Author: Lucas Tcheyan Source: Galaxy Digital Translation: Shan Ouba, Golden Finance

HyperEVM is an EVM-compatible, general-purpose Layer 1 blockchain launched by Hyperliquid. Since its launch in February, it has begun to show early growth momentum.

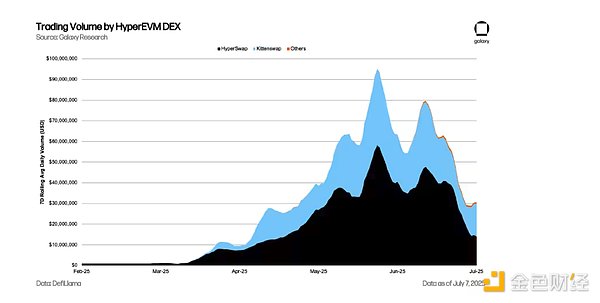

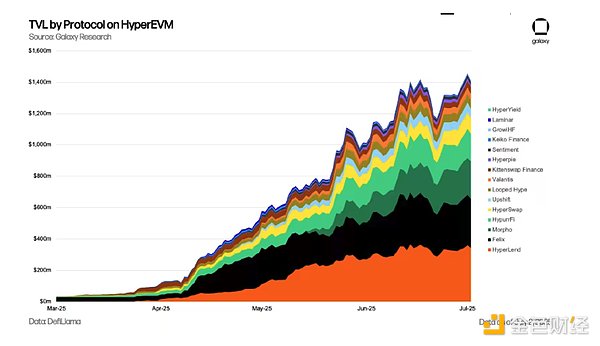

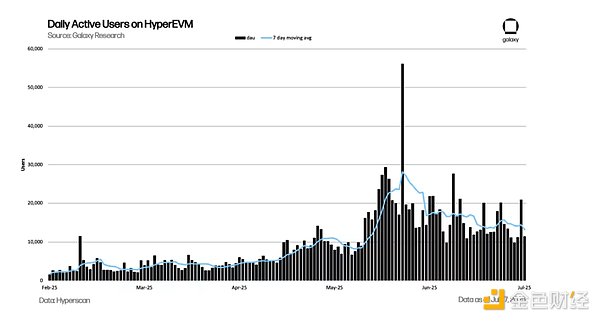

Although the overall activity is still not as good as HyperCore (Hyperliquid's flagship perpetual contract trading platform), HyperEVM has shown steady growth in trading volume, total locked value (TVL), and application development. What's more rare is that this progress has been achieved in the absence of perfect tools and direct incentive programs. Its driving forces include key infrastructure upgrades, the maturing DeFi ecosystem, and increasingly strong market expectations for future airdrops.

The recently released CoreWriter update is seen as an important turning point for the ecosystem. The update opens up full write access to HyperCore, enabling a new class of natively integrated applications across both layers, further blurring the boundaries between the two platforms and enabling HyperEVM to evolve from a sidecar to the core engine of Hyperliquid’s vertically integrated on-chain financial stack.

Key Takeaways

HyperEVM’s launch is a “gradual and controlled” strategy designed to avoid negative impacts on HyperCore. While this strategy has caused some friction for early teams building on the chain, it has still attracted more than 175 development teams to deploy applications on HyperEVM.

