Author: Chi Anh, Ryan Yoon Source: Tiger Research Translation: Shan Ouba, Golden Finance

TL;DR

Russia’s use of stablecoins in oil trade shows that stablecoins are no longer a fringe product—they are playing the role of real financial infrastructure in high-risk, cross-border trade.

Despite domestic cryptocurrency restrictions, China and India are benefiting from stablecoin transactions with Russia and quietly experiencing the efficiency of decentralized finance at the national level.

Governments around the world have responded differently, but all acknowledge that stablecoins are reshaping the way value flows across borders.

1. Under the shadow of sanctions, stablecoins become strategic currencies

The global role of stablecoins is rapidly changing from a speculative tool to a practical financial tool - initially for individual users, then expanded to institutions, and now to the national level.

Initially, stablecoins such as USDT and USDC were used by crypto users for transactions, fund transfers and liquidity management, especially in markets with weak banking infrastructure or capital controls, providing users with more convenient access to US dollars.

Subsequently, stablecoins gradually penetrated into institutional and B2B business scenarios. In terms of cross-border payments, supply chain settlements and salary payments, companies, especially in emerging markets, have adopted stablecoins to replace traditional financial systems. Compared with wire transfers through SWIFT or intermediary banks, stablecoin transactions are not only low-cost and almost instant, but also reduce dependence on intermediaries.

Today, some countries have also begun to try to use stablecoins as strategic tools, especially in the context of facing sanctions or seeking to get rid of the international financial system dominated by the US dollar, such as Russia. Stablecoins are evolving from corporate efficiency tools to political means at the national level. This report will analyze how stablecoins are used to circumvent restrictions, reduce costs, and open up new trade channels through actual cases.

2. Behind the scenes: How global trade quietly adapts to stablecoins

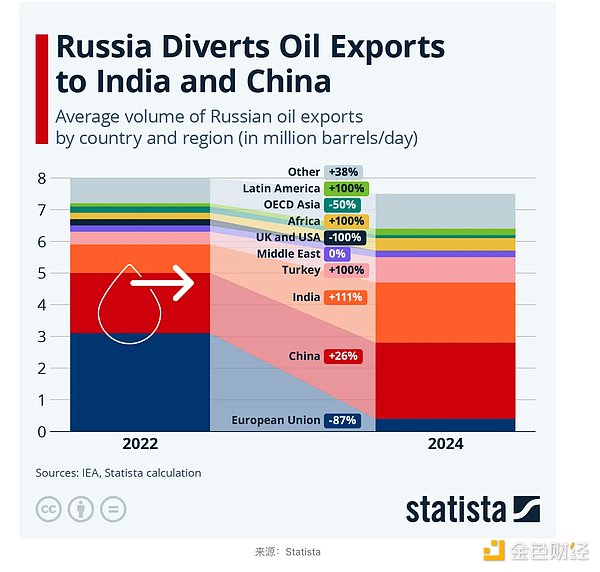

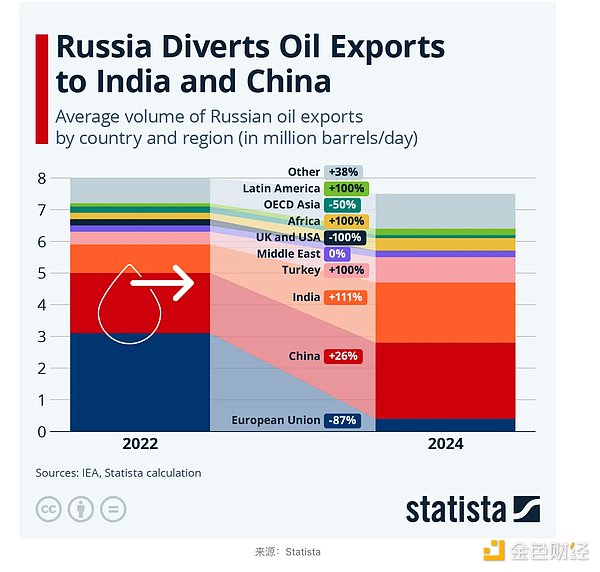

In March 2025, Reuters reported that Russia had introduced stablecoins such as USDT and major cryptocurrencies such as Bitcoin and Ethereum into its oil trade with China. This practice is clearly one of its strategies to circumvent Western sanctions.

The entire transaction process is relatively simple: the Chinese buyer transfers RMB to an intermediary, which converts it into stablecoins or other digital assets, then transfers it to the Russian exporter, and finally converts it into rubles by the Russian side. This mechanism bypasses the Western financial system, improves transaction resilience and reduces the risk of sanctions.

Among these digital assets, stablecoins play a particularly critical role. Although Bitcoin and Ethereum are occasionally used, their price volatility is too large to be used for large transactions. Stablecoins such as USDT have become an ideal choice for cross-border settlement due to their stable prices, high liquidity and convenient transfer performance, especially in an environment subject to international financial constraints.

It is worth noting that although China still strictly regulates domestic cryptocurrency transactions, in the context of energy trade with Russia, the official seems to have a "tacit" attitude towards stablecoin transactions. This attitude, which is not explicitly supported but tolerated in practice, reflects a pragmatic choice under geopolitical pressure.

This dual attitude of "regulatory caution + pragmatic acceptance" reveals a trend: even in countries with strict restrictions, digital assets are quietly accepted for their practical utility. For China, the settlement method based on stablecoins provides it with a new path to bypass the US dollar system while ensuring that the supply chain of commodities is not disrupted.

