Author: Sean Rose, Glassnode; Compiler: Wu Baht, Golden Finance

Foreword

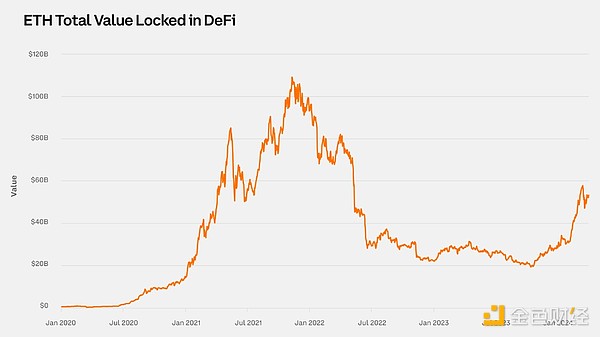

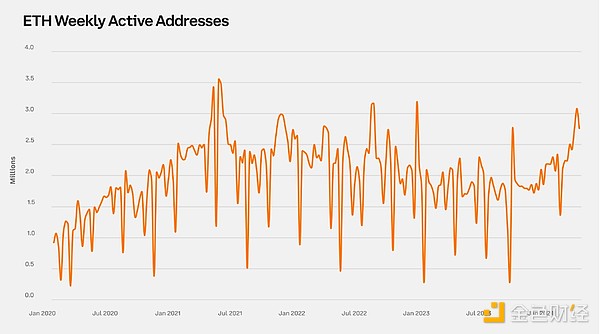

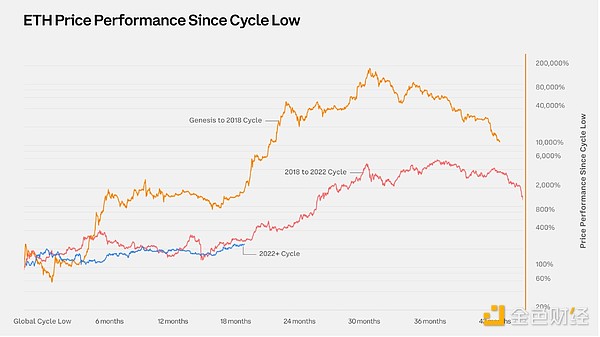

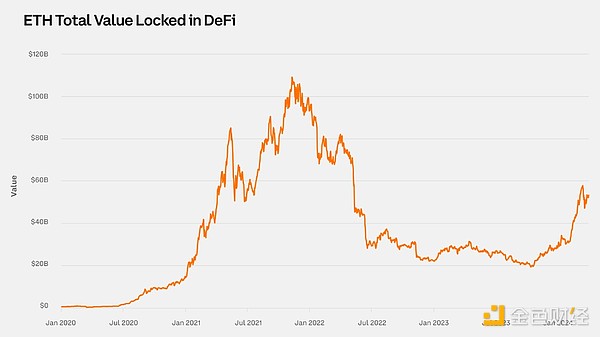

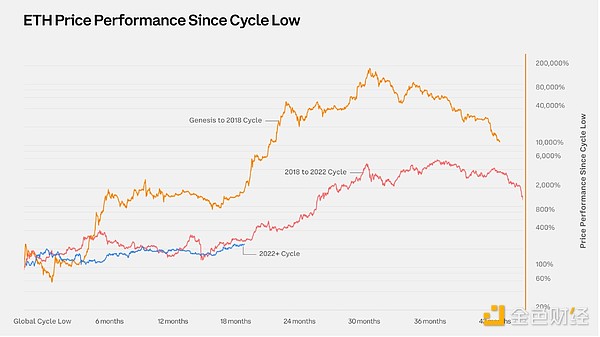

In this article, we turn our attention to the Ethereum landscape. The first quarter of 2024 will be crucial for Ethereum, with major developments that are changing the way it operates. The Dencun upgrade enhances Ethereum’s scalability and reduces transaction costs. Meanwhile, the price of Ethereum reached $4,000, a level not seen in two years. Ethereum staking also increased significantly during this period. In this article, we will examine these changes and discuss their wider impact on the Ethereum network.

