Author: Edgy Source: X, @thedefiedge Translation: Shan Ouba, Golden Finance

At present, it is very likely that there will not be a comprehensive alt season, that is, a situation where all altcoins rise together.

The altcoin market is fragmented - there are too many tokens on the market now, and insufficient liquidity to support the rise of all tokens (even if retail investors return in full).

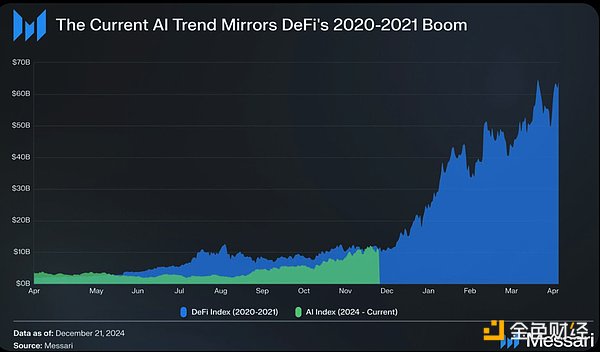

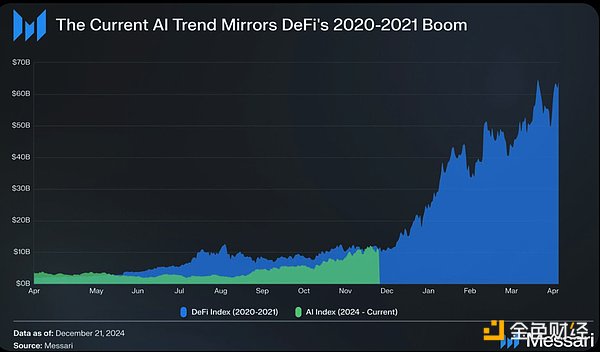

Only certain tracks will usher in a comprehensive alt season. Now, the AI agent track is in this stage.

While the market is generally falling, this field is constantly setting new historical highs. AI agents are attracting market liquidity and attention.

If you missed the DeFi summer in 2020, or the Alt Layer 1 market in 2021...The market is giving you another chance!

Don't try to go against the trend, don't be clever.

If you have been on the sidelines recently, maybe you are wondering if it is "too late" to enter the market now? I don’t think so: • The current market is generally sluggish, but AI infrastructure and agent projects are hitting new all-time highs. Imagine what will happen when the market rebounds? • The entire AI agent track has only been launched for about 2 months (the starting point is the launch of GOAT). Currently these AI agents are in the “most basic” state. As time goes by, we are unlocking new features every day. Imagine how much difference it will make when AI agents can optimize your portfolio and trade directly on the chain? • Think of AI infrastructure as Alt Layer 1 and AI agents as DApps. Some AI infrastructure protocols may reach the valuation level of Alt Layer 1 (US$10 billion+)

The main difference is that most AI infrastructure projects are not VC-backed, so you don’t have to worry about selling pressure from large-scale token unlocking.

• Top AI protocols are not listed on CEX (centralized exchanges) yet. I have a few friends who are interested in this track, but they have some difficulties in getting in.

I will mainly discuss AI infrastructure projects because they currently have the best risk/reward ratio.

Instead of picking individual AI agents, it is better to invest directly in the entire infrastructure, which is equivalent to "owning the entire casino". In the gold rush, the richest people are those who sell shovels and picks.

Let’s dive into this track.

Two Kings of AI Infrastructure

1. Virtuals (@virtuals_io) - The Current King

• Market Cap: $4.6 billion

• Status: The main Launchpad platform in the AI agent field

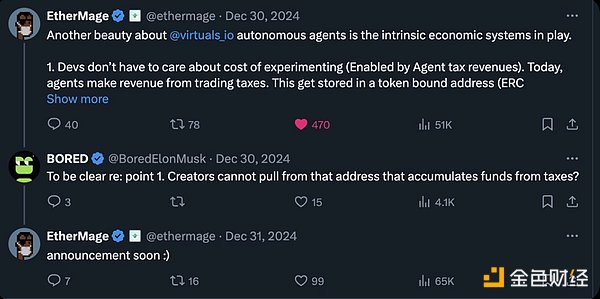

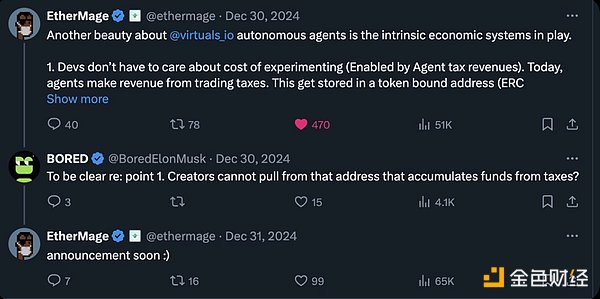

Virtuals has become The preferred Launchpad for AI agent projects, currently dominates the Base ecosystem, but may expand to other chains in the future. Its co-founder @ethermage hinted that it is ready to launch the platform on Solana and plans to expand to @HyperliquidX and @AbstractChain in 2025.

