The downward trend seems to have not yet stopped. On August 19th, the three major U.S. stock indexes fell during the day and closed mixed, with the Nasdaq down 1.46%, the S&P 500 down 0.59%, and the Dow up 0.02%. Large technology stocks fell across the board, with Nvidia down 3.50%, Meta down 2.07%, Tesla, Amazon, and Microsoft down 1.75%-1.42%, Google A down 0.95%, and Apple down 0.14%.

There is no inflation,all signs point to a significant interest rate cut. "Too late" is a disaster! Real estate is just a microcosm; what truly worries the market are the signs of recession. The US housing market is sluggish. Even during the peak season (April to June), the number of home sales contracts signed nationwide hit a new low since 2012, while the housing supply-to-sales ratio climbed to 9.8 months in June. Historically, five of the six times this figure has exceeded 9 have coincided with a recession. Real estate is an industry with extremely high externalities, highly correlated not only with manufacturing and construction but also with other consumer goods transactions. Therefore, to a certain extent, its development serves as a risk signal for observing economic performance. Against this backdrop, the market is bound to develop a certain degree of risk aversion, with funds flowing from high-risk sectors to defensive ones. However, traders have a different view. Recently, there has been strong demand for positions related to the Secured Overnight Financing Rate (SOFR), which is closely tied to policy expectations. Just this week, traders doubled down on this bet, with the number of options contracts betting on a 50 basis point rate cut in September surging to 325,000, with a premium cost of approximately $10 million. If the Fed follows through with the 50 basis point cut, these positions stand to profit as much as $100 million. Market sentiment has shifted swiftly. Alternative data shows that the market, which was in a state of greed two days ago, has suddenly turned to panic today. According to Deribit, According to data, the Delta slope (put-call) of Bitcoin's 30-day options soared to 12%, the highest level in more than four months, indicating that the market is in extreme panic.

Trader Eugene Ng Ah Sio even opened a small long position in ETH, saying he was looking for short-term opportunities in the $4,400-$4,600 range before evaluating whether to continue looking higher.

Of course, there are exceptions.

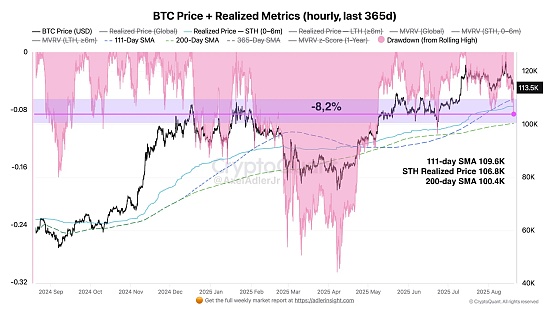

Overall, even though the crypto market has performed poorly under the pressure of the macro environment and sentiment, most analysts hold a more positive view. The highly optimistic Bernstein analyst even predicts that the current crypto bull market is expected to continue until By 2027, Bitcoin could reach $150,000 to $200,000 within the next year. In the near term, since $112,000 is BTC's recent low, this price is indeed the current support level, while the key price for ETH is around $4,100. In fact, the purchase price of ETH by listed companies is not far beyond the price range. According to calculations by on-chain analyst Yu Jin, the cost prices of the two largest cryptocurrency stock companies, BitMine and SharpLink Gaming, are $3,730 and $3,478, respectively. Overall, volatility remains the dominant theme ahead of the globally anticipated Jackson Hole Global Central Bank Annual Meeting. Even with continued declines due to risk aversion and other factors, the true market direction remains uncertain given the lack of clarity regarding the market outlook. Currently, the market has rebounded, with BTC currently trading at $113,819 and ETH at $4,225.66.

Coinlive

Coinlive

Coinlive

Coinlive  Coindesk

Coindesk Beincrypto

Beincrypto Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph