Author: Ponyo Source: X, @13300RPM Translation: Shan Ouba, Golden Finance

The traditional "real income" - such as dividends or handling fee sharing may seem attractive, but it is often just a convenient channel for foundations or large users to withdraw funds. They do not need to sell core holdings (such on-chain operations may cause market panic), they just need to continuously convert ETH or USDC dividends into real money. At the same time, the protocol has almost no reinvestment actions, and small holders are even more powerless to follow suit, and eventually become spectators. On the surface, it is a "harmless" income model, but in reality it may be a hidden pumping mechanism that allows large users to extract the value of the protocol in a low-key and efficient manner, lacking any substantive accountability or public supervision.

1. Buyback and destruction = democratic dividends for small holders

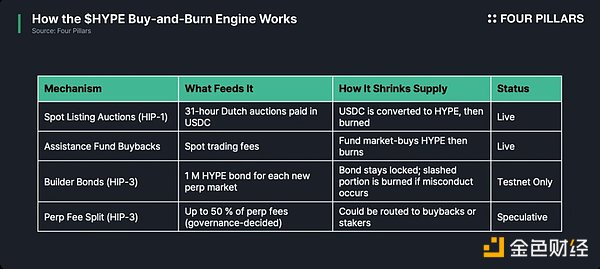

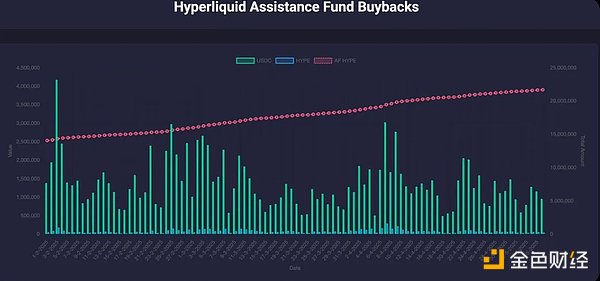

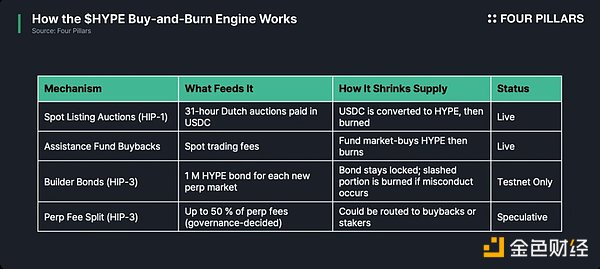

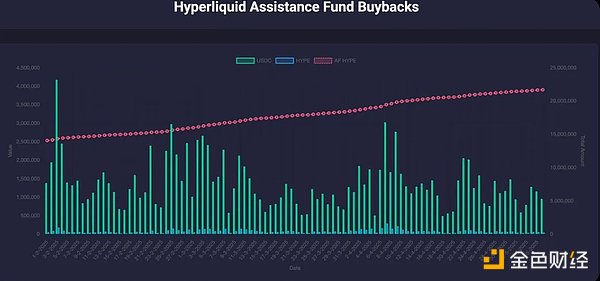

Hyperliquid reverses this logic and adopts the "buyback and destruction" model. Instead of distributing the handling fee as a "pseudo-dividend", it is better to directly use the protocol income to buy back $HYPE in the open market and then destroy it permanently.

This mechanism brings a more democratic way of value growth for small holders: every time the protocol repurchases and destroys $HYPE, the token price tends to rise, so that any holder, especially small users, have the opportunity to freely profit and exit at a high price.

In contrast, the foundation will face many obstacles if it wants to cash out. Once a large-scale sell-off occurs, the chain will be immediately exposed, causing market panic, damaging investor confidence, and even the reputation of the project will be damaged. Although some people question whether some protocols may "make a market" by buying back and then selling at a high price, for teams that work seriously, this behavior is illogical - buying back and then selling will only completely destroy market trust and hurt the value of their own holdings. Even in the relatively loose crypto circle, when the Ethereum Foundation sold ETH on a small scale, it also triggered a backlash from public opinion.

More importantly, the act of selling is equivalent to cutting off the buyback mechanism that supports the value of the token. The buyback itself is a declaration of confidence in the project, telling the market: "The protocol itself is a firm buyer." This not only boosts investor confidence, but also easily stimulates the market's "follow-buy" sentiment. At the same time, the rise in token prices will in turn enhance the long-term interest binding between the protocol and the holders.

