At the "Reconstruction and Response of the International Monetary System" seminar held by the China Wealth Management 50 Forum (CWM50) on May 25, Dr. Zhu Taihui, Senior Research Director of JD Group, made a commentary on "The Impact and Enlightenment of Stablecoins on the International Monetary System".

Dr. Zhu Taihui believes that stablecoins are quite different from general crypto assets. Since 2023, the development of global stablecoins has shown four trend characteristics, including continuous growth in market size, increasing number of holders, expanding usage scenarios, and deepening integration with the traditional financial system.

From the perspective of changes in the international monetary system, the stablecoin market is dominated by US dollar stablecoins in terms of currency, and US dollar financial assets are dominant in terms of reserve fund investment. US dollar stablecoins have driven the "new US dollar cycle" and helped to strengthen the international dominance of the US dollar.

For this reason, the US government's stablecoin legislation and policies since 2025 reflect the strategic intention of leading the development of the global stablecoin market. Behind this is the US's intention to strengthen the position of the US dollar in the international monetary system by actively developing US dollar stablecoins.

For China, it is recommended to comprehensively study and grasp the impact of the rapid development of the global stablecoin market, follow the policy trend of countries to simultaneously support the parallel development of central bank digital currencies and stablecoins, and launch offshore RMB stablecoins in Hong Kong as soon as possible to provide a new engine for the internationalization of the RMB.

*This article only represents the author's personal views.

1. The development of stablecoins shows a trend of scale, popularization and integration

First, the scale of global stablecoins has entered a stage of large-scale growth.

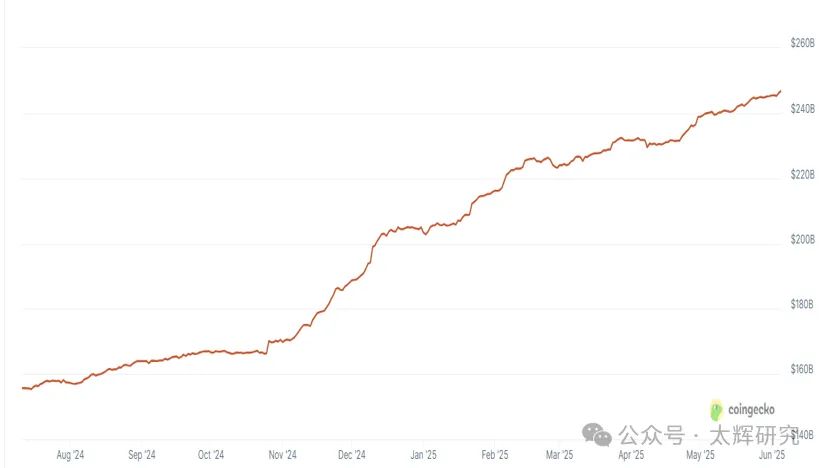

As of May 2025, the total market value of global stablecoins has grown to about $250 billion. It is worth noting that since the second half of 2023, the entire crypto asset market has begun to bottom out and rebound, among which the price and market value of crypto assets such as Bitcoin are still volatile, while the stablecoin market has shown a trend of continued growth in scale and has not seen a correction.

Based on this development trend, Citibank's latest forecast shows that with the support of regulatory policies of various countries, the global stablecoin market value will reach $1.6 trillion in 2030, and may reach $3.7 trillion in an optimistic scenario. This shows that the scale of stablecoins has entered a stage of large-scale growth, and its future development potential deserves attention. Figure 1: Changes in the market value of global stablecoins.

Secondly, the use of stablecoins is developing towards a popular payment tool.

In 2024, the payment scale of global stablecoins has surpassed the total transaction volume of the two traditional payment giants Visa and Mastercard. In the one year from June 2024 to May 2025, the total volume of global stablecoin transactions reached 7 trillion US dollars (after deduplication), and the number of transactions exceeded 14 trillion (after deduplication). At present, the average monthly transaction volume of stablecoins remains at around 130 million, and the average monthly transaction scale is around 800 billion US dollars.

Among them, as of April 2025, the user scale of USDT, the world's largest stablecoin, has reached 450 million, with an increase of more than 30 million per quarter; as of the end of 2024, USDC, the world's second largest stablecoin, has provided services to users in more than 180 countries and regions, and the number of wallets with at least 10 USDC has exceeded 3.9 million. Figure 2: Changes in the number of transactions of global stablecoins. src="https://mmbiz.qpic.cn/sz_mmbiz_png/PwDVEhuy3HR4o4CjicdVKS45bpt07kYibyfXBoScuZAuDzXruGTTFzUClmVZ2ibeibw8c139FcQLnuTYG5pYI7ic4jg/640?wx_fmt=png&from=appmsg&watermark=1&tp=webp&wxfrom=5&wx_lazy=1" _="" alt="图片" data-report-img-idx="1" data-fail="0">

Again, the use of stablecoins is rapidly expanding to payments for physical transactions.