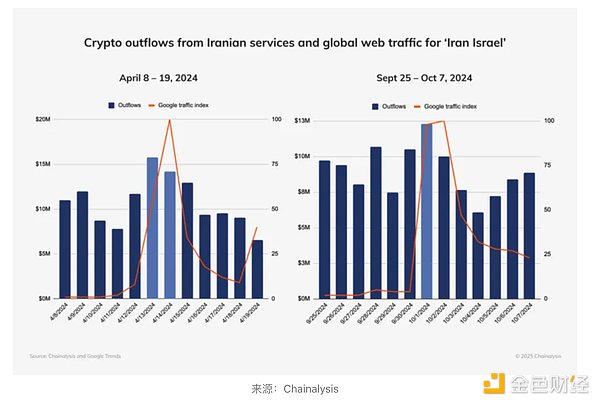

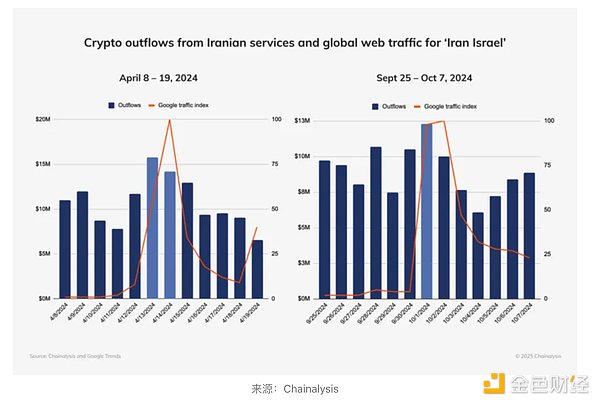

Russia is not the only one to take this approach. Other sanctioned countries, including Iran and Venezuela, have also turned to stablecoins to maintain international trade. These examples show that the model of using stablecoins as a tool to maintain business functions in a politically restricted environment is becoming increasingly popular.

Even if sanctions are eased over time, stablecoin-based settlements are likely to continue to be used. The operational advantages—faster transactions and lower costs—are significant. As price stability becomes increasingly critical in cross-border trade, more countries are expected to intensify discussions on the adoption of stablecoins.

3. Global Stablecoin Momentum: Regulatory Updates and Institutional Shifts

Russia in particular has experienced the practical utility of stablecoins firsthand.After the United States froze wallets linked to the sanctioned exchange Garantex, Russian Finance Ministry officials called for the development of a ruble-backed stablecoin—a domestic alternative to USDT—to reduce reliance on foreign issuers and protect future transactions from external control.

In addition to Russia, some other countries are also accelerating their exploration of the application of stablecoins. Russia's main motivation is to circumvent external sanctions, while many other countries see stablecoins as a tool to strengthen monetary sovereignty or more effectively respond to geopolitical changes. The appeal of stablecoins also stems from their potential for faster and cheaper cross-border transfers, highlighting the importance of stablecoins as a driver of financial infrastructure modernization.

Thailand: SEC will approve USDT and USDC transactions in March 2025.

Japan: In March 2025, SBI VC Trade partnered with Circle to launch USDC and obtained regulatory approval from the Japan Financial Services Agency (JFSA).

Singapore: In August 2023, a regulatory framework for single-currency stablecoins (anchored to the Singapore dollar or G10 currency) was established to allow banks and non-bank institutions to issue them.

Hong Kong: A stablecoin bill was announced in December 2024, requiring issuers to obtain a license from the Hong Kong Monetary Authority; a regulatory sandbox is under construction.

United States: No comprehensive legislation yet. In April 2025, the U.S. Securities and Exchange Commission (SEC) stated that fully backed stablecoins like USDC and USDT are not securities. The GENIUS Act, passed by the Senate Banking Committee in March 2025, aims to regulate payment stablecoins. USDC and USDT are still widely used.

South Korea: Major domestic banks are preparing to jointly issue the first Korean won stablecoin.

These developments show two key trends. First, stablecoin regulation has moved beyond conceptual discussions. Governments are actively developing legal and operational parameters governing their use. Second, clear regional differences are emerging. While countries such as Japan and Singapore are pushing for regulated stablecoin integration, others such as Thailand have taken more stringent measures to protect domestic monetary control.

Despite the differences, there is a clear consensus among all parties. Stablecoins are becoming an integral part of the global financial infrastructure. Some see stablecoins as a challenge to sovereign currencies, while others see them as a faster and more efficient payment tool for global trade. As a result, stablecoins are gaining importance in regulatory, institutional and commercial circles.

4. Stablecoins are not a stopgap measure - they are a new financial infrastructure layer

The growing popularity of stablecoins in cross-border transactions reflects a fundamental shift in financial infrastructure, rather than simply an attempt to circumvent regulation. Even countries that have historically been skeptical of cryptocurrencies, such as China and India, are beginning to use stablecoins indirectly in strategic commodity trade, experiencing their real-world utility first-hand.

This development goes beyond circumventing sanctions. What began as experiments at the retail level has now grown into institutional integration and, in some cases, even national integration—making stablecoins one of the few blockchain-based innovations that has demonstrated true product-market fit. As a result, stablecoins are increasingly viewed as a legitimate part of the modern financial system, rather than a tool for illicit activity.

Those institutions that view stablecoins as structural elements of the future financial architecture, rather than a stopgap measure, are likely to dominate the next wave of financial innovation. Conversely, those that are slow to participate risk being forced to adapt to standards that were set in their absence. It is therefore critical for policymakers and financial leaders to understand the nature and long-term potential of stablecoins and to develop strategies that align with the direction in which the global financial system is heading.

Catherine

Catherine