Author: David Christopher Source: Bankless Translation: Shan Ouba, Golden Finance

One of the most exciting developments over the past year has been the increasingly impressive growth trajectory of Hyperliquid.

The exchange has not only consistently hit new highs across various success metrics, but has also achieved this through a novel combination of network designs—the latest of which is the highly anticipated, natively native USDH stablecoin.

What is USDH?

A Call for Proposals, published last Wednesday, invites stablecoin issuers to submit proposals to the Hyperliquid community for issuing and managing USDH—an initiative intended to stimulate the spot market, reduce reliance on USDC, and improve exchange efficiency. Upon launch, USDH will be used in select spot trading pairs and will reduce fees on those pairs by 80%. This move is intended to transform HyperCore (Hyperliquid's flagship exchange) into a full-service exchange, helping to balance its spot trading volume, which currently lags behind its dominant perpetual contracts business. However, perhaps more importantly, USDH will allow Hyperliquid to address a key vulnerability in its relationship with USDC. The exchange currently holds ~8% of Circle's total USDC supply in its bridge, a model that not only creates a deep dependency on a third party but also leaks $100 million annually to Coinbase (as the US exchange claims 50% of Circle's revenue), while receiving no revenue back into the Hyperliquid ecosystem. A native stablecoin would eliminate this leakage and circulate the estimated $200 million in revenue generated by USDC within the Hyperliquid ecosystem to fuel growth (though how best to do so is still up for debate). Why are teams vying for this opportunity? Proposals closed today, marking the end of the first round of intense competition to govern USDH. But if you're unfamiliar with the exchange, you might wonder why teams are trying to make promises to the Hyperliquid ecosystem on Discord just for the chance to issue their native stablecoin. The answer is that Hyperliquid, with an average weekly trading volume of $57 billion, is earning more than even Nasdaq at its current rate. At some points, it alone accounts for 35% of all blockchain revenue. As of August, it was also the world’s most profitable company, measured by revenue per employee. In other words, for ambitious teams, a piece of this pie is definitely worth fighting for.

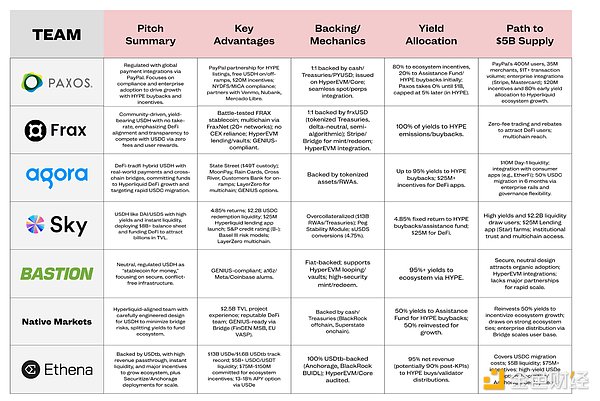

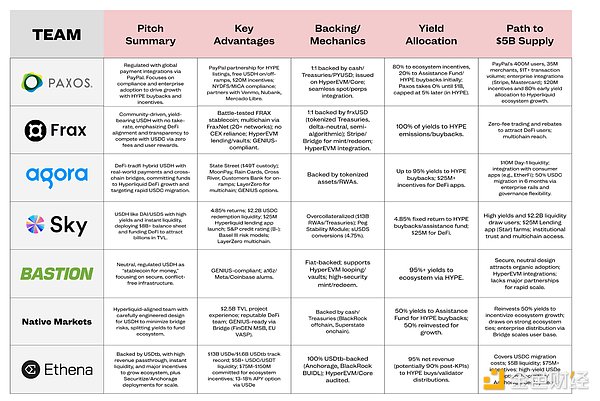

Here are a few of the leading teams that have submitted proposals, along with a breakdown of what they’ve pledged:

