In June 2025, the crypto world ushered in an epic wealth migration: the new project IRIS debuted with an initial market value of $200,000 through the Genesis Launch platform of Virtuals Protocol. After listing on the exchange, the market value soared to $80 million, setting a new industry record of 400 times increase. This performance not only far exceeded BasisOS's previous record of 40 times increase, but also dwarfed the "dog season" of the Solana ecosystem. As the booster engine of this myth, Virtuals Protocol platform token VIRTUAL has achieved a 400% surge in half a year, with a peak market value of over $5 billion. Today, the platform has firmly established itself as the largest AI agent launch platform on the Base network. Behind this national carnival is actually an experiment in wealth distribution reconstructed based on the rules of points - it is quietly reshaping the speculative logic and value order of the crypto market.

01 Rebirth from the Ruins: From the Remains of Chain Games to the AI Agent Distribution Platform

Virtuals Protocol (abbreviated as Virtuals) is a decentralized platform deployed on the Ethereum Layer-2 network Base, dedicated to creating an on-chain AI agent economy, allowing users to easily create, co-own and monetize autonomous AI characters. Its predecessor was PathDAO, a gaming guild founded in Malaysia in 2021. PathDAO focused on Play-to-Earn projects and NFT communities in the early days. With its precise layout of projects such as Axie Infinity and Illuvium, it successfully raised about $16 million in financing, with a valuation of nearly $600 million at one point, and accumulated rich game assets and an active player community. However, the bear market in 2022 hit GameFi hard, and the price of PathDAO tokens plummeted by nearly 99%, with its market value shrinking to less than $6 million. The team tried multiple business lines such as social apps, NFT clothing, and music platforms, but all failed, and the project was on the verge of being stranded.

At the end of 2023, the generative AI craze swept the world, and the concept of AI agents became a new outlet for encryption. The PathDAO community voted on the on-chain DAO (with a support rate of 90%) and decided to completely transform into an AI-driven protocol and change its name to Virtuals Protocol. The core strategy shifted to "assetizing and tokenizing AI agents and empowering the community." This transformation was based on deep insights: the team found that the Japanese VTuber market size exceeded 100 billion yen, but creators only received less than 20% of the revenue; at the same time, Roblox platform experiments proved that AI-driven NPCs can increase player retention by about 3 times. These two data directly gave rise to Virtuals' positioning as a "profitable AI personality."