Ethereum pledge dynamics

Staking Overview

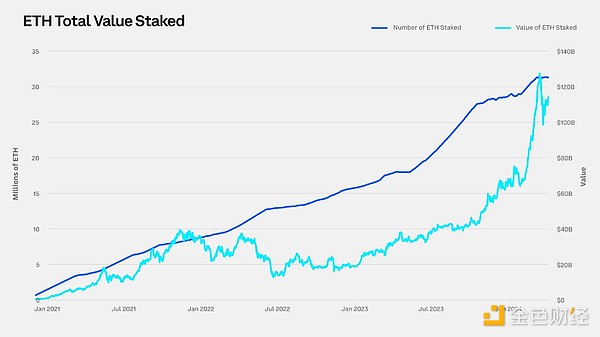

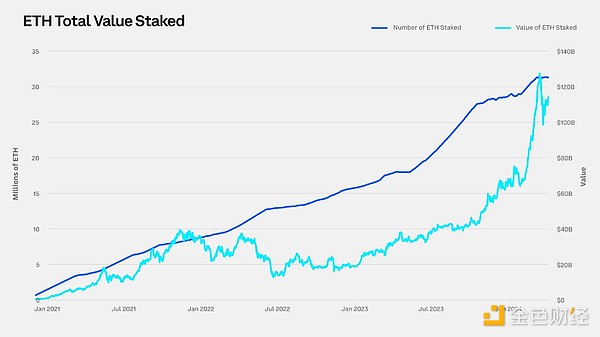

In Ethereum’s Proof of Stake (PoS) mechanism, staking involves locking ETH tokens to support the operation and security of the blockchain. Validators use their ETH to confirm transactions, and in return they are rewarded in the form of newly issued ETH and transaction fees. This process secures the network and encourages participation by providing returns on staked assets.

Pledge growth

Ethereum’s staking landscape changed in the first quarter, with pledged ETH increasing by 9%. This growth is driven by new developments such as maximum extractable value (MEV), liquidity staking, re-staking and liquidity re-staking. These innovations have introduced new incentives to encourage more staking activity, with the Eigenlayer airdrop being a factor that particularly boosted re-staking and liquidity re-staking activity.

Stakeholders< /h3>

The Ethereum staking ecosystem includes a wide range of participants, from individual investors to large institutions. Institutional stakeholders take advantage of these opportunities to earn income from their large ETH holdings. Liquidity staking protocols like Lido and Rocket Pool are important because they provide tradable tokens representing staked ETH, helping stakers maintain liquidity and making participating in Ethereum PoS more attractive.