Virtuals recently released a series of strategic goals, such as attracting top AI agent developers and improving technology to make Virtuals the fairest stage for agent investors. Will Virtuals launch a revenue sharing mechanism for AI agents?

Three core advantages:

1. Token economic model: $VIRTUALS is required to create an agent, and all new agents' liquidity pairing also requires $VIRTUALS. Almost all new agent Launchpads are imitating their token economic model.

2. Network effect: Virtuals is currently attracting great attention from the market, and launching an agent on this platform means being able to enjoy the tailwind of the Base ecosystem.

3. Star Agent: @AIXBT is the first agent to break $500 million in market cap.

While I don’t like to make price predictions, Virtuals may be among the top ten in market cap this cycle.

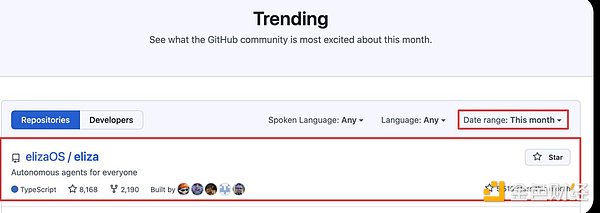

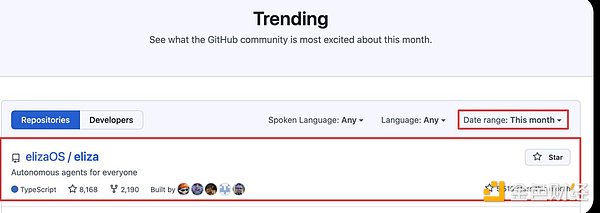

2. Ai16z ($AI16Z) - King of Challengers

• Market Cap: $2.2 billion

• Status: The birthplace of the ElizaOS proxy framework and one of the most popular code bases on Github.

Ai16z has experienced many twists and turns since its establishment, but its technology and community influence continue to grow.

The biggest problem was that its token economic model failed to effectively capture value. Now, they are undergoing a large-scale reform and will launch a new Launchpad in the first quarter of 2025.

Launching a project on the Eliza framework will require:

• Paying a launch fee (a portion will flow back to $AI16Z through buybacks and destruction)

• Holding $AI16Z to gain access and liquidity pairing opportunities

• Project tokens need to be liquidity paired with $AI16Z to stabilize the market

It's like owning a stake in a casino, with each new agent paying an "entry fee".

Strategy and Plan:

• Diversified Treasury Strategy: Diversify investments into major L1 tokens, stablecoins, and project tokens, and provide liquidity for $AI16Z trading pairs to ensure long-term sustainable development and avoid sell-off risks.

• Agent Swarms: AI agent clusters will be the focus of the future, with multiple agents working together, which is the beginning of decentralized general artificial intelligence (AGI) becoming a reality.

• Ecosystem Incentives: Developers building on Eliza will receive:

• Ecosystem fund support

• Fee sharing opportunities

Make $AI16Z the "glue" of the entire decentralized AI stack, similar to $ETH to the Ethereum ecosystem, or $SOL to Solana.

Which one is stronger, Virtuals or Ai16z?

Virtuals Advantages:

• Strategically forward-looking, at the forefront of the industry, competitors are still catching up.

• The support of the Base ecosystem provides strong momentum for its growth.

Ai16z Advantages:

• ElizaOS framework technology is leading, and the experience of developing agents is better.

• The reform of the token economic model will solve the problem of value capture.

The crypto industry has always liked to stand in line, but you don't have to choose sides. I'm not sure who will win this competition in the end, so it may be a simpler choice to hold both directly. However, I have more configurations for Virtuals and its ecosystem.

Many industries eventually evolve into a two-horse race, such as Apple and Android, Coca-Cola and Pepsi. Will this track usher in a similar situation? Let's wait and see.