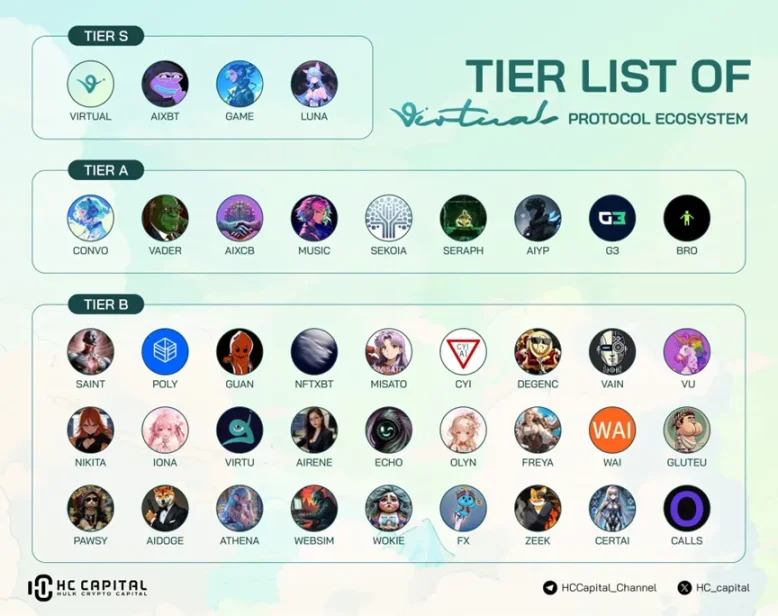

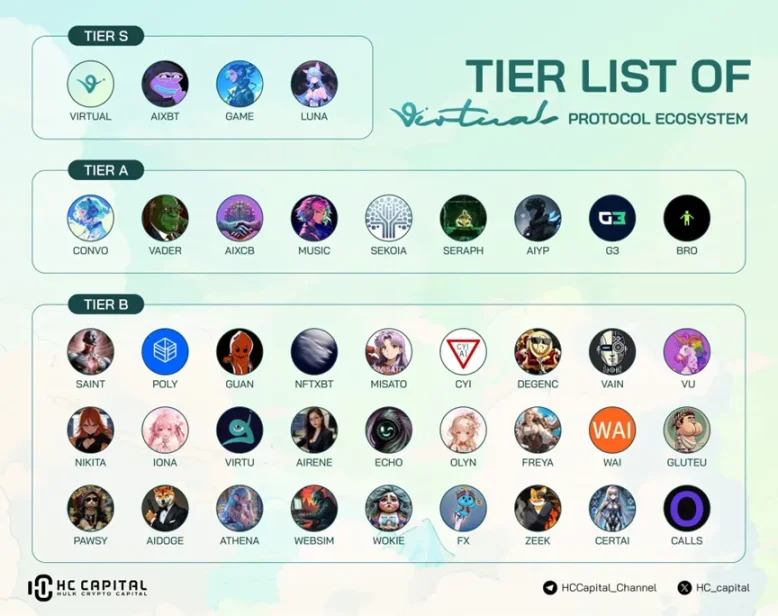

In October 2024, Virtuals was launched on the Base mainnet and launched the first multimodal AI agent, the virtual idol Luna. Luna integrates technologies such as text generation, 3D motion, speech synthesis, and ERC-6551 smart contract wallets, and can independently raise operating funds and issue rewards to fans. After going online, Luna quickly attracted 500,000 fans on TikTok and Telegram, and its monthly income from fan rewards alone reached 1.2 million US dollars, successfully verifying the business model and technical feasibility of on-chain AI agents. Its demonstration effect attracted a large number of developers to pay attention to the Virtuals project itself.

Riding on the success of projects such as Luna, Virtuals launched its core token VIRTUAL on multiple exchanges and Base at the end of 2024. Its price soared from a few cents at the beginning to a historical high of $5.15, and its market value once exceeded $5 billion, far exceeding most Layer-2 and DeFi projects in the same period, marking Virtuals' entry into the mainstream crypto market. The platform's original "low threshold, high incentive" mechanism is very attractive: users only need to pledge about 10 VIRTUAL (about $200) to create a new AI agent and automatically generate a liquidity pool locked for 10 years; when the token market value reaches about $500,000, the system will release the liquidity layer on DEX to ensure trading depth and price stability. This model has greatly reduced the threshold for participation and stimulated enthusiasm for ecological construction.

As of June 2025, the Virtuals ecosystem has demonstrated significant scale and economic effects: the cumulative number of incubated AI agents exceeds 11,000, covering multiple scenarios such as virtual idols, trading consultants, game engines, and content incubation. Virtuals has almost bred more than 80% of the AI agents on the BASE chain, and its generative multimodal agent framework G.A.M.E has also become a popular choice for agents in the Web3 game and metaverse fields. However, Virtuals' vision goes far beyond becoming a leader in AI agent issuance. Its white paper clearly states that the ultimate goal is to build a true "AI sovereign society." Therefore, how to attract more ecological members to join has become the key to Virtuals achieving this grand goal, and will be its development focus for a long time in the future.

