Jessy, Golden Finance

On June 26, Hong Kong issued the "Hong Kong Digital Asset Development Policy Declaration 2.0", proposing the "LEAP" framework, and is committed to building Hong Kong into a world-leading digital asset center.

Affected by this, Guotai Junan International, as the first Hong Kong Chinese brokerage firm that can provide a full range of virtual asset-related trading services, saw its share price rise from HK$1.24 to HK$7.02 in two trading days on June 25 and 26, and finally closed at HK$3.54. Driven by Guotai Junan International, the Hong Kong Chinese brokerage index soared 11.75% in a single day. Tianfeng Securities' Tianfeng International obtained a virtual asset trading license, which also led to its A-share stock price rising to the daily limit. Shengli Securities, as the first brokerage firm to realize currency in and out, also achieved a maximum increase of 160% in one day on the 26th. The abnormal movement of the capital market reflects the expectations of the market for the development of brokerage business in the field of virtual assets.

On the day after the declaration was released, Hong Kong's first daily redeemable tokenized securities were officially launched. It is reported that GF Securities (Hong Kong), as the first brokerage firm to issue tokenized securities in Hong Kong, has now launched the first daily redeemable tokenized securities "GF Token", but this product is a privately issued tokenized money market fund and is only for qualified institutional investors.

Trading virtual assets on brokerage platforms and tokenized securities may be just a starting point. In the future, more traditional brokerage firms may bring more innovations in the encryption field.

New opportunities for brokerage firms under the LEAP framework

The "LEAP" framework proposed in the Declaration 2.0 outlines a clear development path for the Hong Kong digital asset market and opens up unprecedented business growth space for traditional brokerage firms. The core of the impact of this declaration on brokerage firms is to provide clear policy endorsements, lower compliance thresholds, and point out the direction of business innovation.

Specifically, "L" (law) emphasizes the improvement of the regulatory framework. For securities firms, this means that there are clearer rules to follow when engaging in virtual asset trading, custody, issuance and other businesses.

“E” (Ecology) aims to build an ecosystem that integrates Web3 and traditional finance. As an important hub in the traditional financial market, securities firms will be deeply integrated into this ecosystem. This is not just about adding a “crypto trading” section, but also means that securities firms can participate in a wider range of digital asset life cycles, including but not limited to connecting traditional investors with digital assets, providing comprehensive wealth management based on tokenized assets, providing investment banking services for digital asset projects, developing innovative financial products, etc.

“A” (Assets) focuses on developing new assets such as tokenization. Manifesto regards RWA tokenization as a key industry, and physical assets such as precious metals, green energy, and warehouse receipts will be mapped on the chain or will be realized in Hong Kong in the future. In the RWA track, securities firms can participate in RWA issuance and management, such as acting as underwriters and providing related consulting services, which will help optimize the income structure of securities firms and open up new profit growth points. The "GF Token" quickly launched by GF Securities (Hong Kong) is an example. In the future, we should be able to see more tokenized bonds, fund shares, private equity, and even complex derivative structures led by securities firms, which will greatly enrich their product lines and service scope.

"P" (Partnership) emphasizes regional and international cooperation. Hong Kong securities firms may take this opportunity to establish cooperation with leading international digital asset service providers, technology providers, and global projects seeking compliance channels, which will enhance their competitiveness and influence in the global digital asset market.

From losses to new opportunities brought by encryption

In recent years, affected by factors such as global economic fluctuations, geopolitics, and the decline in the activity of the Hong Kong stock market, Hong Kong securities firms' traditional brokerage, underwriting and other businesses have generally faced growth pressure.

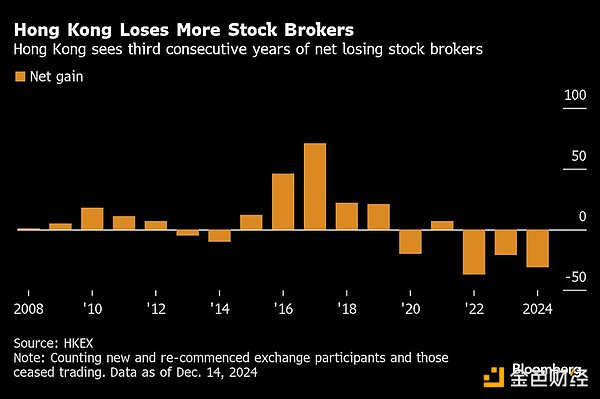

According to data from the Hong Kong Exchanges and Clearing Limited, about 37 securities firms stopped trading in 2024. According to data from the past three years, the number of Hong Kong securities firms has been decreasing year by year. The entry threshold for applying for financial licenses in Hong Kong is relatively low. There are a large number of small and medium-sized securities firms in the market, and homogeneous competition is fierce. In recent years, the Hong Kong stock market has been weak, further exacerbating the operating pressure of securities firms. Some small and medium-sized securities firms are in poor operating conditions and face great survival pressure.

The "Hong Kong Digital Asset Development Policy Declaration 2.0" may bring new opportunities for the development of securities firms. According to the official website of the Hong Kong Securities and Futures Commission, as of June 26, a total of 41 institutions have completed the upgrade of No. 1 license, that is, upgrading the existing securities trading license to provide virtual asset trading services, most of which are securities firms, including Shengli Securities, Tiger Securities, Futu Securities, Tianfeng International under Tianfeng Securities, and Hafu Securities under Oriental Fortune.

Recently, 37 institutions have been approved to upgrade to No. 4 license, namely virtual asset investment consulting - providing professional advice on digital assets, including Zhongtai International Securities and Ping An Securities Hong Kong; 40 asset management institutions have been approved to upgrade to No. 9 license, namely virtual asset management - managing funds with a virtual asset share of more than 10%.

With the implementation of the "LEAP" framework and the deepening of securities firms' practices, the Hong Kong market is expected to usher in a wave of financial innovation led by securities firms, and "GF Token" may be just the beginning. More types of tokenized bonds, funds, REITs, and even IPOs will emerge. Securities firms will also use their structuring capabilities and distribution networks to become core issuers and market makers.

Looking to the future, brokers may combine smart contracts to develop more complex structured income certificates, derivatives linked to digital asset performance, automated investment strategy products, etc. A seamless "fiat currency-stablecoin-cryptocurrency-traditional securities" exchange and trading experience will also be realized. Brokers can provide leverage services such as margin trading based on digital assets held by customers as collateral, integrate comprehensive wealth management and asset allocation plans for digital assets, and so on.

However, the arrival of "spring" is not achieved overnight. The declaration provides fertile soil and a clear direction, but the real harvest requires brokers to continue to deepen their efforts in technological innovation, compliance risk control, customer education, product design, etc. Challenges are always there, and the competition is fierce enough. For brokers, in the track of crypto assets, they face not only competition among brokers, but also competition from compliant exchanges in the same industry.

For the crypto industry, the active entry of brokers has undoubtedly built a bridge between crypto and traditional finance, and the flow of funds between traditional financial products and virtual currencies has become smoother.

Aaron

Aaron

Aaron

Aaron Clement

Clement Hui Xin

Hui Xin Clement

Clement Jasper

Jasper Catherine

Catherine Clement

Clement Snake

Snake Alex

Alex Kikyo

Kikyo