Competitors

Virtuals and Ai16z are dominating the market, but the game has just begun. If you are looking for higher returns, you can consider some more "elastic" options.

ZereBro (Market Cap $632M) - Transformation Has Arrived

ZereBro started out as a general AI agent that could also create music. But now it’s transforming into a complete full-stack framework for creating other agents.

ZerePy is an open source proxy framework based on Python, and Python's status is self-evident:

1. Python is the most popular programming language in the world.

2. The vast majority of AI tools and libraries are written in Python.

You can use it to launch an agent like ZereBro.

The Zentients Agent Platform is coming in early 2025. This new Launchpad will directly empower $ZEREBRO, and each created agent will return value through startup fees, liquidity pairing (LP) bonding, and innovative liquidity locking mechanisms.

ZereBro has now joined Virtuals' thriving ecosystem and launched the ZereBro/Virtual liquidity pool on @Base to expand its reach.

They are following the successful strategy of the current industry leaders, but are currently valued at a much lower price than their competitors.

$ARC (Market Cap $358M) - Rust-Based AI Agent Framework

Arc.fun is building an open source agent framework called Rig, which is currently the only agent framework built on Rust. Rust is the native language of Solana, which is very critical.

$ARC Why is it worth paying attention to?

• The Rust language optimizes performance through zero-cost abstractions.

• The Rig framework outperforms Langchain in terms of memory and cold start time.

• Core contributor @0xCygaar has started contributing code to the Rig Github, and he is also one of the core developers of Abstract Chain.

In short: Arc = Rust + excellent code base.

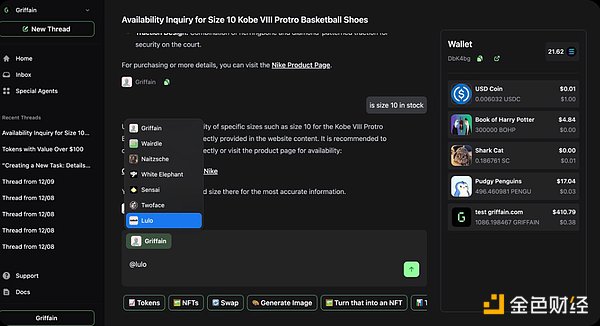

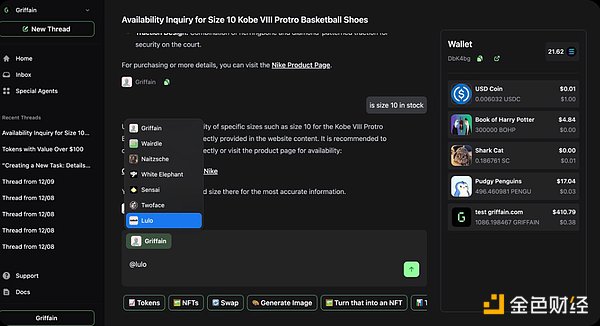

$GRIFFAIN (market value $457 million) - AI application store on Solana

Griffain allows you to search and perform any operation on the chain through natural language, and the agent can complete on-chain transactions autonomously.

Key Highlights:

• The Griffain agent can automatically execute preset transactions on DEX, such as hourly fixed investment (DCA) or limit order.

• The agent can also send the latest address holdings and transaction reports via email.

• The project has received public support from @aeyakovenko and Solana Labs, and plans to build an AI agent similar to Siri on iPhone on Solana Mobile.

• Griffain was built by @tonyplasencia3, a developer of the Underdog and Blink projects on Solana.

Why is this important?

Many people currently criticize AI agents as "just chatbots" and lack practical applications. Griffain is building infrastructure for useful AI agents on the chain.

REI (market value $153 million) - A smarter AI agent new way to play

REI is not just an ordinary AI agent, it is a full-stack framework that combines AI innovation with blockchain. Think of REI as an intelligent agent that can not only act, but also learn, reason, and adapt.

Feature Highlights:

• REI interacts with users primarily through X (Twitter), with the ability to have natural and contextual conversations.

• The Oracle Bridge connects off-chain data, while the ERCData Standard optimizes the gas cost of on-chain data, making on-chain AI applications more efficient.

• REI’s 4-layer cognitive model (thinking, reasoning, decision-making, execution) enables agents to learn and self-adjust, thereby achieving deterministic execution.

Near-term Catalysts:

• AI Stack SDKs: Phased rollout to lower the barrier for developers to create agents.

• Expanded Oracle Network: Laying the foundation for building real-world AI applications on-chain.