02Virtuals IPO model: creating a new paradigm for AI asset issuance

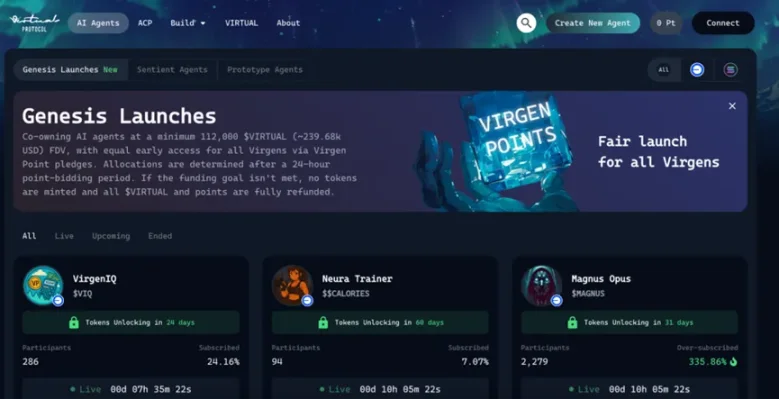

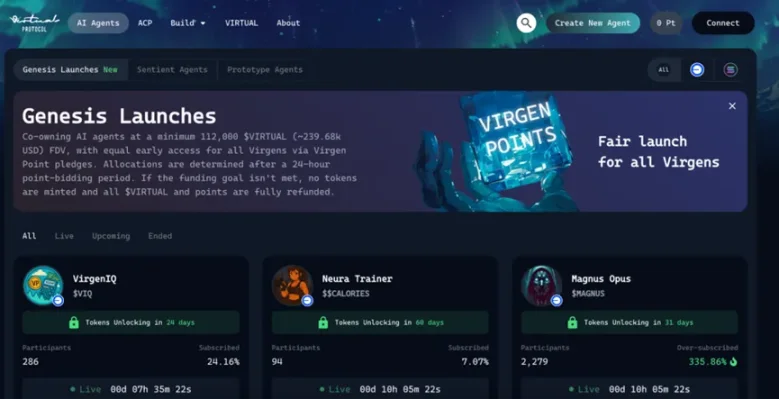

In order to attract more user attention, Virtuals pioneered the "Genesis Launch" mechanism to issue AI agent tokens. Unlike traditional linear airdrops or fixed issuances, Genesis Launch is based on the concept of "contribution points (Virgen Points)", emphasizing participation and contribution rather than pure speculation. GenesisLaunch quickly became popular on the Internet as soon as it was launched. At present, Virtuals IPO has become a new IPO holy land for "money-grabbing parties" to participate in, and even senior speculators are discussing how it can replace the once popular "Alpha airdrop" model. Compared with the traditional one-time distribution of airdrops, which users often sell as soon as they get them, GenesisLaunch emphasizes "contribution is distribution", giving everyone the opportunity to participate in the subscription of new coins with real investment. Almost every day in the official community of Virtuals Protocol, members can post screenshots of their earnings from using VirgenPoints to participate in new listings and win popular tokens. This open and transparent rules and thresholds have completely overturned the situation of "rich people grabbing and retail investors missing out".

Take IRIS as an example. The project started pre-sale in mid-May. In less than 24 hours, it locked more than 120 million points, with an oversubscription of 1,500%. Tens of thousands of users shared 37.5% of the community share. On the day of listing, IRIS's market value soared from $200,000 to $80 million, an increase of more than 400 times, breaking the industry record of AIAgent issuance and instantly dimming the "dog season" of the Solana ecosystem.

The reason why GenesisLaunch has become so popular so quickly is that it has built a closed loop of "incentive-contribution-reward". First, users can obtain basic VirgenPoints by staking VIRTUAL or holding the hot AIAgent tokens in the ecosystem, such as Luna and AIXBT; secondly, users can also accumulate more points by participating in social promotion ("Yapping"), trading on the platform, or staking other project tokens. In this way, whether you are a technical novice or a veteran trader, you can find a contribution method that suits you in capital investment or content promotion, which greatly stimulates community activity and innovation.

In sharp contrast, traditional airdrops often rely only on holding snapshots or completing complicated tasks. Users mostly sell the coins on the same day after receiving them. According to data from Binance Alpha, more than 90% of airdropped tokens plummeted in price within 15 days after issuance, and the three-month retention rate was less than 12%. GenesisLaunch uses a points lock + punitive cooling mechanism: if the new tokens are sold within 24 hours after unlocking, the 10-day points will be cleared, which will greatly curb the arbitrage behavior of "wool-pulling" and make participants more inclined to hold for the long term and continue to contribute.