The Main Contenders

While all proposals have their merits, often combining factors like revenue sharing and regulatory readiness, three proposals stood out based on Hyperliquid’s criteria of “Hyperliquid-first, Hyperliquid-aligned, compliant, and natively minted USD stablecoins.” As James Evans, a member of the Reciprocal Ventures investment team, put it: Is Hyperliquid their "home turf"? Does USDH growth equate to Hyperliquid growth? Does this mitigate regulatory risk? Against these criteria, three teams emerged with the most compelling proposals, albeit with different focuses: Native Markets, Ethena, and Paxos. Let's analyze each team's strengths: Native Markets' proposal most closely aligned with Hyperliquid's native ethos. The team is led by Max Fiege (Liquity alumnus and respected HYPE contributor), and also includes MC Lader (former Uniswap Labs COO) and Anish Agnihotri (Paradigm Fellow). Their proposal outlines the allocation of proceeds between HYPE buybacks and growth incentives, with careful governance configuration. Overall, their strength stems equally from Max's connections and the consistency they demonstrate—building a completely organic project first, rather than relying on incentives, by bootstrapping rather than accepting endorsements. However, some have questioned their submission immediately after the RFP was released, leading some to speculate that they knew the proposal would go live. Regardless, Native Markets may be the team that best aligns with Hyperliquid's organic growth philosophy—though whether a bootstrapped model can provide sufficient fuel for USDH's growth remains questionable. Ethena brings credibility to the DeFi space. While initially generating excitement, its proposal cooled as voting began, in part because its focus remains broader than Hyperliquid's. While they've demonstrated engagement through ecosystem partnerships and understand the growth catalysts they need to focus on, concerns remain about spreading their efforts thin given their expansive product suite. Their proposal leans heavily on its distribution capabilities, pledging at least $75 million to develop a stablecoin and promising to bring institutional players like Securitize and Anchorage Digital to Hyperliquid, potentially further boosting the chain's total value. Overall, Ethena's strengths lie in its track record and influence across both DeFi and traditional finance, but its broader scope and more traditional fundraising background mean it's a less than perfect fit with Hyperliquid's standards. Paxos released its V2 proposal just hours before the submission deadline this morning, gaining significant momentum and shifting its focus from "the safe bet" to "we win only when Hyperliquid wins." V2 reinforces the PayPal partnership discussion from its first proposal, adding HYPE listing on PayPal/Venmo, free global deposit and withdrawal options, and the promise of $20 million in incentives. Furthermore, they introduce a new tiered yield system: until USDH reaches $1 billion in TVL (total value locked), they will charge 0% fees, allocating profits to buybacks and ecosystem incentive pools. Once USDH exceeds $5 billion, they will eventually allocate 70% of their earnings to a relief fund (source for Hyperliquid's token buybacks), 25% to growth, and 5% to Paxos (distributed in HYPE).

Paxos brings the stamina and regulatory prowess of a decade of federal litigation, as well as strength in traditional finance—but it still feels more corporate than the ecosystem's native teams.

Who will win?

Regardless of who ultimately prevails, the past few days have been breathtaking and should be seen as a triumphant moment for the crypto space.

Crypto has created a product so sought after and desired that we're seeing institutions opening Discord and writing lengthy proposals, recognizing the massive opportunity Hyperliquid represents and the paradigm it sets.

Since USDH took the main stage, we've seen MegaETH also announce the launch of its native stablecoin. I expect we'll see more and more ecosystems follow USDH's lead and attempt to internalize (rather than drain) the benefits generated by giants like Tether or USDC. Perhaps most surprising is that this hasn't happened more often before.

Whether Hyperliquid's community ultimately chooses the grassroots ethos of Native Markets, the DeFi sophistication of Ethena, or the traditional finance bridge of Paxos, the impact of that choice will extend far beyond a single stablecoin. If executed well, USDH will not only strengthen Hyperliquid—it will also build on the exchange's track record of success, demonstrating once again how far crypto can go when truly valuable things are built organically.

Kikyo

Kikyo