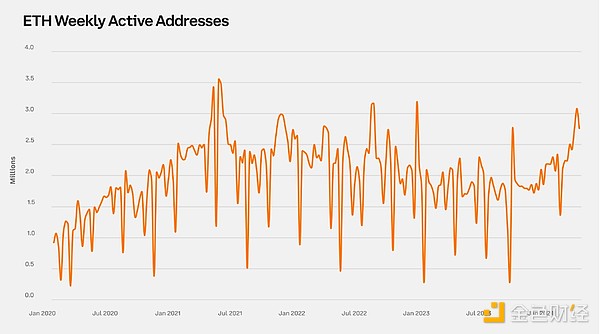

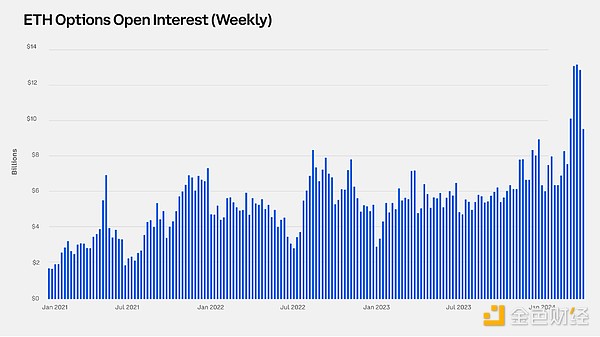

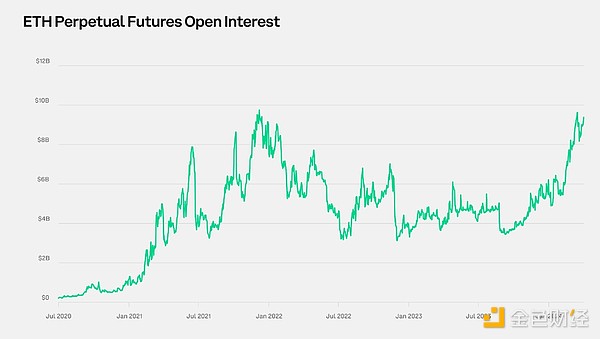

Ethereum Derivatives Markets and Open Interest

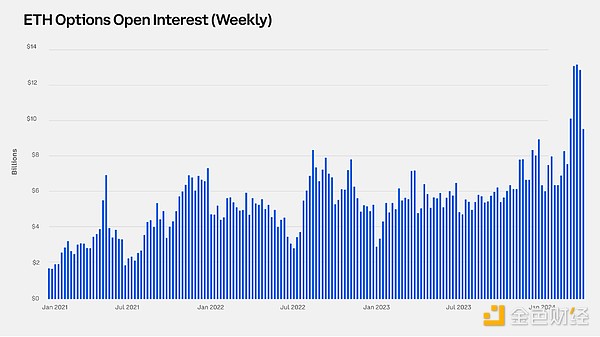

Open Interest Rising

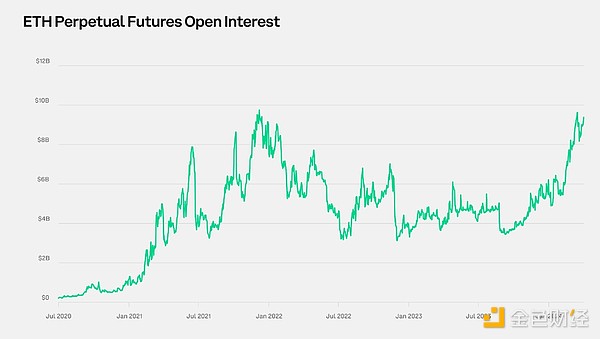

Open Interest represents the total number of unsettled derivatives contracts, such as futures and options. The Ethereum derivatives market has seen significant growth, with options open interest increasing by 50% to a new high. This growth demonstrates the increasing involvement of traders and institutional investors in Ethereum’s financial products.

Market maturity

The growth of the Ethereum derivatives market is evident in the advanced and diverse trading strategies adopted by traders. This development increases market depth and liquidity, allowing for more sophisticated investment and hedging options. This maturity showsthat Ethereum is becoming more widely accepted and integrated into traditional financial systems.

Drivers of the increase in open interest

The increase in open interest in the first quarter was caused by several related factors. Mainly, Ethereum often follows Bitcoin’s market trends. The connection is evident as both the Ethereum and Bitcoin derivatives markets react to the excitement and speculation generated by the development of a Bitcoin ETF. Anticipation of these ETFs not only increases activity in the Bitcoin market, but also affects Ethereum, affecting its derivatives landscape.

Conclusion

Overall, the recent changes in the Ethereum staking and derivatives markets and the Dencun upgrade indicate significant changes in its ecosystem, affecting network functionality and investment dynamics. As Ethereum increasingly mirrors Bitcoin's trends, investors will need to adjust their strategies. Understanding the interplay between these upgrades and market changes is critical to optimizing your investment approach, managing risk, and taking advantage of the opportunities of Ethereum’s expanding role in financial markets.

Joy

Joy