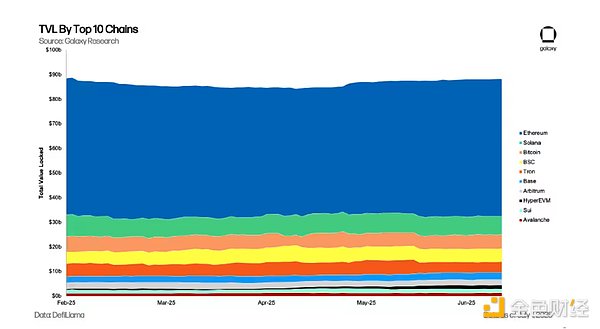

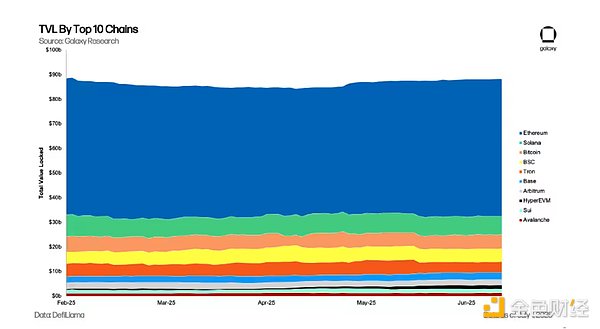

HyperEVM currently ranks 10th in TVL rankings among all L1 public chains. Leading applications are mainly DeFi products, especially lending protocols, which is highly consistent with the goal of HyperEVM - unlocking DeFi composability for HyperCore.

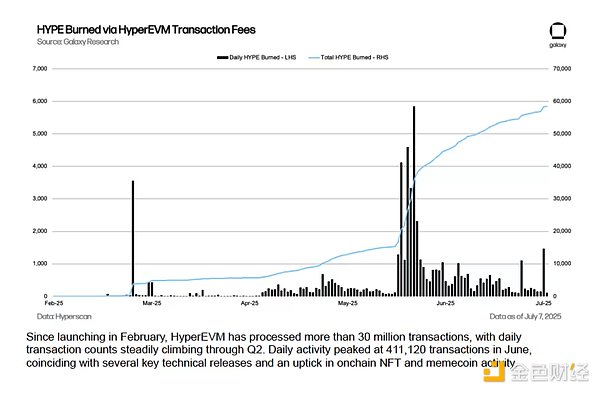

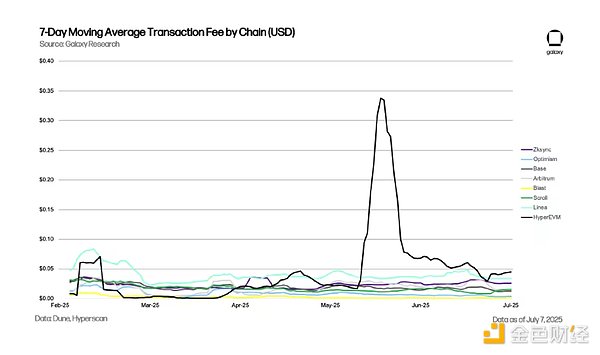

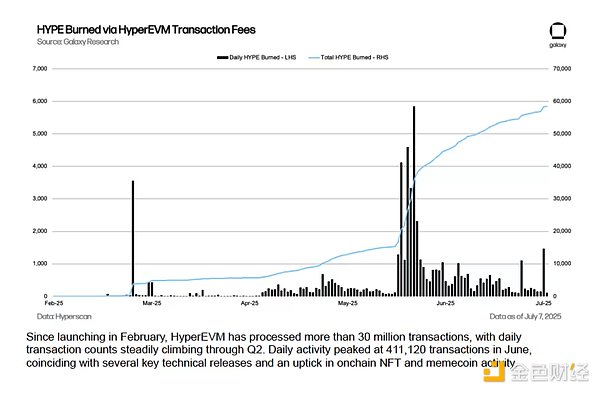

HYPE is the native Gas token of HyperEVM. The base fee and priority fee of all transactions are burned. So far, transaction fees have destroyed 0.006% of the total supply of HYPE, and if on-chain activity grows as expected in the coming months, the destruction ratio is expected to increase further.

User activity is still catching up with the maturity of HyperCore. As the on-chain infrastructure and development tools are improved, more unique use cases will be realized, thereby accelerating the integration and adoption of HyperEVM and HyperCore.

