Source: Grayscale; Compiled by Wuzhu, Golden Finance

Summary

Despite the sharp rise in Bitcoin prices, our cryptocurrency industry framework shows that performance across the asset class has been mixed so far this year. Like the stock market, cryptocurrency returns this year have lacked breadth.

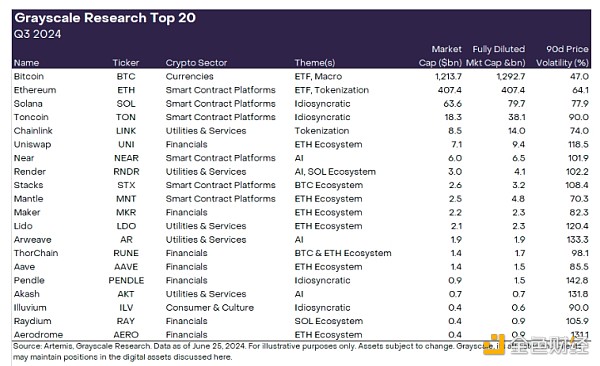

We are pleased to introduce the top 20 coins that Grayscale Research is focusing on, which are our picks for high potential coins for the next quarter. These crypto assets were selected based on the Grayscale Research team's consideration of upcoming catalysts, trending market themes, and specific token fundamentals. Some of the assets in our top 20 list have higher price volatility and should be considered high risk.

With the potential approval of Ethereum spot ETPs, we expect to focus on the Ethereum ecosystem this quarter.

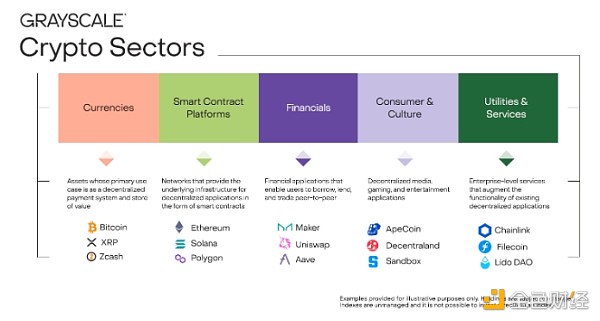

Exploring the crypto asset class can be challenging, which is why Grayscale created Crypto Sectors, a comprehensive framework for understanding all investable crypto assets and how they relate to their underlying technology. Crypto Sectors provides investors with a roadmap comparable to common tools in traditional markets, designed to help investors better understand and navigate the evolving crypto asset class. In addition, we have partnered with FTSE Russell to develop the FTSE Grayscale Crypto Sector Index Series to measure and monitor the cryptocurrency market. [1]

Grayscale Crypto Sectors divides the digital asset space into five distinct sectors: (i) Currency, (ii) Smart Contract Platforms, (iii) Finance, (iv) Consumer & Culture, and (v) Utilities & Services (Exhibit 1). Tokens in the five crypto sectors are associated with unique use cases and investable risks. As a result, their valuations are subject to different fundamental and technical drivers.

Exhibit 1: Crypto sectors divide the digital asset market into five segments

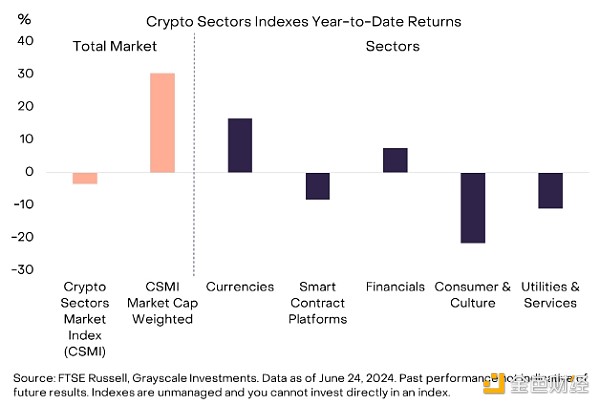

Cryptocurrencies have seen smaller gains this year

Since the beginning of 2024, despite a roughly 50% increase in the price of Bitcoin, our Crypto Sector Market Index (CSMI) has actually fallen by about 3% (Exhibit 2). Assets in the five crypto sectors and the total CSMI are weighted by the square root of their market capitalization to reduce Bitcoin’s dominance and better represent a wider range of assets across the sector. On a market capitalization-weighted basis, the CSMI grew 30%, reflecting Bitcoin’s notable growth and its sizable share of total market capitalization (around 60%). Of the five segments, the best performer was in the monetary-attributable space – reflecting Bitcoin’s outperformance – while the worst performer was in the consumer and cultural cryptocurrency space – primarily due to weakness this year in assets associated with video game applications.