In the early days of its launch, stablecoins were mainly used for investment and transaction settlement of crypto assets. As a bridge between legal tender and crypto asset transactions, they gradually became the main channel for capital inflow and outflow in the crypto market. However, in the past two years, the use of stablecoins has expanded from crypto asset transaction settlement tools to real economy payment settlement tools.

In September 2024, a special survey supported by Visa showed that in emerging market countries such as Brazil, India, Indonesia, Nigeria and Turkey, about 40% of respondents have begun to use stablecoins for daily commodity and service payments and cross-border payment settlements, and another 20%-30% are used for salary payment collection and corporate business operations. Figure 3: Scope of stablecoin usage in five emerging markets. In May 2025, data from the cryptocurrency monitoring platform Fireblocks showed that the use of stablecoins is shifting from transaction settlement to payment. Currently, payment companies account for 16% of their transaction volume, which is expected to increase to 50% within a year. These data show that stablecoins, which are derived from payment and settlement tools for crypto asset investment and trading, are "moving from virtual to real" and rapidly expanding to payment and settlement tools for real economy trade and consumption.

In addition, stablecoins are accelerating their integration with the traditional financial system.

Since 2025, the integration and development of stablecoins with payment institutions, banking systems, and capital markets has become increasingly obvious. Online payment institutions such as Paypal and Stripe have actively explored the launch of stablecoin payments. Head credit card institutions Visa and MasterCard have cooperated with crypto asset exchanges to use stablecoins and blockchain to carry out cross-border transactions and domestic daily consumption payment services to improve payment service efficiency. SWIFT is also considering using blockchain to improve service efficiency.

At the same time, among banking institutions, JP Morgan has developed its stablecoin into an open blockchain payment and settlement platform, Standard Chartered Bank (Hong Kong) is promoting the "sandbox test" of stablecoin issuance, and since 2025, Brazil's largest bank Itau Unibanco, Japan's Sumitomo Mitsui and SBI Financial Group, and the largest bank in the UAE, First Abu Dhabi Bank, have announced the development and launch of stablecoin payment services in different forms, and the global systemically important bank Bank of New York Mellon has expanded its payment and collection services for stablecoin purchases and redemptions.

Recently, a survey report by Fireblocks on 295 payment, banking and other financial institutions around the world showed that 90% of the institutions have actually applied or planned to deploy stablecoins, and only 10% are on the sidelines. These cases and data show that the development of stablecoins and the traditional financial system are accelerating integration. Figure 4: Application of stablecoins by financial institutions. src="https://mmbiz.qpic.cn/sz_mmbiz_png/PwDVEhuy3HR4o4CjicdVKS45bpt07kYibyYadavTjbM5bf5LKGWxfl8Yq7VOK4z2xqnl2ay1OXt9Htv0m159tR9Q/640?wx_fmt=png&from=appmsg&watermark=1&tp=webp&wxfrom=5&wx_lazy=1" _="" alt="图片" data-report-img-idx="3" data-fail="0">

Second, the United States is strengthening the international dominance of the US dollar by developing stablecoins

2. From the perspective of reserve investment, most of the reserve funds of global stablecoins are invested in US dollar assets.

As of March 2025, the scale of stablecoins such as USDT issued by Tether is close to US$150 billion, and the U.S. Treasuries held in its reserve assets are close to US$120 billion (including indirect exposure to Treasury bonds through money market funds and reverse repurchase agreements), accounting for about 80%; the scale of stablecoins such as USDC issued by Circle exceeds US$60 billion, and the U.S. Treasuries held in its reserve assets exceed US$55.5 billion (including U.S. Treasury repurchase agreements), accounting for more than 92%.

Figure 6: Circle’s reserve fund investment

![]()

3. From the perspective of the mechanism of action, the US dollar stablecoin strengthens the international status of the US dollar through the new US dollar cycle.

The above stablecoin market currency structure and reserve asset structure show that the US dollar stablecoin has driven the "new US dollar circulation": using US dollars to purchase US dollar stablecoins - US dollar stablecoins are widely used in payment and settlement of crypto assets, cross-border trade, financial transactions, etc. - US dollar stablecoin reserve funds are invested in US Treasury bonds and financial assets. "

By the end of 2024, the proportion of the US dollar in global foreign exchange reserves will have reached a historical low of 57.8%. The "new US dollar cycle" helps to reverse the weakening trend of the US dollar under the "traditional US dollar cycle": the United States increases the issuance of US dollars - trade deficits drive the outflow of US dollars - countries with trade surpluses invest US dollars in the US financial market.

Figure 7: Changes in the size and proportion of US dollar reservesIn addition, the globalization of stablecoins, the rapid expansion of payments to physical transactions, and the development trend of integration with the financial system will not only affect the use of the US dollar in cross-border trade and financial investment, but will also help promote the penetration of the US dollar into commodity service payments and financial transactions in various countries.

4. From the perspective of policy orientation, the US government's policies and legislation clearly reflect this strategy.