The release of CoreWriter is a major breakthrough that allows smart contracts on HyperEVM to be written directly to HyperCore, which will bring a huge unlocking effect to the application ecosystem and is expected to drive a surge in application deployment and user activity in the coming months.

Hyperliquid's long-term vision is to position HyperEVM as a "complementary financial layer" to HyperCore. The ultimate goal is to build a vertically integrated DeFi stack that allows trading, lending, vaults, and staking to coexist natively and work seamlessly on both chains.

HyperEVM's Architecture

Hyperliquid consists of two interconnected but independent platforms: HyperEVM and HyperCore.

HyperCore is the more well-known part of the two and is Hyperliquid's perpetual contract trading platform, including an on-chain order book, margin system, and matching engine. Since its launch in 2023, HyperCore has dominated the perpetual contract market and even began to compete with the perpetual products of centralized exchanges.

HyperEVM is Hyperliquid's EVM-compatible, general-purpose L1 blockchain, launched on February 18, 2024. It is designed to unlock the composability of DeFi for HyperCore by integrating with a general-purpose smart contract platform.

An important difference is that HyperCore and HyperEVM are two independent chains, but both use the same HyperBFT consensus mechanism (a combination of Proof of Stake PoS and Byzantine Fault Tolerance BFT, optimized for a high-throughput, low-latency system) and share the same validator set. This architecture allows applications built on HyperEVM to interact directly with HyperCore's spot and perpetual contract order books.

Consensus Mechanism and Execution Layer Design

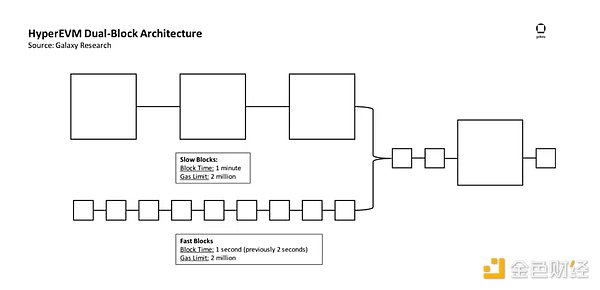

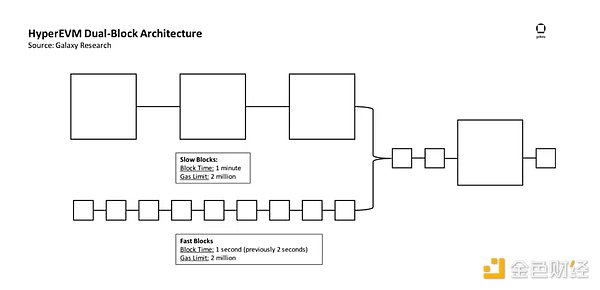

HyperEVM adopts a "dual block architecture" to balance the trade-off between speed and capacity. A small, fast block is generated on the chain every second, with a Gas limit of 2 million, which is used for regular transfers and exchange transactions with almost instant settlement. At the same time, a large block is generated every minute, with a Gas limit of 30 million, which is reserved for heavyweight tasks such as deploying large smart contracts or batch casting of NFTs. HyperEVM has a block latency of less than 1 second and supports a processing capacity of up to 200,000 orders per second.

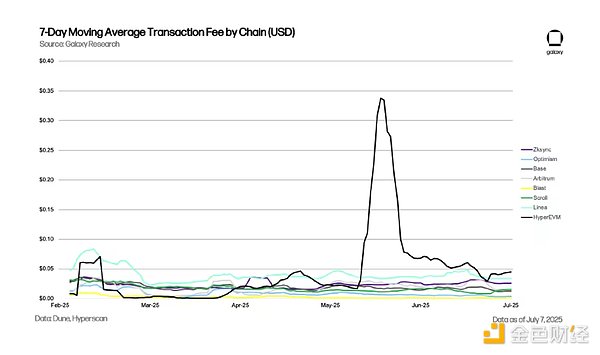

Although HyperEVM has high throughput and low latency, its transaction fees are usually higher than Ethereum Layer 2 (L2), especially when there is congestion on the chain. Data shows that during peak periods, HyperEVM transaction fees will soar significantly (even exceeding $0.30 per transaction).

