing, crypto venture capital activity has shifted significantly to the earliest stages. By 2024, about two-thirds of deals are seed or Series A, and even many Series B/C are largely supporting companies that are only 3–5 years old. This early-stage focus stems from the reduction in the number of late-stage survivors (the 2017 batch of startups either succeeded or exited), and strategic bets on long-term opportunities that mature in sync with market recovery. Galaxy Digital's Q1 2025 research confirms that early-stage companies received the most capital, highlighting active deal flow at the Pre-Seed and Seed stages. What this means for LPs is that capital is deployed into long-term bets that align with classic VC timelines, and lower valuations could amplify returns if the sector picks up (the so-called “vintage effect”).

Refocused Sectors – Risk Weighted Assets (RWA), AI, and Beyond:

Real World Asset (RWA) Tokenization:The tokenization of real world assets (bonds, real estate, intellectual property) is gaining momentum, driven by increased blockchain scalability and greater regulatory clarity. Major funds are investing in startups that are developing RWA infrastructure to enable on-chain trading of private equity or debt and bring real world collateral into the DeFi space. These investments combine fintech with crypto, with the potential to unlock a broader market and generate returns faster than pure crypto speculation. Early signs include banks piloting tokenized private credit and real estate projects, and some crypto funds have reported paying customers for RWA-focused companies in their portfolios.

Modular Blockchains and Second-Layer Scaling:Crypto’s technology roadmap emphasizes scaling via second-layer networks (L2) and modular blockchain architectures that decouple execution, data availability, and consensus mechanisms (e.g., rollups like Arbitrum and Optimism, or modular projects like Celestia and Fuel). VCs are targeting these foundational technologies, which aim to address the limitations of blockchain (speed, cost) and enable scalable applications such as gaming and social networks. Many investments are made in SAFT or token-equity packages, with the expectation that token value will appreciate significantly as these become essential infrastructure. By 2025, Ethereum upgrades and widespread use of layer 2 networks will significantly improve the user experience and could drive mass adoption and outsized returns—echoing VCs’ historical bets on broadband or mobile infrastructure.

AI and Crypto Convergence:In 2023, the rise of generative AI sparked interest among crypto investors in the intersection of blockchain-verified data, tokenized data sharing, and decentralized AI computing or storage. Projects such as Virtuals Protocol, Fetch.ai , Ocean Protocol, Bittensor, and SingularityNET have again attracted attention. Crypto funds are pouring money into startups where “AI meets Web3,” and some AI-focused funds are exploring cryptocurrency integration. Autonomous AI agents operating in a blockchain environment represent an exciting but unproven synergy. Limited partners (LPs) should carefully examine whether these businesses truly need blockchain or are just playing for the hype. Still, leading funds like a16z are actively cross-pollinating crypto and AI.

In 2024-2025, many crypto funds are strategically adapting to the changing landscape:

Flexible Fund Lifecycles:Some funds are extending maturities (e.g., 12 years instead of the traditional 10) or offering LP liquidity options, acknowledging that tokens may mature more slowly or face regulatory delays. LP return provisions and evergreen/open-ended fund structures (such as Blockchain Capital’s shift) provide regular liquidity, combining traditional venture capital with token flexibility.

Vertical Specialization and Expertise:Funds are increasingly focused on specific sectors (DeFi, NFT/Gaming, Infrastructure) and hiring domain experts, such as Solidity developers or gaming executives. Specialization represents an evolution of traditional VC and helps LPs build diversified and targeted portfolios.

Geographic Diversification:Funds manage jurisdictional risk by establishing international entities (Singapore, Dubai, Switzerland, Cayman Islands). Regional crypto funds focused on Latin America, Africa, or Southeast Asia have attracted local limited partners (LPs), similar to the rise of venture capital funds focused on China or India decades ago.

On-Chain DAOs and Tokenized Funds:On-chain investment DAOs (e.g., LAO, BitDAO) and tokenized fund interests are innovative but limited in scale. These models enhance liquidity and participation, and are expected to develop into regulated, transparent on-chain venture capital.

LP Priorities – Risk and Return:

Downside Protection:After the bear market, LPs prioritize risk management, asset custody, profit strategies, and protocol risk assessment.

Manage Liquidity:While liquidity is valued, LPs prefer GPs to be able to strategically choose exit timing to avoid premature selling. Options such as secondary markets and stablecoin issuance can strike a balance between flexibility and security.

Convexity (Upside Potential):Despite the risks, the potential for excess returns in cryptocurrencies remains a major attraction. LPs seek skill-driven, repeatable results, favoring clear market scenarios (bull, bottom, bear) and diversified thematic portfolios.

Allocation across the crypto spectrum:

CIOs can now choose from:

Traditional VCs with occasional exposure to crypto.

Hybrid firms (e.g., a16z, Paradigm) balancing crypto and equity investments.

Crypto-native venture funds with different stages and strategies.

Liquid crypto vehicles (ETFs, hedge funds).

Institutional investors increasingly view cryptocurrencies as an essential part of alternative asset strategies, often allocating cautiously (1-2% initially), balancing risk exposure and uncertainty.

The Philippines SEC's ban on Binance raises concerns among investors, highlighting compliance issues and the SEC's commitment to protecting investors.

Miyuki

MiyukiUbisoft unveils its groundbreaking Web3 game, Champions Tactics, amidst growing anticipation. Despite delays in the scheduled mint for The Warlords of Champions Tactics NFT collection, recent developments, including sneak peeks and strategic partnerships, signal a promising future for the game

Alex

AlexThe issuance of a Wells Notice by the SEC to Uniswap Labs has sparked a unified response from the crypto community, rallying in defense of DeFi innovation and decentralised principles.

Catherine

CatherineIn light of the ongoing congestion on the Solana network, more than 75% of on-chain transactions have been experiencing failures, prompting users to migrate to Ethereum for smoother transfers.

Kikyo

KikyoIn a recent court ruling in Taiwan, it was decided that the assets belonging to David Pan, the founder of Ace Exchange, along with others implicated in the case, will be confiscated.

Catherine

CatherineGameCene raises $1.4M in seed funding, plans to expand its Web3 gaming platform, offering a diverse game library and empowering developers with its Omni-chain Game SDK.

Alex

AlexGameCene 筹集了 140 万美元种子资金,计划扩展其 Web3 游戏平台,提供多样化的游戏库,并通过其 Omni-chain Game SDK 为开发者提供支持。

Alex

AlexDisabling automatic media downloads on Telegram Desktop can potentially mitigate the reported vulnerability, although Telegram itself has categorised the threat as likely to be a hoax.

Kikyo

KikyoBinance sees its $4.3 billion settlement with the U.S. as a positive step towards embracing regulation, which the company believes will bring clarity and comfort to users. The exchange is transitioning to a more mature operation under new CEO Richard Teng.

Miyuki

MiyukiSolana faces transaction failures due to network congestion. Despite improvements, concerns persist about its ability to handle demand.

Weiliang

Weiliang