Written by: Token Dispatch, Prathik Desai Translated by: Block unicorn

Foreword

Tokenization is booming as Wall Street giants rapidly scale up deployments, while the concept was only in the testing phase a few years ago.

Multiple financial giants are simultaneously launching platforms, building infrastructure, and creating products to connect traditional markets with blockchain technology.

In the last week alone, BlackRock, VanEck, and JP Morgan have made major moves, indicating that tokenization of real-world assets has moved beyond proof-of-concept and become a cornerstone of institutional strategy.

In today's article, we will show you why the long-awaited inflection point for tokenization may have arrived, and why this still matters even if you have never bought cryptocurrency.

Trillion-dollar potential

“Every stock, every bond, every fund – every asset – can be tokenized. If it happens, it will revolutionize investing,” said Larry Fink, CEO and chairman of BlackRock, in his 2025 annual letter to investors.

Fink was talking about an opportunity that would allow fund companies to tokenize more than a trillion dollars worth of assets in the global asset industry.

Traditional financial giants have already seized on this opportunity, with adoption surging over the past 12 months.

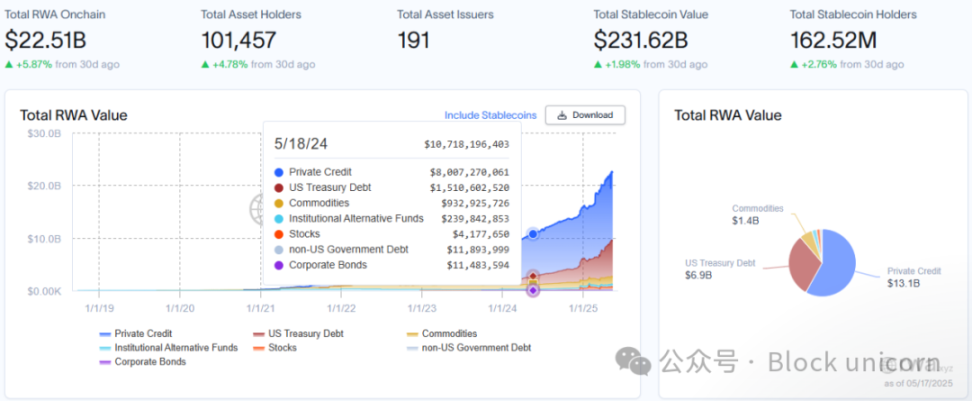

Tokenized real-world assets (RWA, excluding stablecoins) have exceeded $22 billion, up 40% this year alone. However, this is just the tip of the iceberg.

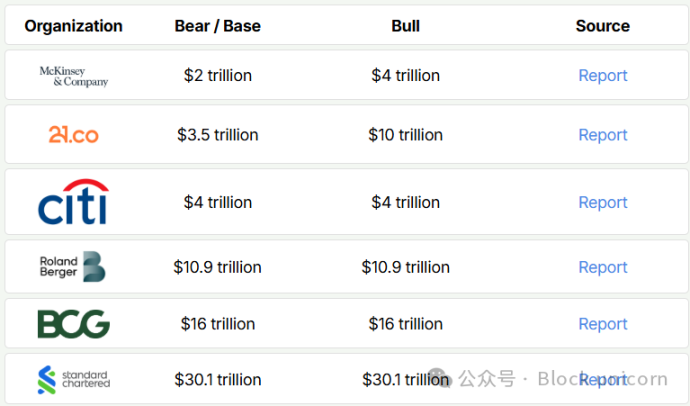

Consulting firm Roland Berger predicts that the tokenized RWA market will reach $10 trillion by 2030, while Boston Consulting Group estimates it at $16.1 trillion.

To put it in context, even at the lower estimate, this would represent a 500x increase from today. If 5% of global financial assets move on-chain, we are talking about a multi-trillion dollar shift.

Before we get into the tokenization initiatives of fund companies, let’s first understand what tokenization is and what it means for investors.

The combination of physical assets and blockchain

Three simple steps: choose a real-world asset, create a digital token that represents ownership of that asset (partial or full), and make it tradable on the blockchain. That’s tokenization.

The asset itself (Treasury bonds, real estate, stocks) has not changed. What has changed is how its ownership is recorded and traded.

Why tokenization? Four key benefits:

Fractional ownership: Own a portion of a commercial building for as little as $100, not millions.

24/7 trading: No waiting for markets to open or settlements to clear.

Reduced costs: Fewer middlemen means lower fees.

Global access: Investment opportunities that were previously restricted by geography are now accessible around the world.

“If SWIFT is the postal service, tokenization is email itself — assets can be transferred directly and instantly, bypassing intermediaries,” BlackRock’s Fink said in the letter.

Silent Revolution

BlackRock’s tokenized Treasury fund BUIDL has surged to $2.87 billion, more than 4x in 2025 alone. Franklin Templeton’s BENJI holds over $750 million. JPMorgan’s latest move connects its private blockchain Kinexys to the public blockchain world.

The value of tokenized U.S. Treasuries is now approaching $7 billion, up sharply from less than $2 billion a year ago, further confirming this growth story.

More and more giant companies are joining the trend with unique products.

This week, VanEck launched a tokenized U.S. Treasury bond fund accessible on four blockchains, intensifying competition in the rapidly expanding on-chain real-world asset (RWA) market.

Earlier this month, Dubai-based MultiBank Group, the world's largest financial derivatives institution, signed a $3 billion real-world asset (RWA) tokenization agreement with UAE-based real estate giant MAG and blockchain infrastructure provider Mavryk.

Smaller countries are also joining the ranks. According to the Bangkok Post, the Thai government is offering bonds to retail investors through tokenization, reducing the entry barrier from the traditional $1,000+ to $3.

Even government agencies haven’t missed out on this revolution.

The U.S. Securities and Exchange Commission (SEC) just hosted a roundtable with nine financial giants to discuss the future of tokenization, which is a stark reversal of the attitude of previous governments.

For investors, this means 24/7 access, near-instant settlement, and fractional ownership.

Think of it as the difference between buying an entire album on CD and streaming only the songs you want to hear. Tokenization breaks assets into affordable pieces, making them accessible to everyone.

Why now?

Regulatory clarity: Under the leadership of US President Donald Trump, his administration has shifted from law enforcement to promoting innovation, with several crypto supporters leading government agencies.

Institutional adoption: Traditional financial giants provide legitimacy and infrastructure support for tokenization.

Technological maturity: Blockchain platforms have evolved to meet institutional needs.

Market demand: Investors seek more efficient and accessible financial products.

Paul Atkins, chairman of the US Securities and Exchange Commission (SEC), sees tokenization as a natural evolution of financial markets, likening it to "the transition of audio from analog vinyl records to tapes to digital software decades ago."

The Road Ahead

Despite the momentum, challenges remain.

Regulatory fragmentation: The global regulatory landscape remains fragmented. The SEC’s roundtable shows an open attitude in the U.S., but international coordination is insufficient. Japan, Singapore, and the EU are moving at different speeds and with incompatible frameworks, creating compliance challenges for tokenized platforms around the world.

Lack of standardization: The industry lacks unified technical standards for tokenizing different asset classes. Should tokenized treasuries on Ethereum be compatible with those on Solana? Who will verify the association of tokens with the underlying assets? Without standardization, there is a risk of isolated liquidity pools rather than unified markets.

Custody and security concerns: Traditional institutions remain wary of blockchain security. The $1.4 billion Bybit hack earlier this year raised thorny questions about immutability and recoverability.

Market Education Gap: Wall Street (“Wall Street”) may be accelerating, but Main Street (“Main Street”) still generally lacks understanding of tokenization.

Our View

Tokenization could be the bridge that connects blockchain technology to mainstream finance. For those who have been following the evolution of blockchain, this may be the biggest impact the space has had so far—not in creating new currencies, but in changing the way we access and trade existing assets.

Most people don’t care about blockchain. They care about getting their paychecks earlier, accessing investment opportunities that were once reserved for the wealthy, and not being squeezed by high fees when moving money. Tokenization provides these benefits without requiring users to understand the underlying technology.

As this space develops, tokenization could become “invisible infrastructure”—just like you don’t think about the SMTP protocol when sending an email. You’ll have easier access to investments, with lower fees and fewer restrictions.

Traditional finance has spent centuries developing a system that favors institutions and excludes ordinary people. For decades, we accepted a financial system designed around institutional convenience rather than human experience. Want to trade after hours? Sorry, no. Only have $50 to invest? Not worth our attention. Want to transfer money internationally without losing 7% in fees? Wait.

Tokenization may break this inequality in just a few years.

As the tokenized experience becomes more popular, the conceptual barriers between "traditional finance" and "decentralized finance" will naturally melt away. Someone who buys a tokenized bond from the Thai government for $3 may later explore DeFi protocols that can generate income. Institutional investors who first encounter blockchain through BlackRock's BUIDL may eventually invest in native crypto assets.

This model drives real adoption, not through ideological transformation, but through practical advantages that make the old approach look extremely inefficient by comparison.

Miyuki

Miyuki

Miyuki

Miyuki Weiliang

Weiliang Catherine

Catherine Anais

Anais Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Kikyo

Kikyo Weatherly

Weatherly Alex

Alex