HyperEVM's Gas token is HYPE, which uses a modified Ethereum EIP-1559 destruction mechanism, and all base fees and priority fees will be destroyed. The chain has EVM compatibility, making it easy for development teams to redeploy existing EVM smart contracts on HyperEVM. Since its launch, HyperEVM has destroyed more than 55,000 HYPE, accounting for about 0.006% of the total supply. In contrast, more than 367,000 HYPE have been destroyed through spot trading fees on HyperCore. At the current market price of $39.12/HYPE, HyperEVM has destroyed more than $2.15 million worth of HYPE. The peak daily destruction occurred on May 26, reaching 5,849 (about $226,000), when contract deployment and user activity surged. As HyperEVM's on-chain activities expand, its contribution to total HYPE destruction is expected to grow significantly, from a marginal consumer to an important driver of long-term supply contraction.

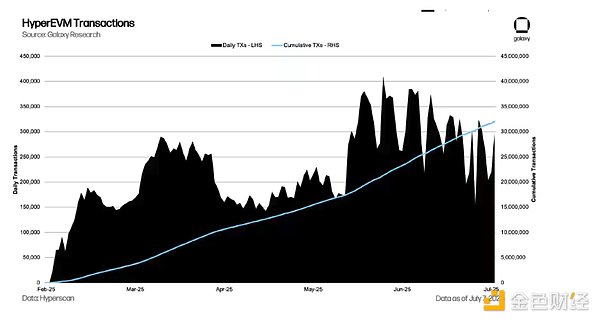

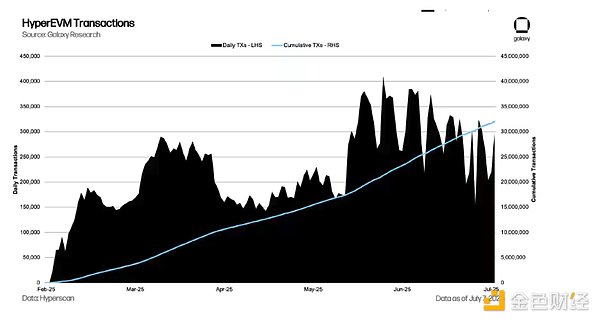

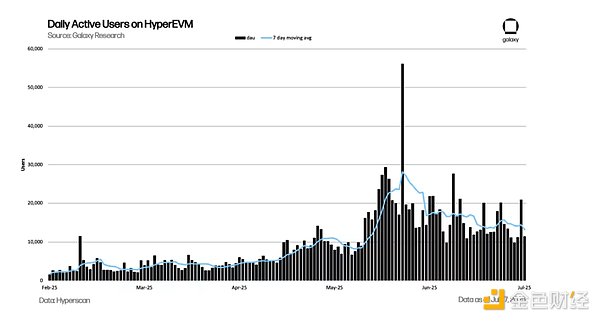

Since its launch in February, HyperEVM has processed more than 30 million transactions, with daily transaction volume steadily climbing in the second quarter. The peak daily transaction volume in June reached 411,120 transactions, and during this period, accompanied by several important technical upgrades, on-chain NFT and memecoin transaction volume also showed an upward trend.

Technical Upgrade

HyperEVM was initially launched with very basic functions, supporting only HYPE spot transfers between HyperCore and HyperEVM, and packaged HYPE contracts for DeFi applications. This is a "simplified" version of the launch, lacking many key features that will be used to distinguish it from other general-purpose L1s in the future, especially deep integration with HyperCore.