In January 2025, immediately after taking office, US President Trump signed the Executive Order on Promoting the Development of Digital Assets and Financial Technology in the United States, which clearly proposed to take action to promote the development of legal and legitimate US dollar stablecoins around the world and promote and protect the sovereignty of the US dollar. Since then, Trump and US Treasury Secretary Bessant have repeatedly stated that the purpose of the United States' development of stablecoins is to consolidate the international status of the US dollar.

The restrictions on overseas issuers and the asset investment direction of stablecoin reserve funds in the Genius Act, recently passed by the US Senate, once again reflect the United States' strategic intention to dominate the development of the global stablecoin market: the development of the stablecoin market must be dominated by both US dollar stablecoins and US issuers.

III. Enlightenment for China to Promote the Internationalization of the RMB

1. Countries’ policies on central bank digital currency and stable currency turn to parallel and integrated development.

In recent years, the policies of major countries in the world on the development of digital currency and crypto assets have formed three representative models. Model 1 is to encourage the development of stable currency and crypto assets, implement strategic reserves of Bitcoin and crypto assets, but restrict the issuance of central bank digital currency (CBDC). The United States is a typical representative of this model. Since 2025, it has actively promoted legislation to support the compliant development of stable currency and crypto assets. At the same time, in April 2025, the U.S. House of Representatives Financial Committee passed the Anti-CBDC Surveillance State Act (H.R. 1919): Prevent central bank digital currency from being used for monetary policy and prohibit the Federal Reserve from directly providing financial services to individuals. Model 2 is to focus on promoting the research and development and pilot of central bank digital currency, but strictly restrict the issuance and trading of stable currency and crypto assets. Model 3 is to simultaneously pilot CBDC and support the compliant development of stablecoins and crypto assets. Major economies such as Singapore, the UAE, Hong Kong, the European Union and Japan have adopted this model.

It is worth noting that since 2023, the policies of various countries have converged, and most of them have turned to the third model of promoting CBDC pilots and supporting the compliant development of stablecoins and crypto assets - the fusion model, and are actively promoting the legislation of stablecoin and crypto asset supervision, and the regulatory framework has gradually become clear. In terms of stablecoin supervision, a clear regulatory framework has been established for the functional positioning, scope of use, access to issuing and trading institutions, issuance and trading scale, daily operations and risk management, anti-money laundering and prevention and control of illegal financial activities of stablecoins.

2. Offshore RMB stablecoins should become a new tool for RMB internationalization.

First, in December 2024, the RMB's share of the international payment market will be 3.75%, which is a large gap compared with the USD's share (49.12%). It is also very different from China's global import and export trade share in 2024 (10.4% for imports and 14.6% for exports). The USD's share in the global international payment market is much higher than the US's share in global trade. China needs new ideas and new approaches to promote the internationalization of the RMB.

Figure 8: The share of RMB and USD in international payments

Secondly, in November 2024, BIS withdrew from the "Central Bank Digital Currency Bridge" project, and in April 2024 supported the launch of another Agora project that uses blockchain technology to improve cross-border payments. Wholesale central bank digital currencies and tokenized deposits in the United States, the United Kingdom, France, Switzerland, Japan, South Korea, Mexico and other countries are all running on the same blockchain system. The role of the "Central Bank Digital Currency Bridge" in the internationalization of the RMB needs to be re-evaluated.

In addition, stablecoins and central bank digital currencies can develop simultaneously. The current system behind my country's digital RMB has been layered, and it is exploring the coordination of centralized management and decentralized ledgers. The Aurum project launched by the Hong Kong Monetary Authority and the BIS Innovation Center in October 2022 is also testing a digital currency system that operates a hybrid of central bank digital currencies and stablecoins.

3. China should pilot the issuance and trading of offshore RMB stablecoins as soon as possible.

On the one hand, the offshore RMB stablecoin is anchored to the RMB circulating overseas, and there are no problems such as the substitution of the mainland's sovereign currency, monetary policy out of control, money laundering and cross-border capital out of control. It can not only enhance the status of offshore RMB in global payments through blockchain, smart contracts, encryption technology, etc., but also will not affect the overall situation of monetary regulation and capital management in the mainland.

On the other hand, Hong Kong is an offshore RMB trading center. The amount of offshore RMB has been growing in recent years, and there is a good market foundation for issuing offshore RMB stablecoins in Hong Kong; Hong Kong has issued the "Stablecoin Ordinance" to establish a relatively complete regulatory framework for crypto assets, providing institutional guarantees for the issuance and trading of offshore RMB stablecoins, and Hong Kong has taken the development of stablecoins and crypto asset services as an important means to boost Hong Kong's status as an international financial center. The issuance and trading of offshore RMB stablecoins should be launched in Hong Kong as soon as possible. Moreover, the market has spontaneously launched offshore RMB stablecoins. For example, Tether issued offshore RMB stablecoins as early as 2019, and its current market value has reached more than 20 million yuan.

In terms of the specific development path, after accumulating experience and improving the regulatory mechanism in Hong Kong, we can follow the gradual model of "first offshore and then offshore", and promote the development of offshore RMB stablecoins from Hong Kong to domestic free trade zones and free trade ports, thereby providing a new engine for the internationalization of RMB.

Joy

Joy