Source: The DeFi Report; Compiled by: BitpushNews

Foreword:

As a controversial but extremely lucrative meme coin generation platform in the Solana ecosystem, Pump.fun has generated fee income almost equal to the entire Solana network (base fee + priority fee) so far this year. However, the current trading price of PUMP tokens is nearly 99% discounted relative to SOL. This week's report will take an in-depth look at Pump.fun and the "Launchpad War" it has triggered within the Solana ecosystem.

Disclaimer: The opinions expressed in this article are the author's personal opinions and should not be regarded as investment advice.

Products and Business Model

Pump.fun is a Solana-based platform that allows anyone to instantly create and trade new tokens (mostly meme coins) with little to no initial liquidity.

The protocol's revenue model is primarily driven by transaction fees, building a complete product suite

Mobile and desktop applications: Provide a user-friendly operating interface.

Live streaming function: Creators can promote their tokens through live streaming.

Simple interface: Users can issue tokens and start trading in just a few minutes.

Integrated Bonding Curve: This is the main way platform tokens are purchased by users. When the token market value reaches $69,000, they will "graduate" and enter the Pump.swap DEX for trading. Pump charges a 1% fee from each buy and sell transaction on the joint curve, which constitutes about 88% of its revenue source.

Pump.swap DEX (launched in March this year): For "graduated" tokens, Pump charges a 0.05% fee on each transaction (of which liquidity providers (LPs) receive 0.20% and token creators receive 0.05%). Currently, this part of the revenue accounts for about 12% of the total revenue.

Data Overview:

Fee Income: Since its launch in early 2024, the platform has generated more than $775 million in fees. During the same period, the Solana network generated $1.16 billion in fees. This means that Pump's fee income accounts for 67% of Solana's total network revenue (88% so far this year (YTD)).

Creator Incentives: By providing creators with a recurring income stream tied to their tokens (with a 0.05% transaction fee after graduation), the platform aims to incentivize creators to engage in longer-term community building rather than just pursuing quick “pump and dump” scams, which have damaged the reputation of the protocol.

Target Market & Vision

Pump’s potential market is essentially the intersection of the global creator economy and the crypto world. The platform aims to attract millions of content creators, influencers, and community leaders who may launch their own tokens as a new way to monetize in the future.

The broader creator economy has grown into a massive market in recent years. In 2024, the industry is valued at approximately $191 billion and is expected to grow at a compound annual growth rate (CAGR) of 20%, reaching $500 billion by 2030.

This market covers influencers on platforms such as YouTube, TikTok, Twitch, and OnlyFans, who earn income through content, merchandise sales, and fan support. We think Pump is positioning itself as a platform that enables creators to monetize in part in the form of social tokens or meme coins, helping creators get "instant funds and attention" from their communities.

The team is not shy about this, in their own words: "Our plan is to kill Facebook, TikTok, and Twitch on Solana."

There are currently more than 207 million active content creators in the world, but only a tiny fraction of them monetize through tokens. For years, we have been looking for the "consumer/social application" in the crypto space that can stand out. Maybe you need to look closely, but we think it may be Pump.fun.

Token Economics

PUMP Total Supply: 1 Trillion

Vested Supply: 612.3 Billion (61.23%)

ICO: All unlocked.

Community: 76% unlocked, the remaining tokens will be unlocked in July 2026.

Team: 100% locked, the first 25% unlock will be after the cliff in June 2026. The remaining tokens will be unlocked linearly over 36 months until June 2029.

Existing investors: 100% locked, the unlocking schedule is the same as the team.

Live Creators, Liquidity and Exchanges, Ecological Funds, Foundations: 100% unlocked.

Token Buyback:

The Pump team said that token holders will benefit from token buybacks and potential revenue sharing. In fact, the team has hinted that up to 25% of the platform's revenue may be distributed to PUMP holders in the future. However, investors should understand that the token does not confer any legal rights to claim any revenue. Buyback data: The team has repurchased more than 3 billion PUMP tokens (0.49% of the existing supply and 0.3% of the total supply).