At the same time, the platform provides sufficient liquidity support for the listing of new tokens. Each AgentToken is paired with a certain amount of VIRTUAL or stablecoins to be injected into the liquidity pool before the opening, ensuring the embarrassment of "no price to buy" and "no order to sell" on the exchange or DEX. In order to prevent whales or robots from grabbing a large share through multi-wallet bayonet layout, GenesisLaunch sets an upper limit of no more than 0.5% of the total issuance for each address, and uses an on-chain randomization algorithm to further balance the distribution, ensuring that small and medium-sized users can also reap a considerable share.

The success of the Virtuals new issuance model lies not only in the popularity of new token issuance, but also in the "old-to-new" effect of Virtuals ecological tokens. Since the large-scale launch of GenesisLaunch, the trading volume and price of VIRTUAL have been rising steadily: in mid-June 2025, the average daily transaction volume of VIRTUAL on the Base chain has exceeded US$150 million, an increase of more than 80% from May; at the same time, holding and staking VIRTUAL to obtain veVIRTUAL governance tokens can continue to earn additional VirgenPoints, allowing a large number of users to lock positions for long-term participation in ecological governance, further consolidating price support and liquidity.

Not only retail investors flocked to participate, but institutions also showed great interest in this new mechanism of "contribution for income". In June 2025, the world's first perpetual contract with VIRTUAL as the underlying was launched on CoinUnited.io, supporting up to 2,000 times leverage trading. On the first day of launch, the contract turnover exceeded US$700 million in one fell swoop, strongly sending a signal: Virtuals is becoming a new speculation and hedging target in the eyes of institutional investors.

03 Ecological Evolution - A thrilling leap from a currency issuance platform to an AI sovereign society

In the future planning of Virtuals Protocol, every technological upgrade and mechanism innovation is to make the outline of the "AI sovereign society" clearer. In the initial stage, Virtuals was just an AI proxy issuance platform, which quickly gathered a group of enthusiastic developers and users through token economic mechanisms such as locking liquidity and repurchase destruction. With the implementation of hundreds of AI agent projects, intelligent agents have begun to operate independently and realize autonomously in scenarios such as games, content creation, and market analysis. Users are no longer just onlookers, but co-builders and beneficiaries. Genesis Launch connects project growth and community participation with the logic of "contribution is distribution", promoting the free flow of funds and creativity in the ecosystem.

But the real turning point is the "Agent Nation" blueprint proposed by the Virtuals team. This is not just a slogan, but the core path of ecological evolution. Through open SDK and cross-chain support, the platform allows each AI agent to migrate freely between networks such as Base, Ethereum, and even Solana; through Agent Commerce Protocol (ACP), agents can sign, deliver, clear, and repurchase on the chain to achieve a truly autonomous business closed loop; community participation obtains governance rights by staking veVIRTUAL, and shares handling fees and repurchase dividends, combining the identities of "participants" and "owners" in the token economy. All this is building a prototype of a digital country operated by countless autonomous agents and co-governing humans.

So far, this ecosystem has demonstrated a number of milestones: IRIS, a security auditing agent in the Ethereum mainnet Genesis Launch, was listed with an oversubscription rate of 1500%, and its market value soared from US$200,000 to US$80 million; virtual idol Luna achieved a monthly income of US$1.2 million due to fan rewards, and its ERC‑20 token market value exceeded US$120 million; VADER, a hedge fund format, has been operating steadily in a cross-chain environment, with a market value of more than US$100 million... These data not only reflect the feasibility of the intelligent agent business model, but also prove that the "AI agent economy" is moving from theory to reality.

With the continued maturity of multimodal AI technology and cross-chain interoperability, Virtuals Protocol is undoubtedly at the forefront of building digital civilization. In the days to come, AI agents will not only be props and tools, but will also become "digital citizens" with autonomous decision-making power and economic rights, participating in production, governance, and even cultural creation with humans. Virtuals will no longer be a simple platform, but is nurturing a new society from the bottom up where countless AIs and humans coexist and govern together - this is the real ecological evolution, and a thrilling leap to an "AI sovereign society" has just begun.

Weatherly

Weatherly