In the launch announcement, the team explained the reason for this "rough state" launch: it is hoped that everyone can "enter equally and start from the same starting line". In addition, the phased and gradual launch strategy also allows them to upgrade the system more safely while collecting real-time user feedback. According to the team developing on HyperEVM, although the lack of a complete tool chain does bring some friction, it has not stopped them from continuing to build.

Since the launch, the team has made several technical upgrades to HyperEVM, including:

March 25: Connect HyperCore and HyperEVM, and users can freely trade any token between the two chains.

April 30: Launched the "Read Precompilation" function, enabling HyperEVM smart contracts to read the on-chain status of HyperCore.

May 26: Reduced the block time of small blocks by half to 1 second, improving the throughput of HyperEVM. Capacity expansion remains the team's primary technical task, and it is expected that the block time will continue to be shortened in the future.

June 26: Updated the block sorting logic of HyperEVM so that post-only orders are prioritized before withdrawals, thereby improving the integration with HyperCore.

July 5: Launched a new pre-compilation called CoreWriter. This function allows HyperEVM contracts to write data directly to HyperCore, including placing orders, transferring spot assets, managing vaults, staking HYPE, and other operations. This marks an important step in the evolution of HyperEVM’s unique capabilities, from being able to “read” HyperCore state to being able to “directly modify” HyperCore state (discussed in more detail below). The team announced the initial version of CoreWriter on July 2 and officially launched it three days later (mainnet updates are usually scheduled on Saturdays).

While CoreWriter is a major step forward in unifying HyperEVM with HyperCore, it also has certain limitations. Most importantly, write operations through CoreWriter are not atomic, meaning that smart contracts cannot confirm the success of orders or state changes on HyperCore in the same transaction. This asynchronous design is intentional and is intended to reduce the risk of front-loading transactions, but it also poses challenges to complex or precisely controlled trading strategies. Therefore, while CoreWriter is able to support new application categories, its early implementations are more suitable for scenarios that can tolerate asynchronous execution or can assume a high success rate, such as staking, vault access, and simple programmatic interactions. Given the complexity of the interaction between HyperEVM and HyperCore, the Hyperliquid team will continue to iterate on the release of features in a phased manner to ensure that the stability of HyperCore is not affected.

HyperEVM's Application Ecosystem

Since its launch, the HyperEVM ecosystem has grown rapidly, with more than 175 projects currently being publicly built on the chain, and many more teams in the stealth development stage. Developers are the core driving force of any emerging ecosystem, and Hyperliquid's ability to attract a large number of high-quality developers is inseparable from its unique architectural design and deep integration with HyperCore - HyperCore is one of the most liquid exchanges on the chain, with a large user base, and can easily cross the chain to HyperEVM.

Many teams that previously developed on other chains that we communicated with generally stated that the decision to switch to HyperEVM was mainly due to the continued demand of users or the need for more liquidity in applications. Additionally, unlike many other L1 ecosystems, Hyperliquid does not have a dedicated incentive or funding program for developers. Instead, the success of the HYPE token itself, and the expectation of future airdrops (42% of the remaining supply), is enough to form a strong motivation for construction.

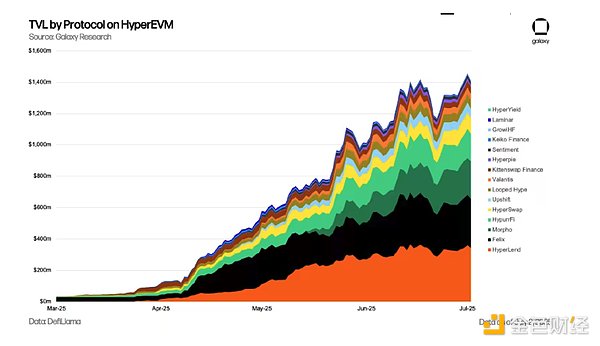

Since its launch, HyperEVM's TVL has continued to climb and is currently ranked 10th among all L1s. This TVL growth is mainly concentrated in a few key protocols (described in depth below). It is worth noting that this growth has been achieved without any liquidity mining activities or ecosystem funding. While the majority of Hyperliquid's users and trading activity are still concentrated in HyperCore, HyperEVM is working to position itself as the DeFi settlement layer for the entire stack. With CoreWriter about to fully unlock write access to HyperCore, TVL will also transform from passive capital (idle lending) to active capital that can interact and trade with real-time perpetual contract markets, vaults, and order books.

