Binance Alpha is a new platform launched by Binance at the end of 2024. The official positioning is "a curated pool of pre-listed tokens". In short, the Binance team will actively explore early crypto projects with potential, and also accept candidate projects recommended by the project parties and the community. After passing the initial screening, these projects will be included in the Alpha pool for display and trading.

In the Alpha stage, Binance will further evaluate whether the project has the conditions for official listing on the Binance exchange based on multi-dimensional indicators such as market performance, community popularity, and compliance. Projects with outstanding performance have the opportunity to "graduate" to the main site, while projects with poor performance may be eliminated.

In addition, Binance has introduced a community voting mechanism that allows users to vote for their favorite Alpha projects. If high-voting projects pass due diligence, they will also have the opportunity to be listed on the exchange. Therefore, Binance Alpha not only provides users with a window to access high-quality early assets, but also provides a channel for many community-based, Meme-based, and small and medium-sized crypto projects to reach a wider range of investors and strive to be listed on Binance.

Binance Alpha is not only focused on BNB Chain assets. When the platform was launched in December 2024, it already covered four mainstream public chains, namely BNB Chain, Solana, Ethereum and Base, and further expanded on May 1, 2025, and officially launched the Sonic Chain Asset Zone.

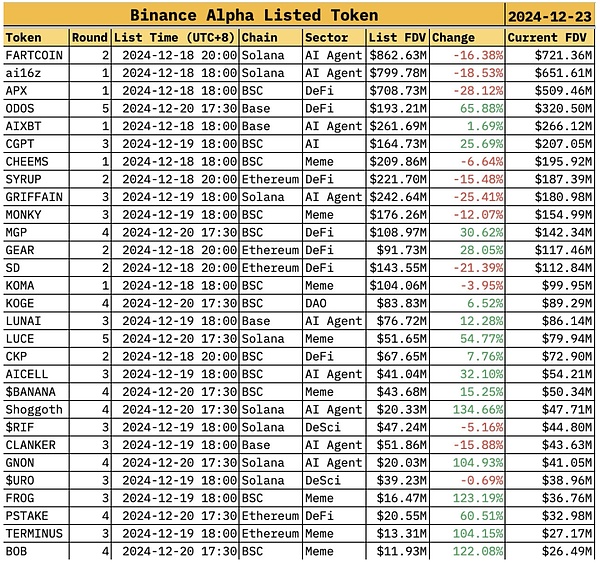

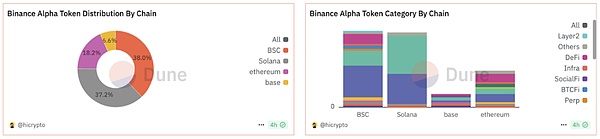

From the token launch data, Binance Alpha showed a clear preference for projects on BNB Chain and Solana. **Taking [December 20, 2024 as the node],** among the first 30 projects launched on the Alpha platform, 12 were from BNB Chain, 8 were from Solana, and the rest were mostly distributed on Ethereum, with Base projects accounting for the smallest proportion.

As of [May 10, 2025], Binance Alpha has supported 126 tradable projects, of which BNB Chain occupies 47, Solana follows closely with 46, Ethereum with 22, Base with 8, and Sonic with 3.

So from the distribution, we can see that Binance Alpha's overall strategy is "two-pronged advancement":On the one hand, it continues to deeply support early projects on the BNB Chain and activates on-chain users and liquidity through incentive mechanisms; on the other hand, it actively attracts users, traffic and attention from the external ecosystem with the help of the introduction and support of ecological potential projects such as Solana, Ethereum and Base, and realizes the expansion of the platform's own influence.

So far, Binance Alpha has been online for about half a year and has completed an important iteration from 1.0 to 2.0. The platform initially existed as an independent functional module in the wallet, and then gradually achieved deep integration with the Binance main site, seamlessly directing CEX's huge user traffic to the Alpha section. At the same time, the platform also strengthened user conversion and participation through a variety of incentive activities, further enhancing the linkage effect and user activity of the entire ecosystem.

Binance Alpha 1.0

Binance Alpha 1.0 refers to the period from the first launch of the Alpha platform in December 2024 to the upgrade to 2.0 in March 2025. In this version stage, the Alpha platform mainly provides a "quick purchase" function similar to flash exchange, where users can easily complete token selection, automatic adjustment of slippage, and built-in MEV protection mechanism to optimize the on-chain trading experience.

