Author: The Smart Ape Source: X, @the_smart_ape Translation: Shan Ouba, Golden Finance

Assessing the true value of a token can be daunting, but with the right approach, you can do it.

The first principle is to avoid confusing concepts. There are many different types of tokens (L1, L2, protocol, L0, etc.), each requiring its own analytical framework. Here, we'll focus solely on L1 tokens, dividing them into two subcategories: general-purpose L1 and application-oriented L1.

General-Purpose L1: $ETH, $SOL, $AVAX, $BNB, $DOT, $ADA, $SUI

Application-Purpose L1: $HYPE, $dYdX, $OSMO, $RUNE, $RENDER, $TON, $RON

Revenue

The first step is, of course, to look at revenue, but not just any revenue. What matters is the portion of revenue captured by the token. This can be achieved through buybacks, burns, redistributions to holders, or even for protocol development. You shouldn't include revenue that is completely outside of L1 and provides no benefit to token holders. Once you've determined the portion of revenue attributable to the token, you need to annualize it. If the protocol hasn't been operating for a full year, you can extrapolate, for example, by taking three months' worth of revenue and multiplying it by four. The FDV/Revenue Ratio can give you a quick first impression of valuation. In traditional tech companies, this ratio is typically between 8 and 15. Again, make sure you only use the portion of revenue that benefits the token. While the FDV/Revenue ratio is compelling, it alone is not enough. For L1, growth and development play an important role in valuation. You should analyze:

It's the trendline, not the absolute value, that's most important. If a metric has been climbing consistently since its release, this generally has a positive impact on valuation, even if the raw numbers aren't significant yet. Investors are pricing in future growth.

Security Budget

Each L1 has a security budget. Ideally, the network is self-sustaining from fees. Otherwise, it relies on token inflation. The key metric here is the net issuance rate, calculated as: (Issuance - Burnt) / Supply.

If this ratio is negative → Excellent, more tokens are being burned than issued.

If it’s positive → inflation, that’s not a good thing.

Future Unlocks

Finally, you need to consider token unlocking. The two main questions are:

When will the tokens be unlocked?

Who will benefit?

If unlocked for marketing or team salaries = negative.

If unlocked for development or redistributed to holders = positive.

If unlocked does not benefit token holders, you can use the following benchmark:

<10% of circulating supply = small impact

10–30% = medium impact

>30% = large impact

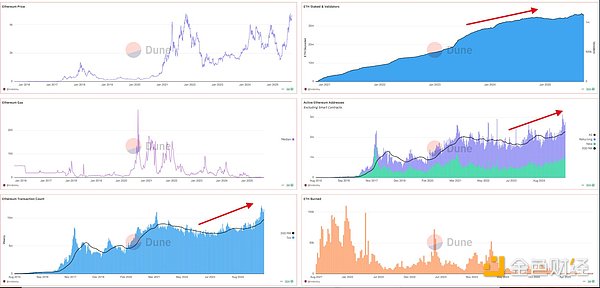

You can also use a tool like @Tokenomist_ai to track the unlock schedule. Over the past 365 days, Ethereum generated approximately $740 million in revenue. This may not seem like much, but it’s largely due to EIP-4844, which significantly reduced gas fees (and therefore revenue). We can assume that 100% of revenues go to ETH via burns, staker payouts, and MEV redistribution. FDV/Revenue Ratio ~675 → astronomical compared to 8-15 for traditional tech companies. But Ethereum also illustrates why revenue alone isn't the most important valuation metric. Ethereum holds a unique position: both a store of value and a global settlement layer. Its valuation incorporates a permanent structural premium. Annual issuance is only 0.5-0.7% of supply, but this is offset (and sometimes even overcompensated) by burns → ETH can even be deflationary. Growth metrics also excel: more stakers, more active addresses, more transactions, and a higher TVL. Ethereum succeeds as a general-purpose architecture.

Thus, saying ETH is overvalued or undervalued is difficult; other cases are easier to judge.

Solana

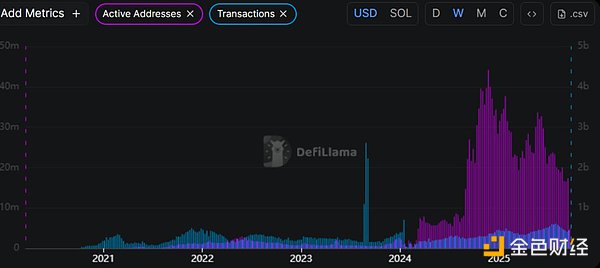

Over the past 365 days, Solana generated approximately $387 million in revenue, most of which benefited token holders through burns and staking rewards. FDV = $143 billion → FDV/Revenue ≈ 370. Again, this ratio is very high compared to traditional companies. Regarding growth, Solana's active addresses and transaction counts suggest it may have peaked, leaving little room for exponential growth. Its valuation is primarily justified by its positioning as a high-throughput blockchain and its significant potential for retail adoption.

Hyperliquid

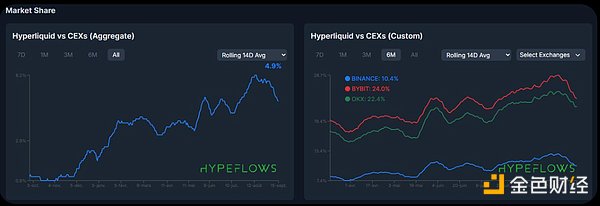

Hyperliquid is unique in that it uses 100% of its revenue for token buybacks, so all revenue accrues directly to holders.

Revenue in last 90 days: $255M → ~$1B annualized. FDV = $52 billion → FDV/Revenue ≈ 52. This ratio remains higher than traditional ratios, but significantly lower than ETH or SOL. The current valuation is also supported by future growth potential: trading volume and user numbers are climbing month by month. Hyperliquid only holds approximately 4.9% of the centralized exchange (CEX) market share. As it steadily erodes CEX dominance, its upside remains substantial. Hyperliquid is a perfect example of how future growth expectations are factored into prices in advance.

Conclusion

Assessing the value of an L1 token is never simple. It's not just about revenue; speculation, narratives, and expectations for the future are often priced in long before they become reality.

That being said, if we look strictly at fundamentals, my view is that most L1 projects are overvalued relative to the value they are actually delivering today. The market continues to operate in a highly speculative manner, with growth and hype playing as large a role, if not larger, than real, current value capture.

In other words, revenue and fundamentals provide us with an "anchor," but the true drivers of cryptocurrency prices remain speculation and future potential.

Weatherly

Weatherly

Weatherly

Weatherly Catherine

Catherine Kikyo

Kikyo Anais

Anais Catherine

Catherine Weatherly

Weatherly Kikyo

Kikyo Anais

Anais Weatherly

Weatherly Catherine

Catherine