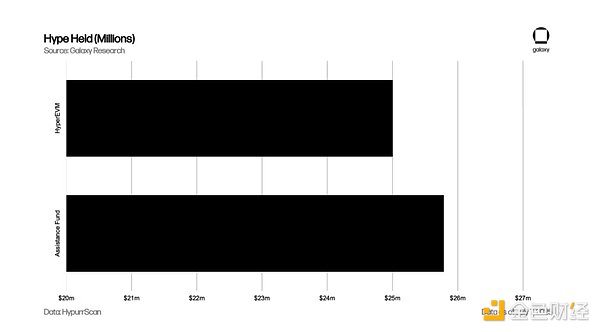

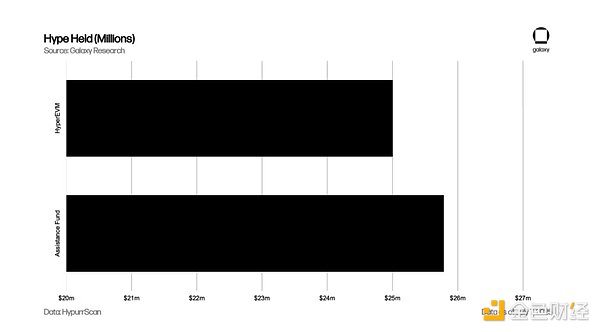

Data shows that the HYPE currently held by Hyperliquid's ecological fund (about 25.79 million) is still higher than the total amount deployed on the entire HyperEVM chain (about 25 million). This imbalance shows that HyperEVM is still in the early stages of development. As the number of usage scenarios on the chain increases, we expect more idle capital to migrate to DeFi uses with actual productivity.

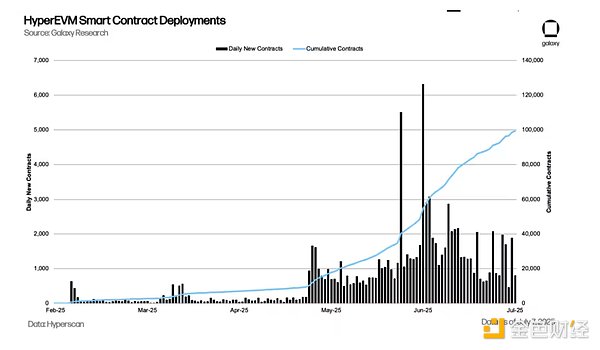

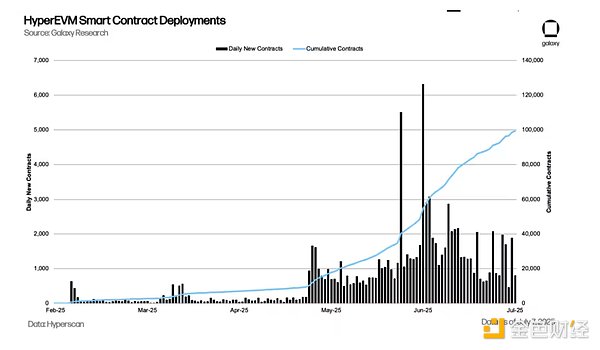

Although HyperEVM was launched in February, the deployment of smart contracts really began to accelerate after mid-May. There are several reasons behind this: when it was first launched, HyperEVM did not support ERC-20, lacked block browsers or reliable indexers, which brought many restrictions to developers. In addition, the Hyperliquid team had almost no advance notice on the launch schedule of HyperEVM, resulting in many teams starting to fully develop and deploy contracts after the mainnet was launched. Smart contract deployments have only started to grow significantly with the launch of infrastructure such as the cross-VM asset bridge, contract indexing, and verification tools in March and April. With the launch of CoreWriter, we expect to see a new wave of smart contract deployments, with more applications and products entering the market.