However, in the 1.0 stage, users can only access the platform and participate in the trading of Alpha zone assets through the Binance Web3 wallet (using MPC technology). The platform is relatively independent from Binance CEX in structure. Although it is relatively convenient to transfer assets from centralized accounts to Web3 wallets, there is still a certain separation between the two, making it difficult to achieve a natural connection between traffic and funds.

Especially in the early stages when there is a lack of a clear incentive mechanism, Binance Alpha's appeal to CEX users is relatively limited, and the platform's activity and user participation willingness are also subject to certain constraints.

Binance Alpha 2.0

Compared to the 1.0 stage, the biggest change in Alpha 2.0 is the deep integration with Binance CEX, making Alpha no longer just an independent functional section in the Web3 wallet, but officially an independent trading area in the Binance exchange. Users can trade Alpha tokens directly through spot accounts or fund accounts, without having to transfer assets to Web3 wallets, greatly reducing the threshold for participation and operational complexity.

The new integration allows Binance Alpha to truly take over the huge user base and liquidity from Binance CEX for the first time, injecting continuous vitality and capital support into the platform. Another core mechanism of the 2.0 upgrade is the launch of the Alpha Points system. Alpha Points is set as a key indicator to measure the user's activity in the Binance Alpha and Binance Wallet ecosystems, mainly based on the user's asset holdings and Alpha token trading behavior. At the same time, Alpha Points has also become a "hard threshold" for participating in Alpha airdrops, TGE, IDO, voting and other activities. Previously, all Binance Wallet users could participate in related activities such as the first 11 TGEs (by staking BNB on PancakeSwap to get TGE project airdrops), but since April 25, 2025, the 12th TGE project KAZOO has officially introduced a set point threshold indicator, and the current 45 points is the minimum participation threshold, marking that the Alpha platform has officially entered the "points-driven" refined operation stage.

In addition to TGE activities, Binance Alpha will also issue targeted airdrops to users based on the Alpha Points threshold. So far, the platform has completed 7 Alpha airdrops, and 5 TGE activities based on the points threshold have been held. If arranged in timeline, these two types of incentive activities are carried out alternately, and each phase has a different points threshold. It is worth noting that whether it is airdrops or TGE, the overall points threshold shows a gradual upward trend.

Alpha Point Rules

Users' Alpha Points are mainly composed of two parts, namely, balance points and volume points. The system will update the daily snapshot according to UTC time, and use the average daily points of the past 15 days as the final reference points for participating in TGE, airdrops and other activities.

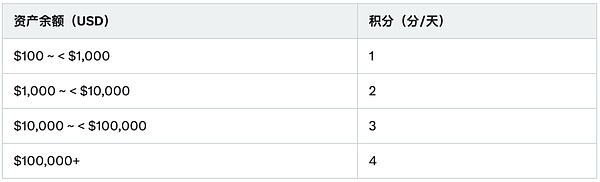

In terms of position points, the system will count the total asset balance of the user in the Binance CEX main account (including sub-accounts) and Binance Wallet, including spot assets, Alpha tokens, and tokens that have been displayed and launched on the Alpha platform. Assets not included include non-spot assets such as LSD assets.

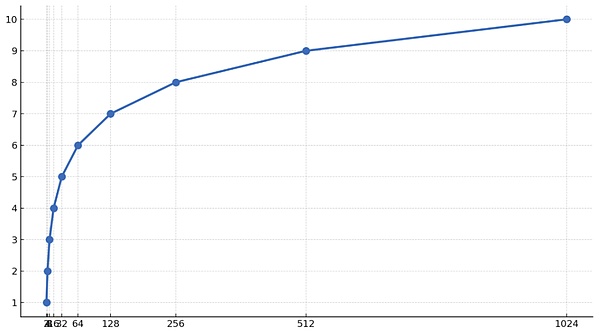

From the perspective of position size, four levels are set, with the lowest threshold being 100 USD, and positions exceeding 100,000 USD can only accumulate 4 points per day at most, rather than more points the more you hold, so this is very friendly to users with small and medium-sized positions, and there will be no gap in points due to large differences in positions.