Fundamental analysis

Active users:

Number of tokens issued:

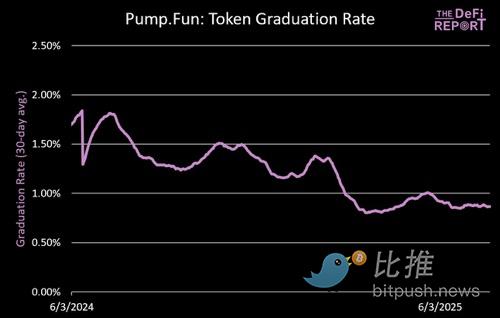

At its peak, Pump was issuing 70,000 tokens per day. With the entry of competitors (which we will talk about later), this number has dropped to about 10,000 per day. Fewer tokens issued means that the protocol's bonding curve fees and transaction fees will also decrease. Token Graduation Rate: Currently, less than 1% of tokens graduate on Pump. This is the main reason why the market considers Pump to be extractive, and it basically tells us that 99% of projects are pump-and-dump scams. There are only 278 tokens with a market cap of more than $1 million, and Pump has issued nearly 12 million tokens since its inception. We hope to see better creator incentive alignment to ensure the long-term success of token issuers, Pump users, and creators.

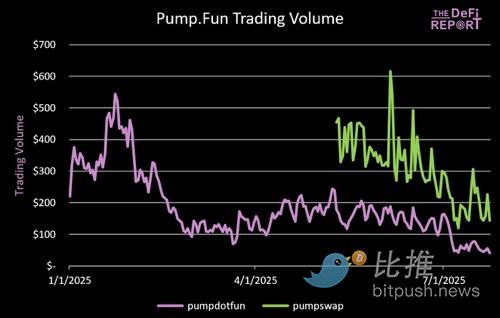

Transaction volume:

It is worth noting that Pump.swap was launched in March this year. Prior to this, the tokens that "graduated" on Pump would be transferred to Raydium for trading (the transaction fees belonged to Raydium). After Pump.swap went online, all Pump tokens "graduated" on its own DEX, and the transaction fees (0.05% shared with creators) also belonged to Pump. This shows that Pump is undergoing vertical integration of the technology stack.

Team and Investors

Pump was co-founded by three young British entrepreneurs: Noah Tweedale (CEO), Alon Cohen (COO) and Dylan Kerler (CTO). When it went online, they were all in their early twenties. As far as we know, the protocol was developed by the team due to their dissatisfaction with the existing meme coin issuance and trading experience.

According to an investigation by Wired, Dylan Kerler was involved in issuing (controversial) tokens on Ethereum as early as 2017 (when he was only 16 years old). This history (although with its specific context) shows that Kerler brings technical expertise and a deep understanding of the viral crypto market to the team. Noah Tweedale and Alon Cohen appear more as public faces, with Tweedale often considered the head of the business, while Cohen actively communicates platform updates and ideas on X (Twitter) and the media.

Despite their youth, Pump's founders have expanded the platform at an unprecedented rate. More than 6.6 million tokens (out of a total of 12 million) have been issued this year alone, and the platform has attracted 22 million addresses. The team currently has about 50 employees, mainly composed of engineers, data scientists, security experts, etc.

Pump's rapid rise was initially due to its self-sufficient development with its own income. However, the project has attracted major investors through recent funding rounds:

Recent ICO (essentially Pump’s Series A): Raised a total of $1.3 billion. $600 million of that came from the public ICO (which sold out in 12 minutes on Saturday!), and $720 million was raised through a private sale to institutional investors. All ICO investors purchased tokens at $0.004 (fully diluted valuation of $4 billion).

Private sale round: The private sale round’s token allocation (18% of the total token supply) went to large, mostly undisclosed backers. However, industry reports indicate that several top crypto funds and firms, including Pantera Capital, Blockchain Ventures, and Kraken’s venture capital arm, participated in the private sale.

Existing Investors: 13% of the token allocation was also reserved for “existing investors,” suggesting that some early private investors were already in the game even before the July ICO. Major cryptocurrency exchanges including Bybit, KuCoin, Gate.io, MEXC, Bitget, and Kraken facilitated the token sale, suggesting that these companies may have also received token allocations.

Competitive Landscape: “Launchpad Wars”

Pump.fun has essentially carved out a new niche on Solana, but competitors are quickly emerging to challenge it.

Raydium Launchlab:

Raydium is the largest DEX on Solana by volume. The protocol entered the Launchpad business in March of this year through Raydium Launchlab — a direct competitor to Pump.fun. Pump previously relied on Raydium for transactions, and once the tokens on Pump "graduated", they would be transferred to Raydium. When Pump announced plans to launch Pump.swap, cutting off Raydium's value chain, the relationship between the two parties was tense. Raydium then launched Launchlab, and the "Launchpad War" began. Fast forward four months, and the market is a different picture.

Data: As of July, Raydium Launchlab has issued 414,000 tokens, while Pump.fun has issued 305,000. This has caused Pump's market share to drop sharply from 99% in the first quarter to 38% at present.