Main protocols ranked by TVL

HyperLend is the largest TVL project on HyperEVM, with a locked volume of $487 million, and is the main lending protocol on the chain. It provides many standard lending features, including core funding pools (supporting the supply or borrowing of multiple tokens in a single pool), efficient modes (allowing users to borrow at higher collateral rates on related assets), and isolated pools (limiting risk to specific token pairs). On June 10, HyperLend announced that it was shifting its focus to integration with HyperCore. With this update, position liquidations can now occur directly on the HyperEVM or be executed on HyperCore via cross-chain. This is one of the first major integrations of HyperEVM with HyperCore, and is exactly the direction that the Hyperliquid founding team envisioned when launching HyperEVM. Through its integration with HyperCore, HyperLend currently offers three different ways for liquidators to execute liquidations. For a full overview of how HyperLend handles liquidations, please refer to their official post. The team also revealed that it is developing other CoreWriter-based products, but has not yet announced details.

Felix ranks second with $340 million TVL and also offers a full suite of on-chain lending products. The two core modules of the application are the collateralized debt position (CDP) market and the "normal" lending market. Felix leverages Hyperliquid’s EVM compatibility to deploy the Liquity v2 architecture on the backend to support its CDP stablecoin feUSD, as well as the Morpho technology stack to build its general lending market. In April, Felix announced the launch of USDhl, a fiat-backed stablecoin developed in partnership with stablecoin platform M0. According to public on-chain data, Felix’s stablecoin product has contributed more than $100 million in stablecoins to the HyperEVM ecosystem since its launch, with the majority ($75 million) coming from feUSD. With the release of CoreWriter, Felix also plans to integrate liquidation functionality into HyperCore.

HypurrFi is the third largest lending application on Hyperliquid, with a TVL of $318 million, and is positioned as Hyperliquid’s “debt infrastructure provider.” In addition to lending services, HypurrFi also issues over-collateralized stablecoin USDXL, and has a built-in decentralized exchange (DEX) and yield vault for users to deploy assets. After USXL depegged in May, the team has lowered the upper limit of stablecoin minting to $5 million to achieve a more robust anchoring mechanism.

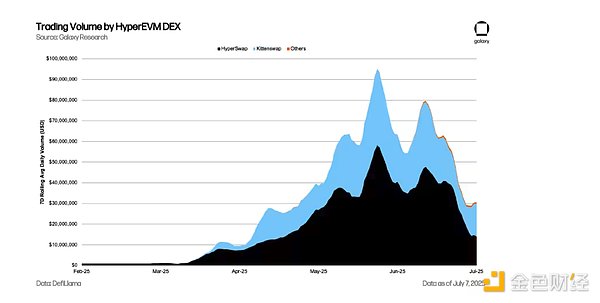

HyperSwap and KittenSwap are the two main AMM DEXs on Hyperliquid, ranking fourth and fifth in TVL respectively. They draw on the common AMM design on EVM, providing standard and centralized liquidity positions, similar to Uniswap, and KittenSwap also introduces Curve's ve(3,3) model. The release of CoreWriter will greatly upgrade the capabilities of these two DEXs, enabling them to integrate HyperCore order books and achieve optimal path routing of user orders between DEX and order books.

Unit Protocol is the asset tokenization layer of the Hyperliquid ecosystem, supporting cross-chain access to major crypto assets (such as BTC, ETH, and SOL) on HyperCore and HyperEVM. Unit runs a decentralized guardian network that issues native spot assets through a locking and minting system without relying on centralized custodians. As of July 1, Unit has helped deploy more than $100 million in BTC and $13 million in ETH on HyperEVM.