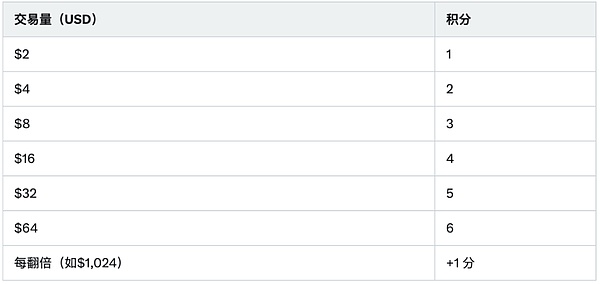

In terms of trading points, the system only counts the trading volume of Alpha tokens purchased by users through Binance Alpha or Binance Wallet (selling does not count). The scoring rule is: 1 point for every 2 USD of purchase trading volume, and 1 point for each doubling of the trading volume. This exponentially growing points model effectively suppresses the "brushing" behavior and reduces the crushing advantage of high-frequency traders and large accounts over ordinary users.

Final user daily points = Balance Points + Volume Points, the system uses the average of the past 15 consecutive days as the evaluation benchmark. This design is intended to encourage users to remain active, form stable trading behaviors, and guide the flow of funds on the chain to gather in the Binance Alpha sector, thereby building a sustainable ecological liquidity foundation.

On the one hand, as the points threshold for each TGE and airdrop activity continues to increase, users need to continue to expand their transactions or holdings to avoid the loss of participation qualifications caused by "points decline". While this mechanism encourages users to continuously inject funds into the Alpha ecological pool, it also completes the dynamic screening of "high-quality participants", forming a precise incentive system oriented towards behavioral contributions, and enhancing the long-term binding relationship between the platform and users.

On the other hand, Binance Alpha's incentive scheme is also relatively flexible and has a certain degree of randomness. For example, in the BOOP airdrop, the user's Alpha points are required to be 137, but users whose Binance UID ends with 4 can also get airdrops with points between 99 and 136. Subsequent airdrops such as MYX, OBOL, ZJK, and SXT all follow this rule.

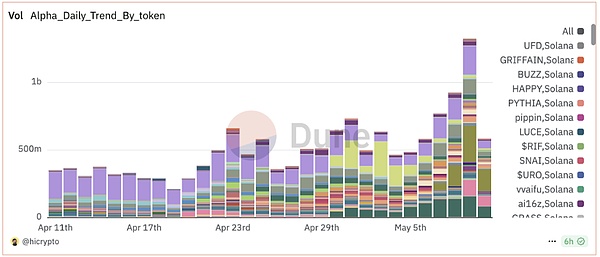

Dune and other on-chain data platforms show that the incentive effect of the Alpha Points system is significant. The daily trading volume of the Alpha sector has continued to rise since the point system was launched, showing strong capital activity.

Starting from May 1, 2025, Binance Alpha launched a double points promotion: users who purchase Alpha tokens on BNB Chain, or buy any Alpha project through a limit order, can get double trading points (for example, a transaction amount of $10 is calculated as $20 and gets 10 points). This also shows that Binance Alpha focuses on supporting the activity of BNB Chain, and this move is for BNB Chain The activity on BNB Chain is also immediate:

Half of the top 20 Alpha tokens by 7-day trading volume are native to BNB Chain.

Of the top 10 Alpha tokens by new active users, 90% are based on BNB Chain, with 6 projects having new user adoption rates exceeding 20%.

BNB Chain added approximately 4.3 million new addresses last week, with the number of new addresses exceeding 1 million per day for two consecutive days. The number of daily active addresses exceeded 2 million, and the total number of independent addresses reached 552 million.

In addition, since May 13, the platform has officially implemented the "points deduction mechanism". After users participate in TGE or airdrops, their Alpha points will be partially deducted. The points have thus evolved from "qualification threshold" to a compound incentive system of **"participation certificate + consumption rights"**.

Examples of Past Alpha Points & TGE Activities

Since the launch of the Alpha Point system (April 25), 7 Alpha airdrops have been carried out, and 5 TGE activities based on point thresholds have been held. The detailed inventory is as follows:

KAZOO (AITO) 4.25

KAZOO (AITO) is the 12th TGE activity of Binance Wallet. In the first 11 periods, users can directly participate in PancakeSwap without any threshold. Stake BNB on Binance Alpha and get airdrops during TGE. However, KAZOO is the first TGE activity to set a point threshold after the introduction of the point system. This TGE requires users to have an Alpha score of 45 points or above to be eligible to participate, and after the TGE of KAZOO (AITO), more and more users have begun to pay attention to the importance of Alpha.