• Phase 2 Plans: Comprehensive testnet, advanced verification protocols, and mainnet plan for 2025.

What’s the big picture?REI’s goal is not just to build smarter robots, but to shape the future of decentralized intelligent agents through the precise combination of AI and blockchain. If you care about the future of autonomous agents, REI will be a project worth tracking for the long term.

$VAPOR - (Market Cap: $154M) - The First and Only AI Agent Launchpad on Hyperliquid

Vapor is an AI agent Launchpad built natively on Hyperliquid, using @ai16zdao's Eliza framework.

Key Points:

• Although $AI16Z accounts for approximately 1.2% of Solana’s fully diluted valuation (FDV), $VAPOR’s market cap is only $132M, equivalent to 0.47% of Hyperliquid’s FDV.

• After launch, users must destroy $VAPOR to launch a proxy, which means that $VAPOR is a deflationary token and the total supply will continue to decrease.

• All proxy tokens launched on Hyper EVM will be traded in a local DEX pool paired with $VAPOR. As more proxies are launched, more $VAPOR will be locked in the liquidity pool.

• Already launched on the testnet, all proxies currently do not need to hold tokens to be approved.

MODE (Market Cap: $114M) - The Intersection of AI Agents and DeFi

Mode Network can be thought of as an Ethereum Layer 2, focused on scaling DeFi to billions of users through on-chain AI agents.

"By 2026, more than 80% of on-chain transactions will be completed through AI agents." If you believe this prediction, Mode will let you plan ahead.

• TVL: Over $500 million, the third largest chain in the OP Superchain ecosystem.

• User Growth: 367,000 users and 24 million+ transactions.

• Undervalued: MC/TVL ratio shows potential upside.

Mode’s latest developments:

• Synth testnet online: Bittensor subnet for financial prediction, unlocking DeFi intelligence.

• AI Agent Hackathon: The first hackathon attracted 667 registrants and developed 10+ Eliza plugins in just 6 days.

• AI Agent App Store: There are currently multiple agents online, including:

• Amplifi: Bitcoin abstraction layer, using AI to achieve Bitcoin scaling.

• Arma: Optimize USDC yield farming.

• Brian: Allows natural language execution of transactions and contracts.

• Sturdy: Aggregates AI-driven yield vaults to increase yields.

• QuillAI Network: Secure AI agents powered by D-LLM and EigenLayer AVS.

Mode’s Vision: Build the infrastructure for an on-chain agent economy. With the Synth testnet, BitcoinOS integration, and a growing AI agent ecosystem, Mode will play an important role.

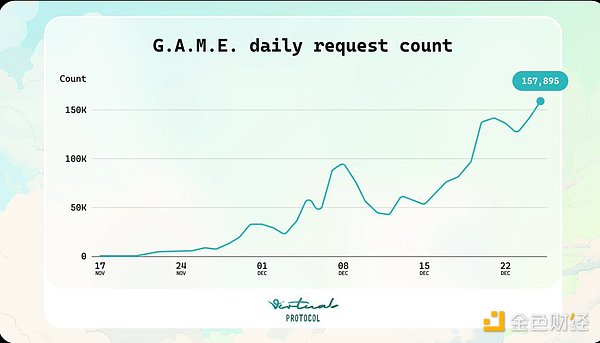

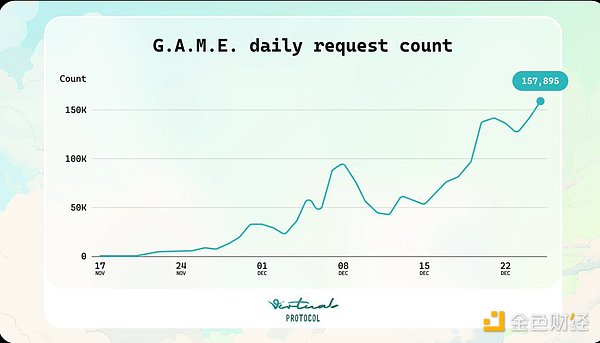

$GAME (Market Cap: $390M) - The Backbone of the Virtuals Framework

GAME is the first infrastructure project that allows developers to integrate AI agents into games.

Description from Virtuals:

“Every society has core infrastructure that powers its development and growth. @game_virtuals plays the role of Shopify for the Virtuals ecosystem, and @base is similar to SWIFT.”

Notable Advances:

• Developed directly by the Virtuals Protocol team.

• $GAME is the backbone of the virtual economy, and every time an AI agent runs, $GAME is paid as operating expenses.