In the final analysis, although the buyback mechanism is beneficial to the foundation, small holders often benefit more from relative returns. They don't have to worry about liquidity restrictions or the reputation costs brought about by large-scale selling pressure. This value growth model benefits the community more fairly and more broadly than proportional dividends.

2. Value Capture 101: Recycling, Not Loss

The essence of token value comes from supply and demand and expectations of future returns. Although handling fee dividends can attract "interest-eating parties", they are also like a leaky bucket. The value created by the protocol continues to flow out of the ecosystem instead of being deposited inside the token to form a compound interest effect. Dividends paid through ETH or USDC will be periodically withdrawn, gradually weakening the growth momentum, while large investors can easily realize arbitrage.

Hyperliquid currently has a total of 422.6 million $HYPE staked, of which the foundation holds approximately 272.7 million (approximately 64% of the total). If the protocol adopts a dividend model instead of a buyback and destruction, the foundation can theoretically receive about 14 million $HYPE per year, or about $352 million (based on 64% of the cumulative buyback volume on May 9, 2025). Even if the foundation claims to reinvest part of it, there is no structural guarantee - a considerable amount of value may be directly withdrawn, and retail users and the wider community have no control over it, and cannot see where these funds will eventually flow.

In contrast, the buyback and destruction mechanism is a direct "recycling" of income, gradually increasing the proportion of each holder by continuously reducing the total amount of tokens. This mechanism can also stimulate a "reflexive" feedback loop - investors who expect supply to continue to shrink are more inclined to hold for the long term, thereby driving prices further up.

At Hyperliquid, spot trading and listing fees will eventually flow to the $HYPE burn pool, which means that the greater the trading volume, the scarcer the token. In contrast, the dividend mechanism is far less reflective - because it requires each coin holder to manually use the dividend to buy tokens again. Hyperliquid's automatic burning mechanism is immediate, stable and sustainable, and establishes a direct and strong positive connection between network activity and token scarcity.

3. Hyperliquid's community priority principle

Hyperliquid's choice of "buyback and destruction" rather than fee dividends reflects its consistent adherence to the concept of community priority. The project rejected VC quotas from the beginning and instead airdropped 310 million $HYPE (valued at approximately $1.6 billion at launch) to over 90,000 users. This broad distribution effectively avoids the risk of internal selling, builds a highly engaged user base, and injects ample liquidity into the ecosystem from day one.

Over 70% of $HYPE is reserved for the community for ongoing airdrops and incentive programs, while the foundation stakes a large number of its tokens to ensure network security. By explicitly avoiding a "pump-and-dump" dividend model, Hyperliquid has achieved a design that feeds protocol revenue back into the value of the token, allowing all participants to benefit. Especially for retail investors, they have greater flexibility to choose when to profit when the buyback drives the price up.

4. Looking Ahead

Following the "real income" craze in 2022, 2024-2025 showed another more sustainable model - "the protocol becomes its own best buyer". We see projects like dYdX starting to add buyback mechanisms to deposit more revenue in their own tokens. The market's signals are becoming clearer and clearer: capturing protocol revenue through a buyback mechanism can enhance investor confidence and make people believe that this token is not an unsupported "air coin".

Hyperliquid has been practicing this logic since the beginning of the project. By using fees for burning, the project not only avoids core coin holders from extracting too much profit, but also circumvents the potential legal gray areas involved in traditional dividends. Every time the protocol earns fees, all coin holders can see the concrete financial effect.

Of course, not all projects that adopt a buyback mechanism have been successful. Protocols that have initiated buybacks but have failed to support token prices often lack real user demand, sufficient fee income, or a solid community foundation. Buyback and destruction is not a panacea, and it cannot save a project with unstable foundations. In order for this mechanism to really work, a protocol must also have clear market fit, stable cash flow, reliable use cases, and an active community that trusts its long-term value.

From this perspective, "buyback and destruction" is becoming the core link in the value capture mechanism of high-quality tokens. It builds an incentive structure: if foundations and other large users want to make a profit, they must do so by increasing the overall value of the token. This brings traders a user experience at the level of centralized exchanges, and also lets them know that their handling fees are truly entering the "value burning" loop, rather than entering the wallet of a large user. The end result is: users are more enthusiastic, the ecosystem is self-reinforcing, and a clear incentive framework is formed to reward real usage behavior.

Kikyo

Kikyo