In addition to the above examples, there are many teams developing products based on CoreWriter integration. Here are some representative projects:

Kinetiq is a liquid staking protocol on Hyperliquid, running between HyperCore and HyperEVM. Users can stake HYPE tokens, which are natively staked on HyperCore, and receive kHYPE, a liquid staking token that can be used for DeFi on HyperEVM. Kinetiq uses an autonomous, oracle-based validator selection system to dynamically delegate HYPE to the best performing validators to optimize yields and support network security. To simplify staking operations between HyperEVM and HyperCore, Kinetiq will leverage CoreWriter for smooth integration and liquidity of staked assets. Just days after the release of CoreWriter, the team has announced plans to launch its product on July 15.

Sentiment is a decentralized lending protocol on HyperEVM that allows users to borrow assets with customizable leverage. Users can pledge assets (such as Kinetiq's kHYPE or other HyperEVM tokens) to lend stablecoins (such as USDC) at competitive rates, supporting strategies such as leveraged yield farming. Sentiment’s smart contracts will soon interact with HyperCore through CoreWriter, enabling real-time access to Hyperliquid’s on-chain order book for collateral valuation and liquidation management.

HyperDrive and Hyperwave offer tokenized versions of HLP. HLP is a community-owned protocol treasury focused on market making and liquidation strategies. The release of CoreWriter will make it easier for these projects to integrate HLP into HyperEVM’s growing DeFi ecosystem.

Liminal is a neutral yield protocol built on HyperCore that leverages Hyperliquid’s high-performance trading infrastructure to execute automated market neutral strategies and capture funding rate returns in the perpetual contract market. Its non-custodial design ensures user control of funds, and institutional accounts use Hyperliquid’s native proxy system for secure trading. With the release of CoreWriter, the team will eventually be able to deploy contracts on HyperEVM for users to manage positions on HyperCore.

Rysk is a decentralized options trading protocol built on HyperEVM that transforms covered call options into liquid trading primitives. It allows users to pre-pay yield and supports advanced options trading in Hyperliquid's DeFi ecosystem. Rysk leverages the HyperCore API to hedge the buy-side flow of options directly on-chain, but the team plans to update the technology stack to integrate CoreWriter, thereby reducing covered options execution risk and bringing more transparency to users. The team is also exploring the possibility of allowing users to customize their own trading strategies by combining options and perpetual contracts through HyperEVM and CoreWriter.

Prospects

Since its launch nearly half a year ago, HyperEVM has all the elements to become a successful general-purpose L1, which can well complement a mature perpetual contract platform. Unlike other emerging L1s that need to rely on large-scale incentive plans or truly disruptive applications to attract users and developers, HyperEVM natively has these two "entrances", allowing developers to focus on product development and innovation.

Hyperliquid founder Jeff Yan recently said in a podcast: "HyperEVM is to the entire financial sector what AMM is to the entire trading sector." HyperCore is the core cornerstone of the Hyperliquid ecosystem, but it cannot alone host all the potential use cases that can be built on top of the perpetual contract exchange. In the short term, HyperCore will likely continue to be the main center of activity, but as chain performance and development tools continue to improve and applications mature, we expect the activity of HyperEVM to accelerate over the next year. By vertically integrating the two platforms, Hyperliquid aims to create a comprehensive financial ecosystem that provides users with all the functions they need in one place and retains liquidity.

The recently released CoreWriter is an important catalyst that will accelerate the development of HyperEVM by enabling deep integration with HyperCore. This is the first time that applications on HyperEVM can be written directly to HyperCore, enabling seamless interaction between the two environments and unlocking more powerful and more synergistic on-chain applications.

In short, CoreWriter is a major milestone in the evolution of HyperEVM. Many developers have already expressed interest in leveraging this integration to build products that are hard to find elsewhere.

Jixu

Jixu