SIGN 4.28

SIGN is the first airdrop project of Binance Alpha and Alpha is the first launch platform. Every user with a score of ≥65 points will receive an airdrop within 10 minutes after the transaction goes online. Each user can receive an airdrop of 1,500 SIGN tokens, which is worth about 100U

https://x.com/binancezh/status/1916745364214083955

MilkyWay (MILK) 4.29

MilkyWay (MILK) is the 13th TGE event of Binance Wallet. Users who participate in this round of TGE activities need to hold at least 75 Binance Alpha points, and the participation income is about 100U

https://x.com/binancezh/status/1916745364214083955

HAEDAL 4.29

Each user with a score ≥ 80 points will receive 356 tokens airdropped within 10 minutes after the HAEDAL transaction goes online, with a profit of approximately 50U

https://x.com/binance/status/1917133095108563152

B² Network (B2) 4.30

B² Network (B2) is the 14th TGE event of Binance Wallet, with an Alpha points threshold of 82 points and a profit of approximately 65U.

https://www.binance.com/en/events/bsquarednetwork-tge

BOOP 5.5

Every user with points ≥ 137 points, and UID ending with 4 and points between 99–136 points can receive 291 BOOP tokens airdropped, with a profit of approximately 100U.

MYX 5.6

MYX is the 15th TGE event of Binance Wallet. Every user with points ≥ 142 points, as well as users whose UID ends with 8 and whose points are between 99–141 points, are eligible to participate in this round of TGE activities and earn approximately 65 U.

https://www.binance.com/en/events/myx-finance

OBOL 5.7

Every user with points ≥ 153 points, and UID ending with 6 and points between 116–152 points can receive 165 OBOL tokens airdropped, with a profit of approximately 80 U.

https://x.com/binance/status/1918594150104264884

ZJK 5.7

Every user with points ≥ 142 points, and UID ending with 2 and points between 64–141 points can receive 50 ZJK tokens airdrop, with a profit of approximately 100 U.

SXT 5.8

Every user with a score ≥ 150 points, and a UID ending in 1 and a score between 66–149 points can receive an airdrop of 512 SXT tokens, with a profit of approximately 80 U.

https://x.com/binance/status/1920418539355193537

DOOD 5.9

Every user with a score ≥ 168 points, and a UID ending in 3 and a score between 129–167 points can receive an airdrop of 9,873 DOOD tokens, with a profit of approximately 100 U.

https://www.binance.com/zh-CN/support/announcement/detail/7744f70f5d7e4bd192ede80a7f8a6574

In addition to the above-mentioned airdrops and TGE activities, Binance Alpha also launched a trading competition from 2025-05-08 16:00 (UTC) to 2025-05-23 16:00 (UTC) after the Sonic Chain area was launched on May 1. Participants will be ranked according to their cumulative total trading volume of eligible Sonic Chain tokens traded on Binance Alpha, and the top traders will receive rewards according to the reward structure.

https://www.binance.com/zh-CN/support/announcement/detail/62f78985d5c8400d93e5ce0fa7d905f0

Conclusion

As an important bridge between Binance and CEX and Web3 ecosystems, Binance Alpha is gradually forming an early project incubation system with a points mechanism as the core and incentives and screening in parallel. Through the Alpha Points system, double points activities and focus on specific public chain ecosystems, the Alpha platform not only improves user participation and platform activity, but also promotes the marketization trial and user education of high-quality crypto projects.

As the platform mechanism matures and the participation threshold becomes clearer, Binance Alpha is no longer just a "display pool" for early assets, but has evolved into an important traffic entrance and resource distribution hub in the Binance ecosystem. In the future, whether Alpha can continue to output high-quality projects, improve the community consensus participation mechanism, and maintain a balance between incentives and compliance in the ever-changing market cycle will be the key to its long-term sustainable development.

Davin

Davin

Davin

Davin Jasper

Jasper Aaron

Aaron Jasper

Jasper Hui Xin

Hui Xin Kikyo

Kikyo Alex

Alex Jasper

Jasper Hui Xin

Hui Xin YouQuan

YouQuan