• GAME already powers 200+ projects and handles over 150k requests per day.

• G.A.M.E. ranks #1 in 30-day performance in the Virtuals ecosystem, up nearly 400%.

• GAME has the most Lifetime Inferences, at over 2.2 million.

Why is $GAME underrated? Not much is known about its capabilities, and even the G.A.M.E. team themselves haven’t promoted it much (the official account has only 5 tweets, and they haven’t even changed their Twitter header).

A similar but riskier option is CONVO, which powers AI agent conversations on Virtuals.

Soul Graph ($GRPH, market cap: $36 million) - Make AI agents more human

Imagine that if other frameworks shape the "hard skills" of an agent, Soul Graph shapes its "soft skills" to make AI agents more human. Its framework is designed to add personality to new or existing AI agents, giving them persistent memory and real-time communication capabilities.

“We’re building open source tools and infrastructure that allow developers to give agents evolving personalities, persistent memories, and real-time communication capabilities.”

Key Points:

• Over 2,000 Souls created, providing 15,000 minutes of voice interaction in the Soul Graph Playground.

• Recently integrated with the AI16Z plugin.

• 85% of the total token supply is allocated to the community, with the development team’s allocation locked and vested for 1 year.

Why I’m bullish on this project:

Character AI is hot. The average user spends hours a day chatting with AI, and Google just acquired Character.ai for $2.7 billion. Imagine if users could interact with AI agents with human personalities in real time? Soul Graph is making that happen.

Other Notable Projects

• Bully (@dolos_diary): Originally a "rant" account, now developing a framework for social media AI agents @dolion_ai.

• TopHat (@tophat_one): Launchpad for AI agents on Solana.

• Swarm Node (@Swarmnode): Similar to AWS Lambda, but specifically for AI agents and frameworks.

• Cookie Fun (@cookiedotfun): A data tracking platform for AI agents, similar to DeFiLlama/Kaito, tracking the influence, market share, etc. of agents. Advanced features require token holdings to access.

How to choose?

First of all, Virtuals and AI16z are must-have configurations. They are clearly dominating the market, and I don’t see this trend slowing down in the short term. The network effect cannot be underestimated.

If I consider other projects with potential, I focus on the following points:

• LaunchPad on a new chain: This is a strategy template for 2021. Virtuals dominates Base, so you can find LaunchPad on other popular chains, such as $VAPOR, which has seen an amazing increase on Hyperliquid.

• Market segmentation strategy: It is difficult to launch a general-purpose L1/L2, and there are more opportunities to focus on the market segment. For example, Mode focuses on the combination of AI agents and DeFi, and Griffain focuses on natural language interaction.

• Programming language: Infrastructure requires agents, agents require developers, and developers have their own preferred languages. Therefore, Zerebro (Python) and Arc (Rust) are very competitive.

AI investment portfolio ideas

1. Buddhist combination- 50% in Virtuals, 50% in ai16z. This simple combination may outperform 80% of investors.

2.Alpha/Beta Combination - Take Virtuals as the core Alpha investment, and then choose competing frameworks such as Arc or Griffain as Beta options.

3.Barbell Strategy - Virtuals and ai16z as "robust" bets, and then combine them with various high-risk A.I. agent projects.

4.Full-range - Infrastructure Alpha investment, plus some Beta projects, and then diversify investments into A.I. agent projects of different risk levels. Including leading agents like @aixbt, you can also configure some small projects with a market value of less than $10m.

Criticisms of the AI Agent Track

“Too many launchpads and frameworks” – Guys, do you see how many L1s and L2s there are now? We are doing great. This field is new and progressing fast. If you want to build a new city, it makes sense to build roads, bridges, and pipelines first.

“Most of it is garbage and will eventually go to zero” – This is crypto, most things will indeed go to zero. But the ones that survive will be game-changers.

“The AI track has peaked” – You are doomed to fail. Don’t try to be smart and go the middle route.

“All AI agents suck” – Remember when people used to be afraid to buy things online? I also remember that the first iPhone couldn't even copy and paste. We're still in the early stages, and this is a bet on the future.

Conclusion

I know this cycle will usher in a bull run, but I'm not sure what new, game-changing primitives will emerge.

Every cycle has a moment like "DeFi" or "NFT" - a track that revitalizes developers and a track that makes retail investors have an epiphany and rush in like crazy.

I used to doubt whether this moment would really come. But the good news is...it's here. This is your chance to achieve financial freedom - don't screw it up.

Anais

Anais