Chart 2: Despite Bitcoin’s sharp gains, year-to-date performance has been mixed

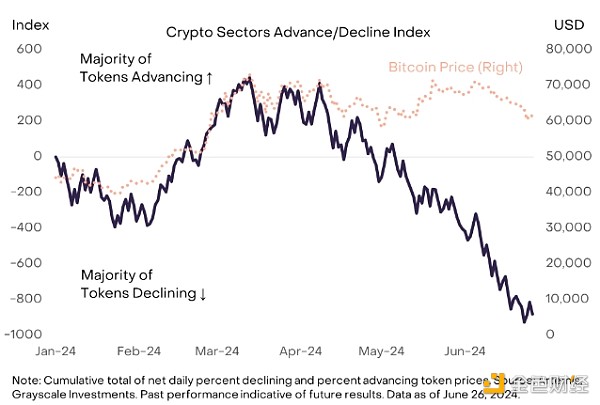

The large return difference between Bitcoin and the broader cryptocurrency market suggests that gains this year have been limited—much like the case with the U.S. equity market, where a handful of large tech companies have recently dominated index returns. Using the crypto sector framework, we can create measures of market breadth, much like those applied to other markets. For example, Chart 3 shows an “up/down” index, where we track the net percentage of crypto sector token prices that have risen versus lost each day. We then calculate the cumulative total over time. By this measure, cryptocurrency market breadth peaked around late March/early April 2024 and has been declining since then. So far this year, despite Bitcoin's huge gains, only about 30% of crypto industry tokens have risen in price.

Chart 3: Market breadth has been declining since March/April

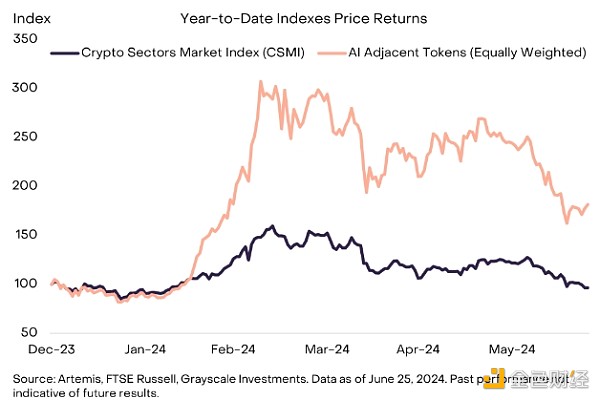

Relatively speaking, a bright spot is some of the assets related to artificial intelligence (AI) technology, which exist in the smart contract platform crypto sector and the utilities and services crypto sector. [2] These protocols attempt to solve AI-related problems (e.g., bots and deepfakes, privacy, model validation), provide resources critical to AI development (e.g., compute, storage, data), or provide a general platform for AI-related services. Year-to-date, a weighted index of a basket of AI-related crypto industry tokens has increased by 80% compared to a slight decline in the overall crypto market (Figure 4).

Chart 4: AI-related tokens outperformed the market

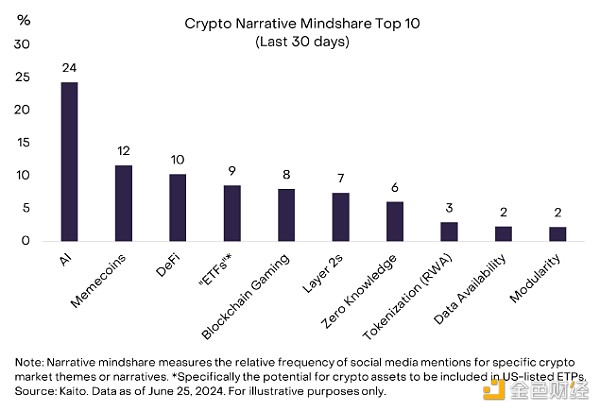

In addition to AI, market participants are also focusing on a variety of other topics, which to some extent affect the relative performance of the entire crypto industry. To help us understand market trends, Grayscale Research uses the "narrative mindshare" measure from data provider Kaito. These data measure the relative frequency of social media mentions of specific crypto market topics or narratives, which helps evaluate crypto assets driven by communities of believers and supporters who frequently express their views on social media platforms. For example, over the last month, AI has remained the dominant theme, followed by exchange-traded funds (ETFs) — i.e., exchange-traded products (colloquially referred to as “ETFs”) approvals may be a short-term catalyst for tokens — memecoins and blockchain-based games (Exhibit 5). While market focus can change, themes tend to be persistent, so measures of narrative mindshare may provide clues to market performance in the coming months.