Let's Bonk:

The above chart shows token issuance by Launchpad (Raydium is represented in green). But this is not where the users are. Users mainly gather on Let's Bonk, a Launchpad interface connected to Raydium Launchlab. Therefore, most of the revenue generated by token issuance on Raydium Launchlab goes to Bonk, which charges a 1% transaction fee on its joint curve. After the token "graduates" to Raydium DEX, Raydium gets 0.25% of all transactions.

Has Pump lost the market?

Given the sharp decline in market share in the past few months, this is a reasonable question. Here is our view on this:

Product Improvements:

Joining Curve: Bonk has made some iterations on the joint curve, aiming to make the price increase slower and more sustainable.

Bots/Snipers: Bonk forces users to do an hCAPTCHA verification to automatically block bots. More importantly, within 60 seconds of the token being released, a "fair shield" is activated - limiting the number of tokens that can be purchased by a single buyer. After that, an AI model monitors on-chain activity and is trained to identify suspicious behavior, with mechanisms to mitigate the impact of bad actors (bots). This is a user protection built into the platform, giving users the feeling that the game is not "rigged."

Governance: Once a token "graduates" on Let's Bonk, the platform automatically creates a basic governance page to enhance user transparency. In addition, the creator's token supply is deposited into a community wallet controlled by a DAO smart contract, and the tokens are gradually unlocked according to a publicly announced schedule. This is designed to prevent the team from selling tokens too early. Token holders can also vote on the use of project funds, such as funding promotion, paying developers, or burning tokens.

Essentially, these new features allow Let's Bonk to brand the new Launchpad as "community first."

So, how sticky is Let's Bonk? Is Pump a dead end? Or will creators and traders flow back to Pump? No one knows the answer. But we have seen many similar situations in the crypto ecosystem over the years, which gives us some inspiration.

First movers usually win.

Protocols such as Uniswap, Aave, Lido, and MakerDAO are good examples. Although there is no guarantee, in the field of crypto protocols, first movers often win in the end. We expect Pump to integrate similar features to Let's Bonk. But at the end of the day, it is not the features that determine the winners.

Brand, execution (ability to pivot/iterate quickly), users/community, integration/network effects, capital, token economics, and incentive alignment with users — these are what determine the long-term winners.

Also, Let’s Bonk still needs to prove it can attract new crypto users. There is no evidence of this yet, and data shows that Pump’s users simply migrated over.

For these reasons, we believe Pump still has a sizable lead (despite recent market share losses).

Creator Incentive Alignment:

Pump shares its 0.05% trading fee on Pump.swap with token creators, achieving long-term incentive alignment. Let’s Bonk does not share fees with creators.

Given Pump’s deep pockets ($1.3 billion raised in ICO), brand, full-stack product (interface, bonding curve, DEX, mobile app, and social elements), and proven track record of fast execution, we still think it has a good chance of being a long-term winner in crypto.

Web2 giants are the ultimate competitors

Pump’s ultimate competitors may actually be existing Web2 platforms like Twitch, TikTok, Patreon, YouTube, etc.

Pump has the potential to disrupt these platforms by providing creators with a better monetization model. To do this, they need to continue to build “social elements” into their product. If this works, then the live streaming feature is just the appetizer.

Risks

Regulatory and Legal Risks: In January, New York filed a legal action against the platform, accusing it of operating an unregistered securities platform. Any enforcement action by the SEC or other regulators could force Pump to geofence its services from major markets or even shut down its services.

Market Adoption and Sustainability Risks: Given that the vast majority of token offerings fail, Pump is vulnerable to crypto hype cycles and user retention challenges. Not to mention, the platform faced significant headwinds early in the cycle for facilitating a large number of scams, which damaged its brand image.

Execution Risks: The Pump team is young, untested, and well-funded.

Platform and operational risks: User-generated content auditing is a challenge for Pump. In addition, the platform faces smart contract and security risks.

Concluding Thoughts

This project does have some complex (or controversial) aspects. But it is undeniable that Pump has:

The only protocol that provides a full-stack new token issuance (interface, joint curve, DEX, mobile application and social elements).

Large reserves of funds (ICO raised $1.3 billion).

Product-market fit and distribution capabilities in high-growth markets (meme coins + creator economy).

A young, competitive team that has demonstrated rapid execution.

A grand vision - to build a social/consumer application that can subvert the existing social/consumer application business model.

Controversy. This may seem abnormal, but it is usually a trait shared by big winners.

As mentioned earlier, we have been looking for social/consumer applications that can stand out in the crypto space.

It may have already arrived.

Kikyo

Kikyo

Kikyo

Kikyo Alex

Alex Brian

Brian Alex

Alex Alex

Alex Kikyo

Kikyo Brian

Brian Alex

Alex Kikyo

Kikyo Brian

Brian