Chart 5: Artificial intelligence remains the dominant theme in the market

Looking ahead: Ethereum takes center stage

Grayscale Research expects that the cryptocurrency market will be impacted by the approval of spot Ethereum exchange-traded products (ETPs) in the U.S. in the next quarter. In late May, the U.S. Securities and Exchange Commission (SEC) approved Form 19b-4 filings submitted by several issuers to list these products in the U.S. Furthermore, SEC Chairman Gensler recently stated that regulators could approve the remaining applications “sometime this summer.” [3] Therefore, while the timing remains uncertain, for the purposes of our market analysis, Grayscale Research assumes that these products will begin trading in the third quarter of 2024. As with the launch of the spot Bitcoin ETP in January 2024, the Grayscale Research team also expects these new Ethereum products to generate meaningful net inflows (albeit less than the Bitcoin ETP), potentially supporting the valuation of Ethereum and its internal tokens.

The Ethereum ecosystem has several unique features that the launch of the spot Ethereum ETP may highlight. For example, the Ethereum network is pursuing a modular design philosophy in which different components of the blockchain infrastructure work together to provide a more optimized end-user experience and reduce costs. In addition, Ethereum is home to the largest decentralized finance (DeFi) ecosystem in the cryptocurrency space and the majority of tokenized projects.

If the approval of the ETP spurs interest and adoption of Ethereum, we may also see increased activity and valuation support for specific Layer 2 tokens (e.g., Mantle), Ethereum DeFi protocols (e.g., Uniswap, Maker, and Aave), and other assets that are critical to the functionality of the Ethereum network (e.g., Lido, a staking protocol).

In addition to the U.S., with the approval of the spot Ether ETP, Grayscale Research expects current market themes to continue to be in focus over the next quarter, particularly the potential intersection between blockchain technology and artificial intelligence. One of the assets in this category is Near, which was founded by the co-creator of the “Transformer” architecture that powers AI systems such as ChatGPT. Near is one of the top smart contract platforms in terms of daily active users and has seen widespread real-world adoption in non-financial use cases. Recently, however, Near has begun leveraging its AI expertise by announcing the development of “user-owned AGI” through an R&D division led by a former OpenAI research engineer advisor. [4] Decentralized GPU marketplaces such as Render and Akash may also benefit from the market’s continued preference for AI.

Apart from the main market themes, various projects appear to be benefiting from their own unique adoption trends, either due to innovative technology or integration with platforms that provide room for user growth. Two notable examples are Toncoin and Pendle. The TON blockchain is a smart contract platform tied to the Telegram messaging platform that has seen significant growth in users, transactions, and fee revenue. Pendle Finance is a relatively new DeFi protocol that allows users to customize the yield profile of their strategies. While not a new trend, we also believe that the Solana network is seeing organic growth in adoption due to a compelling user experience.

Finally, the crypto market will likely continue to differentiate between tokens with relatively low and relatively high supply inflation. While Bitcoin has the largest total supply and a fairly low annual inflation rate, many tokens in our crypto space do not have this structure. In fact, in many cases, tokens have a relatively low circulating supply and relatively large monthly or annual supply inflation (“unlocked”). In these cases, even if a project is experiencing user adoption and revenue growth, supply growth may dilute returns for existing token holders. Examples include well-known Ethereum Layer 2 networks such as Arbitrum and Optimism, which have relatively low returns despite user adoption of their native tokens, likely due to high growth in circulating supply.

Introduction to Grayscale Research Top 20

In order to highlight high-potential tokens in specific cryptocurrency industries, we have launched the Grayscale Research Top 20 Tokens (Exhibit 6). We believe that the top 20 assets represent a diverse range of assets in the crypto industry that have high potential to grow in the coming quarter due to (i) direct catalysts or trending themes, (ii) favorable specific protocol adoption trends, and (iii) low or moderate token supply inflation. These assets were selected to represent the near-term market outlook and therefore may exclude higher market capitalization assets without immediate catalysts or sustained improvement in fundamentals. We intend to update the Grayscale Research Top 20 list on a quarterly basis. Some of the listed assets have high volatility (as shown in the far right column of Exhibit 6) and should be considered high-risk assets.

Exhibit 6: High Potential Assets in Q3 2024

References

[1] The FTSE Grayscale Crypto Sector Index Series underwent its scheduled quarterly rebalance on June 21.

[2] Grayscale Research believes that crypto tokens that may be related to AI technology are listed in alphabetical order as AGIX, AKT, AR, FET, FIL, GLM, LPT, NEAR, OCEAN, PRIME, RNDR, RSS3, TFUEL, THETA, TRAC and WLD.

[3] Source: CoinTelegraph.

[4] Source: Near and Crunchbase.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Weiliang

Weiliang JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph